The recent Coinbase S&P 500 inclusion promptly raised the bar for the entire crypto industry.

After years of navigating regulatory challenges and fencing off SEC-related “crypto lawsuits,” the crypto titan has finally done it, entering the S&P 500, underscoring a pivotal moment in how the public market perceives digital assets.

According to Meryem Habibi, Chief Revenue Officer at Bitpace, this move “normalizes passive crypto exposure in conservative portfolios that might otherwise avoid digital assets,” signaling a broader crypto institutional adoption trend.

In Brief

-

Coinbase S&P inclusion legitimizes digital assets in conservative portfolios, unlocking potential $10 billion passive inflows.

-

Traditional fund managers like BlackRock and Vanguard must allocate to Coinbase for S&P 500 weighting.

-

Regulatory clarity and profitability will determine which crypto firms follow Coinbase into the index.

Coinbase S&P 500 Inclusion Marks New Era for Crypto Institutional Adoption

Cryptocurrency has been a no-go zone for most within traditional markets. However, this trend has drastically shifted, given Bitcoin’s $100K rise.

Organizations like BlackRock, Metaplanet, Strategy, and others have showcased how institutional crypto investment is the next golden egg.

With Coinbase’s inclusion in the S&P 500, it’s no longer a trend but a valid badge for the industry as a legitimate market.

Jason Kennard, Head of Business Development at ARK Invest Europe, stated how this achievement showcases how crypto infrastructure has matured into a;

“credible systemic part of the financial ecosystem.”

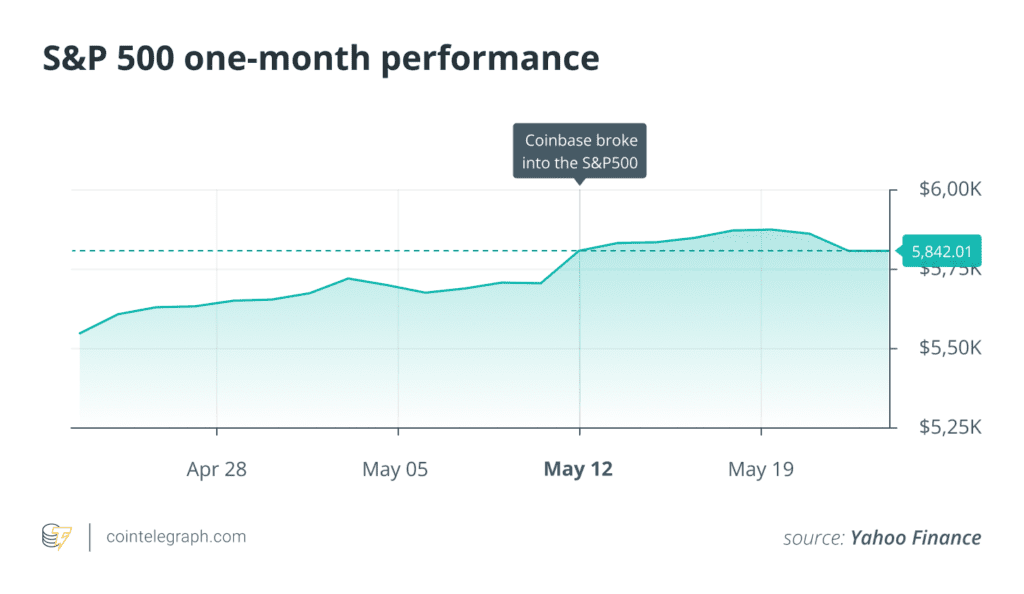

Steve Sosnick of Interactive Broker noted that equity investors in the S&P 500 index will now indirectly gain passive crypto exposure, potentially injecting billions into Coinbase through automated fund reallocations.

CHECK OUT: Crypto Wallet Adoption Accelerates: Key Trends and Innovations Shaping 2025 and Beyond

How S&P 500 Inclusion Affects the Crypto Landscape

The impact of Coinbase S&P membership extends beyond immediate capital inflows.

For some context, the S&P 500, or rather, Standard & Poor’s 500 Index, is a stock market index measuring the performance of the 500 largest publicly traded companies accounting for 80% of US market capitalizations.

The organization itself is a major player in the financial world, spanning 11 economic sectors for trade market exposure and trading over 100 million shares daily.

This isn’t some small-time firm but a whale in the financial market, which used over $5.4 trillion in indexed assets as of 2023.

With Coinbase now joining its pristine and, quite frankly, money-ridden networks, giants like BlackRock and Vanguard are now obligated to allocate capital to the firms.

This creates a $10 billion potential inflow if the company secures a 0.1% weighting in the index.

You didn’t misread 0.1-weighting garners $10 billion.

Given Coinbase’s vast network and being a major whale within the crypto industry, attaining such a fat is mere childsplay.

Mark Palmer of Benchmark observed that this normalization could accelerate crypto institutional adoption by retirement plans, sovereign wealth funds, and other risk-averse entities.

He added:

“What’s remarkable about this is that just a few months ago, the company was engaged in an intense legal battle with the SEC, which was charging that its platform was illegal because it was trafficking in unregistered securities,”

Institutional Crypto Investment Gains Momentum

With Coinbase joining the ranks, it raises other questions, especially on which crypto firms are eligible for index inclusion.

The organizations, with sheer profitability and a stupidly high market cap, meet the index criteria, but others, like Galaxy Digital and Marathon Digital, still face some hurdles.

Owen Lau of Oppenheimer & Co. argued that full convergence between traditional finance (TradFi) and crypto is “happening and will continue.”

The firm also cited other firms like Robinhood/Bitstamp, Kraken/Ninja Trader, and Ripple/Hidden Road as good examples.

In addition, partnerships like Galaxy’s Nasdaq listing and Coinbase’s role as an ETF custodian are prime examples of the current change in tidings.

Despite this, some still highlight the various risks that come with it. Experts like Seoyoung Kim of Santa Clara University emphasized;

“Crypto, overall, is still a very small fraction of the overall economy. I think the greater convergence coming ahead will be increasing institutional adoption of blockchain-based protocols and tokenization.“

Passive Flows and Regulatory Clarity

The influx of passive crypto exports via index funds could provide current institutional strategies with better alternatives.

S&P DJII estimates $10 trillion tracks the S&P 500, meaning even a small weighting could funnel massive capital into crypto-native firms.

Habibi emphasized that the current crypto-trends reward companies willing and daring enough to venture into the market.

Balancing innovation with regulatory compliance is by no means an easy feat; however, it’s still a vital factor for crypto institutional adoption.

This is highlighted given the SEC’s current legal onslaught on Coinbase with recent breaches.

As Kennard noted:

“Regulatory clarity is still emerging, but institutional rails are being laid fast,” setting the stage for more firms to bridge the TradFi-crypto divide.

A New Chapter for Crypto and TradFi

While Coinbase’s inclusion is groundbreaking, the path for others might not be as clear. Russell Rhoads of Indiana University stressed that S&P 500 constituents must highlight a broader economic approach. However, profitability and market cap barriers are still high.

Currently, firms like Circle and Fireblocks may eventually pursue the same goal, but consistent earning and scalability will be the deciding factor.

As Sosnick concluded, “We’ll likely see existing S&P 500 firms adopt blockchain services before true-blue crypto companies enter the index.”

The Coinbase S&P 500 inclusion is more than a corporate triumph. It’s a bellwether for crypto institutional adoption.

The merger between TradeFI and cryptocurrency bridged the gap between conservative portfolios and digital assets while inspiring a new wave of infrastructure.

With such passive inflows highlighting how the S&P 500 affects the crypto market, investors, organizations, and innovators must quickly adapt before the shift saturates.

Ignoring this move and its effects risks missing the next phase of the financial history.