Table of Contents

TL;DR,

- After a $19.35 billion liquidation event, the crypto bull run is paused, not over, as liquidity and capital rotation patterns hint at a continuation.

- The market is split: bears point to stalled ETF flows and a 20% BTC drop, while bulls see historical patterns where gold rallies precede Bitcoin surges.

- Traditional four-year cycle models are now irrelevant; the market’s next move depends entirely on institutional flows, derivatives, and macroeconomic policy, not halving dynamics.

Investors, traders, and institutional investors are on edge due to Bitcoin’s recent swings, and the community is divided on whether the bull run has ended or not. After Bitcoin gained an all-time high of $126,272 on October 6, it just broke below $100,000 a few hours ago. A decline exceeding 20% has rattled the community, with the majority gearing up for an upcoming bear run.

Here’s a breakdown showing how the data itself is conflicting, with different metrics telling different stories. Has the bull run ended, or is this a pause shaped by distribution, deleveraging, and policy shocks? The answer hinges on where liquidity flows next and how fast confidence returns.

Is the bull run over or just catching its breath?

The crypto market finally made its way to traditional stocks, reaching a total valuation of up to $4T. This encouraged institutional investors; however, global politics have now come to play a role in its volatility.

According to several well-known analysts and traders, we might have already witnessed this cycle’s peak. Taking a few steps back, during the October tariff bombshells, the market experienced its largest liquidation of over $19.35 billion, affecting 1.6 million traders.

The crypto market liquidity crisis exposed various structural fragilities like oracle mispricing, thin order books, and overheated funding rates (7%+ annualized) that collapsed as longs unwound. According to Wintermute’s November 2025 market report, global liquidity has expanded by over $2 trillion since June 2023, with the Federal Reserve’s M2 money supply now exceeding $22 trillion.

FOLLOW UP: A False Sense of Security: Africa’s Prominent Distributor Challenges Bitcoin ETF Narrative

This massive exposure isn’t flowing into digital assets, with Bitcoin ETF flows stalling completely. Some may argue over corporate treasury accumulation sustaining the market, but it has effectively dried up. This crypto market liquidity crisis explains why Bitcoin has gained a mere 4.2% year-to-date while the S&P 500 has surged 16.76% over the same period.

Bitcoin hashprice (Source: Luxor)

On-chain metrics were cautionary with analyst Willy Woo issued prescient warnings on October 8 about tightening global liquidity, predicting potential for an 80% correction when Bitcoin traded near $122,000. His analysis spots the focus on what drives Bitcoin price movements. When prices peaked, perpetual swap funding rates reached 7%+, a clear indication of excessive long-side crowding.

In under one month, long-term holders distributed 104,000 BTC during October, the heaviest selling wave since July.

Add in the U.S. government shutdown’s liquidity drag (CBO: $7–14 billion in lost output), and crypto became the worst performer, fueling one side of the debate. DAT activity dried up, and Bitcoin underperformed equities even as macro tailwinds appeared on paper.

The Counterargument: Capital Rotation Patterns Suggest Continuation

On the other side, many advocate the bull run still has one final swing, using historical patterns and relative value analysis for a compelling counterargument. Many Bitcoin trading strategies focus on more than its absolute price.

Charting Bitcoin against the S&P 500 reveals that BTC’s ratio to equities only barely exceeds the previous cycle’s peak. If Bitcoin were to reclaim the prior S&P 500 ratio high of approximately 19.6, the price would reach roughly $135,000 at current equity levels.

When taking Gold into account, we can derive an intriguing analysis. While BTC completely dominated in dollar terms, it still remains well below its previous cycle’sall-time high when priced in gold.

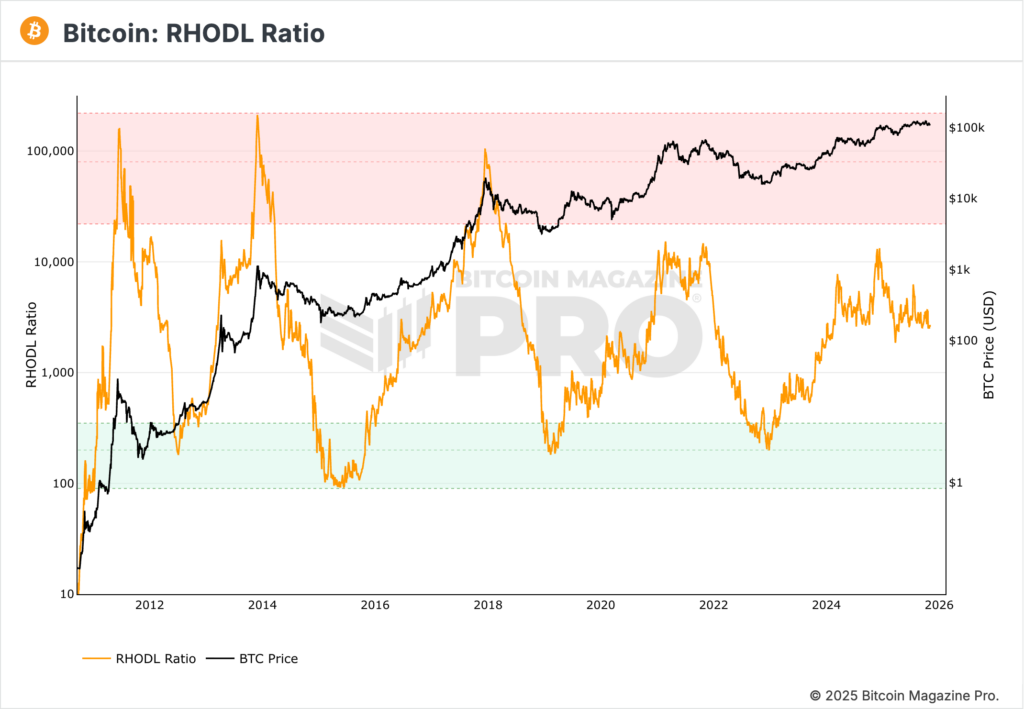

RHODL Ratio (Source: Bitcoin Magazine)

According to Matt Crosby, Bitcoin Magazine’s lead analyst, a full recovery to the previous cycle’s high points near $150,000, with a brief 2024 reclaim implying closer to $160,000. This playbook has marked each prior bull run, where gold’s surge preceded a major BTC advance as capital rotated to higher beta.

FOLLOW UP: Bitcoin’s Next Price Targets Revealed by Top Analysts (Crypto Insights)

The gold-to-Bitcoin trading strategy is a repeat pattern. In 2012, 2016, and 2020, gold rallied first, and Bitcoin soon followed with substantial gains. Think of it as early-stage soft capital rotating.

What Drives Bitcoin Price Movements in the Current Environment

The main driving factor for the bull run has significantly changed since the halving. As Wintermute strategist Jasper De Maere noted, “The concept of the four-year cycle is no longer relevant.”

What was once driven by the halving event, supply dynamics, and miner capitulation patterns is now dominated by institutional flows, derivatives positioning, and macro liquidity conditions. Bitcoin is now tightly correlated with the S&P 500, meaning sustained equity strength serves as one of the most reliable precursors to Bitcoin outperformance.

Current metrics show that the market is in extreme fear, a split community, and a handful of institutes that can determine Bitcoin’s price with a few orders. Short-term holders, measured by on-chain metrics, showed mild losses by early November (STH NUPL at -0.05), indicating recent buyers faced drawdowns but not catastrophic losses.

Verdict

So is the bull run over? Based on the data, analysts’ notes, and current market statistics, the cycle looks paused, not finished, showcasing that liquidity is actually reaching crypto. For a better term, it’s entered a critical testing phase.

October’s crash was a leverage and structure story catalyzed by tariffs and cooled by a less‑dovish Fed. Yet the rotation template (gold → equities → BTC) and relative‑value gaps against both the S&P 500 and gold leave upside scenarios intact if flows return.

What seems certain is that traditional cycle models have lost predictive power. Understanding Bitcoin ETF flows, treasury buys, and government policy are the new indicators to determine where the market will sway next.