-

Crypto self-regulation is essential for maintaining order in Africa’s crypto market while protecting investors and preserving innovation.

-

African nations show diverse regulatory approaches, from South Africa’s cautious embrace to Nigeria’s restrictions and Kenya’s balanced caution.

-

The ideal African crypto framework balances scam prevention with financial inclusion through collaboration between self-regulation and government oversight.

In an ever-evolving world of digital currencies, crypto self-regulation has emerged as a vital component to maintain order and still keep up with the evolving industry. Blockchain oversight in Africa is still a heated topic with many nations gearing up their legal teams to research and implement policies and laws that best suit their needs.

Now this presents a peculiar view between self-regulation vs. government crypto laws, which is better? Each provides benefits of crypto to Africa’s economy but also has its challenges. Let’s dive in and see how self-regulation protects crypto investors, how government crypto laws are easily implemented and scrutinizing the challenges of African crypto regulation.

The Regulatory Spectrum: African Nations’ Approaches to Crypto Self-Regulation

When peering into the looking-glass we can see that blockchain oversight in Africa has brought about a range of diversity, from enthusiastic acceptance to outright boos and rejection. Taking time to really dig deep into these differences helps illuminate just how severe are the challenges of African crypto regulation.

Moreover, the growing list of hacks and scams has created an infamous reputation for the cryptocurrency industry. Hackers have taken advantage of the newness of these industries to exploit and essentially dupe gullible investors. Their criminality, however, has yet to negate the benefits of crypto in Africa’s economy. Thus, a peculiar solution presents itself: fighting crypto scams via self-regulation. Although before diving into understanding how self-regulation protects crypto investors, let’s peer into the approaches key African regions have approached government crypto laws.

South Africa: Embracing Regulation with Caution

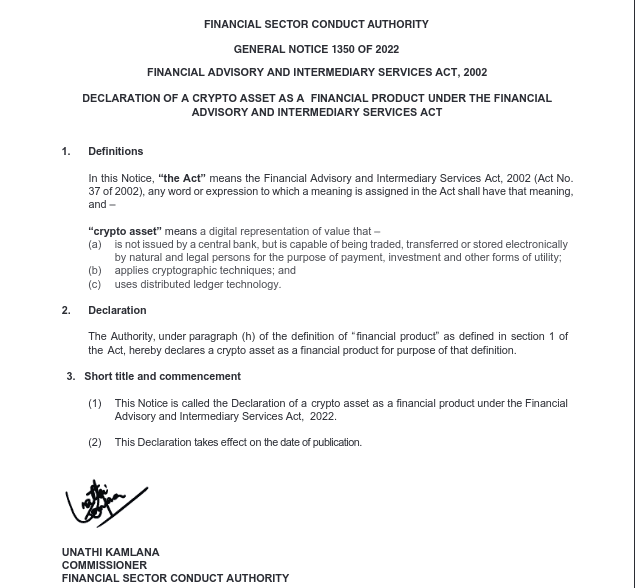

South Africa, a beacon of hope for crypto in Africa, stands out the most due to its unique and quite frankly ingenious approach. In 2022, the region’s Financial Sector Conduct Authority (FSCA) declared crypto assets as financial products under the Financial Intermediary and Advisory Services (FIAS) Act 2002. This regulation essentially required Crypto Asset Service Providers (CASPs) to prevent any FTX-like scenarios from running rampant, showcasing the power of licenses and strict compliance measures.

In 2022, the Financial Sector Conduct Authority (FSCA) declared crypto assets as financial products under the Financial Intermediary and Advisory Services (FIAS) Act 2002. [Photo:www.gov.za]

Nigeria: A Cautionary Tale of Regulatory Whiplash

Nigeria’s track record with crypto regulation is one for the books. Once home to one of Africa’s most vibrant crypto markets, the country imposed a series of restrictions in 2024 aimed at curbing currency depreciation and capital flight. These measures led to banning local banks from processing crypto transactions and went on to target major exchanges like Binance. In addition, Nigeria was the first African country to launch the eNaira, but let’s be honest here, the CBDC was a colossal failure with many still opting for various digital assets as a solution.

ALSO, READ: Bitcoin as a Reserve Currency: Africa’s Financial Future or a Volatile Gamble?

To add oil to the flame, the nation’s Central Bank singled out Binance for blame in February 2024, leading to the exchange shutting down naira-related operations. This crackdown highlights the challenges of African crypto regulation when economic concerns are met with poorly thought-out policies. Despite this, Nigeria is still a major crypto market, showcasing how Web3 is the very definition of “where there’s a will, there’s a way.”

Kenya: Balancing Innovation with Caution

Kenya recognizes the potential benefits of crypto in Africa’s economy while maintaining vigilance against risks. The country has not implemented outright bans but has issued warnings about the volatility and risks associated with cryptocurrencies. However, the nation implemented a tax law on digital assets prior to any action for adoption, which essentially led to a massive step back for most crypto traders and organizations.

Where Does Crypto Self-Regulation Come into Play

Crypto self-regulation means establishing industry organizations, guidelines, and a code of conduct for market participants to do business within the ecosystem. The guidelines can span a broad spectrum, ensuring security against hacks and scams and maintaining transparency through Know Your Customers (KYC) mechanisms.

When examining how self-regulation protects crypto investors, several factors come up. These include accountability, transparency, contractual relationships, information sharing, and coordination. Government regulatory agencies could offer additional oversight for crypto self-regulation. Many might assume self-regulation vs government crypto laws is the norm, but both can mutually benefit through cooperation.

Case Studies in Crypto Self-Regulation

Rwanda’s Emerging Framework

Rwanda has been an upcoming underdog within the industry. The nation has shown increasing interest in blockchain technology, with government officials expressing openness to its dynamic and unique innovation. In addition, the country has taken vital approaches to reflect a growing understanding that self-regulation vs government crypto laws can complement each other.

Ghana’s Pragmatic Approach

Ghana has maintained a pragmatic stance, neither endorsing nor banning digital assets while developing a regulatory framework. This is a unique and strategic approach that focuses on a key element: the region acknowledges the potential of digital assets but rather than outright banning them, it focuses on developing them organically while giving policymakers time to study potential impacts.

Drawing the Legal Bottom Line

Fighting crypto scams via self-regulation while still reaping the benefits of crypto in Africa’s economy is a tough act to balance. The industry itself is still fairly new, and throughout its numerous ups and downs, robust security measures and consumer protection protocols are vast and ever-developing. However, while other more developed regions continue to develop and reach regulatory frameworks that best suit their regions, Africa has its own unique benefits, its own unique skill sets, and its own problems.

The challenges of African crypto regulation aren’t a representation of self-regulation vs government crypto laws; rather, they showcase how we as Africans must develop a framework that actually caters to our problems. Blockchain oversight in Africa shouldn’t solely focus on how to fight crypto scams; rather, how to ensure rural regions acquire financial inclusion. It should focus on how governments can essentially cater and make up for the failings of traditional banks—a very sound and practical argument.

The legal bottom line is, aside from focusing on how to fight crypto scams, can’t governments also focus on how to promote this new technology in a way that it actually helps its natives?

For more informative and entertaining articles, sign up below and join our ever-growing Web3Africa community where we value you, our esteemed reader, above all else.