In Brief

- Fintech regulation across Nigeria, Kenya, South Africa, and Egypt sets the stage for agile frameworks that foster innovation while protecting consumers.

- Pro-regulatory environments—anchored by sandbox programs and clear policies—accelerate mobile money adoption, digital currency integration, and investor confidence.

- Overcoming fragmentation, funding volatility, and cybersecurity challenges requires collaborative, adaptive frameworks to ensure inclusive, sustainable fintech growth.

Africa’s financial sector is undergoing monumental transitions, with DeFi and digital money dominating most industry and governmental talks.

The continent’s smartphone use, growing youth and talent pool, and the rising adoption of blockchain technology are each fueling the next economic shift.

However, with rapid growth, supportive and equally agile fintech regulation is required.

Recent research has highlighted how many African nations have shifted to foster clear, innovation-friendly regulatory frameworks alongside exponential fintech market growth projections.

This article explores the progress and challenges across key markets, focusing on mobile money adoption, digital currency regulation in Africa, and the role of a regulatory sandbox in shaping innovation aligned with government ideals.

The Rise of Pro-Regulatory Markets: Nigeria, Kenya, South Africa, and Egypt

A distinct group of nations has emerged as frontrunners, demonstrating proactive approaches to fintech regulation that balance innovation with consumer protection and financial stability.

Nigeria’s Digital Currency and Regulatory Innovation

Nigeria, Africa’s powerhouse in crypto and fintech adoption, has recently made strides in ensuring fintech regulation aligns with its rising adoption rate.

Talks around a new National Blockchain policy and the recent launch of cNGN (Naira stablecoins) have sparked new tangents for its regulatory body and The CBN.

Fintech licensing in Africa, particularly in Nigeria, has seen firms like Flutterwave secure high-level payment processing authorizations.

Nigeria’s SEC launched a regulatory incubation program for virtual assets as a means to develop adaptive rule sets for the nations.

CHECK OUT:Stablecoins in Hyperinflationary Markets: A Survival Guide for African Entrepreneurs

Its Financial Act 2023 includes digital assets in taxation, ensuring all digital lenders register with the Federal Competition and Consumer Protection Commission.

These regulations have paved Nigeria’s ascent, with its RegTech sector anticipated to grow by 40% by the end of 2025.

The nation has showcased a keen focus on tackling compliance challenges in emerging markets to ensure it remains a top contender in Africa’s fintech industry

Back in 2023, the region experienced a sharp funding decline from $ 976M in 2022 to $400M.

Kenya’s Regulatory Sandbox and Digital Payments

East Arica’s undisputed champion of mobile money adoption, Kenya’s fintech regulation, is anchored in its pioneering regulatory sandbox programs.

Due to the nation’s historical success in digital money, the region has ensured its policies foster growth. Nairobi’s “Silicon Savanah” is attracting $174 million in funding in 2023 Alone.

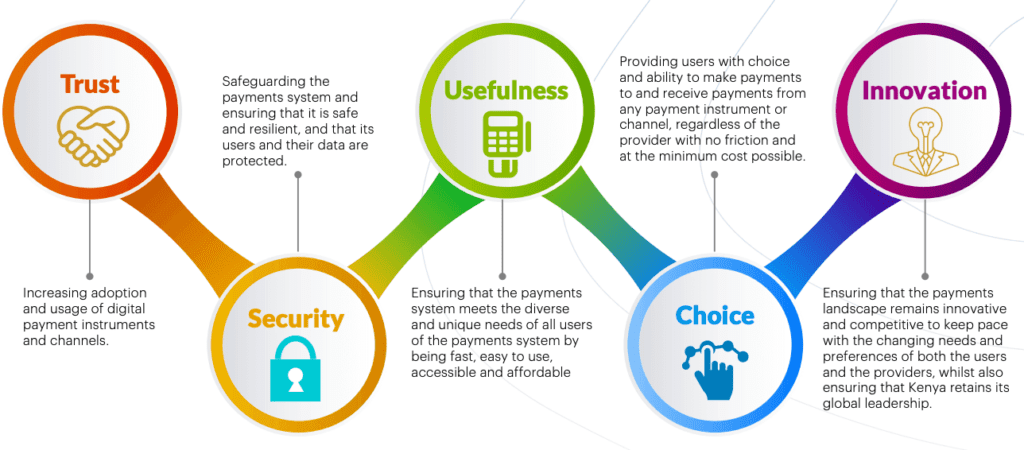

The nation’s Kenya Digital Economy Blueprint and National Payments Strategy 2022–2025 provide clear directions.

Kenya’s National Payments Strategy 2022–2025.[Photo:Financial Sector Deepening Kenya]

The Capital Markets Authority launched one of Africa’s largest regulatory sandbox programs, integrating several testnet innovations on mobile-based investment schemes and crowdfunding.

In a nation where digital money was adopted way before fintech came into the picture, its supportive environments have fueled growth, solidifying its leadership status.

South Africa’s Rapid Payments and Financial Inclusion

When it comes to having mature financial sectors, sophisticated fintech regulations, and Africa’s leading pro-blockchain environment, South Africa dominates.

The regions boast a 95% financial inclusion rate, providing a strong foundation for Landmark initiatives like the Rapid Payments Program (RPP).

However, oversight for fintech organizations falls under general financial frameworks like the Financial Advisory and Intermediary Securities Act(FAIS).

South Africa’s Financial Intelligence Centre Act (FICA) requires Crypto Asset Service Providers (CASPs) to register since December 2022.[Photo:LinkedIn]

To foster innovation, its FSCA launched its won regulatory Sandbox program, but the sector faces headwinds, including being placed on the FATF’s “grey list.”

This is due to its inefficiencies when providing anti-money laundering controls, prompting increased scrutiny and resource allocation by regulators.

However, its recent Travel Rule aligns with international standards, likely supporting crypto growth by providing clarity.

Egypt: Boom Fueled by Policy & Population

Egypt’s fintech scene is experiencing explosive growth fueled by landmark investments like Halan MNT’s $130 million raise in 2023.

In response, the Central Bank of Egypt and the Financial Regulatory Authority(FRA) covered non-banking financial services.

In addition, both entities have collaborated to launch sanboxed, and the recent National Artificial Intelligence Strategy (2025–2030) aims to leverage AI in fintech.

The InsurTech sector alone is projected to reach $2 billion by the end of 2025. However, significant constraints exist with the CBE banning digital assets it hasn’t approved.

Despite this, the overwhelming positive momentum in broader digital currency regulation in Africa efforts and fintech support places Egypt firmly among the leaders.

Neutral Markets: Ghana and the Path to Regulatory Clarity

Countries like Ghana, Cameroon, and Uganda fall under a transitioning phase. Back in 2020, Ghana launched its first dedicated fintech, Zeepay Ghana Limited, and is actively exploring a CBDC(eCedi).

This is, however, expected to shift drastically, given the new heated wave of digital currency regulation in Africa, with Nigeria and Kenya launching new laws to accommodate their growing market.

CHECK OUT:Web3Bridge: Premier Web3 Developer Training for African Coders

Similarly, Morocco and Côte d’Ivoire are developing frameworks but lack the infrastructure to match pro-markets.

Their fintech market growth projections suggest potential, but execution will depend on harmonizing regulations across sectors.

Overcoming Persistent Hurdles: Fragmentation, Funding, and Fraud

Despite the encouraging progress, significant challenges persist continent-wide, impacting both established leaders and developing markets:

Unfortunately, various key challenges persist throughout the continent, such as:

- Fragmented Frameworks: Disjointed policies across jurisdictions complicate cross-border operations.

- Cybersecurity Risks: Rising fraud cases, such as Nigeria’s NGN5 billion loss in 2023, demand stronger safeguards.

- Funding Volatility: Declines in venture capital, as seen in Nigeria, threaten startup sustainability.

- Balancing Innovation & Risk: Regulators continuously grapple with enabling cutting-edge technologies (like blockchain and AI in finance) while safeguarding consumers and financial stability.

The Path Forward: Collaboration and Adaptive Frameworks

Africa’s fintech regulation landscape is rapidly progressing, with many governments pivoting towards collaboration rather than dictatorship.

Innovation is rapidly catching up, and current controls do not apply, especially within the realm of web3.

Fintech market growth projections have significantly increased as more startups shift towards offering financial tools akin to banking systems directly from your phone.

While countries like Ghana, Tanzania, and Morrocco are navigating how best to employ better regulations fostering growth within the nation

For investors and entrepreneurs, the continent offers a unique blend of scalability and social impact.

By leveraging regulatory sandbox programs and addressing compliance challenges in emerging markets, Africa’s fintech sector is poised to redefine financial inclusion on a global scale.

In 2025, the continent’s ability to navigate these dynamics will determine whether it becomes a model for sustainable innovation or a cautionary tale of regulatory fragmentation.