-

Understanding how fiscal policy impacts cryptocurrency markets provides a unique perspective to regulatory issues and where they clash with digital assests.

-

Government fiscal policies, including spending decisions and taxation, directly influence cryptocurrency markets by affecting inflation rates, liquidity, and investor behavior.

-

Well-structured regulatory frameworks that balance consumer protection with industry innovation are essential for fostering cryptocurrency market stability, preventing manipulation, and encouraging institutional participation.

Cryptocurrencies, digital assets, and the entirety of the Web3 space have now stepped into the global lens with many big names like the United States, BRICS Cooperation, and major African entities like Kenya, Nigeria, and Egypt. Before you get all quick to say, “it’s always been at the global lens,” it’s a bit different now.

When Bitcoin overtook the price of gold back in 2024, the power of digital assets has made itself clear to the entire world, and now everyone wants to hop onto the bandwagon. Digital assets have effectively showcased their dominance and rocked the very core of traditional finance, bringing a major question: how does fiscal policy impact cryptocurrency markets?

For those unaware, fiscal policies often play an integral part within any economy, more so within African nations. In a nutshell, the importance of a fiscal policy can directly affect you since it plays a major role in the inflation of fiat currencies, economic stability, and driving development.

So, without further ado, let’s dive into understanding the benefits of fiscal policy in crypto; answering the question: does cryptocurrency have fiscal policy; comprehending what is fiscal policy in cryptocurrency; and frankly getting to know how fiscal policy impacts cryptocurrency markets.

How Fiscal Policy Impacts Cryptocurrency Markets

Understanding the Importance of a Fiscal Policy

Within any government or state, the majority of citizens understand that taxation is a core component of running any state. Albeit that many African states have had few run-ins with tax laws, increments, and seeing its utilization, it doesn’t refute the basic significance of taxes. Fiscal policy essentially refers to the use of government expenditure and taxation to influence the economy.

ALSO, READ: Bitcoin as a Reserve Currency: Africa’s Financial Future or a Volatile Gamble?

At its core, the basic and proper functioning of any government has the capability, through strategic economic decisions without corruption, to stimulate growth, control inflation, and manage unemployment levels.

Essentially, a fiscal policy, if implemented correctly, allows a nation’s government to maintain economic stability and drive development. The importance of a fiscal policy cannot be overstated, but it’s well known that various African nations often have a hard time implementing such an intricate strategy due to various deep-seeded issues.

Understanding how fiscal policy impacts cryptocurrency requires you to view the relationship between how crypto has grown over the years and government interventions. Currently, with the recent Bitcoin boom, various government decisions on spending, taxation, and regulatory frameworks directly affect the digital asset market. Prime example: expansionary fiscal policies that increase money supply can lead to inflation, common in many African nations.

This, in turn, causes many citizens and investors to seek alternative assets like cryptocurrencies for sustenance. Conversely, contractionary policies might reduce liquidity, causing many to sell to get back their money’s worth, negatively impacting crypto valuations. It’s an interesting push-and-pull relationship when you think about it, but the question on all your minds is: does cryptocurrency have fiscal policy? For legal geeks, it’s what is fiscal policy in cryptocurrency?

Does Cryptocurrency Have Fiscal Policy?

The importance of fiscal policy is often witnessed in centralized and traditional financial systems. Unfortunately, cryptocurrencies are purposefully designed to supersede such legacy limitations. As a result, governments cannot directly control digital assets simply because Satoshi Nakamoto ensured the original cryptocurrency wouldn’t be.

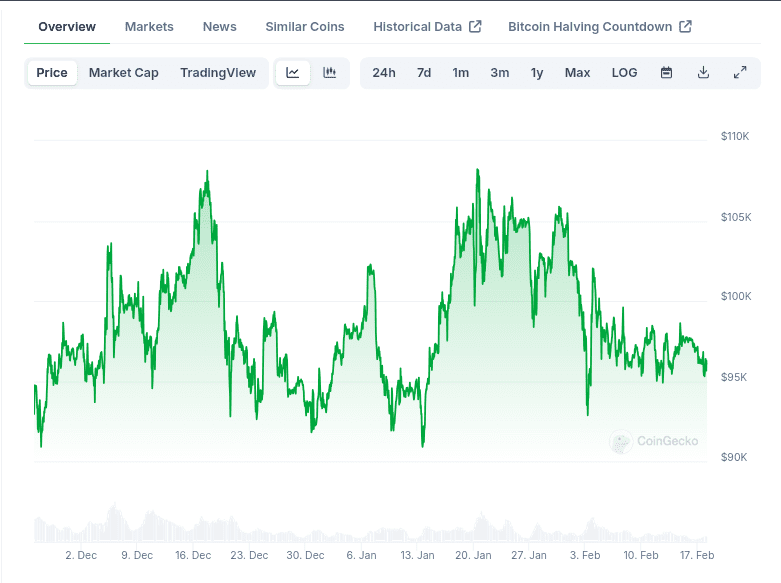

When Bitcoin overtook the price of gold back in 2024, the power of digital assets has made itself clear to the entire world, and now everyone wants to hop onto the bandwagon.[Photo: CoinGecko]

Benefits of Fiscal Policy in Crypto

The benefits of fiscal policy in crypto depend on several factors. For instance, having clear regulatory frameworks that focus on adoption and protection of the consumer rather than control significantly boosts confidence and encourages institutional participation and market stability. This was showcased during the SEC siege on crypto, where despite claims of protecting user interests, the majority of the industry could only see an attempt at control.

Additionally, well-structured policies can aid in preventing market manipulation, as witnessed when BTC played jump rope with the $100,000 mark, with various whales pumping and dumping prices for profit. Does cryptocurrency have fiscal policy? No.

There are various benefits which may protect consumers while fostering innovation and technological advancements, but it will require plenty of trial and error. The development of a global crypto legal framework is often considered a fantasy since it implies various entities to set aside their differences, fears, expectations, and greed to develop a framework on a technology not designed to be controlled.

What is Fiscal Policy in Cryptocurrency?

Elaborating on what is fiscal policy in cryptocurrency requires us to view how governments approach taxation, regulation, and spending concerning the nature of digital assets. This includes applying various traditional factors like capital gains taxation to new and improved crypto transactions. Some might view government spending and crypto as oil and water, especially within Africa—two things that cannot mix due to various factors, norms, and opinions. Despite this, there have been various known and functioning attempts, i.e., South Africa’s crypto tax laws have taken such factors into account.

The Good, The Bad, The Ugly, and The Retarded

Understanding how fiscal policy impacts cryptocurrency markets is essential for investors, policymakers, and industry participants alike. The general viewpoint of adopting a new technology is often frowned upon, and it’s only until Bitcoin clocked $100,000 that the entire world got into a frenzy of adopting digital assets. Despite this positive movement, adopting digital assets goes against most norms in various African countries.

The concept of CBDCs is now frowned upon since many crypto investors and traders understand the dangers it poses if implemented under a not-so-friendly regime. This is why the majority of governments opt to research or take a neutral stand, viewing and gradually raising adoption while figuring out the best way to curb bad actors like scammers. Regardless, the industry, in and of itself, is not perfect—it’s evolving and adapting to new changes and improving upon itself.

For instance, what started out as “money from the sky” has now transformed into an industrial revolution encompassing industries that no one expected it would. Likewise, developing a fiscal policy or regulatory framework will take some time, but instead of focusing on how to control it, policymakers should focus more on how to help address the nation’s issues.

If you’re interested in more informative, entertaining news, make sure to sign up below and join our ever-expanding Web3 Africa community.