In Brief

-

Local currency swaps on the PAPSS blockchain marketplace eliminate dollar dependency, enabling instant peer‑to‑peer fiat settlements across Africa.

-

Bantu Blockchain and Interstellar simulate native stablecoins for major African currencies, delivering fast, low‑cost cross‑border transactions.

-

The PAPSS system fosters intra‑African trade, supporting AfCFTA goals by providing secure, real‑time local currency swap infrastructure.

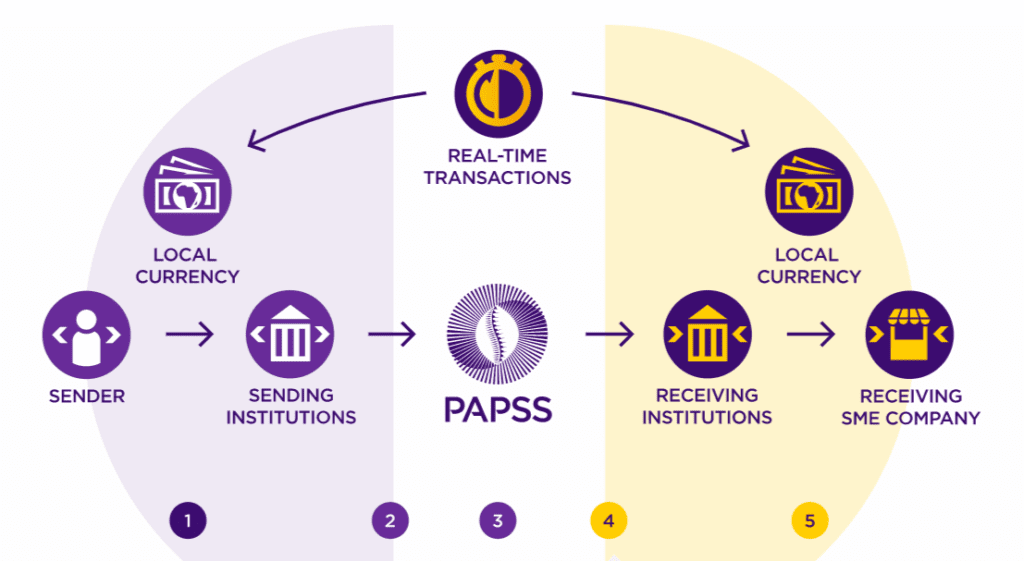

Blockchain for intra-African trade is now possible via the Pan-African Payment and Settlement System(PAPSS), via its historical blockchain-based currency marketplace.

The design, mission and application are straightforward; simplifying trade and facilitating local currency swaps within Africa.

This new frontier exemplifies blockchain’s vast applicability throughout Africa, reducing its dependency on the US dollar, dollar-backed stablecoins and the EURO for cross-border transactions.

It’s not just a win for multinational corporations, but local businesses can now expand African commerce to the next level.

The Engine: How the PAPSS Payment System Achieves True Local Swaps

During the annual meeting of Afreximbank, the system’s parent organization, held in Nigeria, CEO Mike Ogbalu unveiled the next step for trade in Africa: blockchain.

The ingenuity of the PAPSS payment system lies in its simulation of local currency stablecoins.

To accomplish this, the new system is built on the Bantu blockchain alongside African blockchain infrastructure provider Interstellar.

Drawing from the growing success of cNGN stablecoin, Interstellar devised a method to represent local fiat currencies peer-to-peer on the blockchain.

Building on PAPSS’ original Instant Payment Settlement system, its uses pre-funded settlement accounts opened by commercial banks to facilitate cross-border transactions into local currencies.

CHECK OUT:Visa and Yellow Card Launch Africa Stablecoin Settlement: Crypto Treasury Boost

Intersellar comes in by simulating local fiat-pegged stablecoins to settle transactions in native currencies within the marketplace.

This provides a dollar-free trade platform, establishing local currency swaps with heightened speed and reduced costs.

Bantu Blockchain’s chief operating officer, Victor Akoma-Philips, stated:

“The goal of PAPSS was to make Africans trade amongst each other using just local currencies, but there was a problem. The problem was that even though that was the idea in front, settlement in the back still needed dollars…. Instead, we created a semblance of stablecoins to use for corporate settlements, and that is what we have been using to move funds across African countries”

Why Africa Needed a Dollar-Free Trade Solution

Africa is steadily shifting toward digital assets as an alternative to mobile payment platforms.

Despite the two leveraging on the digitization of fiat currency, the former dominates with its superior systems, accompanied by lower costs.

According to the World Bank, Africa, despite having the lowest infrastructure, bears the dubious honour of being the World’s most expensive region for remittances.

The data reveals an average fee of 8.455 per tranfer in Q3 2024, soaring to a crippling 20% in some nations.

Local currency swaps via PAPSS and blockchain eliminate dollar dependency, enabling instant, low-cost transactions across 19 African nations. [Photo:Papss]

Compounding this, corporations like airlines faced immense difficulty earning with over $1 billion trapped within Africa, according to IATA estimates.

These factors, among others, often hinder the African Continental Free Trade Area (AfCFTA) dream of creating a $3.4 trillion integrated market.

The new system, thanks to Bantu Blockchain and Interstellar, shatters the final constraints, creating a dollar-free trade platform, a first major milestone for the continent.

CHECK OUT:How South Africans Are Spending $112k Monthly Via Crypto Payments.

Picture it, a Kenyan company transacting with a Ghanaian supplier, bypassing the KES to USD to GHS hurdle, avoiding compounding fees and delays.

With the PAPSS payment system, local currency swaps are instantaneous, enabling direct settlement.

A Landmark Step Towards Financial Sovereignty

The notion of a decentralized African payment system didn’t come overnight. Afreximbank launched PAPSS in 2022; however, its practicality garnered quite a lot of attention.

The platform’s core mandate is to boost intra-African trade, which, despite a robust 12.4% YoY rise to $220.3 billion in 2024, still only constituted 14.4% of Africa’s formal trade (Afreximbank data).

AfCFTA Secretary-General Wamkele Mene once emphasized the sovereignty angle:

“Trading in the United States dollar or any other currency has no business between African countries… We must use our currencies.”

The recent update makes sophisticated corporate stablecoin settlement solutions possible via local stablecoins like the cNGN.

However, much work remains. For instance, the new marketplace needs balanced liquidity across all 40+ currencies to function optimally for all members.

Currently, PAPSS is used across 19 countries spanning all four points of Africa.

Fortunately, the strong institutional backing PAPSS has received is necessary, becoming a growing alternative for cross-border payment solutions.

Its ability to enable genuine local currency swaps and establish a functional dollar-free trade platform tackles the two demons of exorbitant costs and dollar dependency.

While scaling and currency liquidity become their next barrier, this initiative showcases how blockchain, digital assets, and Web3 mean more than just cryptocurrency.

It provides concrete pathways towards financial autonomy that Africa has yearned for since its independence.

1 comment

[…] CHECK OUT:How PAPSS Enables Local Currency Swaps for Intra-African Trade […]