- MicroStrategy lawsuit reveals SEC risks in Bitcoin treasury strategies, urging African firms to balance innovation with regulatory compliance.

- The firm’s $59B BTC holdings underscore Bitcoin’s volatility, forcing corporations to adopt risk-mitigation frameworks amid rising legal threats.

- SEC filings against MicroStrategy signal tightening oversight of crypto disclosures, pushing African companies to prioritize transparency in treasury decisions.

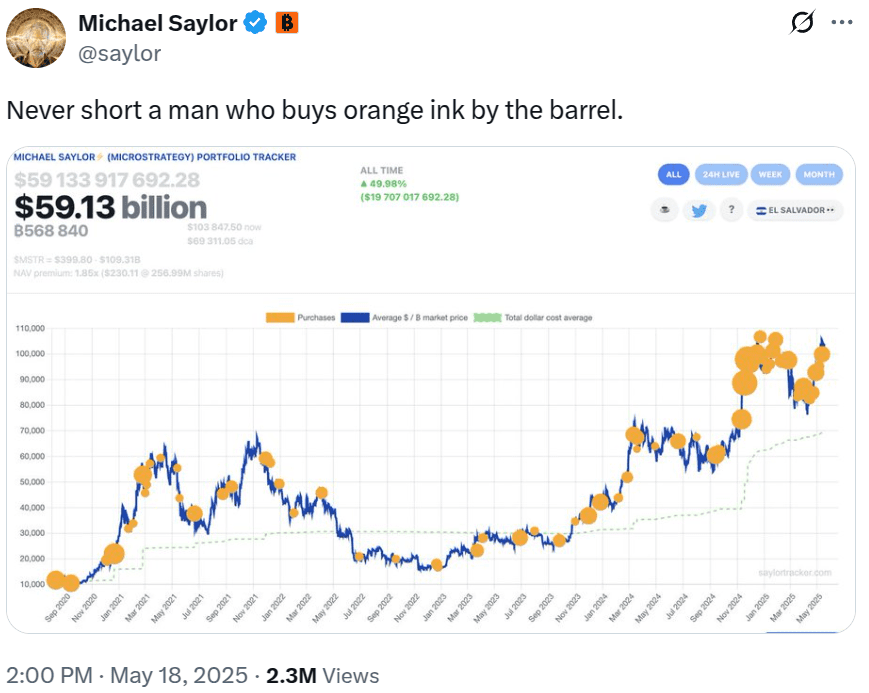

Bitcoin has been the hot topic for most institutional investors, with Metaplanet’s 1,004 BTC buy and MicroStrategy’s 7,390 Buy last week.

However, trouble looms over the largest corporate Bitcoin holding as the MicroStrategy lawsuits peak with the SEC’s latest filing.

The largest corporate whale on the market is facing a class-action Bitcoin lawsuit alleging that the executive heads of the company provided false and/or misleading statements regarding the profitability of its Bitcoin corporate strategy.

Veteran traders, investors and innovators know all too well how legal issues can detriment crypto-based organizations’ profits swiftly, severely and without remorse.

With an aggressive buying strategy, this new Bitcoin acquisition lawsuit might just cut the momentum MicroStrategy has developed throughout the year.

MicroStrategy Bitcoin Purchase Amid Class-Action Lawsuit

As per the SEC filing, Strategy(formerly known as MicroStrategy) purchased 7,390 BTC at an average price of $103,500, bringing its total holding to 575,230 BTC, a whopping $59.2 billion as of May 2025.

The firm’s approach exemplifies a bold Bitcoin corporate strategy that other public companies are increasingly emulating, i.e. Metaplanet’s recent 1,004 BTC buy.

According to recent records, the firm aims to allocate a substantial portion of its treasury toward Bitcoin to hedge against inflation and unlock long-term value.

The acquisition is funded by stock offerings totalling $764.6 million, offering a diversified strategy as Bitcoin offers a non-correlated asset class that can balance equity and bond-heavy portfolios.

This also included the sale of 1.7 million shares of its Class A common stock for $705.7 million and 621,555 shares of its Series A perpetual preferred stock for $59.7 million.

CHECK OUT: Metaplanet Bitcoin Purchase Propels Firm into Global Top 10 BTC Holders

Furthermore, it has provided a year-to-date yield of 16.3% as of May 18th, highlighting how this Bitcoin corporate strategy can generate appreciable returns.

Unfortunately, trouble loomed at the corner with the MicroStrategy Bitcoin acquisition coinciding with a class-action Bitcoin lawsuit.

The SEC bared its fangs against its executive teams, claiming they falsified the risks tied to Bitcoin volatility and recent crypto accounting bills.

The MicroStrategy lawsuits revolve around key figureheads: Michael Saylor, Phong Le, and Andrew Kang—for violating Section 10(b) of the Securities Exchange Act.

The case falls under the violation of Section 10(b) of the Securities Exchange Act, highlighting that their Bitcoin Coprotae Strategy isn’t as profitable as they make it out to be.

By understanding Bitcoin treasury risks, other corporations tend to emulate their strategy, as already seen, raising the risk substantially, especially given how the crypto industry tends to flip the script when you least expect it.

Critics, however, argue that the lawsuit lacks merit, with pseudonymous DeFi developer 0xngmi noting that Strategy’s “leverage on Bitcoin” is openly acknowledged in filings.

Bitcoin Treasury Risks and Legal Challenges

The MicroStrategy lawsuit highlights the broader implications of participating in volatile markets.

At current prices, Strategy’s holdings represent 2.7% of Bitcoin’s total supply. However, the holdings are prone to various risks, such as sharp market corrections, which could trigger significant losses.

Unfortunately, with the growing adoption of crypto assets as lucrative investment portfolios, many large firms are diving into the scene with little hesitation.

The lawsuits highlight this trend as a major red flag, urging scrutiny of firms, especially given how corporate bitcoin holdings affect stock price dynamics.

Bitcoin price.[Photo:CoinMarketCAP]

In pre-market reading, shares fell 2.3% following the lawsuit announcements, though long-term bulls cite a 47% unrealized gain since its initial Bitcoin bets.

The company has announced its intentions to attain $42 billion in bitcoin purchases by 2027, following suit to its 42/42 capital strategy.

Corporate Bitcoin Adoption: A Double-Edged Sword

Strategy’s Bitcoin corporate strategy has inspired peers to rally and follow suit. Data shows over 70 traditional firms report BTC treasury exposure, including Metaplanet, Semler Scientific, and Tether-backed venture Twenty-One.

With Bitcoin maintaining its $ 100 K+ price range, many partnerships and collaborations around digital assets have taken a significant uptrend.

Only last week, luxury watchmaker Topwin, now known as AsiaStrategy, surged more than 60% in pre-market trading after the company officially released its plans to adopt a Bitcoin accumulation strategy.

As per a prior article, Metaplanet joined the top 10 rankings after purchasing 1,004 BTC, now outpacing even EL Salvador.

Meanwhile, Bahrain-based firms and small enterprises are showcasing a $24.4 million market cap after adopting the Bitcoin corporate strategy with investment firm 10X Capital.

Unfortunately, the Bitcoin acquisition lawsuit raises questions concerning regulatory compliance and future market prices.

CHECK OUT: Bitcoin Forecast Suggests 30% Rally—But Risks Remain

Companies embracing Bitcoin must balance innovation with transparency, especially as the SEC tightens oversight of crypto disclosures.

MicroStrategy’s Path Forward: Legal Battles and Strategic Goals

The MicroStrategy lawsuit is a cautionary tale for corporations emulating the same strategy. While the endeavour does generate substantial gains, the legal challenges highlight future risks in the case of another crypto market crash.

The takeaway is clear for investors: High-reward strategies demand equally robust risk management. Bitcoin isn’t a sprint; it’s a marathon with more players joining the race.

The competition is stiff. Whether Strategy pulls through is only a matter of time.