In Brief

-

cNGN investments allow Nigerians and international users to swap stablecoins and access high-yield money market funds seamlessly on-chain.

-

By eliminating intermediaries, cNGN reduces friction, enhances transparency, and provides faster settlement for both retail and institutional investors.

-

Xend Finance’s ecosystem, including Asset Chain and AXA partnerships, strengthens Africa’s position in decentralized finance innovation.

Xend Finance is an upcoming name within Africa’s fintech landscape. As a leading DeFi platform, the firm’s core mission is to combat currency devaluation and financial exclusion.

Given Nigeria’s recent stablecoin launch, the platform has sought to provide a means for Nigerians and Africans to access broader and more lucrative cNGN investments.

During a webinar, Xend Finance CEO Ugochukwu shared that the company intends to partner with money market fund AXA Finance to power new ways for Nigerians to invest in stablecoins.

How cNGN Investments Simplify Access

Nigeria has dominated Africa’s crypto sphere in use and implementation. Aside from developing Africa’s first CBDC, the nation has recently made waves with its latest stablecoin project, cNGN.

Although cNGN’s true value might not be as high as that of other global stablecoins, it does offer numerous benefits, such as avoiding excess fees and delays.

This potential collaboration aims to introduce stablecoins to Nigerian Money market funds, which include short-term debt instruments and securities known for comparatively high yields.

Accompanied by Xend’s growing services this new addition offers to streamline various processes.

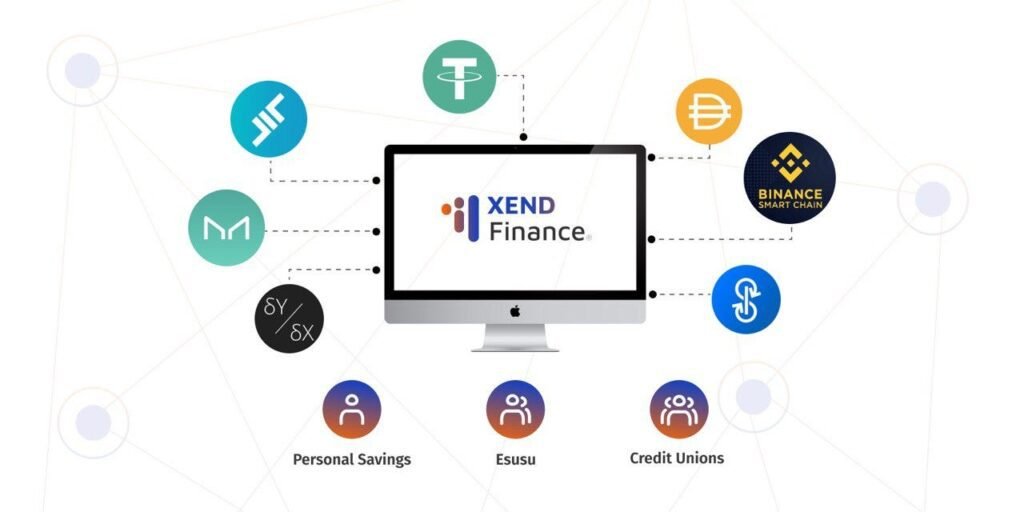

Xend has developed a variety of services in collaboration with other exchange fostering digital asset adoption in Africa.[Photo: Xend-Finance]

CHECK OUT:Xend Finance: Revolutionizing DeFi and Real-World Asset Tokenization for Global Investors

This enables investors to channel their funds directly into Nigerian money market instruments via Xend Fiance, bypassing traditional friction.

The stablecoins effectively eliminate the need to consistently convert one’s currency from digital assets to fiat back to digital assets.

Aronu emphasized this simplicity during the webinar, stating:

Maybe a person has a thousand dollars. They can easily go to a DEX and swap 100 dollars — 10% of that — and convert it to cNGN and invest in the Nigerian money market easily. We have already enabled that through the Xend Finance application and are working with AXA [money market fund] to make it happen.”

Overhauling Investments, Yield and Operational Superiority

Africa-backed stablecoins offer operational practicability.

However, introducing cNGN investments into money market funds tugs at the heart of small-time investors.

Attractive cNGN yield rates are possible, offering higher rates of returns than other African nations.

Arony specifically highlighted the potential returns available through this new channel:

For example, on the Xend Finance app, you can earn maybe 21/22 [percent] annually from the Nigerian money market through cNGN… It’s live, and we’re attracting much liquidity. People with even USDT now can easily invest with stablecoin in money market funds.

In addition, the entire transaction—from swapping USDT to cNGN on the Asset Chain to investing via Xend Finance—occurs on-chain, leveraging smart contracts for speed and transparency.

Beyond Investments: Solving Liquidity Fragmentation

While the main goal is to improve investments in Nigeria’s ecosystem, Aronu also envisions stablecoin as a solution to a broader challenge: liquidity fragmentation in P2P markets.

Currently, Africa, especially Nigeria, has a P2P market heavily dominated by USDT to Naira Swaps. According to a report, stablecoins account for 43% of Africa’s total crypto transactions, showcasing their preferability.

As a result, many traders and users engage in off-chain trades with various intermediaries, a process prone to delays, fraud and settlement disputes.

It’s gotten so bad that Nigeria’s government declared war on fraudulent crypto exchanges, flagging any exchange that doesn’t adhere to its guidelines.

CHECK OUT: Boosting Financial Apps with NGN/USD Price Oracle Integration on Base Mainnet

This is not an issue for cNGN investment. Being a naira-equivalent on-chain allows users to trade their local currency directly within Xend, providing security, speed and efficiency in one platform.

“What cNGN does is that it bridges that [fragmentation of liquidity] gap. You don’t need to trust any third party or anything like that. These assets [USDT and naira] can be traded directly on-chain.

Asset Chain’s DEX is central to this solution as it facilitates USDT/cNGN swaps.

A Pioneering Step for Xend and Nigeria

XEND Finance has made its goals clear: demystifying the process of investing in Nigeria with crypto. Its features, ranging from facilitating crypto trades to offering RWA solutions, paint a broader picture of its dedication.

With the dependency on USDT fostering growth within Africa, its overreliance does project long-term issues for us. Many pool USDT to Nigerian investments, becoming a go-to strategy for anyone within the space.

The integration of cNGN might not necessarily provide much in its innate value, but it does offer various perks.

Its ability to connect international crypto liquidity with high-potential investment opportunities is a core factor. It also solves on-ramp/off-ramp challenges and fragmentation while fostering financial inclusion.

Quite frankly, XEND is showcasing how adoption looks: not just using what’s available but what we have to solve our problems.

With Web3, Africa has a chance to build a future for itself. cNGN might not be as highly valued, but it does offer a better alternative that showcases our prowess.

1 comment

[…] CHECK OUT: cNGN Investments: Xend Finance’s Gateway to African Markets […]