Table of Contents

TL;DR,

- The cNGN stablecoin is Nigeria’s regulated, naira-backed digital currency that succeeded where the eNaira failed, surpassing 1 billion tokens in circulation by late 2025.

- Unlike the faltering eNaira CBDC, the privately-issued cNGN stablecoin focused on interoperability, fintech integration, and low-cost utility, driving rapid adoption across Nigeria.

- Backed by Nigeria’s National Blockchain Policy, the cNGN stablecoin operates with SEC oversight, offering a practical tool for remittances and DeFi that the closed eNaira system could not.

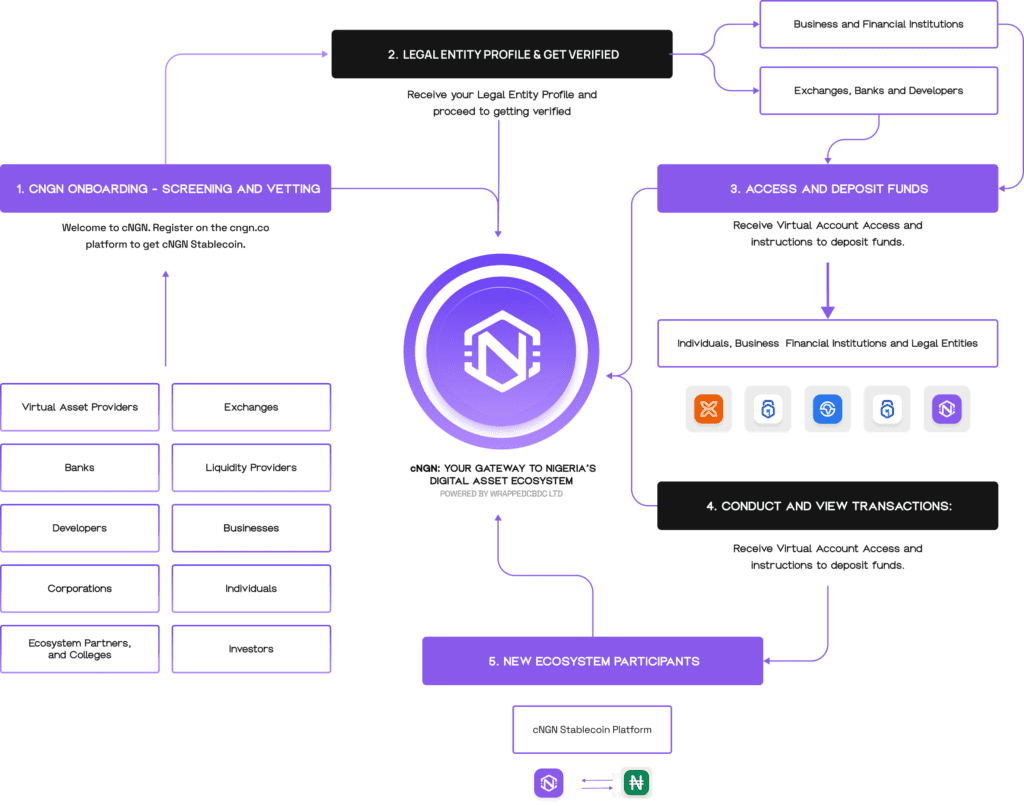

Nigeria’s next major digital currency experiment after its troubled CBDC rollout is the cNGN stablecoin, a naira‑backed token issued by private consortium WrappedCBDC Ltd. The African Stablecoin Consortium first announced cNGN in February 2024. After delays and regulatory fine‑tuning, it relaunched as Africa’s first fully regulated stablecoin.

This story is about how regulation and blockchain experts worked together to make it happen. By December 2025, well over 1 billion tokens were in circulation, a trajectory that stands in sharp contrast to the eNaira’s 98.5% wallet inactivity rate reported by the IMF in mid-2023.

What Is the cNGN Stablecoin?

The cNGN stablecoin is a digital token backed by real money that is worth the same as the Nigerian naira. This token is managed by the African Stablecoin Consortium and issued by WrappedCBDC Ltd., a joint venture led by Convexity Technologies alongside Interstellar, Digital Currency Coalition, and Alpha Geek Technologies.

The token operates under the Nigerian Securities and Exchange Commission’s Regulatory Incubation (RI) sandbox program.

Here’s the technical breakdown of Africa’s first and successful stablecoin.

- Backing: Every token is supported by naira reserves held in designated commercial banks and securities. As of October 2025, reserves comprised 54% bank deposits and 46% treasury bills and money market instruments managed by CardinalStone.

- Blockchain infrastructure: Multi-chain interoperable design. The Bantu blockchain serves as the authoritative ledger, with tokens also deployed on Base and Asset Chain networks.

- The African Stablecoin Consortium (ASC), a pan-African group made up of the founding organizations, is responsible for governance. There is no single point of control because nodes are spread out among ASC members.

- Minting and burning: Tokens are only minted after the reserve account has been confirmed as settled. When tokens are redeemed, they are permanently burned, keeping the 1:1 peg through constant reconciliation.

According to Uyoyo Ogedegbe, Managing Director of WrappedCBDC,

“cNGN went through over two years of technical, regulatory, and operational groundwork. The focus was on getting it right rather than rushing to market.“

The Failure of the eNaira Was the Success Behind the CNGN Stablecoin

As Africa’s first stablecoin, its story mainly revolved around the failings of its predecessor.

The eNaira was launched in Nigeria in October 2021. It is Africa’s first CBDC and the second in the world after the Bahamas’ Sand Dollar.

There were many good things said about it, but adoption stopped almost right away. By July 2024, despite 12% of the population holding wallets, only around 2.2 million transactions had occurred since launch, and 99.63% of naira in circulation remained physical cash.

At the Cedi @ 60 International Currency Conference in November 2025, CBN official Musa Itopa Jimoha said:

“Nigerians were not interested in the eNaira, the central bank was not prepared to be a retail bank, and the market was already providing solutions.“

The CBN ultimately shifted the eNaira toward a wholesale focus rather than a mass‑market retail product.

So what went wrong? It’s a digital token functioning similarly to mobile money? Was it the technical bit? The marketing? Or the notion behind CBDC?

For the eNaira, it was a combination of several factors. For instance,

- Onboarding friction: Users had to download a dedicated eNaira Speed Wallet app, adding a step that existing banking and fintech apps did not require.

- Limited interoperability: The eNaira couldn’t work with public blockchains or decentralized finance (DeFi) protocols because it was built on the private, permissioned Hyperledger Fabric ledger. This means that it wouldn’t be easy for you to get to your crypto wallet.

- Exclusion of intermediaries: Commercial banks and fintechs, the engines of Nigeria’s digital payments ecosystem, were initially sidelined, a marketing nightmare ultimately weakening network effects.

So, the eNaira had a bottleneck in terms of adoption, reach, and onboarding. The cNGN stablecoin did the polar opposite, focusing on how easily Nigerians can access Africa’s first stablecoin. It is listed on existing licensed exchanges (Busha in February 2025 and Quidax in March), operates across public blockchains enabling DeFi access, and invites fintech integration through ISO 20022-aligned messaging.

The cNGN vs eNaira contrast is stark: by late 2025, cNGN had surpassed 1 billion tokens in circulation, while the eNaira still struggled with 98.5% wallet inactivity.

How Nigeria’s Blockchain Policy Supports Stablecoin Adoption

While Nigeria has long dominated Africa’s crypto ecosystem, its regulation only recently switched gears. On May 3, 2023, Nigeria’s Federal Government approved the National Blockchain Policy, issued by the Federal Ministry of Communications and Digital Economy.

Dr. Bosun Tijani, Minister of Communications, Innovation, and Digital Economy, described it as a “structured, inclusive, and forward-looking framework for blockchain adoption in Nigeria.”

The policy focused on:

- Driving economic growth and enhancing transparency

- Improving financial inclusion and supply chain oversight

- Create digital economy jobs

- Leverage local blockchain development

The policy actually paid off, with the Central Bank reversing its 2021 prohibitions on crypto transactions seven months later.

On December 22, 2023, the CBN issued new “Guidelines on the Operations of Banks,” formally lifting the ban. The SEC started its regulatory incubation programs, and Nigeria’s blockchain policy got better. Well-known companies like Quidax and Busha were the first to get the go-ahead. WrappedCBDC finally got an approval-in-principle for the cNGN stablecoin in 2024.

By July 17, 2025, Nigeria officially began implementing the blockchain policy, naming Chimezie Chuta as Chairman of the National Blockchain Policy Steering Committee—further institutionalizing the regulatory environment in which cNGN operates.

Early Traction and Growth Trajectory

cNGN stablecoin adoption started modestly.

- February 4, 2025: 4,400 tokens in circulation, 7 holders, 14 on-chain transactions.

- March 2025: Following the Quidax listing, circulation jumped to 121.3 million tokens and 127 holders.

- December 12, 2025: Over 1 billion tokens in circulation, driven by activity on Base and Asset Chain.

Opeyemi Awoyemi, general partner at Fast Forward Venture Studio (which invested $100,000 in WrappedCBDC), observed:

“System records like this open up things you thought were not possible. Now, crypto players can offer yield. It also creates demand for the naira… Trading becomes easier when a Chinese company doing business in Nigeria can now hold naira through the cNGN without opening a bank account.“

What This Means for Nigeria’s Crypto Community

Local stablecoins often have a different niche when compared to global stablecoins. USDT and USDC are mainly used for their value and ease to bypass FX rates. The African Stablecoin Consortium intended the cNGN stablecoin as a utility for cross-border transfers.

cNGN transaction fees range from $0.10 to $0.34 (₦150–₦500). For Nigeria, which received $20.1 billion in remittances in 2022, it drastically cuts costs and delays from days to minutes. However, the project’s main growth strategy currently focuses on local distribution through licensed Nigerian exchanges and fintechs.

WrappedCBDC vets every exchange’s reserve management, charging a ₦100,000 verification fee. Licensed operators can offer naira-denominated on-chain services—yield products, cross-border settlement, DeFi liquidity—previously impossible under the eNaira’s closed architecture.

This availability makes onboarding much simpler, especially in a country where 25% of 235 million people remain unbanked.

However, while there is much promise in terms of utility, much can be said for its value. A naira-backed stablecoin inherits the naira’s volatility, and a depreciating currency produces a depreciating digital equivalent.

This becomes an issue when considering cNGN relies on the solvency of the private commercial banks holding the reserves.

A Calculated Bet on Private Innovation

As Africa’s first stablecoin, cNGN stablecoin is the first attempt at democratizing access to digital assets. The cNGN vs eNaira debate is one-sided, with the former showcasing how utility can often trump value.

The product and its demand are in sync, with many fintech opting for the stablecoin when setting up shop in West Africa.

The African Stablecoin Consortium and WrappedCBDC have built what the eNaira could not—a flexible, interoperable, privately managed naira token with formal regulatory oversight.