-

BTC price drip led to over $500 million in futures liquidations.

-

Altcoins like XRP and Dogecoin fell over 5% but began recovering.

-

Major coins like Solana, Ethereum, Cardano, and Binance Coin dropped 2-5%.

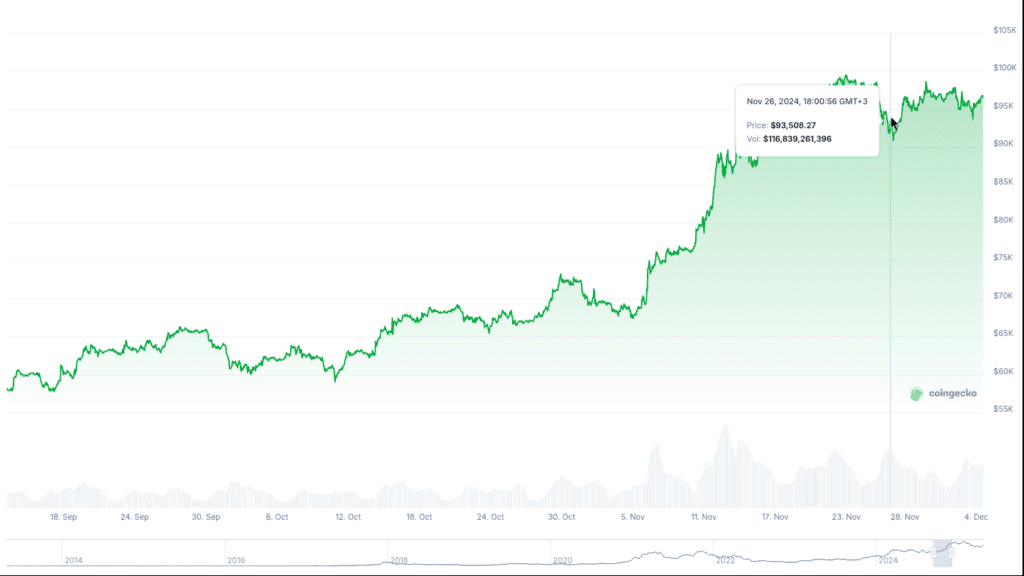

The recent BTC price dip from $98,500 to $95,788 has raised several questions for analysts. Granted, as per our previous article on Bitcoin spoofing, this sudden dip in price could reflect a possible pullback from BTC.

This information, though opinionative and speculative and gained from crypto market sentiment analysis, plays a vital key in understanding the current trends in cryptocurrency.

This article delves into the inner workings of the Bitcoin price dip, breaking down the impact of Bitcoin on altcoins and seeking crypto liquidation strategies for small traders when institutional crypto interest continues to pull strings behind the scenes.

Bitcoin Price Dip and Its Ripple Effect: What It Means for Africa’s Crypto Market

The Bitcoin price dip experienced this weekend reflects standard profit-taking as traders responded near the $100K mark. Per normal crypto market sentiment analysis, this trend often occurs when prices are near milestones. In addition, we must understand that Bitcoin influences the general crypto market.

Bitcoin’s impact was apparent among other altcoins during this downturn in cryptocurrency trading markets. Major altcoins like XRP and Dogecoin (DOGE) saw more than 5% falls before showing signs of recovery during early Asian trading hours.

CHECK OUT: Is Nigeria Web3 Ecosystem a Goldmine? $3B Stablecoin Data Reveals.

Coins like Solana (SOL), Ethereum (ETH), Cardano (ADA), and Binance Coin (BNB) experienced decreases of between 2% and 5%, but current trends suggest resilience among many digital assets despite short-term losses.

Futures Liquidations and Market Dynamics

The fallout from the Bitcoin price dip extended into futures markets, leading to over $500 million of liquidations of futures positions. According to analysts, over $366 million were long positions of this total amount, while approximately $127 million came from shorts.

These figures illustrate a high-risk environment where traders were highly exposed during volatile times.

Photo:CoinGecko

Utilizing crypto liquidation strategies for small traders to minimize losses during liquidation events is a make-of-break tactic.

This is more so since smaller altcoins and midcap futures were hit even harder during this volatile time than Bitcoin or Ethereum.

While the impact of Bitcoin on altcoins is undeniable, not all tokens move in lock-step. Various undervalued assets are prone to larger swings, but a key role is figuring out their nascent potential. Given their large use case, memecoins are often the choice for low-cap altcoins with recovery potential. However, this doesn’t make them a sure bet choice, especially given their history of rug pulls, scams, and security breaches.

Institutional Crypto Interest and Market Optimism

Despite recent fluctuations, institutional crypto interest remains a core driver behind optimism in the market. Analysts’ predictions of Bitcoin ETF investments have led them to raise their forecasts for price movements, with some even suggesting it could reach beyond $100,000 soon enough.

Even as the Bitcoin price dip persists, concerns regarding their impact leave many to ponder on how to trade crypto during market dips.

The original crypto coin lives up to its title as it often serves as a barometer of crypto market sentiment analysis and can have far-reaching effects across various digital assets; for instance, decreased trust usually causes increases in volatility across other cryptocurrencies.

However, positive trends are emerging within the cryptocurrency landscape. An increase in Ethereum and Solana ETF adoption suggests institutional trust may be expanding beyond Bitcoin alone. At the same time, talks regarding pro-crypto policies under potential new administrative regimes demonstrate an ideal environment for innovation, particularly within Africa’s blockchain sector.

Short-term fluctuations create uncertainty; however, institutional players remain undaunted by temporary price drops and are unperturbed by short-term price volatility.

Adapting to Market Realities: Lessons for African Traders

The recent BTC price drop presents opportunities and hurdles for African investors, developers, traders, and innovators. Although some may view this decline alarmingly, it can facilitate strategic decision-making based on sound risk management principles.

Wise investors could take this dip as an opportunity to acquire undervalued assets amid shifting sentiment in the cryptocurrency market or, more generally, understand why Bitcoin’s price is falling so they can develop strategies that reduce risks while increasing potential rewards.

Events like these demonstrate how necessary rapid adaptation and staying informed are to maintain an efficient investment portfolio.

Some traders thrive by:

- Leverage volatility: Use dollar-cost averaging during dips to lower entry points.

- Diversify exposure – Allocate a portion to stablecoins or low-cap assets with growth potential.

- Focus on fundamentals: Projects with strong use cases (e.g., Ethereum’s smart contracts) often recover faster.

- Community-driven insights: Engage with local forums to share crypto liquidation strategies and sentiment trends.

Navigating Uncertainty with Informed Strategies

The Bitcoin price dip has aroused investors’ worries about potential market instability. Yet this also serves to demonstrate its fundamental resilience within the crypto ecosystem.

Many analysts remain confident, projecting that Bitcoin could soon reach the $100K mark, an extraordinary rise that underscores its significance to altcoins and market dynamics.

As questions regarding Bitcoin’s drop arise, staying informed on current trends in the cryptocurrency market becomes essential to effectively handling any changes that might affect it. Staying updated about trends will enable participants to navigate these shifts more smoothly.

Web3Africa communities remain dynamic environments where participants must carefully manage risks. We invite readers to investigate how blockchain can transform African economies while contributing to sustainable development efforts. Whether exploring low-cap altcoins with recovery potential or mastering risk management, staying informed turns volatility into opportunity.