-

The DeFi Revolution sweeping Africa is dismantling traditional banking barriers and catalyzing mobile-first financial inclusion.

-

Innovative startups like Xend Finance and Pezesha showcase how yield aggregation, stablecoin staking, and credit-union tokenization deliver double-digit APYs to underserved communities.

-

While Africa’s Web3 industry holds immense promise, network congestion and regulatory uncertainty must be addressed to ensure sustainable growth

The DeFi revolution is here, and Africa has wasted no time gearing up for the next industrial revolution. Decentralized finance reshaped money management across Africa and allowed underserved communities to bypass outdated financial obstacles.

This trillion-dollar industry leverages blockchain technology, unlocking opportunities for millions of unbanked individuals, and fosters startups disrupting African fintech.

This article explores how Africa is becoming a global hub for DeFi innovation, driven by mobile-first DeFi platforms and rudimentary DeFi investment strategies.

The DeFi Revolution: Empowering Africa’s Unbanked Population

How DeFi in Africa Challenges Traditional Banking

Traditional banking in Africa has struggled to meet the financial needs of a good portion of its population, as its establishment costs are prohibitive for many regions lacking basic financial services. This leads to lengthy and expensive journeys for access or, worse yet, no services.

In the past decade, various startups disrupting the continent’s fintech industry have taken a peculiar tangent.

By leveraging on the high mobile penetration in Africa and the adaptability of blockchain, a series of Mobile-first DeFi platforms have emerged to empower users with financial autonomy.

CHECK OUT: How Does DeFi Work Exactly? Is It An Industry? A System? Or The Next Step In Tech

The benefits of DeFi for the unbanked population are numerous, given this unique approach. Today, various African-based platforms have provided users easy access to digital assets services from their smartphones and mobile phones.

Startups Disrupting African Fintech

The Web3 Revolution in Africa has taken the industry in waves, with many constantly redefining what fintech is.

There is a massive wave of Web3 startups, with many having local roots determined to fix issues related to their community.

They include:

- Xend Finance (Nigeria): As a pioneer in credit-union tokenization, Xend offers decentralized savings pools yielding up to 15% APY, outpacing traditional banks.

- Pezesha (Kenya): Pezesha uses the Celo blockchain to offer SMEs loans using stablecoins (cUSD). With over 75,000 loans disbursed, it exemplifies DeFi investment strategies that prioritize accessibility.

- Kotani Pay (Kenya): Bridging mobile money and crypto, Kotani’s USSD-enabled on-ramps have slashed remittance costs from 111% to under 2%, proving the power of mobile-first DeFi platforms in low-connectivity settings. In addition, the incorporation of USDC and USDT showcases how to use stablecoins to protect savings.

- Melanin Kapital (Kenya): Tokenizing carbon credits to finance solar irrigation and green mobility for SMEs—a novel fusion of DeFi and climate action.

- Paylend Africa: Offers 2.5% annual interest loans to MSMEs via its Inua Biashara program, digitizing over 20,000 businesses.

- Jia: Enables collateral-free credit through community-governed token pools, targeting growth capital of up to $5,000 for SMEs.

Growing Focus on African Startups

The DeFi revolution in Africa has caught the attention of various accelerator programs seeking to be part of Africa’s Web3 industry. One such program is the Y Combinator (YC), an established global accelerator with high-profile investments like Reddit and Dropbox.

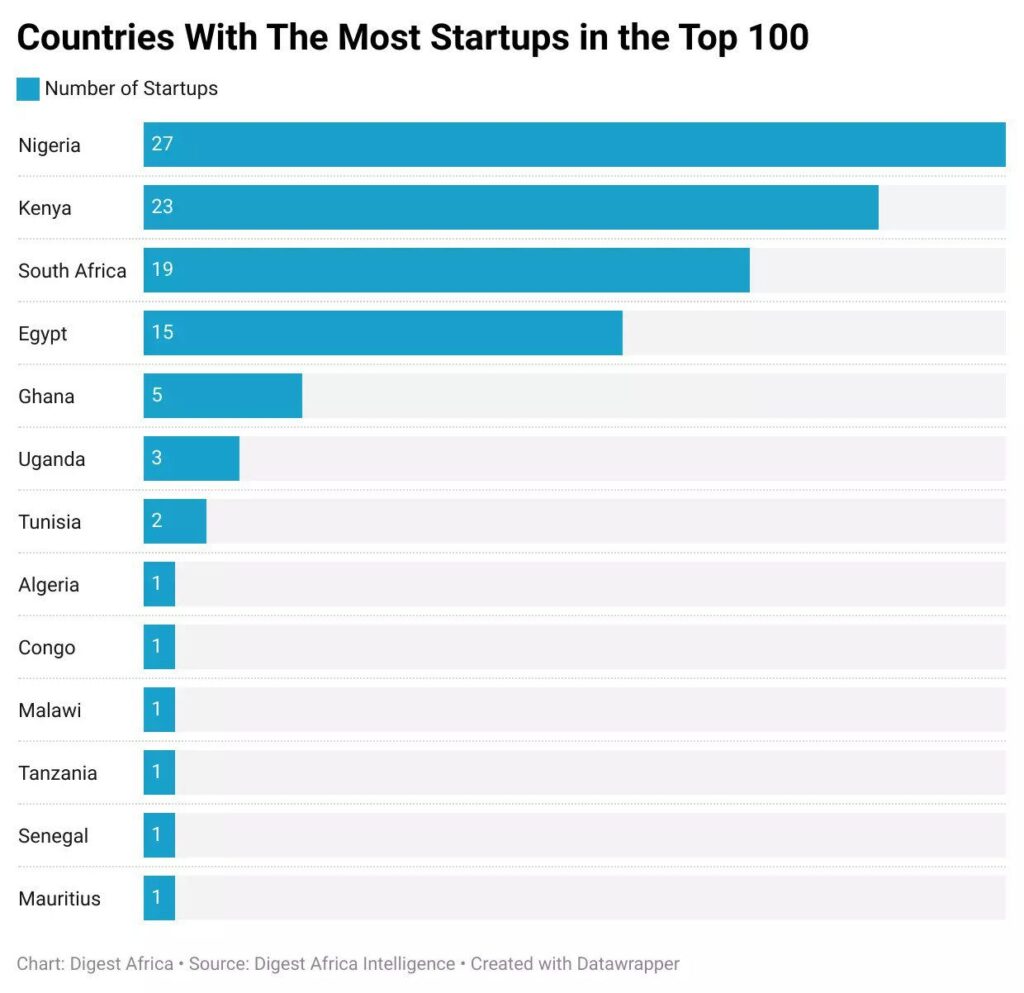

Rate of Web3-Startups in Africa[Photo: Technext]

Other investor programs with a keen interest in Africa are:

- Adaverse – Has provided investments ranging from $50,000 to $750,000, mentorship, technical infrastructure, and a three-month accelerator curriculum covering product design, technical support, andcommunity building. It has backed startups like Afriblocks, Cassava Network, Stakefair, and House Africa.

- CV Labs Africa Blockchain Accelerator – focuses mainly on early-stage blockchain startups to invest in African blockchain startups. It has backed organizations like Mazuma, Pravica, and Carmachain.

- Olympus Accelerator Programme – released a $15 million grant to be used in the mentorship, technical, and business training of Web3-based startups and to give access to a decentralized platform for global investor and entrepreneur connections. Prominent names like Kotani Pay, Totalipay, and ICP Hub Kenya owe their fame to this program.

- StarkWare Africa Fund & Accelerator – has released up to $150,000(KPI-based) grants and invented up to $500,000 to provide 12-month accelerator, mentorship, and business support.

There are additional mentions like Africa Giant Web3 Labs and Google for Startups Accelerator Africa, showcasing the growing interest of the globe in investing in African blockchain startups.

Key Strategies Transforming African Finance

There are often three core strategies that the common local can participate in. Given their effectiveness, some of these methods have significantly contributed to the DeFi revolution.

They include:

- Yield aggregation: Pooling assets across protocols like Compound and Aave to maximize returns.

- Stablecoin staking: Locking stablecoins in liquidity pools to earn interest while hedging volatility.

- Credit union tokenization: Creating community-governed pools that mirror traditional cooperatives but with higher APYs.

Furthermore, the growing use of stablecoins has shielded most from inflationary pressure; a [prime example is seen from Xend Finance’s credit-union pools that generate up to 12–15% APY in stablecoins.

The Road Ahead: Scaling the DeFi Revolution

One truth remains even with the dynamic nature of Web3: Africa’s DeFi revolution is a tangible shift towards inclusivity and programmable finance. Through various DeFi investment strategies, the sector is creating a tailored path for savings, credit, and remittances, focusing on you, dear reader.

CHECK OUT: Why DeFi Feels Safe—Until You Discover Its Liquidity Web

The innovative startups disrupting African fintech demonstrate that local contexts like mobile networks, informal economies, and regulatory landscapes can be capitalized as strengths. Furthermore, we can rewrite Africa’s financial playbook with global investors like Binance Incubator Program accelerators.