-

Blockchain protocols in Africa enable low-cost, decentralized finance for SMEs, bypassing corrupt traditional banking systems.

-

Celo’s mobile-first design and Stellar’s $0.00001 fees dominate Africa’s remittance and cross-border payment sectors.

-

Regulatory ambiguity and infrastructure gaps threaten blockchain protocols’ scalability despite their transformative potential for African economies.

Africa’s digital transformation is shifting into high gear with new and legacy industries seeking a chance at the trillion-dollar market.

However the main question persists which blockchain business model suffices? Where to set up your startup and which ecosystem best catered the unique African needs?

Understanding which blockchain protocol to set up house in is the difference between higher returns, broader reach, expensive fees and restrictive ecosystems.

This article explores leading enterprise blockchain solutions, citing global blockchain protocols that have powered Africa’s Web3 ascent. In addition, figuring out whether these decentralized networks fit the needs of your SME.

Understanding Blockchain Protocols: Foundations for Success

Blockchain protocols govern the decentralized world’s backbone, governing how transactions, data, and information are validated, stored and secured.

These systems are often divided into three main categories: permissioned(private), permissionless(public) and hybrid(blend of both). We’ll tackle the first two, given their in-depth roots in Africa.

Well-known decentralized networks like Ethereum and Bitcoin are classified as permissionless, meaning anyone can view data and participate within their community.

Permissioned are less known given their strict adherence to privacy and anonymity, hence chains like Hyperledger Fabric are served for the geeks and investors of Web3.

The main difference between these two types of blockchain protocols boils down to their consensus mechanism. In layman’s language, how transactions and dates are validated.

CHECK OUT: Liberland’s Blockchain Governance Models: A Blueprint for Future Societies

This is a crucial aspect since mechanisms like Proof-of-Stake (PoS) or Byzantine Fault Tolerance (BFT) directly impact speed, energy efficiency and scalability.

For instance, Ethereum’s TPS(transaction processing speed) is 50-100 per second, while Solana towers at 50,00 per second.

For Business owners, CEOS and entrepreneurs, integrating enterprise blockchain solutions requires significant understanding of the intricate capabilities of various blockchain protocols.

Fortunately, numerous systems have emerged over the years, each providing intricate differences significantly lowering the entry barrier.

Fret not, this guide has done the research and provides you with bite-sized information on the crucial sectors to consider providing affordable blockchain solutions for SMES.

We aim to answer questions like “How to choose a blockchain protocol for a small business” and highlight emerging blockchain protocols in Africa.

Comparing Africa’s Leading Blockchain Protocols

Ethereum: The DeFi Powerhouse

It’s always important to highlight the top dog of the Web3 ecosystem, Ethereum.

Best known for its initiative to create a decentralized ecosystem giving birth to the concept Web3, Ethereum has maintained its top position, becoming the undisputed king of DeFi.

Since 2022, “Merge” transitioning to Proof-of-Stake, Ethereum now offers greener operations processing around 50-100 transactions per second on its Layer-1 network.

Its dominance has enabled this titan to expand its operation, fostering well-known Layer-2 solutions like Polygon and Arbitrium over 1000 TPS.

Years of revisions, adjustments and improvements have fostered exquisite performance metrics such as its 12-second finality rate with an average gas fee of $0.1-$1.7.

This figure, however, can spike during peak hours and volatile periods.

True to its goals, Ethereum has incorporated mature development tools like Solidity, Hardhat, and MetaMask.

Home to over 1,216 projects, Ethereum is a standard ecosystem for most dApps, DeFi platforms and NFTS in Africa.

Prime example, popular African-based Web3 projects like Trendx, Tata iMali, Kiva Protocol and Dignified ID reside within the ecosystem.

BNB Smart Chain

Binance’s BNB Smart Chain has also made a name for itself as a powerhouse blockchain protocol for African startups.

The decentralized network operates on a Proof-of-Staked Authority with 45 active validators, 21 Cabinets(highest staked amounts), and 24 Candidates.

With recent upgrades, increased block gas limit from 100 million per second to 200 million per second, BNB has achieved over 10,000 TPS.

Among various blockchain protocols,BNB is favoured due to its low transaction costs averaging between $0.03 and $0.1.

In addition, as an edge, BNB is an Ethereum Virtual Machine-compatible chain.

This means the network heavily benefits from familiar tooling, enabling seamless porting of Ethereum dApps.

Various tools include: Truffle/Hardhat, BSCScan explorer, MetaMask, BNB Chain SDKS, etc.

Binance has grown tremendously with its focus on the continent’s Web3 ecosystems. Binance Africa has trained over 1000 African developers, assimilating them or hosting their applications, i.e. Xend Fiance.

Cardano

Cardano, a popular among decentralized business networks, utilizes the Ouroboros Proof-of-Stake protocol.

The protocol can process more than 1000 TPS with popular projects like Leios, fostering a potential of 11,000 TPS.

Furthermore, it offers low transaction fees between $0.03 and $0.1.

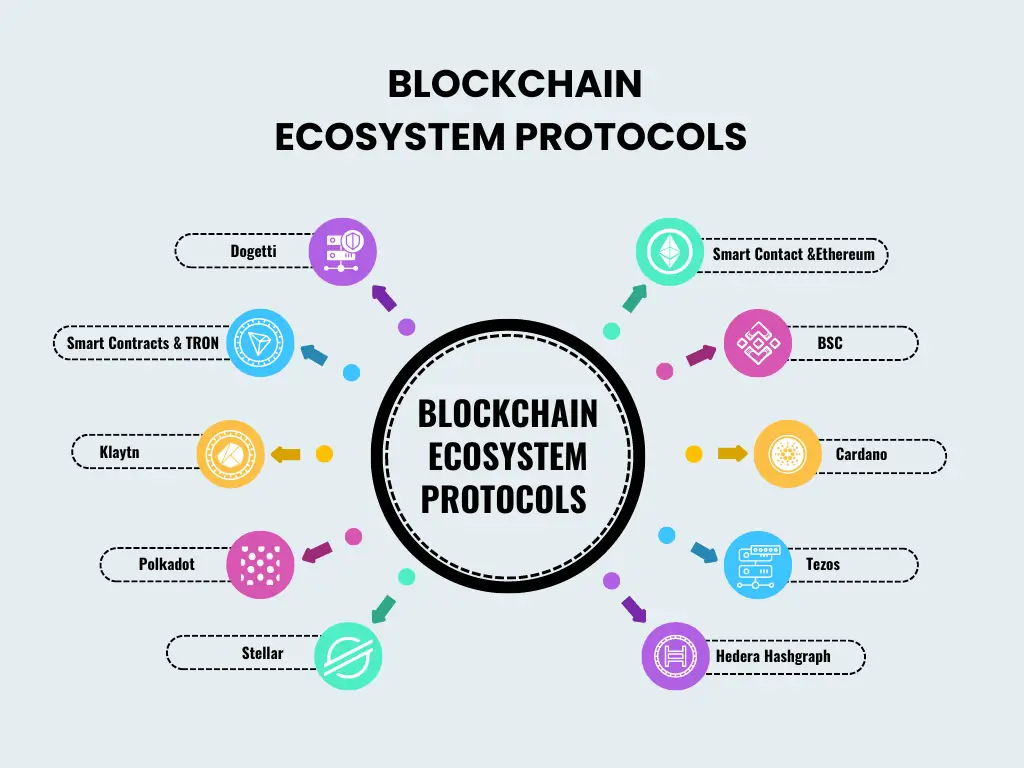

The top blockchain protocols globally.[Photo: FasterCapital]

In addition its developer toolkit improved significantly with Plutus Playground and Adalite Wallet proving to be significant upgrade. One of its key focuses is partnering with governments, aligning its blockchain agendas with compliance practices.

Stellar

Stellar, a permissioned blockchain protocol, utilized a Federated Byzantine Agreement consensus. Its average throughput broke its previous record, standing now at 200 TPS.

Its negligible fees, at $0.00001 per transaction, make it highly cost-effective for transactions.

Its latest Soroban smart contract platforms provide developers with versatile tools.

Celo: Mobile-First Designed

Celo utilized a Byzantine Fault Tolerant (BFT)-style Proof-of-Stake consensus yielding around a 9.7 TPS rate with blocks produced every second.

A noteworthy difference with this particler blcockain protocol is its mobile-first design, including a USSD fallback and a native cUSD stablecoins.

Its unique approach heavily aligns with Africa’s increasing mobile penetration, making it accessible to a wide range of users.

In addition, it uses the EVM for contracts, making Ethereum developers’ code easily accessible to its users. The Celo Foundation is active in Africa’s Web3 ecosystems, piloting numerous initiatives, especially in West and East Africa.

Hyperledger Fabric: Enterprise-Grade Privacy

Hyperledger Fabric provides a unique outlook for a decentralized business network.

The system is a permissioned protocol supporting pluggable consensus like Raft, Kafka PBFT. Currently, the network has no native token but utilizes chaincoded smart contracts with SDKS for Go, Java and Node.js languages.

Its designs make it more practical for supply chain, access control or regulatory networks.

Emerging Protocols to Watch in Africa

Several noteworthy blockchain protocols trailblazing the market include:

- Avalanche: Its sub-second finality and 4,500 TPS via EVM-compatible subnets provide compelling use cases for cheap cross-border financial services and stablecoin use cases.

- Mina Protocol: A 22 KB blockchain using zk-SNARKS provides ideal connectivity in low-bandwidth rural areas.

- Polkadot: Its parachain architecture and Substrate framework offer various advantages to agricultural supply chains, enabling cross-border traceability.

- Hyperledger Indy: A self-sovereign blockchain protocol that enables unique data traceability and accountability applications.

- Lightning Network: Bitcoin’s layer-2 solution has gained notable traction for peer-to-peer (P2P) remittances and micro-payments

Mapping Protocols to African Business Models

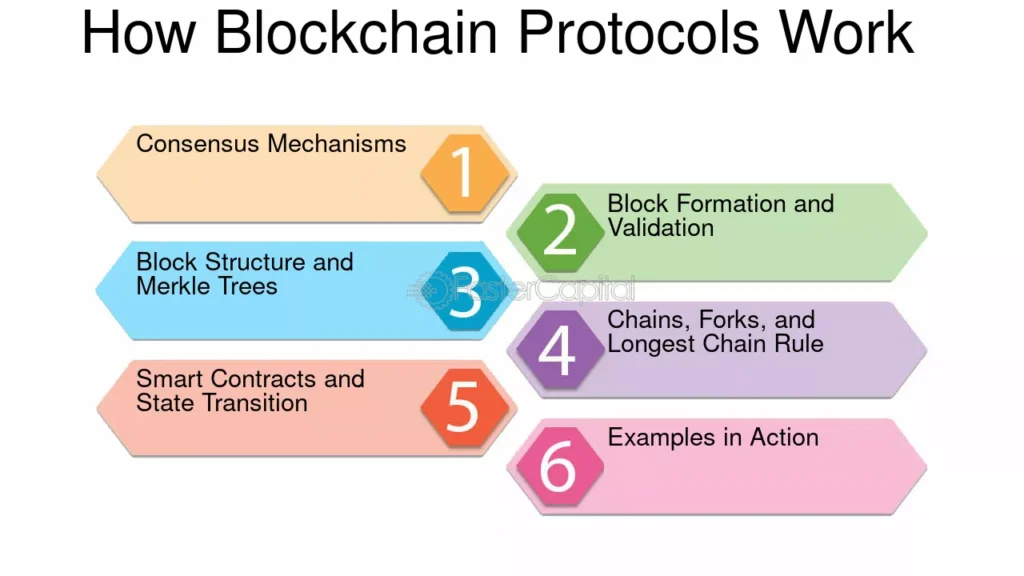

A general outlook on how blockchain protocols work.[Photo: FasterCapital]

Financial Inclusion & DeFi

For businesses targeting the unbanked population, Ethereum’s mature DeFi ecosystem provides robust tools to create market reach. Projects like Uphold’s microloan platform exemplify how Ethereum’s reach. In addition, for low area connectivity, the Mina protocol can be added as a bonus with Celo’s mobile-first design and cUSD stablecoin to make it compatible for gig-economy services and rural reach.

Supply Chain & Traceability

Hyperledger’s Fabric’s privacy model supports mining and agricultural provenance models.

Its emphasis on data confidentiality and integrity is mandatory for any supply chain endeavours. Public chains are often avoided when dealing with sensitive data, making other examples like Quorum a good choice.

Remittances & Cross-Border Payments

For cross-border payments, many often opt for Ethereum, but Celo, Stellar, Solana, and BNB chain offer significantly reduced fees ideal for first-phase startups or remittance services.

Furthermore, instances like Celo target Africa’s mobile penetration, making it ideal if you are looking for integration and easy market reach.

High-Volume Micropayments & NFTS

Solana’s renowned transaction rate and sub-second latency make it a top choice for large-scale token exchanges and NFTS. BNB Chain and avalanche EVM compatibility benefits both developers with its vast array of tools, making deployments much simpler.

Regulated Finance & Interbank Workflows

R3 Corda’s point-to-point privacy and CorDapp workflows are well-suited for consortium banking use cases like Project Khokha.

Quorum’s private-transaction EVM fork supports secure settlement in regulated environments. Permissionless networks lacking governance controls should be avoided for these applications.

Government & Public Sector Initiatives

Algorand’s energy-efficient PoS, carbon-negative operations, and sub-5-second finality make it suitable for national e-identity or climate-tracking systems.

Hyperledger Fabric’s fine-grained permissioning provides robust security for public-sector data. Permissionless chains may not meet government oversight requirements, making them less appropriate for these initiatives.

Lessons & Case Studies from African Innovators

Various African initiatives utilize the above blockchain protocols efficiently. Some keynote examples are;

- Arianee is a Kenyan-based organization utilizing Ethereum to provide tokenization functionalities. This more hinges on supply management and even some instances of agricultural products.

- 1TRIBE Africa Onchain – leverages on Polkadot ecosystem to provide cultural initiative promoting decentralized futures through onchain heritage, education and entertainment.

- Project Khokha – a proof-of-concept wholesale payment system for interbank settlement using a tokenized South African rand on Quorum.

- Absa Bank – the first African bank to join the R3 consortium, exploring blockchain solutions for financial markets.

- Kiva Protocol – Powers Africa’s first decentralized national ID system in Sierra Leone, enabling citizens to own and use their national civil identity digitally.

Building Future-Ready Blockchain Solutions

Choosing the right blockchain protocol requires aligning efficiency with niche.

Different decentralized blockchain networks work well in various protocols, while others lead to even more issues. You just need to find one that aligns with your blockchain business model.

Whether deploying Enterprise blockchain solutions for mining giants or affordable blockchain solutions for SMEs, Africa’s innovators prove that decentralized technology can drive inclusive growth.