-

Analysts highlight BRICS’ reliance on market growth for development, supporting cryptocurrency ecosystems.

-

BRICS Single Digital Asset provides new view points for its alliance expansion focused on African nations and driving blockchain adoption.

-

BRICS’s expansion boosts cross-border cryptocurrency networks, particularly in Ethiopia’s blockchain sector.

In 2025, the BRICS alliance continues to reshape and redefine global economic dynamics with its groundbreaking initiatives throughout the world but more so in Africa. With this in mind, its recent—and by far groundbreaking—leap of faith, the BRICS Single Digital Asset, has rocked its alliances, influencing millions across continents.

The design of its digital asset infrastructure poses an interesting trail of thought and poses a major opportunity to revolutionize trade and financial transactions among its allied nations. Essentially, its main goal is simple, straightforward, bold, and quite frankly tantalizing: reducing dependence on traditional reserve currencies and streamlining economic integration.

The expansion of BRICS to include Egypt, UAE, Saudi Arabia, Iran, and Ethiopia has created new opportunities for African blockchain adoption. These nations bring diverse economic strengths and technological capabilities to the table, enhancing the alliance’s ability to develop robust digital asset infrastructure that can support large-scale cryptocurrency transactions and blockchain applications.

The BRICS Single Digital Asset: A New Frontier for Global Economics

Economic analysts such as Brazilian expert Jose Juan Sanches emphasize the BRICS alliance’s dependence upon market-led growth rather than external political dynamics for development. This creates an ideal climate for blockchain adoption across its bloc and provides independent cryptocurrency ecosystems that remain functional even amid geopolitical uncertainties.

Africa stands to gain greatly from blockchain technology’s increasing use. South Africa, Ethiopia, and Egypt can leverage membership in the BRICS alliance to integrate cryptocurrency into their financial systems. The integration of African nations into the BRICS framework has significantly bolstered cross-border cryptocurrency networks. Ethiopia, in particular, has emerged as a key player in Africa’s blockchain landscape, with its growing technology sector and strategic position on the continent.

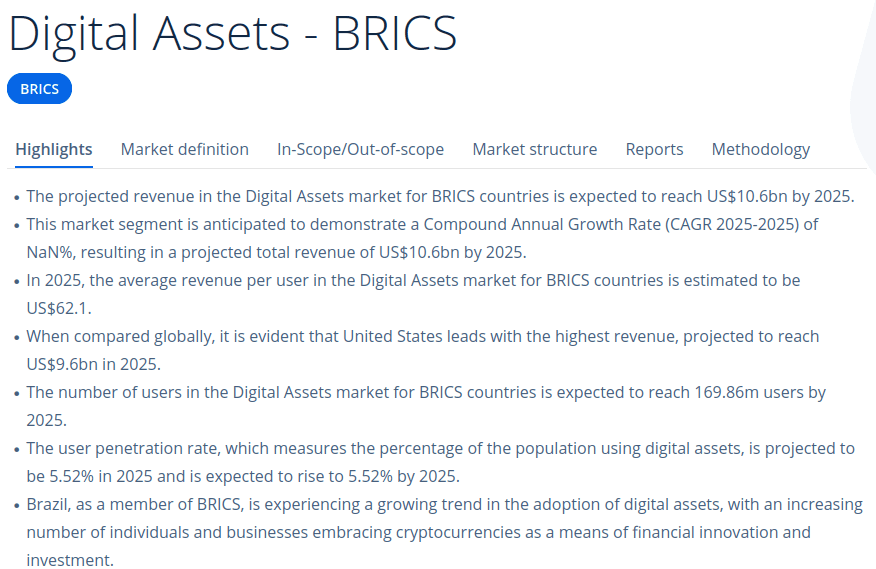

According to analysts, the flow of digital assets between BRICS nations has increased by 45% in 2025 compared to previous years. This poses an interesting angle for the BRICS-Africa cryptocurrency collaboration, which has led to joint ventures in fintech innovation.

The flow of digital assets between BRICS nations has increased by 45% in 2025 compared to the previous year, according to recent market analyses.[Photo: Statista]

Russia’s Leadership Role in Blockchain Innovation

As chair of the BRICS alliance, Russia has pushed for more discussions around blockchain and digital assets. Hosting over two hundred events—including the Kazan Summit—she prioritized the integration of digital assets into the alliance’s economic framework. This aligns with Russia’s vision to promote worldwide cryptocurrency adoption amid evolving US-BRICS relations.

ALSO, READ: Liberland’s Blockchain Governance Models: A Blueprint for Future Societies

The Kazan Declaration highlighted the need for collaboration in digital asset innovation. While not explicitly endorsing any single cryptocurrency, the summit emphasized how blockchain technology could streamline financial inclusion within Africa’s bloc nations—trends that resonated deeply among African countries looking to use blockchain for financial inclusion purposes.

Political Stability as a Catalyst for Crypto Growth in Africa

Politico-social stability among BRICS member nations is a principal reason for the growing adoption of cryptocurrency across Africa. African countries within this alliance can use political stability as leverage to attract investments into blockchain infrastructure projects, creating ripple effects throughout digital economies on the continent.

As part of its ambition for greater financial integration, the BRICS alliance is exploring the possibility of a grand idea: the BRICS Single Digital Asset.

However, Russian President Vladimir Putin recently clarified that the potential for such projects carries grave implications, which the organization is not yet ready to handle. For African nations, this raises essential questions regarding the feasibility of a unified cryptocurrency framework within such an expanding monetary bloc.

An alternative digital asset or blockchain-based financial solution could substantially expand financial inclusion across Africa. By advancing discussions surrounding such solutions, African nations can ensure their unique needs are addressed—fostering financial empowerment among underbanked populations.

BRICS alliance, showcasing all the respective heads of state.[Photo: Council-on-Foreign-Relations]

Smart Contracts for Transparent Governance: Building Trust in Digital Economies

Transparency and accountability are critical components of successful digital economies. The implementation of smart contracts for transparent governance within BRICS nations has created new standards for public sector operations.

These self-executing contracts automatically enforce agreed-upon terms, reducing opportunities for corruption and increasing efficiency in government transactions. This technological advancement has not only improved governmental operations but also boosted foreign investment by creating more predictable and transparent business environments.

Role of Africa as a Mediator Using Digital Assets

African nations, with their distinct perspectives and growing blockchain expertise, can serve as mediators in global conflicts. By using digital assets and decentralized platforms to foster trust and collaboration within the BRICS alliance, they can position Africa as a key player in international peace-building initiatives.

The BRICS alliance is solidifying its main goal of dominating the Web3 economic future despite current crypto market volatility. Blockchain solutions for financial inclusion are numerous, and the BRICS Single Digital Asset is a grand idea—but like all innovations, working out the kinks is a factor many must account for.

For instance, take South Africa: one of the main reasons it leads in crypto adoption is the progress it has made, not to control its digital asset wave but to integrate it steadily. A counter to this example is Nigeria’s eNaira, a colossal failure due to its rushed implementation and the CBDCs’ focus on control rather than financial inclusion.

The collaboration between BRICS and African nations represents not just an economic partnership but a shared vision for a more equitable global financial order.

If you’ve reached this far, sign up to our newsletter to get more informative, factual, and entertaining news focuses on telling the story from your perspective for a change. Sign up to our newsletter and get a sneak at our predictions focused on educating and empowering you to think for yourselves rather than following a trend.