Table of Contents

TL;DR,

- The Core DAO Africa Innovation Fund is deploying $5 million to support Web3 builders, offering a crucial lifeline in a market where the average deal size for African startups dropped by 44% in 2024.

- This hybrid initiative moves beyond simple cash injections by connecting developers with technical infrastructure, a network of 50+ VCs, and potential follow-on equity investments from a larger global ecosystem.

- Projects focusing on real-world utility—such as cross-border payments, supply chains, and DeFi—are prioritized, with a streamlined application process that favors, but is not limited to, those building on Core Chain.

In January 2024, Core DAO officially started the African Innovation Fund, which will give $5 million to help Web3 builders, innovators, and problem solvers all over the continent. Its main goal is simple: to connect African blockchain developers with money, technical infrastructure, and venture networks through a hybrid model that combines Web3 grants that don’t dilute ownership with possible equity investments.

Everyone is watching Africa right now. The whole African blockchain startup funding sector made about $122.5 million in 30 deals in 2024. Core DAO Africa’s $5 million is about 4% of the continent’s total annual funding. It’s a meaningful intervention in a market where the average deal size declined 44% year-over-year and remains 56% smaller than global averages.

What Is the Core African Innovation Fund?

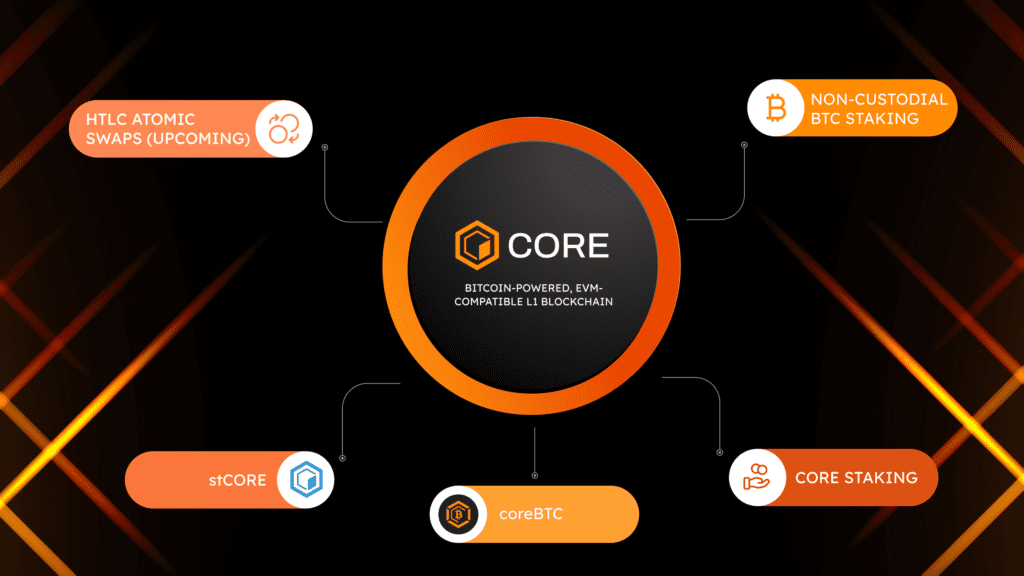

The African Innovation Fund is, as its name suggests, a targeted funding program run by Core Foundation, the organization behind Core Chain—a Bitcoin-aligned, EVM-compatible layer-1 blockchain. Announced through Core DAO’s official blog in January 2024, the fund is fully capitalized at $5 million, according to initial contributor Brendan Sedo.

The funding program is Core DAO’s first regional deployment of its broader $15 million Core Venture Network (CVN) regional funding pool and a $200 million global Ecosystem Fund established in April 2023 with partners Bitget and MEXC. Within this structure, the African Innovation Fund acts as a dedicated pool for African blockchain startup funding, especially for projects that need early Web3 grants before they are ready for equity.

Most have described this particular structure as a combined effort to pull in grants and venture capital investments while capitalizing on Core’s native technology.

Applicants gain access to:

- Non-dilutive Web3 grants for early-stage projects to build proof-of-concept or MVP

- Technical resources and infrastructure (access to Core Chain tooling, developer support)

- Builder programs with milestone-based funding tied to deliverables

- Introductions to venture capital partners within the Core Venture Network (50+ VCs), expanding the pipeline of African blockchain startup funding

- Potential follow-on investment (equity or token-based) from the $200M Ecosystem Fund for projects that demonstrate traction

This differs from pure grant programs (e.g., Gitcoin community rounds) or traditional VC funds. The model mirrors StarkWare’s $4M Africa fund, which offers grants up to $150,000 and equity investments up to $500,000, though Core DAO has not publicly disclosed per-project caps. Compared with other Web3 grants in Africa, the African Innovation Fund is positioned as a hybrid bridge between grants and venture capital, tailored to Core DAO Africa’s ecosystem.

Africa focuses on the utility of blockchain rather than its monetary value. This particular grant focuses on

- This grant supports projects that “deliver tangible value to local communities,” as stated in the official announcement.

- Solutions addressing real African pain points: cross-border payments, remittances, supply-chain transparency, decentralized identity, data storage, and DeFi-backed credit

- Open-source projects that meet transparency and compliance standards

- Builders are willing to build on or integrate with the Core Chain, though the fund “welcomes builders regardless of blockchain protocols.”

Rich Rines, an initial contributor at Core DAO, stated:

“Africa is quickly becoming a major hub for crypto and is filled with potential. We are excited to support and help develop that potential with the launch of The Core Africa Innovation Fund. The fund goes beyond just monetary support. We are aiming to truly nurture the next generation of builders and create a sustainable, interconnected blockchain future within the continent.”

Here, the African Innovation Fund is framed as a long-term catalyst for African blockchain startup funding, not just a one-off pool of Web3 grants.

Brendan Sedo explained Core’s rationale in an interview:

“What we are seeing is in regions like Africa, there have been very high adoption rates [of crypto]. We had this very large airdrop event, and we have a huge community today, a very large portion of which is based in Africa; because we have a large community, we want to encourage builders to build things that solve problems in the region.”

How African Web3 Builders Can Apply for Core DAO Africa Grants

Applications are now open and accessible via a Google Form. The procedure so far goes as follows:

- Submit the online application with basic team details, project description, stage, and relevant links (GitHub, demo, pitch deck).

- Core contributors, like Oluwashina Peter, who is responsible for African deal flow, do internal screening.

- Follow-up interviews or due diligence (probably by email, Discord, or phone)

- The placement of a project in the grants track, builder program, or VC pipeline depends on its current stage.

Types of projects that can apply (from official announcements):

- Gaming, stablecoins, cross-border payments.

- Supply chain, real estate, DeFi-backed loans.

- Credit rating systems, decentralized storage

- Healthcare, NFTs, general DeFi applications

Requirements that must be met (according to the standards of the Core Chain Grants Program):

- Open source

- Clear community or ecosystem benefit

- Demonstrated execution capability

- Transparency in fund usage.

- Compliance with local laws and regulations

What This Means for African Web3 Builders

The fund offers a reliable way to obtain non-dilutive capital in a market where the average deal size has dropped by 44% in 2024. Builders, on the other hand, should keep their expectations in check. Core has not released case studies, cohort announcements, or funded-project lists, suggesting disbursements may happen through private channels rather than headline cohorts.

CHECK OUT: The $731 Million Underdog: How Obiex Conquered African Crypto Without a Single VC Check

Additionally, the African blockchain startup funding landscape is concentrated. According to statistics, all 30 deals so far are distributed between Nigeria, South Africa, Kenya, Seychelles, and Morocco. Although the regulatory complexity varies by country, the pan-African scope of the Core fund may provide opportunities for builders in underserved markets such as Ghana, Ethiopia, and Rwanda.

Some few mentionable African blockchain startup fundings include:

- StarkWare Africa Fund: $4M, grants up to $150K, equity up to $500K (StarkNet-focused)

- Algorand Foundation Africa: Hackathon-tied grants up to $95K

- Polygon Africa Bootcamp: Education-first, ~$2K–$10K bounties

Core’s differentiator is the $200M backstop for follow-on funding—successful projects can theoretically scale from a $20K grant to a $500K+ Series A co-investment.

While the fund “welcomes builders regardless of blockchain,” projects built on Core Chain likely receive priority. Builders committed to other ecosystems (Ethereum, Solana, Polygon) should clarify alignment early.

A Meaningful but Modest Intervention

The Core African Innovation Fund represents a credible, mid-sized commitment to African Web3 builders in a market where capital is scarce and deal sizes are shrinking.

Builders should approach this as one option among several, compare it against StarkWare, Algorand, and local VC funds like CV VC’s African Blockchain Fund, and prepare for a process that likely favors Core Chain–aligned projects.

CHECK OUT: Antugrow Is Putting Farm Credit On-Chain, and 500 Global Accelerator Took Notice

For African Web3 developers solving real problems—remittances, supply-chain fraud, underbanking, or fragmented payments—the fund offers a hybrid path from non-dilutive grants to venture backing. If you operate in or report on Core DAO Africa, the next logical step is simple: apply, then measure outcomes against real users.