TL:DR,

- The CBDC vs cryptocurrency landscape in Africa shows contrasting approaches: Nigeria launched Africa’s first CBDC (eNaira) on October 1, 2021, while Central African Republic adopted Bitcoin as legal tender in April 2022.

- Nigeria’s eNaira offers both physical cards and digital wallets for payments, while CAR froze its Bitcoin legal tender implementation in July 2022 to develop better cryptocurrency regulations.

- Following Nigeria’s eNaira launch, other African nations including Ghana, South Africa, and Kenya have begun developing their own CBDC programs to improve financial inclusion.

CBDC vs cryptocurrency; the latest hot topic as the world shifts towards a more digitalized and interconnected financial ecosystem. These digital currency titans represent two unique approaches to reinventing money, each offering advantages and challenges specific to different needs and purposes. We look at Bitcoin, the first cryptocurrency adopted by an African country, the Central African Republic, and Africa’s first CBDC, Nigeria’s eNaira.

Understanding African CBDCs in the Modern Economy

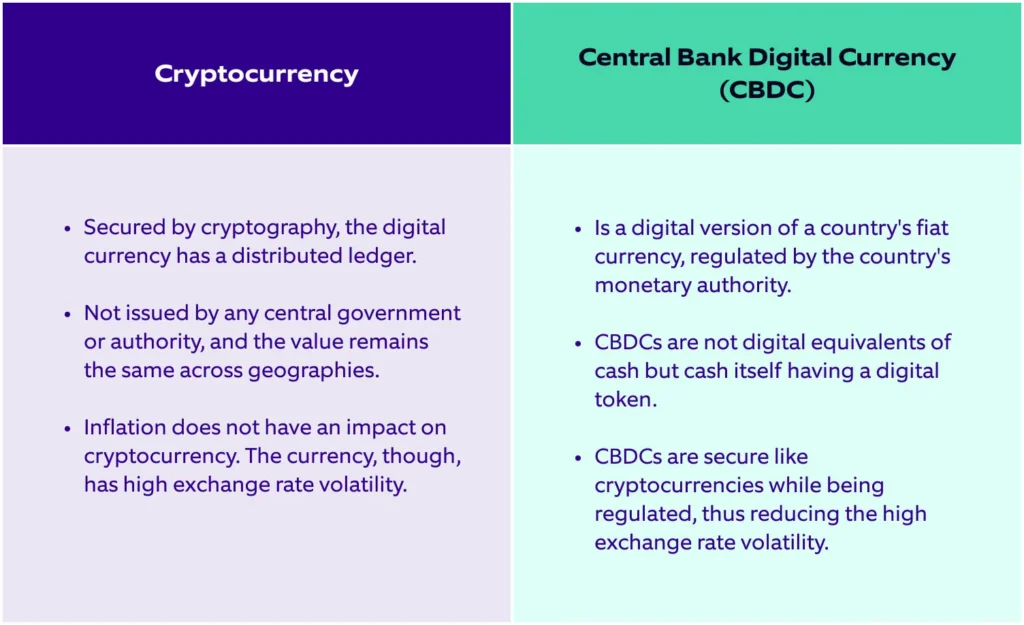

Promoting financial inclusion through blockchain technology is the very notion of CBDCs. They present a digital rendition of a country’s fiat currency(official currency) issued and overseen by its central bank. Unlike decentralized cryptocurrencies, authorized financial institutions and central banks have full control over CBDCs.

The main focus for African CBDCs is to counter the high rate of unbanked and underserved citizens. It’s a modernized approach to inclusion, taking advantage of Africa’s high mobile penetration.

CBDCs are digitalized fiat currency, hence for Central Banks their main focus is on stability and control. What they are after is trust while maintaining the 1:1 ratio to their traditional fiat currency. For these particular digital assets, stability is non-negotiable.

The democratization of finance grants the opportunities mentioned above to participate in the formal financial system. It bridges economic disparities and fosters greater economic participation for individuals who previously lacked access to traditional banking services.

What is cryptocurrency: The Decentralized Alternative

Cryptocurrency was the original digital asset created using cryptography as its security measure, offering decentralized services while still upholding an immutable record and verification mechanism through blockchain technology.

RELATED: Advanced to CBDC Proof-of-Concept: Rwanda Tests Real-World Use Cases

Utilizing blockchain in this manner offers added features like anonymity, borderless transactions, and limited supply. This makes cryptocurrency an ample alternative for a medium of exchange and a store of value. However, like the CBDC vs cryptocurrency debate, their adoption and regulation in Africa are still evolving.

What sets them apart from CBDCs is their decentralization. Primary examples are like Bitcoin and Ethereum, which lack a central authority or intermediaries. This aspect grants users more financial autonomy and control over their assets, as they do not rely on a central bank or government to validate and approve transactions.

This feature fuels its core driving factor behind its adoption in Africa: cross-border transactions. It lacks the constraints offered when transactions are monitored and regulated, an aspect CBDCs embrace; however, this factor also brews additional challenges, like illicit activities like money laundering.

A Common ground between CBDCs and cryptocurrencies

While the debate of CBDC vs cryptocurrency rages on, bot technology does share some common ground: financial inclusion through blockchain technology. CBDCs utilize this technology to digitize fiat currencies, offering efficient, safe and transparent transactions within a regulated framework. Meanwhile, cryptocurrencies challenge the status quo, introducing an entirely new financial system: decentralized finance. A new system where the user has complete control over their assets.

The differences between cryptocurrency and CBDC. [Photo: Nagaro]

Bitcoin Legal Tender: The Central African Republic Experience

Central African Republic made waves when, in April 2022, they adopted Bitcoin as legal tender, becoming only the second nation worldwide to do so. Yet many questioned CAR’s ability to implement and regulate bitcoin under current economic constraints.

The CAR government’s reasons for pursuing the Bitcoin legal tender route primarily involved boosting the country’s economy, attracting foreign investment, and providing an alternative currency to its citizens. The government also argued that Bitcoin would help to reduce corruption and improve financial inclusion through blockchain technology..

However, this move poses some risks. For instance, CAR must improve its infrastructure to accommodate the day-to-day use of Bitcoin. Most important, educating the general population regarding the technology is an entire feat in and of itself. As a result, accusations have surfaced that the government is using Bitcoin to launder money and bolster its military support.

In July 2022, the CAR government announced that it was freezing the application of its law to focus more on developing regulations for its digital currency adoption. The future of Bitcoin in the CAR is still undetermined, even though the government has expressed its commitment; the possibility that the project might be abandoned is high.

African CBDCs: Nigeria’s eNaira Leading the Way

The eNaira is Africa’s inaugural digital equivalent to its Naira currency. Launched by Nigeria on October 1, 2021 alongside an accompanying wallet system, setting an agenda for adoption across Africa.

The Central Bank of Nigeria stated that the main goal for the eNaira was to improve financial inclusion, reduce the cost of cross-border payments, and combat economic crime. Its main focus revolves around enabling easier payment of goods and services while offering better P2P monet transfers and the automation of overnment taxes and fees. The eNaira was also set to improve remittances from abroad.

This African CBDC is available in two forms: a physical eNaira card and a digital eNaira wallet. The card can be used to make payments at point-of-sale terminals. The digital eNaira wallet can make payments online or through mobile apps.

The eNaira is a secure and traceable currency. All transactions are recorded on a distributed ledger, making counterfeit or double-spending difficult. The Central Bank of Nigeria can also track each transaction, combating financial crime.

RELATED: Bank of Ghana Partners with University of Ghana Forging Financial Revolution From the Ground Up

Unfortunately, this African CBDC has met mixed reactions, with many citing it as a failure. Others have praised its potential to improve reach while reducing transaction costs; however, some concerns have been raised over its implementation and security.

Determining the success of the eNaira remains premature. However, the Central Bank of Nigeria is committed to the project.

The Battle Rages On: Future of CBDC vs Cryptocurrency

The CBDC vs cryptocurrency debate goes beyond the matter of supremacy; it’s more about practical benefit and utility. Cryptocurrency is considered a no-go zone by most African nations, with many highlighting how its decentralized manner will make regulating it a legal nightmare. On the other hand, many users shun from implementing African CBDCs, with many questioning their motives and implementations.

The experiences of countries like Nigeria and the Central African Republic provide insight into these concerns. Fortunately, with digital currency adoption, there is still one more factor to consider: African stablecoins.