The crypto training session organized by the Virtual Assets Chamber of Commerce(VACC) and Binance has been a pivotal step towards robust Kenya crypto regulation bill frameworks.

In Brief

-

Crypto training session equipped Kenyan MPs with hands-on blockchain and VASP Bill insights to craft balanced crypto regulations.

-

The session’s focus on consumer protection, financial crime prevention, and tax frameworks addressed critical gaps in Kenya’s digital asset laws.

-

Public participation and continuous blockchain education are essential for adaptive, innovation-friendly crypto regulation in Kenya.

The initiative, held in Nairobi, aimed to bridge the knowledge gap among members of Parliament’s Finance and National Planning Committee, equipping them with a hands-on understanding of blockchain technology and virtual assets.

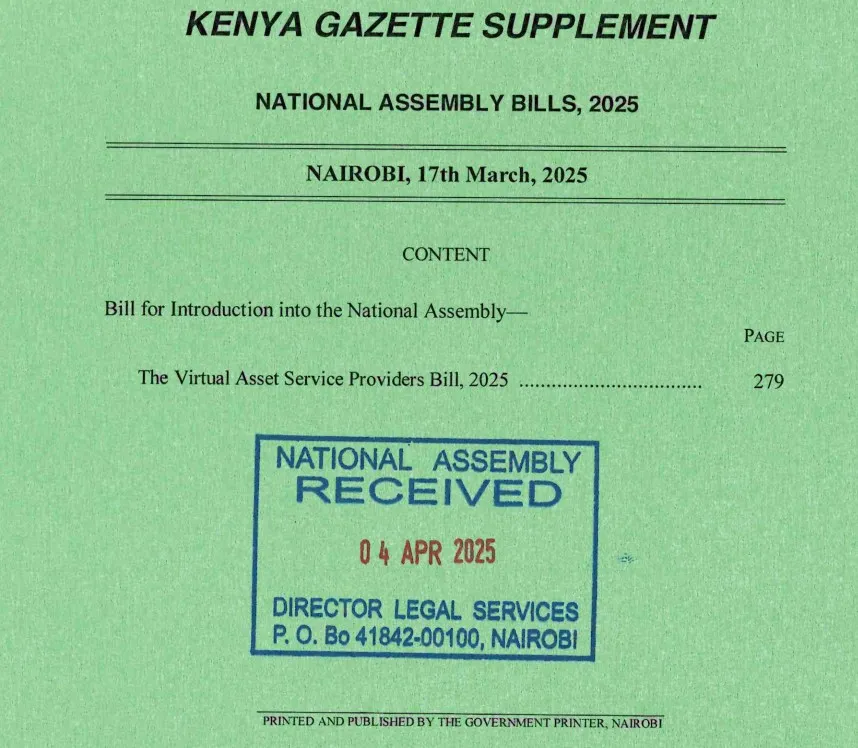

The Kenya crypto regulation bill, specifically the recent Virtual Assets Service Providers(VASP) Bill 2025, is moving closer to enactment; such policy training is critical to ensure proper legislative decisions.

Kenya Advances Crypto Regulation with Parliamentary Crypto Training Session Ahead of Landmark Bill

With Kenya gearing up to develop its own set of crypto bills, the blockchain policy training session, in collaboration with Binance, provided practical insights into the crypto ecosystem.

The lawmakers engaged in real-time transactions on the Binance platform, explored digital currencies, and discussed regulatory challenges.

This immersive approach is strategically aimed at demystifying blockchain technology to Kenyan leaders and highlights the need for a balanced crypto regulation bill fostering innovation while maintaining consumer protection.

Julius Ruto, a parliamentarian, emphasized the significance of the training, stating:

“This is a new frontier. Kenya is already third in Africa in terms of virtual asset adoption. We must protect consumers and investors with proper legislation.”

The session underscored the urgency of the VASP 2025, which seeks to bring virtual asset service providers under local regulatory oversight.

The bill seeks to bring VASPs under local regulatory oversight, tapping into the region’s anticipated to reach $40M by the end of 2025.

The VASP Bill lays the ground work for regulation within Kenya’s crypto market[Photo: BitKE]

Key Themes from the Crypto Training Session

The crypto training sessions highlighted several critical areas, including consumer protection, financial crime prevention and monetary policy.

Allan Kakai, Director of VACC, noted,

” The session offered critical strategies to safeguard users and support responsible growth.“

A notable aspect of the training was its focus on blockchain legislation workshops.

The sessions provide lawmakers with a deeper understanding of what blockchain is beyond its crypto framework. This enabled them to craft policies that address the unique challenges of the evolving sector.

A prime example is a keen focus on digital asset tax strategies, highlighting the need for a framework balancing between taxing traders and exchanges while promoting its growth.

CHECK OUT: Kenya Crypto Laws: Hyperfocused Pathway Through Regulatory Overwhelm

This also is an attempt to avoid the failings of its previous tax laws on digital assets.

Public Participation in Crypto Laws: A Cornerstone of the Kenya Crypto Regulation Bill

As the crypto bill enters a two-week public participation phase, the training session has amplified calls for inclusive policy making.

The National Treasury, Capital Markets Authority, and Central Bank of Kenya developed the bill and sought input from the citizens and industry stakeholders.

This phase is a must-have segment, especially given how global institutional adoption of cryptocurrency is a growing trend. Small-scale traders, crypto exchange startups and large exchanges provide an ample source for developing an adaptive legal framework.

Tony Olendo, VACC Chairperson, stressed the importance of these collaborations;

“This legislation is our opportunity to make Kenya a regional innovation hub.”

Intergrating feedback from the public, the bill can bridge regulatory barriers without enforcing strict taxation, effectively chasing away local innovators and traders.

Blockchain Training for Lawmakers: A Path to Informed Governance

The blockchain training for lawmakers conducted during the session has laid down the foundation for improved legislative efforts.

It grounds future bills in reality rather than speculation, equipping MPs with the technical knowledge of cryptocurrency.

This is vital given the region’s history with scammers, which has gradually eroded citizen trust in cryptocurrency.

The training also highlighted the need for more legislation workshops given the Africa’s rapid adoption rate. Continuous education for policy makers will essentially lead to adaptive regulations rivaling the likes of Mauritius and South Africa.

For instance, the rise of tokenized securities and decentralized finance necessitates a dynamic regulatory framework that evolves alongside technological advancements.

A New Era for Kenya’s Digital Finance Sector

The crypto training session marks a turning point in Kenya’s approach to digital finance.

Fostering collaborative blockchain policy training sessions between regulators, industry players and the public, the country is positioning itself as a leader in Africa’s crypto landscape.

Various digital asset tax strategies can be applied, giving varied streams of revenues for the nations.

The lessons learnt from the initiative will be instrumental in shaping a regulatory environment that supports growth, protects consumers and rives financial inclusion.

The success of the VASP 2025 Bill will depend on its ability to adapt to the ever-changing digital landscape while maintaining the trust of investors and innovators alike.

2 comments

[…] CHECK OUT:Kenya Fast-Tracks Crypto Regulations with Lawmaker Training Backed by Binance […]

[…] CHECK OUT: Kenya Fast-Tracks Crypto Regulations with Lawmaker Training Backed by Binance […]