In Brief

-

Coinbase crypto services democratize digital asset access by providing low-fee, localized onramps empowering African users.

-

Partnerships with Yellow Card and Jambo Technology expand accessibility, offering seamless USDC purchases and mobile onboarding.

-

Investments through Coinbase Ventures foster local startups like Mara, catalyzing innovation and financial inclusion across the continent.

Africa, for the first time amid 3 industrial revolutions, is at the center of the biggest technological revolution.

With 3 leading pioneers, Kenya, Nigeria, and South Africa, we have a chance to dominate via cryptocurrency, decentralized applications, NFTs, DeFi, and stablecoins.

It’s not a shock that Coinbase, a global leader in the digital asset space, eyes the continent to empower Africa through strategic partnerships and accessible services.

This article explores how Coinbase crypto services are driving change, enhancing digital asset accessibility, and spearheading circular financial inclusion initiatives across the continent.

Core Coinbase Crypto Services: The Foundation

Africa’s embrace of digital assets has become a necessity and opportunity for alternative income, global reach, and a chance to reinvent our systems from scratch.

In recent years, Coinbase has recognized our potential and sought to provide a robust solution to Africa and the globe, building the future of finance, or rather, a crypto future.

The platform offers key services such as

- Buying, Selling, & Trading: Access to a vast array of digital assets (over 17,000), including Bitcoin (BTC), Ethereum (ETH), and many others.

- Coinbase Wallet: A self-custody wallet giving users full control over their crypto assets, crucial for interacting with decentralized applications (dApps) and the broader Web3 ecosystem.

- NFT Marketplace: A platform for creating, buying, and selling digital collectibles.

- Earning Opportunities: Options to earn rewards through staking or educational programs (“Learn and Earn”).

- Tools for Businesses & Institutions: Coinbase Commerce facilitates crypto payments for merchants, while Coinbase Prime and Custody serve institutional needs.

While the services form the bedrock, Coinbase had to do a little bit extra to ensure it set up a proper base within the continent.

Digital Asset Accessibility: Bridging the Gap for African Users

Coiinbase crypto services are tackling these challenges by integrating tools that democratize access to alternative financial options.

A cornerstone of this effort is their partnership with Yellow Card, a licensed stablecoin on/off ramp operating across 20 African countries.

The partnership featured the Yellow Card Widget interacting with Coinbase Wallet, enabling the purchase of USDC using local payment methods.

CHECK OUT:Inside Btrust’s $1M Bitcoin Grant Strategy for the Global South

This enables low-fee crypto transfers, reduces the reliance on volatile fiat currency, and offers SMEs a gateway to the global digital economy.

Coinbase Wallet fees, often lower than conventional banking, significantly lowered the barrier to becoming a popular alternative, especially given Africa’s growing stablecoin dependency.

Financial Inclusion Initiatives: Expanding Reach Through Local Partnerships

The firm commitment to financial inclusion initiatives is evident in its Nigeria expansion via Onboard Global, a compliance-focused crypto platform.

The initiative enabled Nigerian users, Africa’s largest crypto adopters, access to Bitcoin, Ethereum and Litecoin.

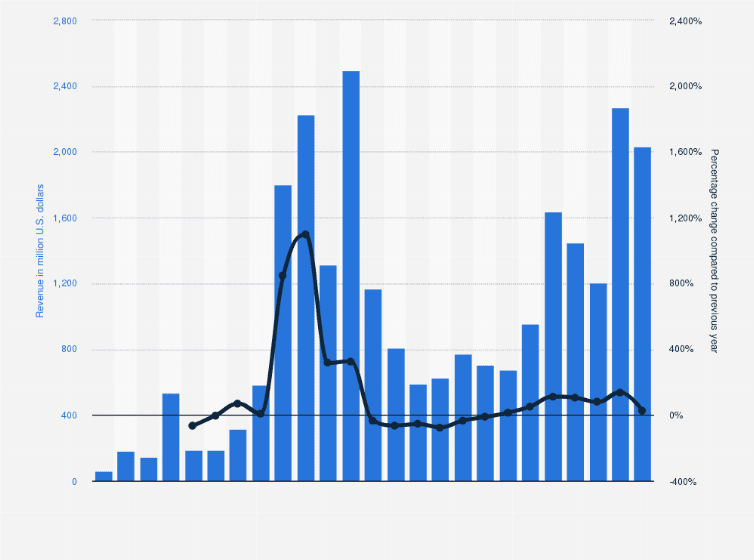

Coinbase Revenue[Photo: Statista]

The results continue to speak for themselves as Nigeria still maintains its title as Africa’s lead in crypto transaction volume.

Regulation has become a necessity within many African nations, and Coinbase has showcased its commitment to aligning with such fostering trust in digital assets.

Low Fee Crypto Transfer and Mobile Onboarding: The Jambo Technology Collaboration

To further simplify access, Coinbase partnered with Jambo Technology, a mobile device manufacturer distributing smartphones in over 120 countries, including Africa.

Coinbase Wallet was preinstalled in JamboPhones, enabling seamless onboarding for millions of first-time Crypto users.

Having over 700,000 sales in 2024 alone, the initiatives provide users with access to manage crypto, interact with dApps, and explore DeFi solutions.

Coinbase Wallet integrates Yellow Card Widget giving African users global access to USDC.[Photo: YellowCard]

In addition, it bypasses high bank fees and currency conversion costs while taking advantage of the continent’s growing mobile penetration rate.

Supporting Innovation: Cobase’s Investment in African Startups

Beyond facilitating adoption directly, Coinbase crypto services are nuturing Africa’s entrepreneurial ecosystem via investments inlocal startups.

A note-worthy case is Mara, a pan-African crypto exchange backed by $23 million in funding led by Coinbase Ventures.

The African-based platform offers brokerage services, educational resources, and a layer-1 decentralized network tailored to African Markets, more so in Kenya and Nigeria.

The platform is also known for its educational initiative, as crypto-illiteracy is still a common pain point for the entire continent.

By supporting the Mara Foundation, Coinbase has provided a vast number of users access to stablecoins like USDC and EUROC. Theses

These efforts aim to stabilize local economies while fostering blockchain-driven sustainable development. As Mara’s CEO stated, “We’re building a financial system that works for everyone, not just the privileged few.”

Building a More Open Financial Future

While Coinbase crypto services are facilitating the continent’s growing crypto adoption and its investments pioneering a new age of startups, there is still more work to do.

Its adaptive approach is a key metric to its monumental success within Africa.

CHECK OUT:FiveWest Launches LZAR Stablecoin: Rand-Backed Digital Currency for Africa

Prioritizing compliance and community engagements through initiatives like Yellow Card’s stablecoin on-ramps, Onboard Global’s Nigerian expansion, and Jambo Technology’s mobile onboarding enhances digital access accessibility.

Furthermore, it advances financial inclusion at scale, becoming a more logical solution for any novice.

As the continent continues to embrace digital finance, Coinbase’s role as a bridge between innovation and opportunity will be pivotal in shaping a more equitable financial future.

By prioritizing low-cost solutions, user education, and strategic collaboration, Coinbase is proving that financial inclusion is not just a goal—it’s an achievable reality for millions across Africa.