Table of Contents

TL;DR,

- Nigeria, South Africa, Mozambique and Burkina Faso exit the FATF grey list.

- The countries achieved this by implementing major reforms, including South Africa’s new crypto (VASP) regulations and Nigeria’s improved collaboration between its Central Bank and financial intelligence units to tackle money laundering.

- FATF delisting hinges on 40 Recommendations, 11 Outcomes, and strict thresholds; Africa’s progress offers a playbook for Cameroon, Tanzania, and Uganda.

Compliance is the cornerstone of adopting digital assets, particularly in light of recent institutional acceptance. In recent updates Nigeria, South Africa, Mozambique, and Burkina Faso have successfully exited the FATF grey list.

The Paris-based watchdog’s announcement at its plenary session represents years of institutional reform, regulatory overhaul, and political commitment. FATF President Elisa de Anda Madrazo characterized this as “a positive story for the continent of Africa.”

Nigeria, South Africa, Mozambique, and Burkina Faso Exit FATF grey List

South Africa and Nigeria were placed within the FATF grey list in February 2023, which instantly raised concerns among international investors. The listing placed them among ten other African countries under monitoring as of October 2023:

- Cameroon

- Democratic Republic of Congo

- Mali

- Senegal

- South Sudan

- Tanzania

- Uganda.

For South Africa, the grey listing followed what officials described as “the weakening of key law enforcement and other institutions during the state capture era.” The impact was shifted with institutional erosion creating vulnerabilities that the FATF monitoring framework quickly identifies with its comprehensive assessment process.

FOLLOW UP: Nigeria’s Crypto Boom: IMF Warns of FX Risks And Urges Tighter Regulation

The framework evaluates jurisdictions across 40 recommendations spanning seven categorical areas, from legal architecture to international cooperation protocols.

For Nigeria, it mainly represented vivid and open gaps between its legislative frameworks and operational effectiveness. It’s typically a vulnerability that affects 97% of assessed countries worldwide.

However, the main question is, why is such an event significant?

Why this FATF grey list exit matters for Africa

The FAT mainly focuses on setting international guidelines concerning money-laundering (ML) and terrorist-financing (TF) risks. Think of them as the global watchdogs when it comes to large sums of money “vanishing in thin air.” Considering how digital assets have a tendency to link with AML compliance issues, it sets up the link.

Additionally, research compiling FATF assessments and international financial data finds a peculiar link. On average, post-grey listing, capital inflows fall by 7.6% of GDP, while cross-border payments decline by 10%, and de-risking adds 2–5% to transaction costs. For Nigeria the impact was a bit more open, with FDI declining by 33% from 2022 to 2023 and a further 19% from 2023 to 2024.

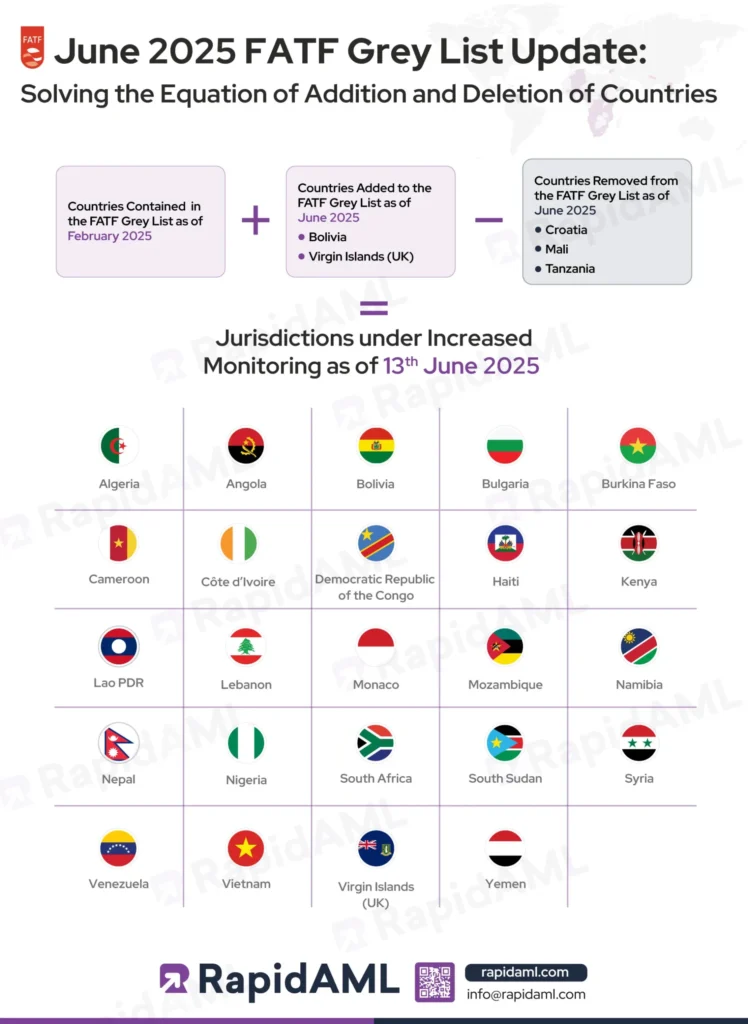

June update on grey List 2025.[Photo: FATF]

Analysis indicates that only 17% of supervisors globally achieve effective risk-based supervision implementation—a standard that nonetheless remains universal.

What changed in South Africa and Nigeria?

Escaping the FATF grey list requires comprehensive AML compliance reforms that are practical. South Africa’s government and regulator embarked on what insiders described as transformative institutional change. The region actively acknowledges how digital assets are transforming the financial sector and opening doors to new issues. The result is stronger supervision of financial institutions, more inter-agency collaborations, and remediation of institutional gaps.

For context, FATF’s explicit listing criteria include having 15 or more partially compliant or non-compliant ratings on its 40 recommendations. This includes covering areas like money laundering criminalization, terrorist financing, and customer due diligence.

For South Africa it was introducing a new suite of crypto regulations. The country already has explicit rules over crypto licensing requirements and governance over on- and off-ramp services. Proper VASP regulation requirements reduce exposure to ML/TF attempts. South Africa’s FSCA now ensures all crypto exchanges, wallet providers, and other digital asset businesses comply with the same money laundering standard.

Nigeria’s AML compliance reforms mainly focused on unifying its regulatory frontier. Currently its central bank and financial intelligence unit work collaboratively to identify and trace suspicious transactions, many of which fall under cryptocurrencies.

Nigeria’s EFCC and CBN have been on the front end of identifying any irregularities in the region’s crypto ecosystem. Recently, both entities have made headlines, especially after the SEC has full regulatory authority over cryptocurrencies. Additionally, the region has provided clear crypto tax regulations, neatly tying its compliance-ready ecosystems for FATF’s approval.

FOLLOW UP: Nigeria Crypto Tax 2026 Guide: Calculate and Report Your Gains

Blind spits that money laundered Exploitation is common given blockchain’s pseudonymous nature. Centralized exchanges have diluted this “hidden” nature; however, clear tax, operation, and security frameworks provide accurate data collection, making “suspicious” transactions all the more unlikely.

How FATF rules shape delisting timelines

FATF’s 40 Recommendations is the blueprint behind whether or not a country falls under its relist.

The lists cluster into seven categories ranging from national AML/CFT policies and preventive measures to beneficial ownership transparency and institutional powers. The International Cooperation Review Group (ICRG) applies explicit triggers for greylisting. Counties must also demonstrate effectiveness across 11 Immediate Outcomes, from risk understanding to international cooperation.

There are three main thresholds to consider:

- at least 15 partially or non-compliant ratings across the 40 recommendations

- three or more deficiencies on critical recommendations

- effectiveness shortfalls across Immediate Outcomes (for example, nine rated Low/Moderate with at least two Low, or six rated Low)

This also included balancing between technical compliance and implementation.

For South Africa, Nigeria, Mozambique, and Burkina Faso, it’s mainly a turning point, especially with digital assets becoming mainstream. Unlike global markets, Africa’s crypto ecosystem is centered around utility rather than value. The majority of transactions are within low- to mid-income earners who use digital assets like stablecoins and crypto for payments, transactions, and a hedge against inflation.

Integrating VASP registration requirements is an attempt to align with more compliance frameworks. This ensures safety while fostering growth. The demand is rising with genuine institutional improvements. While Africa is still slow-paced in adoption, it’s an opportune moment for regulations to pave the path for innovation. The question now is whether other monitored jurisdictions, like Cameroon, Tanzania, and Uganda, can replicate this success through similar dedication to both technical compliance and operational effectiveness.