• African nations face significant crypto legal challenges as they navigate how to regulate decentralized finance while balancing innovation with consumer protection and financial stability.

• Several African countries have implemented specific regulations and taxes on cryptocurrency transactions, showing diverse approaches to blockchain technology integration.

• The transnational nature of blockchain creates complex jurisdictional issues, highlighting the need for international cooperation in developing consistent regulatory frameworks.

In today’s digital landscape and wave, understanding the dynamic back-and-forth between cryptocurrency and legal frameworks has become a heated topic. Bitcoin proved its superiority by surpassing the $100,000 mark on December 5, 2024, showcasing that the once-ridiculed scam had become more valuable than 1 kg of gold.

This essentially became an eye-opener for most African nations to take accountability and dive into designing a decentralized finance legal framework. This article explores the current state of crypto legal challenges, delving into cross-border crypto disputes, understanding how nations can fight money laundering with crypto tracing, with a keen focus on how Africa can become the change instead of following the wave.

Understanding Crypto Legal Challenges

The decentralized, immutable, and integral nature of digital assets presents unique crypto legal challenges for governments worldwide. For instance, unlike legacy financial systems, crypto forgoes centralized authorities.

This very nature has its ups and downs; one of its benefits is that it combats corruption, making every transaction transparent, but it also makes it difficult to apply existing legal frameworks. From a basic understanding, it’s like expecting a new entity to follow an old roadmap that has clearly failed, especially within Africa. This essentially presents entirely new challenges to lawmakers to balance its transparent nature while still protecting consumers and maintaining financial stability.

ALSO, READ: BRICS Single Digital Asset: The Global Digital Currency Revolution

With a closer look into Africa, we have various types of governments. For instance, South Africa, a well-known player in the crypto world, took time to implement digital assets into everyday life, such as crypto ATMs, and then applied standard income tax rules to crypto assets.

This showcased a mature understanding that digital assets were a means to assist and grow financial inclusion. Then another example is Kenya, which implemented a 20% excise tax on crypto transactions through the Capital Markets Act (CMA Bill 2022) amendment before any prior initiatives to adopt. This very example speaks volumes and showcases the priorities firsthand.

Decentralized Finance Legal Framework

Decentralized finance is a tangent or, in simpler terms, a by-product of the various pillars of Web3, which has brought about new cross-border crypto disputes. In Africa, DeFi platforms have risen in fame and functionality, and each operates outside traditional financial systems, thereby creating new decentralized finance legal framework considerations. With the use of smart contracts, it forgoes intermediaries like banks or transaction posts, challenging existing laws designed for centralized systems.

A prime example is Nigeria, a bustling nation knee-deep into digital assets, which has taken a cautious approach to decentralized finance regulations. This led to the Central Bank of Nigeria issuing warnings about the risks associated with crypto assets as it explored how to implement new blockchain technology laws that seek adoption rather than control.

Fighting Money Laundering with Crypto Tracing

A major and valid concern surrounding cryptocurrency is their potential use in money laundering and other illegal activities. The use of crypto mixers is a valid concern among many African nations, and various advancements in crypto tracing have made it possible to combat some of these issues.

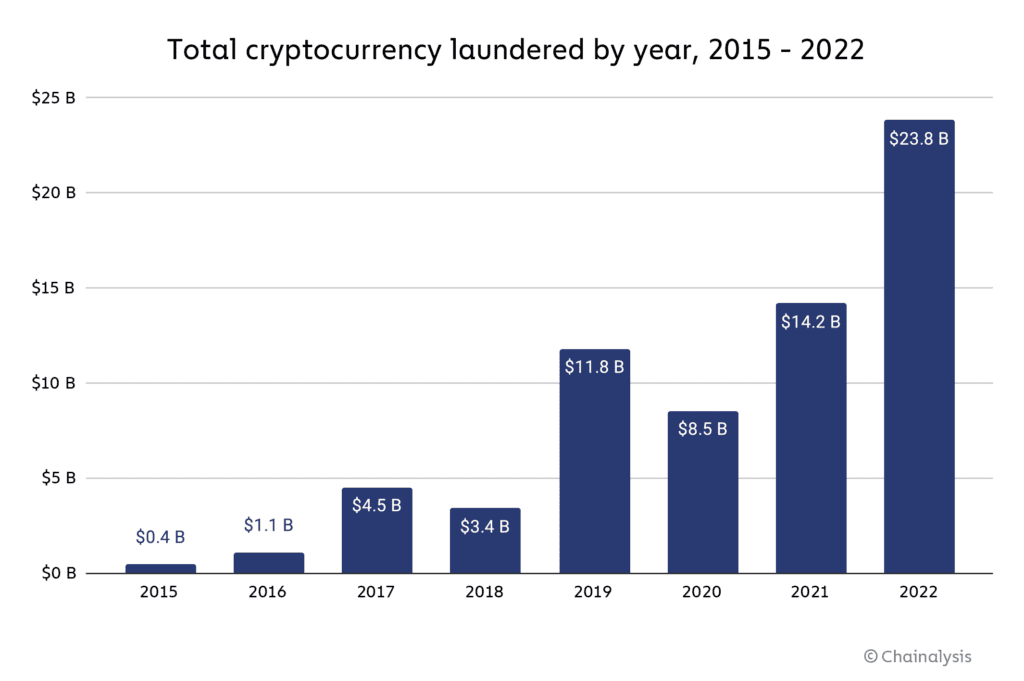

In 2022, Chainalysis reported that illicit addresses sent nearly $23.8 billion worth of cryptocurrency, a 68% increase from 2021. Unfortunately, there is no such thing as the perfect security system; blockchain is a new industry, and its rapid growth has also attracted bad actors.

In 2022, Chainalysis reported that illicit addresses sent nearly $23.8 billion worth of cryptocurrency, a 68% increase from 2021.[Photo: Chainalysis]

With this in mind, several nations like Kenya and South Africa have implemented strict anti-money laundering (AML) regulations for crypto exchanges. This ensures that customer identities are verified and suspicious transactions are reported.

Quite honestly, the debate on balancing security for safety reasons and security for control reasons has been a heated debate. A prime example is the SEC crypto hunt, which clearly bordered on control rather than safety. This showcases how much work is required to develop blockchain technology law since it’s a new industry that requires new laws.

Blockchain Legal Challenges 2025

Several blockchain legal challenges 2025 have emerged. For instance, the transnational nature of blockchain technology makes it difficult to determine jurisdictional authority for disputes. A cyber attack can occur on a Kenyan-based DeFi platform, but when traced, the perpetrator may reside in Singapore or the US. This showcases how difficult it is to apply existing laws to blockchain technology truly.

Ghana provides an interesting case study in blockchain legal challenges 2025. The nation is currently exploring how to regulate crypto assets while encouraging blockchain innovation. In 2024, Ghana’s parliament began deliberations on a crypto regulation bill that would establish a legal framework for digital assets.

Cross-Border Crypto Disputes

Blockchain technology has the ability to interconnect nations without the cumbersome hustle of traditional financial systems. This borderless nature does raise some cross-border crypto disputes, which often involve multiple jurisdictions with differing legal interpretations.

This makes resolving these issues more complex, which makes accountability more prominent when dealing with smart contracts. Essentially, technology isn’t inherently evil; rather, it’s the minds behind it. A prime example is the FTX scenario, which rocked the entire world in 2022, causing uproar in many nations. The beauty of smart contracts and blockchain technology is that the evidence is often portrayed right there within the system, which is why culprits such as the “Crypto Queen” are still hiding.

This, however, highlights the need for international cooperation in developing consistent decentralized finance regulations.

Blockchain Technology Law in Africa

Blockchain is the future, and Africa is at the center stage of this change. As a result of this dynamic and rapid shift, several African nations are at various stages in developing blockchain technology law.

South Africa: The country has implemented blockchain solutions for digitizing legal documents, which has reduced time and costs in both civil and criminal cases.

Nigeria: The Securities and Exchange Commission (SEC) categorized cryptocurrency as securities in 2020, representing a step toward comprehensive regulation. In addition, the nation has a functioning CBDC called the eNaira.

Ghana: The country has implemented blockchain technology in its land registration system through a pilot project with the Land Commission and World Bank. This improved its transparency and efficiency in land registry, and it is deliberating on establishing a legal framework for digital assets.

Kenya: Kenya’s Capital Markets Authority created a sandbox environment for blockchain and fintech companies to test applications, though cryptocurrency projects were initially excluded. The government established a Blockchain and AI Task Force in 2018, publishing a comprehensive strategy paper in 2019 outlining regulatory approaches for blockchain technology.

Mauritius: The nation created a regulatory sandbox license allowing development of blockchain-based solutions under supervision of the financial services regulator. The Economic Development Board has issued these licenses to various FinTech companies.

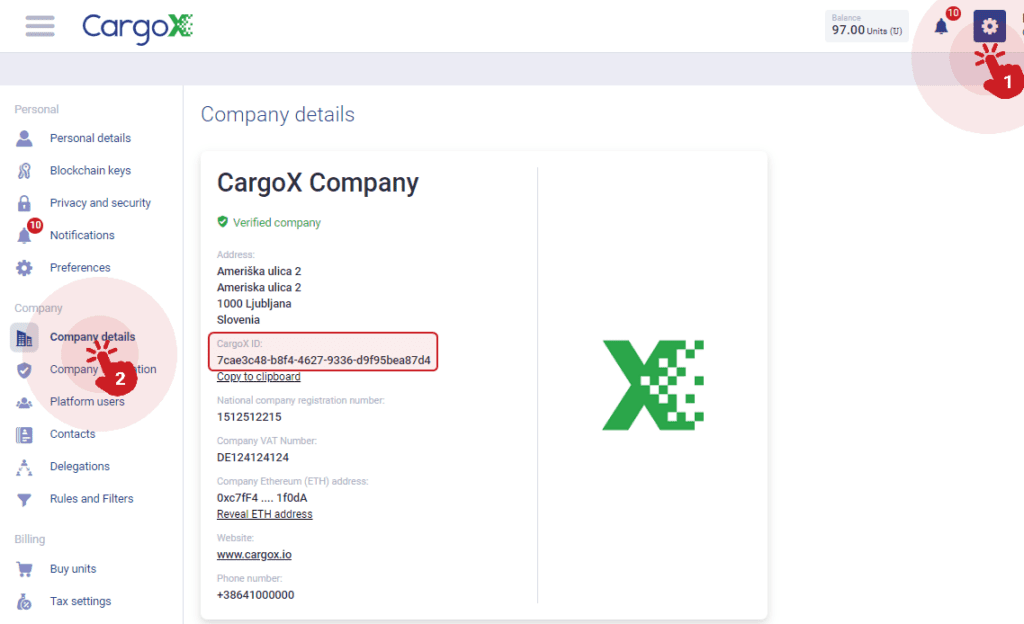

Egypt: Egypt implemented the blockchain-powered CargoX platform in 2021 as part of its Advanced Cargo Information (ACI) system. This initiative improved customs administration and trade facilitation by providing real-time, immutable data sharing across stakeholders in the supply chain.

Egypt implemented the blockchain-powered CargoX platform in 2021 as part of its Advanced Cargo Information (ACI) system.[Photo: CargoX-Platform]

Botswana: The country has focused on exploring blockchain applications in natural resource management and public sector efficiency.

Zimbabwe: has taken a restrictive approach to cryptocurrencies, with the Reserve Bank of Zimbabwe issuing warnings about their use. However, the government has shown interest in blockchain technology for improving transparency in certain sectors.

Namibia: has prohibited cryptocurrencies while exploring blockchain applications for specific government functions.

Tanzania: Tanzania has maintained a neutral stance on cryptocurrencies while developing regulatory frameworks for blockchain technology.

Uganda: has shown interest in blockchain technology for improving agricultural supply chain transparency and efficiency. The government has partnered with international organizations to implement blockchain solutions for tracking coffee and other agricultural products.

Conclusion

Crypto legal challenges are ongoing debates among many African nations. The very concept of blockchain technology law demands an approach to the unknown since existing laws either clash with various core elements or are merely unapplicable to various scenarios. This merely showcases the complexities when it comes to tackling such issues but also begs an even higher question: what are nations doing about it?

For more interesting, entertaining, and factual news, sign up below to join our growing community and never miss any tantalizing news that seeks to just lay it all bare.