Table of Contents

TL;DR,

- The Ethereum ERC404 token standard is an experimental protocol that merges fungible tokens (ERC-20) with NFTs (ERC-721), generating over $100M in early trading volume by enabling dynamic, liquid NFT trading.

- This hybrid standard allows tokens to automatically mint unique NFTs when held as whole units and burn them when sold, creating native liquidity but remaining a complex, unaudited, and high-risk experiment.

- ERC404 demonstrates demand for liquid NFTs by enabling direct DEX trading and DeFi integrations, yet its unofficial status and technical complexity pose significant security and regulatory challenges.

Evolution is the beating heart of any new technology, pushing its boundaries to see how far it can go. On February 2, 2024, a pseudonymous development team known as Pandora Labs introduced the Ethereum ERC404 token standard.

According to the official notice, the standard is a hybrid protocol that attempts to merge the uniqueness of NFTs with the instant liquidity of fungible tokens.

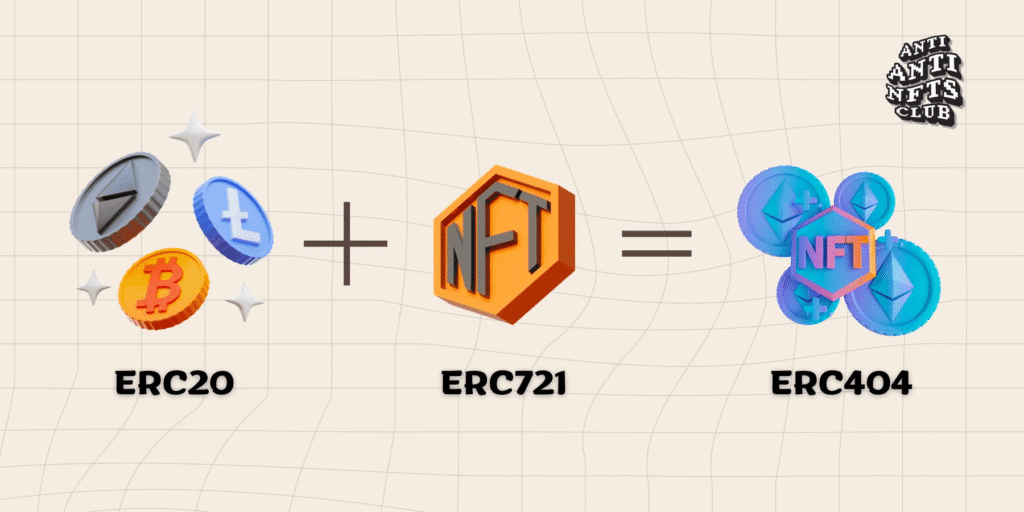

For tech-heads, it’s a merge between ERC‑20 (individual NFTs) and ERC‑72 (fungible tokens like USDC) into a single smart contract that dynamically mints and burns NFTs based on token ownership.

The first proof-of-concept, Pandora (PANDORA), minted “Replicant” NFTs when a wallet held a full token and burned them when that token was sold. That simple mechanic unlocked a token surge from $250 to $32,000, generating more than $100 million in trading volume.

Here’s a deep dive into this unique protocol.

What is the ERC404 token standard?

The Ethereum ERC404 token standard is an experimental protocol combining ERC-20 fungible token logic with ERC-721 non-fungible token behavior within a single smart contract. The keyword here is experimental.

The protocol remains an unofficial entity assigned the number “404” (named after the web error code). This is generally because it does not comply with official Ethereum Improvement Proposal (EIP) specifications.

CHECK OUT: Stateless Ethereum Node Cuts Storage Needs, Boosts Network Security

Here’s where things get intriguing. The ERC404 protocol enables something quite unique: “semi-fungible” assets. Basically they are tokens that behave like standard tradeable currencies on decentralized exchanges but automatically generate unique NFTs when held in whole units.

For some context, ERC-1155, a multi-token standard, supports both fungible and non-fungible tokens but still requires a predefined token standard.

ERC404 bypasses this, enabling dynamic transactions (easily switching between ERC20 or ERC721), meaning fungible fractions can become unique NFTs and vice versa through quantity-based logic rather than preset categories.

How ERC404 actually works

ERC404 NFTs basically work with the core mint-and-burn logic:

- Buying/Accumulating: When a user acquires 1.0 full token (e.g., 1 PANDORA) via a DEX like Uniswap, the contract automatically mints a unique NFT to their wallet. The specific NFT is made at random and has different levels of rarity.

- When that user sells or transfers the token and their balance drops below 1.0, the NFT that goes with it is burned (permanently destroyed).

- Fractionalization: If you have 0.5 tokens, you only own the fungible balance. There is no NFT in the wallet. When you add up fractions until they reach 1.0, a new NFT mint with new, random traits happens.

- “Rerolling” for Rarity: This standard lets traders buy and sell NFTs over and over again to “reroll” for rare traits. This is not possible with traditional ERC-721 collections because each sale burns the current NFT and each purchase mints a new one.

This process creates hybrid NFT tokens that can easily change between being tradeable like money and being unique collectibles, depending only on how much is in the wallet.

The Launch Trajectory and Early Adoption

Pandora initially launched the protocol and featured 10,000 PANDORA tokens paired with 10,000 potential “Replicant” NFTs. The response was a market cap peak of trading volume exceeding $100 million in the first week and a market cap peaking near $300 million.

The thesis of the Ethereum ERC404 token standard was proved and accepted.

Pandora marks the first attempt to launch a token on Ethereum using a new, experimental token standard (not an official EIP/ERC): ERC404. [Photo: Dune]

Other adopters included

- DeFrogs: A 10k Pepe-themed collection demonstrating that sweeping a “floor” can be as simple as buying tokens on Uniswap. It started with 80% of the supply going to a liquidity pool and later got listed on a centralized exchange. By the middle of 2024, the floor price of DeFrogs’ NFT had risen to about 1.35 ETH, making it the second ERC404 token to be listed on a centralized exchange.

- EtherRock404: A derivative of the original 100-piece EtherRock collection, it showed how historically illiquid NFT sets could become DEX-tradable.

As of March 2024, Uniswap V3 took up a lot of the daily Pandora volume, which proved the liquidity thesis. Blur and OpenSea are two marketplaces that show the linked ERC404 NFTs. OKX and Binance wallets also added support for viewing ERC404 assets.

NFT liquidity pools are made right inside DEXs, which lets prices change automatically instead of depending on manual marketplace listings. The spreads on ERC404 assets are usually less than 1–2%, while the spreads on traditional NFT collections are typically 5–10% or more.

Using ERC404 Tokens to Bridge DeFi and NFTs

The hybrid NFT tokens offer additional advantages, particularly due to their unique nature. For example, using ERC404 tokens to connect DeFi and NFTs opens up many new possibilities for integration:

- Lending and borrowing: The Teller Protocol made it possible to use Pandora tokens as collateral, which is hard to do with one-off NFTs.

- Perpetuals/derivatives: Wasabi Protocol and other projects tried out leveraged exposure to ERC404 collections.

- Fractionalization Without Middlemen: ERC404 does native fractionalization directly within the token contract, unlike protocols like NFTX that need wrapper tokens and institutional middlemen.

- Liquidity: Collections can directly add to Uniswap pools, which makes native NFT liquidity pools with an ERC-20-style user experience.

Projects like Pandora Finance’s “Express Protocol” on Polygon now allow code-free deployment of ERC404 collections, lowering the barrier for creators.

Why the Ethereum ERC404 Token Standard remains experimental.

While the notion of hybrid NFT tokens has seen some traction, ultimately it’s shelved as experimental and for good measure.

For starters, it’s too complex, raising major concerns over security. Early implementation was deployed without any formal audit. A similar hybrid approach (ERC‑X) suffered a double-spend exploit in Feb 2024 ($470k).

Blending two protocols into one is not efficient in terms of cost. Overloading ERC‑20 transfers to trigger NFT logic is costly. This criticism led developers like Cygaar and Quit to introduce DN404 (a dual-contract design) roughly a week after ERC404’s debut.

Some dApps, bridges, or custodians may mishandle a token that can “disappear” (NFT burns) during standard transfers.

Regulation remains a core issue. Native fractionalization blurs lines regulators use for securities analysis. No definitive guidance exists yet for hybrid fungible–nonfungible constructs.

Major centralized exchanges (Binance, Coinbase) have been slow to support ERC404 due to the complexity of managing tokens that can burn unexpectedly.

CHECK OUT: Ethereum Restaking Crisis: Yield Hunters Abandon Legacy Protocols

An Experimental Standard With Promise and Peril

The Ethereum ERC404 token standard is a one-of-a-kind mix of new ideas and pushing the limits of blockchain. With over $1.6 billion in trading volume and 719 deployed contracts, the standard shows that there is a need for more NFT-like assets that can be traded easily.

ERC404 is still high-risk, though, because it is an experimental, unaudited, and unofficial standard.

Hybrid NFT tokens give users and creators who are willing to make these trade-offs a very interesting look at a future where digital assets can easily switch between being collectibles and being used as money.