-

Bitcoin price surge hits $100,000, underscoring its growing global influence and potential for financial transformation.

-

Trump’s election and pro-crypto policies have spurred investor optimism and boosted Bitcoin prices.

-

Africa stands at a crossroads, leveraging Bitcoin’s surge for financial inclusion and blockchain innovation.

Bitcoin reached an iconic achievement by surpassing $100,000 and briefly peaking at $103,800, underscoring the profound Bitcoin price surge impact on global markets and regional economies.

Though this milestone achievement garnered worldwide media coverage, its significance and implications remain obscure: what rallied behind the surge, how Bitcoin impacts emerging economies, did the recent pro-crypto regulatory trends have anything to do with it, and what this means for Africa.

Bitcoin Price Surge Impact: How $100K Milestone Could Reshape Africa & Global Crypto Trends

Bitcoin price surge can be directly tied to Donald Trump’s election win on November 5th. Bitcoin experienced an extraordinary rally of over 40% shortly thereafter, showcasing the impact of pro-crypto policies on Bitcoin.

Many see his selection of Paul Atkins, an advocate of positive crypto regulatory trends, as his new SEC chair as being instrumental.

CHECK OUT: Bitcoin as a Reserve Currency: Africa’s Financial Future or a Volatile Gamble?

Unlike chairman Gary Gensler, commonly known as the instigator of the crypto crackdown, Atkins shares a profound view towards low-cost crypto remittances with properly established regulations.

This leadership transition has created a fertile ground for crypto market growth, providing an upbeat look for Bitcoin price predictions 2025. Senator Kirsten Gillibrand expressed her trust in Atkins’ ability to implement effective federal crypto legislation.

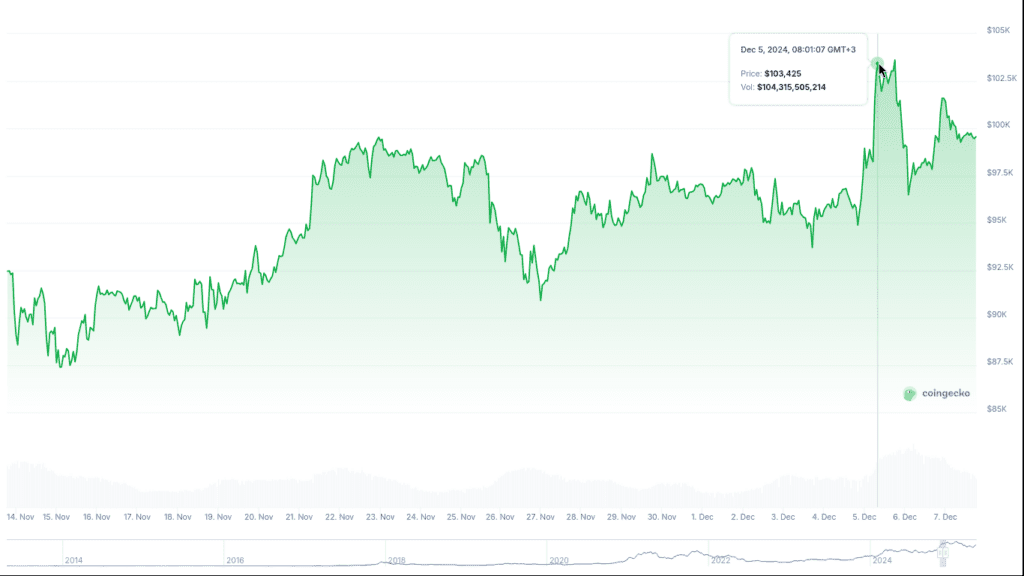

Bitcoin Price surge to $100K.[Photo: CoinGecko]

Some of Trump’s plans for the future include:

- U.S. policy shifts: President Trump’s pledges (e.g., a strategic national crypto stockpile) and vows to “fire Gary Gensler” reflect the impact of pro-crypto policies on Bitcoin (“On day one, I will fire Gary Gensler” is one such promise) and underscore evolving U.S. priorities.

- SEC leadership changes: Analysts are watching for Trump’s SEC chair crypto policies to be explained, as any new chair could steer the SEC toward a more industry-friendly stance.

- Global coordination: G20 discussions in early 2025 highlighted cross-border frameworks for stablecoins, DeFi, and AML compliance, signaling a gradual shift from outright bans to nuanced oversight.

How Bitcoin Impacts Emerging Economies: Africa’s Blockchain Revolution

United States policies directly shape Bitcoin, yet their effects go far beyond our borders. Crypto-hot zones like Africa, which are already exploring blockchain’s potential, could take advantage of its rising legitimacy.

As the crypto titan crosses the $100,000 threshold, it may signal increased trust in cryptocurrency as an economic store of value, prompting more Africans to use Bitcoin for savings, remittances, and trade activities.

Bitcoin as a Catalyst for African Transformation

The Bitcoin price surge impact is felt fervently here in Africa. African economies stand poised to use Bitcoin’s momentum as an agent of transformation.

Africa’s financial systems often face limited banking infrastructure and high cross-border remittance costs, making cross-border money transfers costly for underserved populations.

Many traditional cross-border fees average 8% to 12%, while platforms like Bitmama and YellowCard now enable transfers at under 2%, saving users $4.3 billion annually.

In Nigeria alone, crypto remittance volumes grew 210% in 2024, per Statista, as citizens leveraged Bitcoin’s liquidity to bypass inflationary local currencies.

As Bitcoin passes $100k, this could indicate increased trust in cryptocurrency as an economic store of value, potentially prompting more Africans to use Bitcoin for savings, remittances, and trade activities – unlocking previously inaccessible economic opportunities.

Opportunities for African-Led Crypto Projects

Spotlight on African Innovations

Africa’s reliance on low-cost crypto remittances has surged alongside Bitcoin’s price. This prompts many local entrepreneurs to hasten the pace of innovations while the market has limited competition from the likes of Luno, Flutterwave Yellowcard, Bitmama, and Paxful. Recent Bitcoin price rallies may spark new projects across Africa.

African developers now have an incredible chance to show how their solutions address local obstacles, especially with stablecoins becoming popular in Africa.

Emerging research indicates that digital-only MTOs (money transfer operators) have reduced costs to about 4 percent, and stablecoins further drive down expenses by minimizing on-chain transaction fees and eliminating intermediary margins.

Challenges and Solutions for African Developers

Despite the future of Bitcoin gaining a glimmer of hope, we still have plenty to do to catch up. Regulatory Frameworks within Africa are still limited, with representatives such as South Africa, Nigeria, Kenya, and Tanzania taking few steps.

Furthermore, infrastructure issues like unreliable power supplies or internet connections could limit how rapidly blockchain projects grow in scalability.

In addition, the impact of pro-crypto policies on Bitcoin can spur growth; unchecked expansion risks, fraud, and market instability.

Thus, a balance is needed to create an environment in which crypto can flourish in Africa; nations could position themselves as pioneers within this movement.

The Investment Perspective: Africa in the Spotlight

The Bitcoin price surge impact is evident. Africa has an outstanding chance of attracting international investment, especially as sectors like decentralized finance (DeFi), digital identity, and blockchain logistics develop rapidly.

Investors have increasingly recognized Africa’s vast potential, evidenced by an upsurge in blockchain-focused funds targeting African startups. Harnessing investor interest for Africa-specific crypto capital projects that drive economic development and technological progress.

To understand how Bitcoin impacts emerging markets, we must look at the effects of positive crypto trends, the increased adoption of low-cost crypto remittances, and the collaboration between government and developers. Through this, African leaders, entrepreneurs, and communities can position themselves at the vanguard of the blockchain revolution.

Africa gains much from harnessing Bitcoin and blockchain to address long-standing challenges while opening new opportunities. Let us seize this moment to forge a lasting future together! The future is bright.