-

Metaplanet Bitcoin purchase added 1,004 BTC ($104.6 M), raising its holdings to 7,800 BTC valued at over $815 M.

-

Bond-funded treasury model drives aggressive accumulation while preserving shareholder value amid rising Bitcoin prices.

-

High yield metrics and strategic buys propel Metaplanet toward its 10,000 BTC goal, setting an industry benchmark.

With the entire globe shifting towards digital assets and cryptocurrency, more and more institutions are pouring millions into the industry.

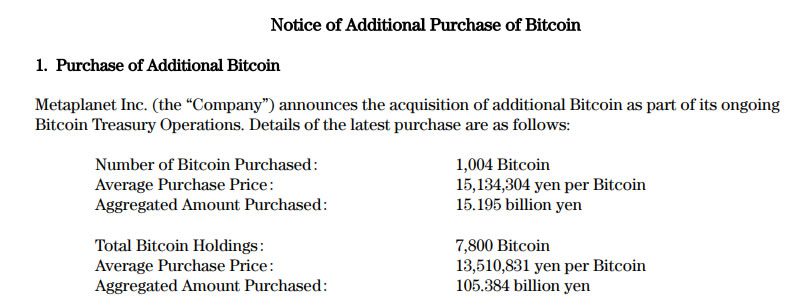

The recent Metaplanet Bitcoin purchase has sent rippled through the ecosystem, with the firm adding 1,004 BTC, 15.2 billion yen($104.6 million), marking its second-largest BTC buy ever.

This new addition brings in the corporate bitcoin holdings to a whopping 7,800 BTC valued at north of $815 million.

This figure trails its prior major Bitcoin acquisition of 1,241 BTC on May 12 for $129 million. Metaplanet has officially solidified its position as Asia’s largest public BTC holder, ranking tenth globally.

Metaplanet Bitcoin Purchase Propels Firm Toward 10,000 BTC Milestone

Corporate Bitcoin Holdings: A New Era

Ever since Bitcoin showcased its might by surpassing the $100K market, the entire outlook on Bitcoin shifted.

What was once considered a fad is now the top investment strategy for most whales and small-time traders.

The surge in corporate Bitcoin holdings is mainly attributed to various factors like the US-pro-crypto agenda, Bitcoin ETF inflows and a radical shift in treasury management.

Furthermore, bitcoin’s recent surge has spurred many to hop into the trend to gain as much profit as possible. Metaplanet’s approach eerily mirrors Michael Saylor’s Strategy, which leads the pack with 568,840 BTC(worth $59 billion).

CHECK OUT: Bitcoin Forecast Suggests 30% Rally—But Risks Remain

Despite this stiff competition, the May Metaplanet Bitcoin purchase, now at 2800, has narrowed the gap between corporate giants and small players.

As per data from BTC investment firm River, corporations have outpaced ETFs, governments and retail investors as net buyers in 2025.

This raging buying spree has considerably bolstered confidence in Bitcoin and digital assets in general as long-term investment options

BTC Treasury Strategy Driving Growth

According to the data and buying trends, Metaplanet’s BTC treasury strategy focuses more on minimizing dilution while maximizing shareholder value.

The Japanese organization maintains its liquidity for continued accumulation by financing acquisitions through bond sales, which also includes its recent $15 million issuance.

This model has fueled a major Bitcoin acquisition streak in 2025 alone, but different firms have different approaches.

Metaplanet Bitcoin purchase disclosure.[Photo: Metaplanet]

Metaplanet Chief Executive Simon Gerovich emphasizes that the Strategy aligns with long-term value creation, noting the firm’s average purchase price of $91,300 per BTC position, enabling substantial gains as prices near all-time highs.

Bitcoin Yield Metrics: Measuring Success

An edge the organization has is its Bitcoin yield metrics. The company reported a 95.6% yield in Q1 2024 and a 47.8% in Q2, reflecting significant growth in BTC reserves relative to diluted shares.

These metrics highlight and emphasize the effectiveness of its buy-and-hold strategy, although analysts wave the red flag of caution. Unfortunately, such strategies carry bitcoin investment risk for SMEs.

While institutional and publicly listed firms can hedge via bonds or equity, small and medium-sized enterprises face various barriers.

For instance, liquidity strain is a major turn-off since locking capital in BTC may restrict operational budgets.

In addition, regulation and volatility are still the main causes of concern, despite the former having several advancements throughout Africa and globally.

A prime example of the stark difference between both spaces, Metaplanet stock has surged 12% post-announcement, and its market cap hit $2.34 billion. For SMEs, this might be a far-fetched goal at the moment.

Strategic Positioning in a Competitive Landscape

With corporate bitcoin holdings of 7800, Metaplant now rivals US-listed firms like Coinbase(9,267 BTC) and Block Inc. (8,584 BTC).

In addition, the organization is just 301 BTC shy of surpassing well-renowned Galaxy Digital Holdings(8,100 BTC) to claim ninth place globally.

With Strategy still accounting for 77% of corporate BTC growth in 2025, Metaplanet still faces an enormous undertaking if it ever seeks to dominate the market.

A template for corporate crypto treasuries?

The latest Metaplanet Bitcoin purchase occurred as BTC traded near $103,343, buoyed by macroeconomic optimism and U.S.-China tariff negotiations.

The rally has generated at least $77.4 million in unrealized gains for Metaplanet. However, experts warn SMEs from attempting such bold moves.

Bond-funded buys mitigate equity dilution and present borrowing capacity, but the reliance on debt markets can introduce interest-rate vulnerabilities.

Furthermore, bitcoin’s volatility requires rigorous risk management, a lesson that is applied even to deep-pocketed corporations.

However, continued institutional participation exemplifies a moderate BTC treasury strategy, showcasing how digital assets steadily reshape how we approach them.

Metaplanet’s roadmap to 10,000 BTC hinges on sustained bond financing and favorable market conditions.

With Bitcoin’s price action remaining resilient, the firm’s approach might be a blueprint that encourages more African institutions to dive into the shark-infested but lucrative crypto waters.