-

Mike Hearn launched Bitcoin XT, the first notable Bitcoin copy, in 2014 to implement several new changes.

-

A bitcoin hard fork is a parrel bitcoin blockchain network that has undergone a drastic change in protocol.

-

The primary purpose of Bitcoin XT was to increase the transaction speed from seven transactions per second to 24 transactions per second.

Bitcoin has transformed the world by ushering in the concept of Web3. Within less than two decades, blockchain developers have found a new way to re-use its fundamental functionality: blockchain. Although what many might not know is that throughout the years, there have been various “Bitcoin copies” or, in more technical terms, more than one type of Bitcoin fork. However, each has played a significant role in influencing the overall Bitcoin Decentralized Network. This article will tackle one of the main questions asked in Web3: How Do Bitcoin Forks Work?

In addition, we will take time to analyze Bitcoin from the ground up, from its origins all the way to understanding Bitcoin Gold and Privacy and the various impacts of Bitcoin Forks on Transactions. So if you were ready for a short piece, yeah, think again.

Understanding the fundamentals behind a Bitcoin copy

It is common to hear many crypto traders within Africa refer to various altcoins such as Ethereum or Cardano as Bitcoin copies, but it’s far from the truth. In hindsight, Bitcoin is considered the original cryptocurrency, but the only similarity it shares with other altcoins is the fundamental aspect that makes up the entirety of cryptocurrency: blockchain technology.

However, the term Bitcoin Copy, or in more technical terms, types of Bitcoin Fork, stems from its various variations that are either similar or entirely different, but each belongs within the same Bitcoin Decentralized Network. The term more commonly used is blockchain fork. This begs the question: How do Bitcoin Forks Work? To answer this, we must first go back a few decades and analyze what is and what made the original cryptocurrency.

ALSO, READ:Bitcoin as a Reserve Currency: Africa’s Financial Future or a Volatile Gamble?

The original Bitcoin blockchain network was the first iteration of a decentralized nature, which meant that any alterations to the network required consensus among its participants. Effectively actualizing true democracy, a fear many African governments dread. Unfortunately, since Bitcoin presented a new concept, competition was bound to erupt, and with the likes of Mastercoin and Ethereum, Bitcoin’s decentralized nature had to improve.

Understanding Bitcoin Copy: The Concept Behind Bitcoin Forks

This meant that the network had to undergo several changes, and it required the support of most users. In layman’s language, a type of Bitcoin Fork alters its decentralized network protocol. Forking is essentially a software update mechanism for blockchain networks. When developers identify improvements or necessary changes to the Bitcoin protocol, they can initiate a fork.

The concept of forks was necessary since it was the only way to upgrade Bitcoin’s blockchain network without building a new one from scratch.

This process creates a divergence in the blockchain, resulting in two separate chains: the original Bitcoin blockchain and the new Bitcoin copy.

There are two significant types of blockchain forks:

-

Hard forks

-

Soft forks

Hard Forks vs. Soft Forks: Key Differences and Implications

Hard Forks

According to Moore’s Law, technology will advance every two years, and this law has formed the baseline of most developed technology, ensuring that an improved version is underway. As the concept of Bitcoin’s decentralized network soon gained much fame and attention, various blockchain developers took Satoshi’s initial idea and redefined it. Improving on transparency and the enemy of corruption, a plague much seeded in Africa.

This created new tokens that had better, faster, and different functionalities from Bitcoin’s blockchain network. To improve, Bitcoin underwent a process called forking. Unfortunately, in some scenarios, the outcome led to the development of an entirely new type of Bitcoin fork. A hard fork creates a permanent divergence in the blockchain, resulting in two separate networks that don’t recognize each other’s transactions. This backward-incompatible change requires all nodes and miners to upgrade to the new protocol.

Accidental Hard Forks

In addition, there is also a term known as accidental hard forks, and developers created several Bitcoin copies through this process. An accidental hard fork occurs when two miners find and use the same block simultaneously, and when the Bitcoin decentralized network issues a consensus, both will receive the notification simultaneously.

As a result, both parties will keep mining on different chains before another miner adds a subsequent block. Since the process will involve miners adding blocks to the chain, the smart contracts select only one and discard the other. As a result of each chain functioning with different rules, the system will pick the longer chain. The miner who worked on the abandoned block will eventually lose.

Soft Forks

Soft forks still adopt the principle of altering Bitcoin’s blockchain network; the difference comes from the required alteration. A soft fork is also known as a forward-compatible fork.

This means that both the old and new blockchain networks can continue to coexist in the same virtual space, and thus the old can easily send a block to the new blockchain and vice versa. In layman’s language, a soft fork can convince the old blockchain network to accept the new rules without altering its original functionality.

A soft fork is more efficient and cost-friendly since both networks can coexist.

Hard Forks vs. Soft Forks: What’s the Difference?

A decentralized network potentially means that there will be two opposing sides. The Web3 community then argued which approach was better, but hard and soft forks are helpful depending on the circumstances.

Soft forks are more efficient, milder, and more accessible to implement than hard forks. Unfortunately, this poses a severe security threat. If perpetrators access one network, they will easily access the other. For some time now, a Bitcoin copy that is a soft fork has developed various measures to mitigate this flaw.

The hard fork provides efficiency and flexibility for the developer. As competition rises, the need for improvement is necessary. Fortunately, when creating a hard fork, a developer has creative freedom. If an idea or a concept fails, the developer can discard the new blockchain network without potentially harming the original.

Bitcoin Copies That Revolutionized Blockchain Technology

Throughout Bitcoin’s history, numerous forks have emerged, each with unique characteristics and goals. Some of the most significant include:

Bitcoin XT

As mentioned earlier, Bitcoin XT was the first major type of Bitcoin fork aimed at increasing transaction speed. While it ultimately failed due to lack of community support, it paved the way for future improvements and demonstrated the viability of forking as a development strategy.

Bitcoin Classic

When Bitcoin XT declined due to several issues, the community saw an opportunity for even faster transaction speed. As a result, most crypto traders were eager for the following type of Bitcoin Fork. This led to the creation of Bitcoin Classic several months after its predecessor shut down. One of the few problems Bitcoin XT presented was a slow and limited network due to the size of the blocks. To mitigate this problem, developers designed Bitcoin Classic with only 2MB blocks.

Eager crypto traders quickly adopted the improved type of Bitcoin fork and ran about 2000 nodes. Fortunately, the project is still alive and marked a significant point in Bitcoin’s decentralized network.

Bitcoin Cash: The Successful Hard Fork

Created in 2017, Bitcoin Cash addressed scalability issues by increasing block size limits. This type of Bitcoin fork became one of the most successful hard forks, eventually splitting into Bitcoin Cash ABC and Bitcoin SV. Its market performance and adoption rates have made it a notable player in the cryptocurrency space.

Segregated Witness

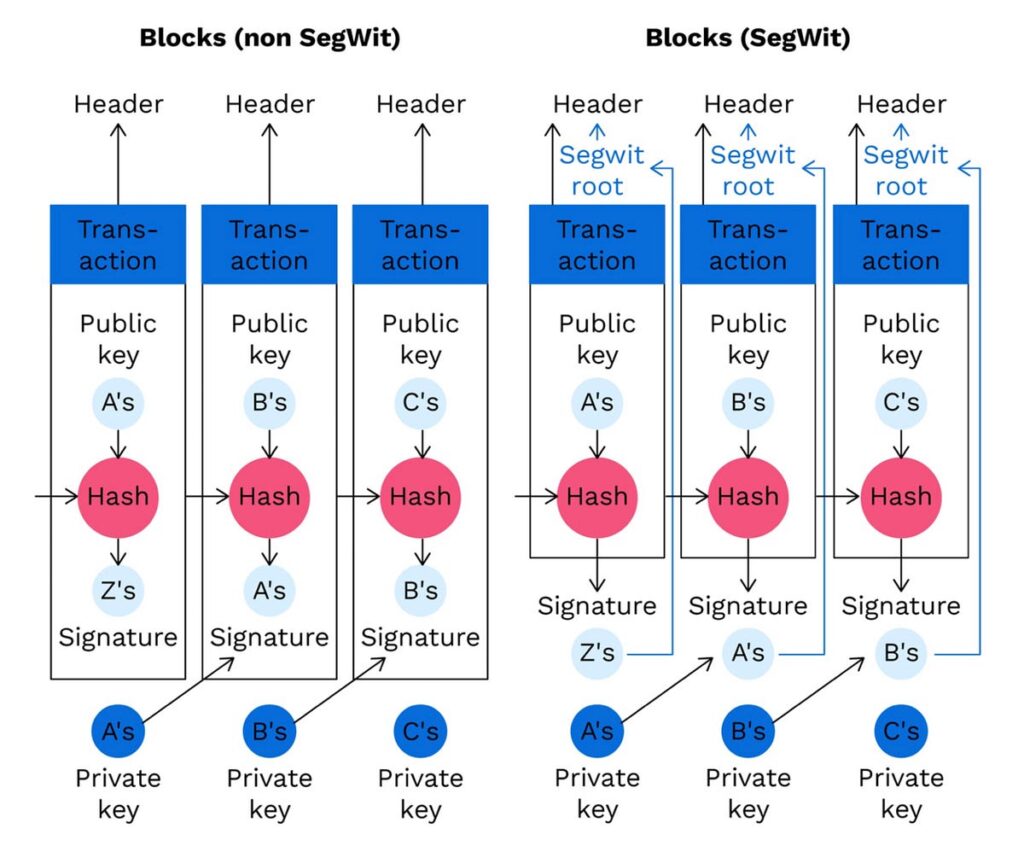

SegWit was an earlier type of Bitcoin fork, just like Bitcoin XT. However, Pieter Wuille, its founder, decided to take a different route than its counterpart Bitcoin XT. Wuille believed that the solution to increasing the speed of a Bitcoin copy was by decreasing block size. According to his thesis, the smaller the block size, the less congested and slow Bitcoin’s network will become.

Basic make of Bitcoin SegWit which focused more on the security aspect of it.[Photo: Medium]

SegWit was the first soft fork that also aimed at improving the security of Bitcoin. According to its report, this was possible by increasing the rate of transaction speed. By doing this, rogue nodes would no longer be able to change transaction details.

Bitcoin Gold and Privacy: A Special Case Study

Many crypto traders considered Bitcoin Gold an improved version of Bitcoin with an original touch. The creators of this type of Bitcoin fork wanted to restore the mining functionality with a basic graphic processing unit. This was in response to the various woes of crypto miners who claimed that the activity soon became too focused on equipment and hardware requirements. The concept of Bitcoin Gold and Privacy sparked a new debate among individuals, a concept focusing mainly on privacy.

Many crypto traders consider Bitcoin Gold an improved version of Bitcoin with an original touch.[Photo: BitMex-Blog]

To accomplish this, the creator added a unique feature to this Bitcoin Copy called pre-mine. It is a process in which the developers mined 100,000 coins after the hard fork development. These coins are in special endowments, and developers indicated that they would later grow to finance the Bitcoin Gold ecosystem. Its choice to bring back the essential elements led to the organization adopting the PoW mechanism.

Impact of Bitcoin Forks on Transactions and Network Performance

The impact of Bitcoin Forks on transactions ultimately depends on the make of the fork. Many might want to continue the classic Hard Forks vs. Soft Forks debate, but it boils down to efficiency and what the developers had in mind.

For instance, Bitcoin Cash dramatically increased transaction capacity while SegWit focused on security; Bitcoin Gold and Privacy were like two peas in a pod. The impact of Bitcoin Forks on transactions focuses more on the practicability, use, and design of the decentralized network. There are roughly between 70 to 100 Bitcoin forks, some designed to improve on existing systems while others took a leap of faith into the unknown and brought something completely new.

What Bitcoin Forks Mean for the Crypto Ecosystem

Each of these types of Bitcoin forks had a significant role to play in ensuring the prosperity of its original fork. The failures and successes have led to the rapid improvement of the renowned and well-known Bitcoin decentralized network.

At the end of the day, developers who opt for blockchain developments follow the principles left behind by Satoshi Nakamoto, which are transparency, freedom, and an end to centralized control. There have been multiple debates on the philosophical views, the practicability, and the moral aspect of different types of Bitcoin Forks.

The beauty about it is, it honestly doesn’t matter. Blockchain, NFT, Metaverse, AI, and new technology are going to come. The beauty about Web3 is that it doesn’t seek control, it doesn’t seek co-existence; its primary function will always be to usurp Web2, to bring about true decentralization, true transparency to finally make it clear to everyone, make it known to everyone who is who. Transparency and immutability are unchanging factors of blockchain with a singular goal to highlight everyone instead of the elite.

The change is here, it’s inevitable. Now the question simply remains: Will you be a part of it and finally watch and know who is who, who is evil, and who is good? Or will you take it upon yourself to be the change? Regardless, THE CHOICE IS YOURS.

For more interesting, informative, and factual articles, feel free to sign up below and be part of the Web3Africa community, a platform that does not seek control, doesn’t seek to be controlled, but seeks to tell the truth regardless of anyone’s feelings.