In Brief

-

Blockchain drought insurance in Kenya uses NDVI‑based smart contracts to trigger RLUSD payouts, ensuring objective, timely support for pastoralists.

-

The pilot’s success—no drip in vegetation but solid process validation—enabled a $40K Phase 2 expansion to cover 533 beneficiaries.

-

By combining satellite data, smart contracts, and stablecoin reserves managed by BNY Mellon, the model offers a scalable blueprint for climate risk mitigation across Africa.

Ripple recently concluded its blockchain drought insurance pilot in Kenya, demonstrating a new model for drought risk mitigation for Kenyan Pastoralists.

Blockchain’s capabilities go beyond P2P trading and lower cost; it has provided an alternative means for financial safety to communities living on the front lines of climate change.

Ripple’s Innovative Blockchain Approach to Drought Risk Mitigation

After the numerous legal battles, Ripple’s strategy for survival was providing utility for its decentralized token and network. Achieving this meant expanding beyond the crypto sphere and showcasing how its ecosystem is a relevant solution globally.

One such initiative was a blockchain drought insurance program in Kenya’s arid region, Laikipia County.

The program collaborated with Mercy Corps Venture, Arbitrum and donor platform DIVA donate to provide timely, transparent financial support to pastoralists facing vegetation stress.

CHECK OUT:From Concept to Launch: Africa’s Regulated Stablecoin Journey

The main selling point of the initiative was combining satellite-index insurance with the efficiency and automation of smart contract insurance powered by the RLUSD stablecoin.

Additionally, the program had a keen interest in gender inclusivity and sustainable aid delivery, encompassing 517 pastoralists, which included a significant number of women.

Communities within the regions heavily rely on livestock, making them acutely vulnerable to harsh climate changes and severe dry spells, as witnessed in 2022.

How the Smart Contract Shield Works

Ripple intended to showcase how blockchain technology can redefine insurance, encompassing a vast demographic. The pilot’s true brilliance lied within its objectivity, automation, eliminating bureaucratic hurdles and potential disputes.

The platform utilized satellite technology to determine its Normalized Difference Vegetation Index (NDVI) of Laikipia. Smart contracts would analyze he data, setting up an NDVI threshold of 0.55, indicating severe drought stress.

This would meet the criteria set, prompting the blockchain network, housed within Ethereum, to release full RLUSD stablecoin payouts distributed among the particpants’ digital wallets.

The payouts were triggered if the values ranged between 0.55 and 0.61(e.g., an NDVI of 0.57 triggered approx. 67% of funds). However, beyond 0.61 indicated sufficient vegetation to sustain livestock.

This sophisticated approach eliminated traditional delays and opacity associated with insurance claims. It offered a transparent and verifiable mechanism for fund allocations.

Furthermore, utilizing RLUSD stablecoin provided a predictable aid value unhindered by inflation rates common within most African fiat currencies. It enabled low-cost blockchain payouts for pastoralists directly within their digital wallets, making the procedure faster, prompting a quick response to mitigate any risks.

Pilot Success: Validation and Scalable Foundations

The pilot period was a success with positive ecological news: satellite data showed favourable vegetation conditions across Laikpia.

As a result, no drought payouts were triggered due to unmet criteria; however, its practicability proved the projects as success.

The RLUSD stablecoin allocated wasn’t lost or returned but seamlessly rolled over into an expanded Phase 2. This was primarily possible since RLUSD utilizes an escrow-based system to manage funds and facilitate conditional payments securely.

Furthermore, this increased its funding pool to $40,000, enabling the programs to insure now 533 pastoralists, offering each up $75 in Ripple drought cover for Kenya during the next high-risk drought season.

As the project scale continued, collaborations with local organizations ensure effective deployment and community engagements.

Utilizing blockchain as a framework for climate risk mitigation is a novel concept and one applicable in various parts across Africa.

According to the National Drought Management Authority, 23 counties will continue to face serious drought-related stress. The blockchain drought insurance is now a viable product with a large use case.

RLUSD: Building Trust for Real-World Impact

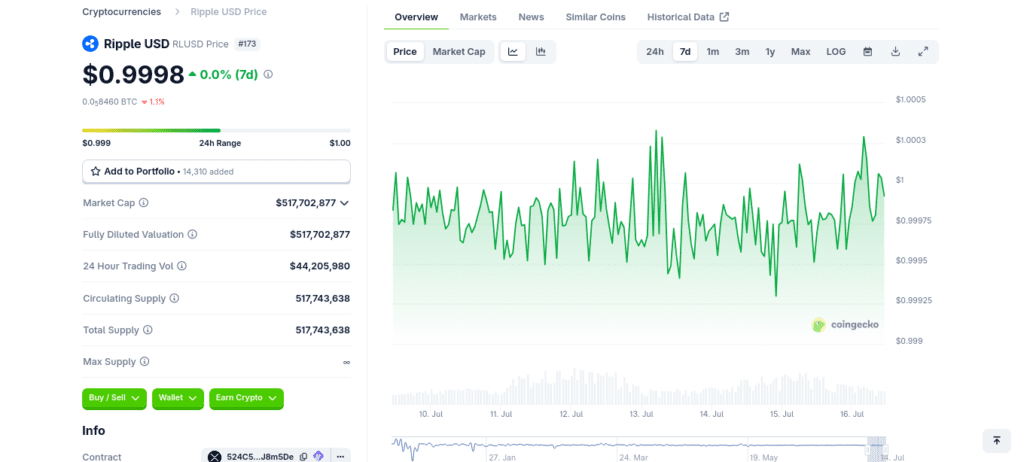

One of the main aspects that kept Ripple afloat amid its numerous legal battles was providing utility for its products. RLUSD passed 501 million tokens, with its market valuation hitting around $501 million, per CoinGecko data.

Its credibility for humanitarian and financial applications like this has ensured Ripple continues to climb the latter.

Recently, Ripple partnered with BNY Mellon, which oversees approximately $52 trillion in assets under administration, will manage the cash and US Treasury reserves backing every RLUSD token.

CHECK OUT: MiniPay Q2 2025: Stablecoin Wallet Growth, New Features; Mini App Boom

The successful pilot and subsequent scaling provide compelling evidence that blockchain drought insurance, powered by stablecoins like RLUSD and automated by smart contracts, offers a viable, efficient, and trustworthy model.

As Phase 2 unfolds, protecting over 500 pastoralists with readily available RLUSD stablecoin, the world watches.

As for Africa, it’s provided a blueprint of alternative drought risk mitigation strategies utilizing the efficiency of blockchain.

If it successfully aids in actual drought events, the model will transition from a small-scale project to an initiative that African governments can explore.

The convergence of blockchain, objective data, and stable digital assets is proving to be a potent tool for building much-needed financial resilience.