-

Blockchain banking solutions harness decentralization and transparency to empower Africa’s over 43% unbanked population.

-

Mobile-first DeFi platforms capitalize on smartphone ubiquity to drive GDP growth and accessible finance.

-

Stablecoins and DEXs slash cross-border remittance costs, boosting SME profitability and economic resilience.

Web3 and blockchain have completely redefined how the world views Africa. From a backwards continent with internal strife working against itself, to the leading development ground for the next industrial revolution.

One of its pioneering endeavors is blockchain banking solutions brought about by democratizing financial services.

Over the past decade, Web3 has laid the foundation for various financial inclusion strategies via its decentralization, transparency and unexpectedly mobile-first designs.

Today, more so in Africa, DeFi vs Traditional banking is a one-sided battle, with the latter conceding defeat by finding various ways, i.e. mobile banking, to maintain its relevance.

This article provides an in-depth dive into unveiling how DeFi improves financial access, the various mobile-friendly DeFi solutions dominating Africa’s economy, and illuminating the impact of blockchain banking solutions.

Overview of Financial Exclusion in Africa

Let’s be frank, leaving aside ideologies, future outlook, and just laying it bare, among the core issues chaining Africa’s growth is its broken, pit-filled, and corrupt financial system.

According to statistics, over 43% of adults lack access to formal financial services, with the remaining either having limited or facing various barriers.

The World Bank’s Global Findex estimated that 75% of poor people globally lack financial services, with rural African communities taking the biggest chunk of the pie.

CHECK OUT:Neon Dreams: Savor the Electric Rhythm of African Metaverse

Furthermore, even with around 60% having access, deep-seated corruption, fluctuating fiat currency, high tax rates, high interest rates, and high transaction fees painted more regress than progress.

The disparities in financial inclusion across different African nations were noticeable before Web3 solutions.

The European Investment Bank released a report showcasing Kenya leading by a 67% inclusion rate, followed by Nigeria with a 60%, while nations like Cameroon at 47%, Uganda at 28%, Zambia at 23%, both Benin and Senegal at 20% and Cameroon at just 13%

This exclusion rate has stifled economic growth for decades, but has introduced a market where Web3 has thrived significantly.

What are Blockchain Banking Solutions?

Blockchain banking solutions, called Decentralized Finance, were essentially a Hail Mary.

These systems and organizations harness distributed ledgers at their core to create secure, transparent and democratized financial services.

DeFi became the next iteration of finance and took a significant wave, threatening even the dominance of banks.

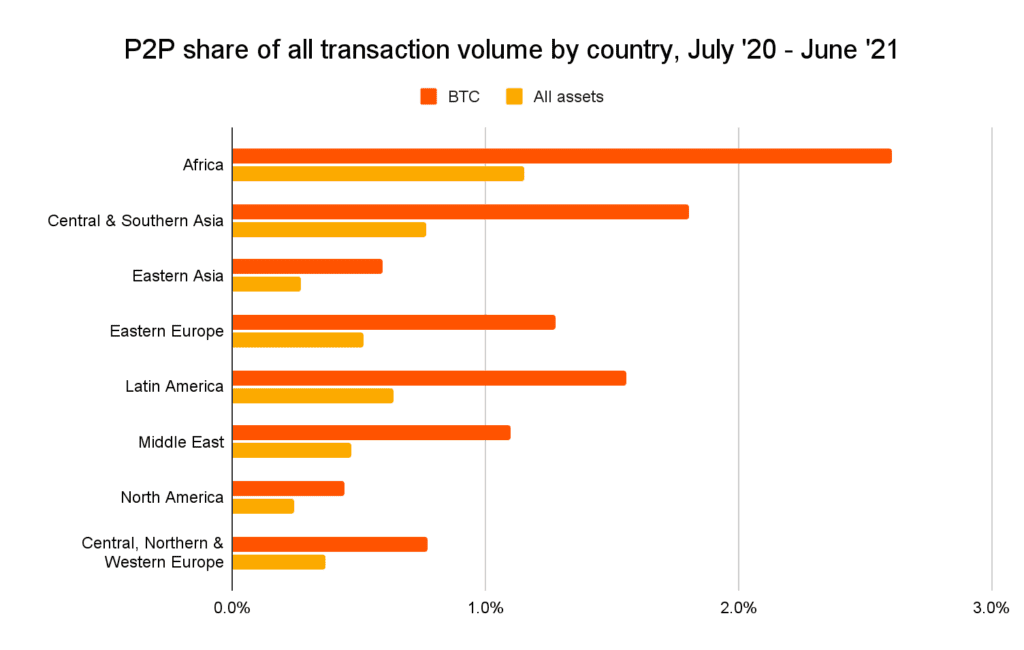

Global P2P statistics.[Photo: The World Economic Forum]

Blockchain banking solutions eliminate intermediaries, reduce costs, speed transactions and enable services in areas lacking infrastructure. See the silver lining?

Hence, the dawn of Africa’s DeFi financial inclusion season kicked off with organizations like Yellow Card, Flutterwave and other local organizations soon dominating the space.

Key Blockchain Banking Solutions in Africa

Paxful:

Primarily a P2P platform incorporating DeFi features, this African-founded exchange has significantly boosted financial inclusion in regions like Nigeria, Kenya, South Africa, and Ghana.

The platform enables easy access to the crypto markets and contains multiple payments methods; bank transfers, gift cards, and mobile money.

Furthermore, it supports decentralized wallet features and has escrow services ensuring that each transaction is complete.

Egoras (Nigeria):

A Nigerian-based efi platform that offers uncollateralized micro-credit via community governance, aiming to scale from 1,000 to 100,000 enterprises.

The platform offers wallet intergatijon and even a native token; EGR token, on the ledning protocols. EGR is utilized in its governance model that collectively approves or declines loan applications.

Its reward structure offers two forms of compensation: EGR voting rewards generated through inflationary monetary policy or ETH tokens prizes when borrowers repay their loans.

Jamborow (Nigeria):

Jamborrow offers a unique tangent in blockchain banking solution by providing blockchain-backed savings groups (“Chamas”), smart-contract KYC, and a partnered trust engine by UTU.

Beyond providing easy payments, it also partners with local media to promote DeFi education.

Yellowcard (Pan-Africa):

Yellow Card, a leading African crypto exchange, offers local payment integrations for stablecoin and crypto trading.

In addition, the platform offers users direct access to decentralized liquidity pools and crypto-saving programs.

AfriDeFi

A decentralized exchange enabling yield farming by proving liquidity to decentralized markets.

This enables users to earn interest on their crypto holdings via decentralized staking.

The organizations also facilitate blockchain-based loans

Ubikiri

A DeFi protocol based in Nigeria that addresses the limited financial inclusion in the regions.

The platform allows users to access decentralized loans backed by crypto collateral.

In addition, users can earn rewards by providing liquidity to decentralized market platforms, an excellent way for users to earn from their crypto holdings.

Its low-cost peer-to-peer transactions with stablecoin support are among the features that have significantly boosted its popularity in Rural Nigeria.

How DeFi is Changing Financial Services in Africa

For the most part, the success of DeFi initially hinged on the lucrative venture known as cryptocurrency.

Its foundation, or providing easy access to high-value currencies, greatly resonated with locals seeking an alternative.

With Africa, sadly, boasting one of the highest unemployment rates despite having the highest Human Capital rate, many took to blockchain, and a unique intersection emerged: mobile-friendly DeFi solutions.

In an ironic twist of fate, Africa’s mobile technology laid the groundwork for its financial innovation. Regions like Kenya, Nigeria, South Africa and Ghana pioneered this underdog adoption.

Research indicates that a 10% increase in mobile broadband penetration can increase GDP by 1.0-2.5%.

In 2023, this adoption rate contributed approximately $140 billion to Africa’s GDP, with projects costing a potential of $170 billion by 2030.

This many DeFi platforms already offering minimal charge fees, 24/7 operating hours and global access had a new and thriving market; smartphones.

Soon enough, DeFi rewrote the dynamics of loans using on-chain data and community governance.

It gave access to high valued and stable currency; USDC, and USDT, with built-in fiat conversion services allowing business owners easy access to their capital and loans.

Soon enough, locals began relying more on DeFi platforms than banks and their local currencies, causing a more fluctuating rate but somehow affecting even a small group of locals.

A prime example is Nigeria’s government’s concern over the low use of naira and eNaira as many locals opt for cryptocurrencies or stablecoins offered in mobile-friendly DeFi solutions like Luno, Yellow Card or Flutterwave.

How Blockchain Banking Solutions are Bridging the Gap

Decentralized Lending and Borrowing

DeFi financial inclusion strategies involve better lending services than banks. Solutions like Egoras in Nigeria offer uncollateralized microloans via community voting on loan applications.

These services leverage the immutability, transparency, inclusivity and mobile access of DeFi platforms.

Stablecoins and Digital Currencies for Financial Stability

Chainalysis released data showcasing that stablecoins constitute 435 of Sub-Saharan Africa’s $59 billion crypto transaction volume between July 2023 and June 2024.

Local platforms like Yellow Card, Bitmama, Bitpesa, and many more contribute heavily given their favourable features that facilitate stablecoin trading, enabling low-cost cross-border remittances.

This prompted many SME’s continental and global access to improve profit margins significantly.

Decentralized Exchanges (DEXs)

The democratization of markets is a core element of DeFi financial inclusion.

Various African DEXs, including Bounties Africa, Kuda Exchange, and Africrypt, have empowered numerous traders, allowing users to easily swap stablecoins for global assets and access various investment opportunities.

While the subject of African-based DEXS is still nascent, continued access to global DEX heavily dominates Africa’s crypto ecosystem.

Mobile-First Blockchain Banking Solutions

Mobile-friendly DeFi solutions are the crown of democratizing finance in Africa. Many, if not all, blockchain banking solutions ensure their features are easily accessed on smartphones.

This heavily leverages on Africa’s mobile penetration and is the success behind organizations like Yellow Card, SympliFi and Bitmama.

Typically, access to devices like laptops is limited, but smartphones are easily affordable to many locals, providing a medium to promote education, access and solutions to users.

DeFi, The Future Banks For Africa

For Africa, blockchain banking solutions are more than just easy access to money, markets, and low costs; they provide access to a corrupt-free, expansive and accommodating financial structure.

Mobile-friendly DeFi solutions are already dominating the market, forcing many banks to seek decentralized solutions.

Unfortunately, it’s not always giggles and holding hands, regulatory clarity, infrastructure and connectivity barriers, and even security concerns hinder this radical shift.

Currently, African governments are warming up to the financial inclusion strategies decentralization offers, with some actively conducting research in developing adaptive regulations.

This isn’t just some fad meant to pass, but a shift, a shift in which Africa has the best chance to flip the economic hierarchy.

It only requires collaboration between governments and locals; instead of seeking foreign aid and initiative, why not bank on the creativity of locals? Instead of going and deploying abroad, why not partner with government agencies to streamline financial services?

These aren’t idealistic questions but actual initiatives governments and local organizations can take to ensure Africa is ever going to claim a top seat.