Decentralized applications are the future of tech with ecosystems competing for which provide better tools, lower gas fees, and broader ecosystems.

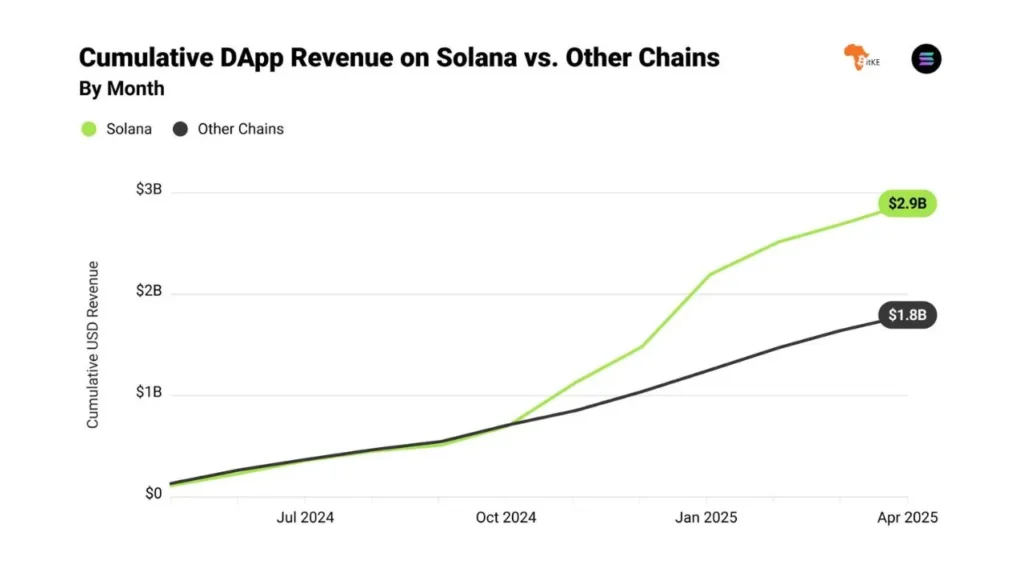

However, in an unexpected twist, Solana dApp revenue outpacing the reigning king, Ethereum, by commanding over 50% of total dApp revenue.

Key Takeaways

- Solana dApp revenue now captures 50% of global decentralized income, driven by memecoins, low fees, and Telegram integration.

- Pump.fun’s $630M and Phantom’s $32M highlight Solana’s dominance in social finance and stablecoin adoption across African markets.

- Ethereum’s DeFi decline to 12.84% revenue share underscores scalability challenges, while Solana’s 65,000 TPS fuels Africa’s Web3 experimentation.

Solana, the phenomenal Layer-2 blockchain, has finally revealed its prowess by not only dominating token performance and ecosystem revenue.

The meteoric rise contrasts sharply with Ethereum DeFi decline of about 12.84% as more ecosystems refined their consensus mechanisms, proving how Web3 is rapidly evolving.

Ethereum’s DeFi Decline: A Catalyst for Solana’s Rise

One of the undisputed leaders of Web3, the backbone of decentralized applications, Ethereum’s influence and performance have recently taken a sharp nose dive.

Broader Dapp revenue stats showcase a pivotal growth within the ecosystems with Layer-2 networks and the latest Layer 1 blockchain technology taking a new frontier.

CHECK OUT:From Cold War Bunker to Luxury Stay: Solana Doomsday NFT’s Bold Plan

The ecosystem’s high gas fees during late 2024 shunned many small traders, opting for many to hunker down in one alternative ecosystem with slap-dash innovation.

While Ethereum protocols like Loido and Aave continue to generate $88 M-$180 M, their growth still pales compared to Solana.

Researcher 0xGumshoe notes;

“Solana went from nothing to EVERYTHING, from 0.3% to 50% of all App Revenue. For every $100 of app revenue in crypto, $50 is captured by Solana Apps. That’s a 166x growth.”

A primary selling point for the ecosystem is its ability to attract users and developers to low-cost DeFi platforms.

Essentially, Solana transaction fees are mounting at $0.00025, while Ethereum’s stand at $0.03. See the difference? With a fraction of what the former king offers, many opted for the Solana.

Furthermore, Solana Dapp’s revenue dominance was heavily driven by the success of several projects like Pump.fun, and Phantom.

According to statistics, Pump.fun generated approximately $630 million over the last year, while Phantom, a Solana-based wallet, was popular with USDC and USDT stablecoins, generating at least $32 million.

Essentially, the cost effectiveness, paired with a standard TPS rate of 65,000 throughput, contributed heavily to cementing its reputation as the hub of high-volume, memecoin-friendly, and social finance decentralized titan.

Breaking Down Solana Blockchain Dominance

Solana’s revenue drivers reveal how the ecosystem has focused more on developing a diverse ecosystem, emulating Ethereum’s approach but providing lower costs and better interactions:

- Memecoin Mania: Pump.fun’s $630M annual revenue—third only to Tether and Circle—showcases how the ecosystem capitalized on the memecoin hype of 2024.

- DeFi Innovation: Raydium and Jupiter Exchange contributed $32M and $22M monthly, representing 86% of the total spot DEX revenue. As for the latter, Jupiter Pro’s advanced trading interface, sophisticated analytics, and Swap API attracted numerous traders.

- Consumer Apps: Telegram bots generated $300 million throughout 2024. DeFi and NFT infrastructure like Kamino generated $2.7 million from lending services. Metaplex and Magic Eden generated $1.3 million and $400,000 through minting tools and marketplace trades, proving Solana dApp revenue isn’t reliant on a single niche.

Notably, in Q1 2025, Solana revenue hit $1.16 billion despite the March cool down of $146 million, a decline from February’s $300 million and January’s $650 million.

This resilience, accounting for 46% of all Dapp revenue stats, showcased how Solana outperformed Ethereum in DeFi.

CHECK OUT:30% No More? Apple’s Crypto Policy Shake-Up

Emerging DeFi Trends 2025: Beyond Speculation

If revenue charts and stats tell the story of market momentum, then the individual dApps reveal the growing development in Decentralized applications.

- Tokenized Physical Goods: Projects like dVIN Labs (luxury wine NFTs) and Dripster.fun (on-demand manufacturing) merge blockchain with tangible value. The former released NFTs valued at $1 million, and the latter showed $3M in trading volume during its launch.

- Behavior-Based Finance: Moonwalk Fitness and Time.fun incentivizes health and productivity through staking mechanics, earning $3.4M and $3M, in seed funding.

- SocialFi Experimentation: News2Pump turns viral tweets into tradable tokens, generating $300K volume in 48 hours.

These emerging DeFi trends in 2025 showcase how Solana has adopted a broader outlook to Web3, facilitating a blend of utility with blockchain technology’s wide range of applicability.

Meanwhile, the Ethereum DeFi decline stems from its inability to scale cost-effectively despite hosting over 1000 Layer2 projects.

While Hyperliquid’s $212M revenue shows pockets of innovation, Ethereum’s ecosystem lacks the frenetic experimentation defining Solana’s 2025 surge.

A New Era for dApp Economics

With Solana dApp revenue resetting industry metrics, a stiff bar has been set for competitors.

Blockchain has allowed it to host speculative and utility-driven applications, giving players various choices.

Low-cost DeFi platforms attract more mainstream users and developers in Africa, where the DeFi ecosystem is at its peak.

Solana is a growing option given its blend of speed, affordability, and creative positions. Today, it’s not just traders who seek out Web3 but innovators seeking to establish new frontiers in the decentralized world.

For Ethereum, the path forward demands urgent scalability upgrades. For now, the DApp revenue stats don’t lie: Solana isn’t just leading; it’s reimagining what blockchain can achieve.