With the increased adoption rate of stablecoins by traders, freelancers, and cross-border transactions, licensed South African financial service providers, in partnership with Lisk, have officially launched the LZAR stablecoin.

In Brief

-

LZAR is a South African Rand-backed stablecoin designed to reduce remittance fees and improve financial inclusion across Africa.

-

Backed by FiveWest and built on Lisk, the stablecoin offers a compliant, fast, and scalable blockchain infrastructure with real-world utility.

-

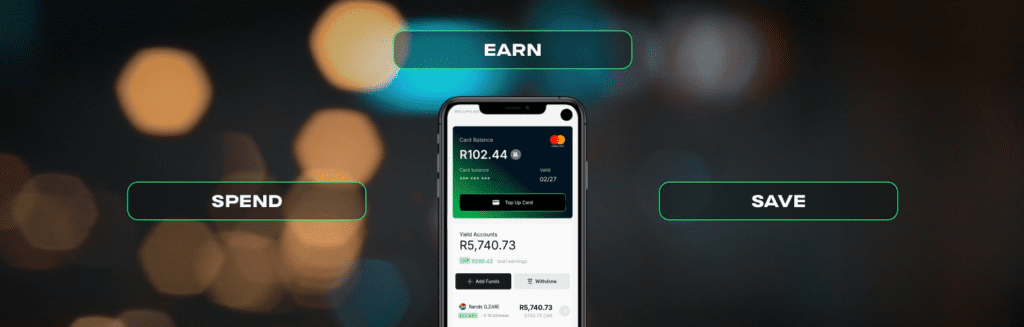

Users earn up to 10% APY while spending or saving with LZAR, making it a competitive alternative to traditional bank savings accounts.

The digital asset backed by the South African Rand(ZAR) aims to tackle persistent challenges like financial exclusion, costly remittances, and limited saving opportunities across the continent.

This Rand Stablecoin leverages Lisk’s scalable blockchain infrastructure, creating a blend of deep local financial expertise and cutting-edge decentralized technology.

South African Rand-Backed LZAR Stablecoin: Revolutionizing Financial Inclusion Through Blockchain

Stablecoins have become a monumental force within the continent’s ascent into a decentralized financial future.

Accounting for 43% of the continent’s total crypto transaction volume, stablecoins have proven to be a popular alternative for most natives seeking stable alternatives.

As a result, many African nations have dived into researching developing African-based stablecoins despite still facing inflation, leveraging the vast reach of digital assets.

CHECK OUT:Meet Africa’s New Stablecoin Credit Card for Global Payments

The LZAR stablecoin arrives at a monumental time, driven mainly by necessity. The digital assets are designed to bridge the gaps in the legacy banking system by providing accessible, low-cost financial solutions.

With low-cost crypto transfers and a competitive stablecoin yield of up to 10% annually percentage yield, digital assets position themselves as a compelling alternative to conventional savings accounts.

Available from the FW Money Application[Photo:Lisk]

Lisk’s scalable blockchain infrastructure contributes to its low-cost crypto transfers and near-instant settlement times. This feature makes it ideal for cross-border remittances and peer-to-peer payments.

These combinations pose the LZAR as a versatile blockchain savings solution and payment rail.

Addressing Africa’s Financial Pain Points

While the initiative offers inflation-beating digital savings accounts for users, its true test lies in its adoption.

Fortunately, for LZAR, it shows much promise as businesses like Flamingo’s Coffee Bar in Jeffrey’s Bay have signed up to use it.

As per Lisk’s offcial announcements here’s how the LZAR is transforming Flamingo’s Coffee Bar:

- For Flamingo: No set-up costs, no transaction fees, and no risk of chargebacks.

- For Customers: Gain the ability to spend LZAR like cash while still earning interest—no need to choose between saving and spending.

- For the Community: Customers can easily send LZAR to friends and family with zero fees, creating new networks of support and inclusion.

Digital assets have a practical utility; for instance, merchants can enjoy negligible setup costs and minimal-to-zero transaction fees as compared to traditional card processors or international money transfer services.

Its 10% APY yield allows customers to have better spending processes while they earn, a unique dual advantage combining various elements of traditional banking and Web3.

CHECK OUT: Mastercard x MoonPay: Stablecoin Cards for Africa’s Unbanked

The South African stablecoin holds much potential and exemplifies the country’s decade-long journey for a pro-crypto environment.

In addition, migrant workers sending funds to South Africa or neighboring countries can potentially bypass high fees and long delays, proving the efficiency of the coin.

FiveWest: The Anchoring Force Behind LZAR

FiveWest, the brainchild behind the LZAR, is a financial service provider that has made a name for itself in Africa’s fintech sector.

The organization has showcased its resilience and determination to facilitate Africa’s digital financial future by staying compliant with regulations.

The organization operates under a Financial Services Provider license(FSP No. 51619) and is authorized by the Payment Association of South Africa(PASA).

Their comprehensive suite includes:

- OTC Trading Desk: Facilitating large-volume crypto transactions.

- Stablecoin Brokerage: Enabling stablecoin exchange with minimal price deviation.

- Payment Gateway: Allowing merchants to accept crypto settled in ZAR.

- Payment Infrastructure: Offering bespoke rand collection and settlement solutions.

- Custody Services: Providing secure digital asset storage.

- Earn Program: Offering yields on digital assets.

In actuality, the Earn program has been a key feature for the digital asset as it caters to its stablecoin yield feature.

A Partnership Forging the Future

The FiveWest-Lisk partnership has greatly contributed to the success of the stablecoin.

FiveWest brings its indispensable regulatory features, giving it an automatic green light with South African regulatory bodies.

It’s essentially a badge of trust showcasing that its expertise in digital assets management, yield generation strategies, and its nuanced understanding of local and national market needs is not just for show.

List, on the other hand, contributes its blockchain fractures an expertise specifically designed for real-world applications.

Together, both provide the necessary ingredients to facilitate and foster the growth of a rand-backed stablecoin.

Conclusion

The launch of the LZAR stablecoin signifies more than just another ass in the market but the steady adoption of blockchain in the continent.

It’s a targeted effort to leverage blockchain to fix some of the issues hindering the client’s financial growth.

Ultimately, the success hinges on its adoption by merchants, remittance users, and savers, alongside ongoing regulatory engagements.

Although its foundation is a licensed local issuer, a well-known blockchain infrastructure provider, and a clear value proposition addressing critical pain points do give this African stablecoin the edge it needs.