-

Coinbase data breach saw insiders exfiltrate user names, emails, and addresses, leading to a dramatic 7% stock decline.

-

Concurrent SEC scrutiny of past user-metric disclosures underscores the need for transparent reporting and robust compliance.

-

Industry must adopt zero-trust architectures, micro-segmentation, and advanced behavioral analytics to prevent future breaches.

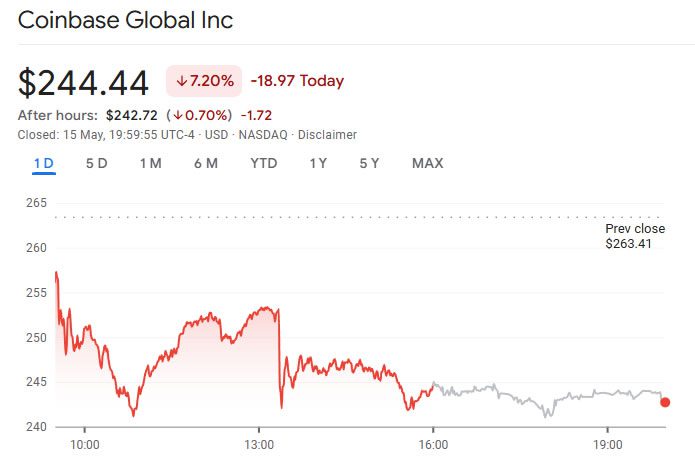

The recent Coinbase data breach has recently sent shockwaves throughout the crypto sector as investigations collide with ongoing regulatory scrutiny, sending its stocks plummeting 7% ahead of its landmark S&P 500 inclusion.

The dual crises, a cryptocurrency ransom attack and an SEC investigation, highlight how the rapidly evolving crypto sector faces numerous hurdles.

This recent breach raises compelling cases regarding KYC compliance standards and post-breach accountability.

Insider-Driven Cryptocurrency Ransom Attack Targets User Data

On May 15, 2025, Coinbase confirmed that a hacker had infiltrated its systems, acquiring confidential customer records and conducting cryptocurrency ransom attacks.

According to investigations, insider sources recruited overseas support agents abusing their login privileges to exfiltrate names, email addresses, and transaction histories.

Unlike normal credential theft, the breach did not expose passwords, however, stolen information included names, emails, and physical addresses, exposing the victims to a myriad of exploits.

CEO Brian Armstrong explained in a company statement;

“These attackers contacted multiple customer support agents, seeking a weak link willing to accept bribes in exchange for private data. Sadly, a few bad apples accepted.”

Rather than concede to the $20 million standard, the organization showcased its might and initiated its Coinbase user reimbursement processes, pledging to cover all verified customers’ losses from subsequent phishing scams.

As per the organizations, the estimated cost for reimbursements and incident response ranges between $180 million and $400 million, underscoring the impact of data breaches on crypto stocks.

Coinbase stock 24 hours. [Photo: Google Finance]

SEC Investigation into 2021 User Metrics Adds Regulatory Heat

Unfortunately, Coinbase troubles extend beyond technical fixes.

The U.S. Securities and Exchange Commission intensifies its SEC investigation into the exchange’s past reporting.

Dating back to 2021, the regulatory bodies claimed that the organization’s user count disclosure misled investors.

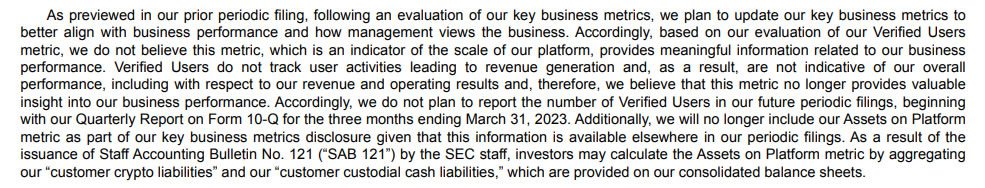

Specifically, the SEC verified user investigation proved the exchanges’ claim of having 100+ million verified users.

Paul Grewal, Coinbase’s Chief Legal Officer, dismissed the inquiry, stating;

“This is a hold-over inquiry from the previous administration about a metric we stopped reporting two and a half years ago. We now emphasize monthly transacting users as the more relevant indicator of platform activity.”

While Coinbase has engaged Davis Polk & Wardwell to navigate these waters, the case underlines a broader trend: exchanges must marry transparent reporting with rigorous security and compliance frameworks.

Despite the ongoing prosecution, the SEC filed a separate lawsuit in 2023, signaling heightened scrutiny of crypto KYC compliance practices.

Crypto KYC Compliance Under Microscope

Emerging research alongside SEC investigations point for gaps within a exchanges customer verification procedures.

Know-your-customer (KYC) rules are designed to prevent fraud and money laundering requiring platforms to rigorously authenticate insiders.

CHECK OUT: HashKey Global MENA Launches Regulated Crypto Platform with UAE Crypto License

While Coinbase insists its compliant with crypto KYC compliance metrics and Bank Secrecy Act guidelines, the recent breach says otherwise.

Lingering doubts over its transparency in crypto reporting are rising, with many taking a cautious stance.

In 2024, crypto-related hacks are estimated to cost $2.2 billion as the industry grows. Nick Jones, CEO of Zumo, notes that “bad actors are leveraging AI tools to bypass fraud prevention measures.”

In addition, while external hackers orchestrated the scheme, insider involvement highlights the need for layered checks.

No system is foolproof, but with emerging AI tactics pushing existing measures, the need for better behavioral analytics tools to flag anomalous access patterns is growing.

Impact of Data Breaches on Crypto Stocks and Sector Trust

Security and trust are the cornerstones of the crypto industry. Coinbase’s 7% stock slide exemplifies this fact as it erodes short-term investor confidence..

Fortunately, Coinbase’s quick thinking and proactive reimbursements cushioned it from a landslide liquidity risk, but much work is still to be done.

Blockchain security is improving with many organizations incorporating zero-trust architecture, enforcing least-privilege access, and micro-segmentation.

In its 2022 financial statement, the firm stated it would stop reporting the metric as it no longer believed it provided meaningful information to its business performance. [Photo: SEC]

Bo Pei, analyst at U.S. Tiger Securities, states,” The cyberattack may push the industry to adopt stricter employee vetting and introduce some reputational risks.”

A Pivotal Moment for Crypto Accountability

The Coinbase data breach and SEC investigation are inflection points for the crypto industry.

Coinbase is a pinnacle of the crypto industry whose 24-hour trading volume is approximately $2.2 billion.

It acts as a bridge for traditional finance and digital assets, robust crypto KYC compliance and preemptive security measures become non-negotiable.

While the company’s S&P 500 debut marks a symbolic win, its response to these crises is a test where centralized exchanges can measure the rigor of mainstream markets.

While cryptocurrency ransom attacks and other blockchain attacks are still prevalent, security measures continue to improve, as regulations catch up.

All eyes remain on how Coinbase balances user protection, regulatory cooperation, and damage control in an era where data integrity defines market trust.