TL;DR,

- OKX exchange officially exits Nigeria on August 16, 2024, due to increasingly restrictive CBN crypto regulations affecting the entire ecosystem.

- Nigerian users must close all trading positions and withdraw assets before the midnight deadline as regulatory pressure forces another major exchange departure.

- The exit follows similar regulatory challenges faced by Binance, highlighting Nigeria’s shifting stance from crypto adoption to strict restrictions.

The lucrative world of peer-to-peer crypto trading has grown from a “side hustle” to a main source of income for many Africans amid the bull run. The promise of greater returns has lured in many, and the Central Bank of Nigeria(CBN) has raised the red flag on the markets.

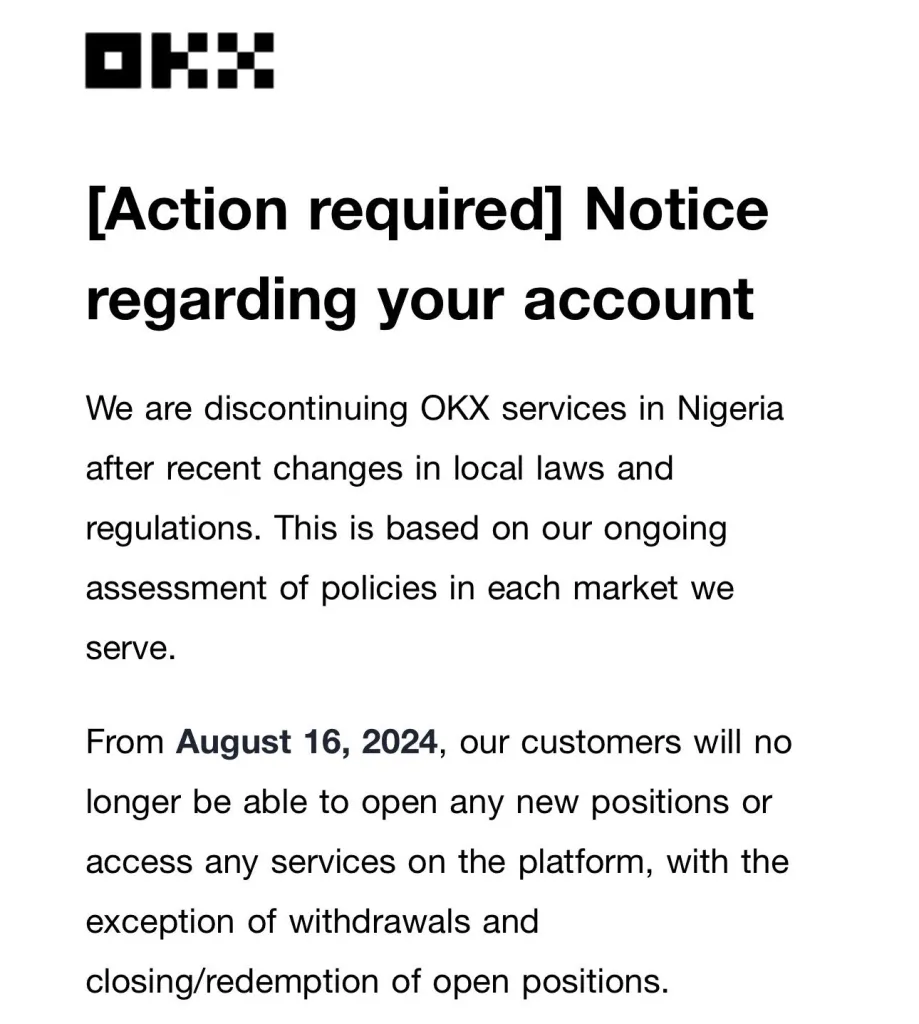

The CBN crypto crackdown is real and has affected its entire ecosystem. The OKX exchange has finally raised its white flag. As per the announcement, the global exchange will cease its services from Nigeria as of August 16, 2024.

Nigerian crypto regulations have proven cumbersome to its community as its government and central bank are still wary of digital assets’ sheer growth and adoption rate.

OKX Exchange Waves the White Flag: An Official Exit

With Nigeria’s crypto regulations increasingly becoming unfavourable, many fintech organizations within the area have suffered losses. The OKX exchange, Binance’s competitor in Africa, was among those that could not adapt to the changes.

In May 2024, the OKX exchange announced it would cease its Naira withdrawals due to regulatory concerns. This came shortly after the CBN accused Binance of manipulating the Naira currency.

With Naira withdrawals shut down, many speculated on the steady decline of the platform, and such fears finally materialized. The crypto trading platform materially announced that starting August 16, they would no longer open new trading positions or provide access services for Nigeria.

RELATED: Nigeria’s Crypto Boom: IMF Warns of FX Risks and Urges Tighter Regulation

The exchange said, “We are discontinuing OKX services in Nigeria after recent changes in local laws and regulations. This is based on our ongoing assessment of policies in each market we serve.”

What OKX’s Exit Means for Nigerian Users

The OKX exchange urges all its users to close all open positions and orders in peer-to-peer crypto transactions, margin, perpetual, futures, and options markets, cancel any outstanding spot orders in USDT, DAI, and EURT, redeem assets from Grow products, including Earn, Loan, and Jumpstart, and transfer assets to a wallet of their choice.

They added;

“We request you to please review your account and complete applicable steps by midnight (PST) on August 16, 2024.“

With strict Nigerian crypto regulations in place, the region’s crypto economy has declined, forcing other exchanges to tread carefully. The CBN has prohibited regulated financial institutions from accepting or facilitating crypto payments, eradicating an earlier ban lifted in December 2023.

The Regulatory Red Flag Raised in Nigeria

Crypto trading in Nigeria is one of the many highlights of Africa’s ascent towards a blockchain future. The nation has been featured numerous times among the top crypto trading regions worldwide.

Within Africa alone, Nigeria was among the first regions to showcase a positive incline in peer-to-peer crypto transactions. Its unstable fiat currency forced many citizens to look for alternative means of income, and the crypto industry offered the perfect solution.

According to a report from Reuters, Nigeria’s volume of crypto transactions grew 9% year-over-year to $56.7 billion between July 2022 and June 2023. This figure represents the most recent climax of the region, showcasing how crypto trading in Nigeria has become a growing solution to improve its citizens’ livelihood.

Unfortunately, this solution worked too well, eventually posing a threat, forcing a CBN crypto crackdown on Nigeria’s entire ecosystem.

From the get-go, its government rejected the notion of cryptocurrency and banned its use within banks. This, however, only seemed to further the region’s “crypto flame” as it only placed a dent in its trajectory. As the years progressed, its government introduced the naira, Africa’s first CBDC, hoping to introduce a digital asset as an alternative.

CBDCs are fundamentally different from cryptocurrencies, only increasing their accessibility but doing little to their value. As a result, the eNaira effectively failed to replace its growing crypto adoption.

Soon, the web3 organization emerged within Nigeria, shifting its market from consumers to producers. Despite Nigerian crypto regulations keeping a tight leash on banks, it did little to affect the progress of fintech or web3 organizations. Peer-to-peer crypto trading soared.

This eventually forced the hand of its central bank, which identified crypto trading as a primary cause of its fiat decline.

RELATED: Binance Nigerian Operations Hit Major Roadblock With Executive Detention

This led to crypto-related incidents involving significant issues related to Binance, several Nigerian Fintech platforms, and individual crypto traders. The bank sued Binance for alleged tax evasion, forcing the billion-dollar company to restrict and limit its availability within the regions.

This turn forced Binance to consider leaving Nigeria, igniting a trend that could end the region’s crypto dominance.

The High Cost of Regulatory Uncertainty

Uncertain regulations have been the Achilles heel for the crypto industry in general. Establishing unclear or restrictive crypto regulations has slowed or eliminated a region’s adoption rate. A prime example is the US crypto environment. The SEC crackdown on crypto in the US has painted a negative picture for the area. Many international and local exchanges have shut their doors to the US, dealing a massive blow to its crypto adoption rate.

If Nigerian crypto regulations continue to hinder the progress of exchanges like Binance and OKX, it will inevitably lead to a similar path to the US.