-

Bitcoin price surge reflects ETF inflows and African remittance reliance on BTC for cheaper cross-border payments.

-

Short-seller liquidations of $55M amplified BTC’s rally, signaling bullish momentum.

-

Corporate Bitcoin adoption, led by MSTR, offers African economies a hedge against inflation and crypto ETF access.

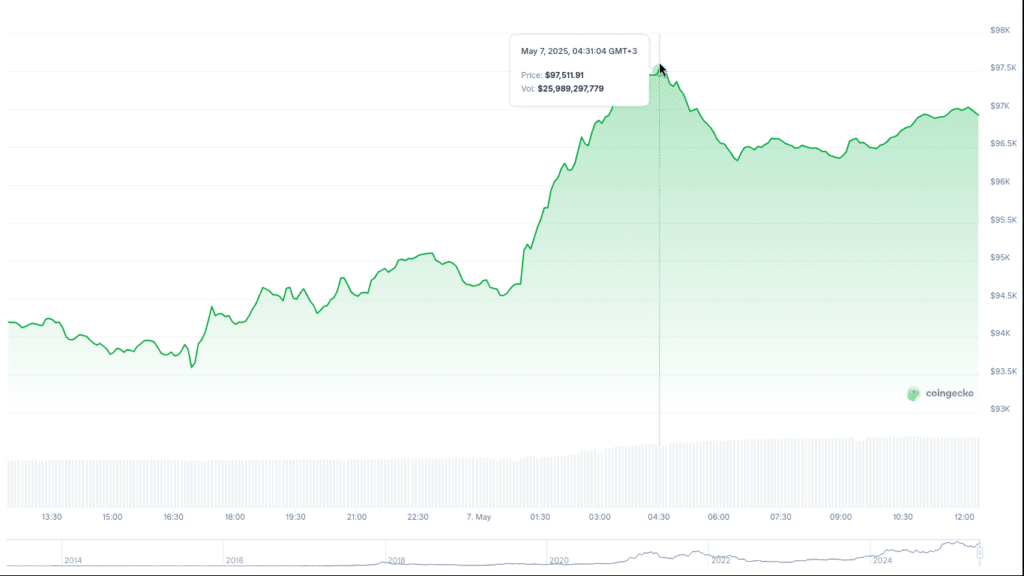

An electrifying bitcoin price surge reignited optimism within the digital assets’ capability to re-attain its $100K mark. The original crypto coin rose by $3,500 in a single day, reaching $98,0000.

These significant movements have caught the attention of investors and analysts, wondering whether Bitcoin price predictions 2025 showcase potential highs in the hope of breaking news once again.

Bitcoin Price Surge Powers African Crypto Revival

Bitcoin ETF Net Inflows and Market Dynamics

With digital assets becoming more mainstream, many attribute the recent surge to the notable Bitcoin ETF net inflows, indicating renewed investor interest in the market.

The growing number of regulatory clarity from powerhouses like the US has driven positive outlooks for the market, with investors considering Bitcoin a viable asset class.

While Asia and North America dominate headlines, African platforms still showcase some promise given recent legal developments in South Africa, Kenya and Nigeria.

This dynamic reflects regional imperatives as remittance corridors within West Africa are leaning on Bitcoin for faster, cheaper cross-border payments.

CHECK OUT: Bitcoin as a Reserve Currency: Africa’s Financial Future or a Volatile Gamble?

On the contrary, East Africa’s growing adoption of DeFi ventures leans more on experiments with collateral pools to find the balance between fiat and crypto transactions.

With regions developing clearer guidelines focused on consumer protections, Bitcoin EFT net inflows are alluring to whale investors within Africa.

Bitcoin resistance levels near $98000 are a hot topic with market participants closely monitoring technical indicators, hoping it’s just a bear market into the $99 mark.

The Relative Strength Index (RSI) currently hovers near 66, signalling potential overbought conditions while remaining within neutral territory.

This unique paradigm indicates a sustained accumulation without escalating into speculative excess.

Tracking Bitcoin Short Positions and Liquidations

During this short but intense bitcoin price surge, short sellers have found themselves between a rock and a hard place.

According to experts, $40 million in Bitcoin sort position met the undesirable fate of being forcibly unwound within just four hours. The event caused total liquidation exceeding $55 million in 24 hours.

These Bitcoin short options liquidations accelerated the rally, with traders buying to cover short positions, increasing the upward pressure on the price.

Bitcoin Balance Sheet Acquisitions Gaining Traction

Africa’s crypto market has steadily evolved over the years, and after the 2024 crypto bull run, it’s no longer just money from the air but a viable source of income.

A growing trend of Bitcoin balance sheet acquisition has spurred private companies to dive into the market. On a global scale, over 70 companies worldwide are now adding Bitcoin to their balance sheets.

Among these notable trends, MSTR’s earnings calls released last week suggested the company intends to double its acquisition plans, aiming to acquire $84 billion for bitcoin purchases over the next two years.

This tactic can also be utilized to hedge against hyperinflation in markets throughout various African nations.

This rapid development underscores the viability of increased institutional adoption of Bitcoin as a beneficial asset.

Bitcoin shoots up nearing the $98K mark but falls short.[Photo: CoinGecko]

The current Bitcoin price prediction for 2025 remains largely speculative. Many experts anticipate BTC climbing towards $100K and potentially reaching $ 110k.

The ETFS, the growing adoption of DeFi and corporate adoption, plus the growing rate of crypto laws within Africa, will mainly drive this.

Currently, Africa is still a minor player within corporate holdings, but in due time, with more adaptive policies, this may change for the better.

Conclusion

The recent bitcoin price surge reflects a confluence of factors ranging from Bitcoin ETF net inflows, Bitcoin short position liquidations, to Bitcoin balance sheet acquisitions.

While bitcoin resistance levels still prevail near $98000, the underlying factors point to an upward trajectory.

This would potentially set the stage for new all-time highs in the coming months, urging investors and small traders to gear up for a potential rise.

Despite this recent positive outlook, the market is still highly volatile.

Recent policies from the US and Africa’s growing adoption of better crypto laws may have some effect, but ultimately vigilance prevails.

Investors must remain cautious, keeping up with news trends and, most importantly, major players within Africa’s crypto market.