-

Crypto payments now cover everyday expenses—groceries, travel, subscriptions—with over 35% user adoption across nine regions.

-

Gen Z leads social and gaming use cases, while Millennials and Gen X value travel, digital goods, and secure borderless transfers.

-

Innovations like one‑tap QR codes and zero‑fee crypto cards make crypto payments seamless and accessible in Africa and beyond.

Crypto payments have radicalized how we view digital assets, from paying for coffee with Bitcoin to settling salaries with stablecoins or even online shopping.

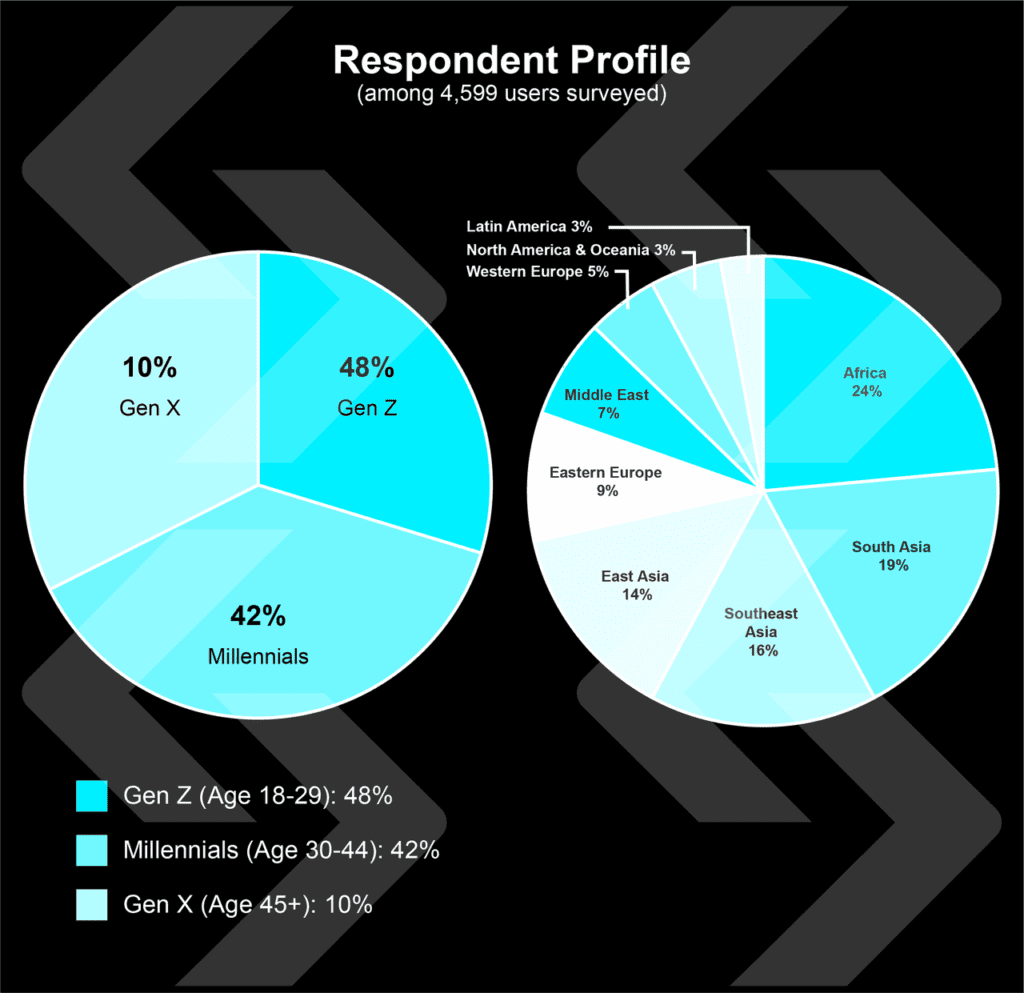

Bitget’s landmark PayeFi Unlocked: Crypto Payment Use Cases, surveying 4,599 users across 9 regions, confirms an undisputed fact: digital assets are reshaping finance. Over 35% of users now leverage crypto for groceries, subscriptions, and travel, providing utility to a technology once dubbed “money from the air.”

Unlocking Crypto Payments: How Digital Assets Power Everyday Transactions

Why Users Choose to Pay with Crypto

Alvin Kan, Bitget Wallet’s COO, observed:

“We’ve moved beyond ‘when’ crypto will go mainstream. Users are already living on-chain.”

The report analyzes the significant transition from focusing on overnight profits to emphasizing utilities that expand finance globally. Pay with crypto is now more of a marketing edge as digital currency adoption sweeps across the globe and in Africa.

This trend aligned with Africa’s recent stablecoin spending wave. It showcased how a rising generation among youths and organizations turns to stablecoins for better pay, lower transactions, and broader reach. This has led to a peculiar rise in QR-based payments, with mobile wallets and crypto-linked cards providing ample stablecoin payment use cases.

In Africa, card payment platforms like ZeroCard and MoneyBagger make crypto payments ideal for its growing ecosystem. Gradually, infrastructure has caught up with Africa’s digital currency adoption. Bitget Wallet citing a 1600% surge in users within its application in 2024 alone.

CHECK OUT: Inside Bitget Wallet’s Meteoric Rise and Rebrand Strategy

Generational Spending Revolutions

Our youths are the future of development, and in recent payment trends, this philosophy is a practical driving force. Gen Zs (18-29) lead crypto payments beyond trading and into social and entertainment driven use cases.

The report revealed promising stats, with 40% diving into crypto in-game while 35% were into social gifting. Seamless integration appears to be the main theme behind this movement fostering digital currency adoption through fun, fast, and gamified experiences.

Millennials (30-44) revealed a more balanced approach, expanding utility across more everyday uses for crypto payments. The study revealed 36% preferred the Pay with Crypto hype for travel and 35% for digital goods. Gaming still remains a focal point, accounting for 35%; however, this group mainly accounts for crypto’s convenience in savings and accessing global markets.

Gen X (45+) utilize crypto to upgrade their traditional spending. Their main focus is how crypto payments provide secure, stable, cheaper and borderless alternatives to stablecoins. The payment trends 2025 revealed 40% use crypto to book travel, 36% to acquire digital products, and 36% to pay utility bills and online shoppings.

Global Hot-Spots: Where Crypto Fuels Daily Life

Digital currency adoption is driven by various factors across the globe. In Africa, the latest hotbed for digital assets, it revealed that 38% focus on using crypto for educations. This, however, fails to account for the growing use case for stablecoin spending and day-to-day purchases from local and upcoming startups. Regions like Nigeria, Kenya, and South Africa have broken boundaries shifting cryptocurrency into daily use with recent advocates spreading its benefits.

Stretching beyond Africa, East Asia, crypto has embedded itself within tech and consumer ecosystems with 41% fostering daily purchases. South Asia dominated the play-to-earn gaming sector at 41% and social gifting at 36%, showcasing local preference to the traditional alternative.

The Middle East has fast-paced its adoption in embedding crypto for everyday use and upgrading lifestyle. 41% accounts for play-to-earn gaming while 31% prefer purchasing luxury goods via crypto, followed by car purchases with 29%.

In Europe (Eastern and Western) real estate tokenization gain traction as wealth diversification. In North America and Oceania balance out mainly on play-to-earn gaming accounting for 31%. Latin America on the other hand fosters steady figures for online shopping (35%) and digital products (38%) with locals shifting to better alternatives to their high-inflation fiat currencies.

Builders: Here’s What Users Demand

In the present day, enthusiasts, builders, consumers, and event traders tend to ask: How to use crypto for daily payments?

Understanding the different needs within the different regions is vital to determining who stays on top and who falls behind. For most African startups it is understanding what the locals need and how to meet those who do not understand crypto.

CHECK OUT:Crypto Wallet Adoption Accelerates: Key Trends and Innovations Shaping 2025 and Beyond

Bitget offers a unique solution to this problem by integrating real-world payment options. They offer viable options such as:

- One-Tap QR Payments: Scan Pay codes at retailers; settle in Fiat instantly.

- Crypto-Linked Cards (Bitget Card): Zero-fee European Mastercard (150M+ merchants).

It’s understood that Gen Z want a means to earn from crypto, Millennials crave utility and flexibility while Gen X desire trust and reliability.

Bottom line:

Crypto payments are the next frontier for finance to solve real major bottlenecks. In Africa, from Nigeria’s education boom to Gen X’s cross-border bills, digital assets’ power needs traditional finance to ignore.

The next billion users aren’t waiting and Africa is still majorly untapped making it the next stop for anyone wanting users on Web3.