-

Kenya’s digital asset tax halving to 1.5% could unlock widespread crypto compliance and developer investment.

-

The new VASP framework pairs consumer protection with IPO-style safeguards, reducing fraud risk.

-

Lower levy plus balanced regulations positions Kenya as Africa’s emerging blockchain innovation hub.

In 2023, Kenya introduced a digital asset tax of 3% on all crypto transactions, sparking controversial debates over its intentions for its ecosystem: control or adoption.

The Nation’s Treasury proposal to halve this rate to 1.5% in its 2025 Financial Bill signals a unique tangent.

Shortly after its VASP legal framework, this slight tweak to its approach might lead to a positive ripple effect throughout its ecosystem.

Kenya ranks 28th globally for peer-to-peer crypto transactions according to the Global Crypto Adoption Index by Chainalysis.

This new tax cut might lead to developing a more conducive environment for crypto tax compliance in Kenya.

Kenya’s 2025 Digital Asset Tax Cut: How the New Levy Will Shape Crypto and Fintech Innovation

The Digital Asset Tax Reduction: A Game-Changer for Kenya

Kenya’s digital asset tax regulations brought plenty of criticism, with some leaders and traders questioning the government’s agenda.

Initially, as per the Finance Act 2023, the 3% tax targeted persons dealing with crypto and NFTS and other digital assets, whether as data, images or written content.

This view was mainly brought about due to the backward apporach of the country as it implemented tax laws prior any legal framework that fostered adoption or consumer protetsion.

According to a 2024 report by the Blockchain Association of Kenya, the levy did more damage than good, forcing many crypto-based organizations to operate informally and at arm’s length from its jurisdictions.

Fortunately, the race for better Fintech innovation policies spurred the Kenyan government to rethink its approach, resulting in the recent VASP crypto law relief and now the levy reduction to 1.5%.

CHECK OUT: Kenya Crypto Laws: Hyperfocused Pathway Through Regulatory Overwhelm

Treasury Cabinet Secretary John Mbadi highlighted that the tax reduction will align with the nation’s intention to balance regulating digital assets while fostering steady adoption.

In addition, the tax will apply to small business owners whose gross turnover falls between Ksh 1 million($7,750) and Ksh 25 million($193,650).

He explained, “When you have lower rates on consumption taxes, you raise more revenue, which in turn enhances revenue collection.“

Kenya Crypto Regulations: A Structured Framework for Growth

The 2025 Virtual Asset Service Providers (VASP) Bill marks a historic pivot in Kenya’s policy toward digital assets.

This legislation introduces a structured framework for the crypto industry, replacing the nation’s earlier cautionary stance.

The new Kenya crypto regulations designate the Central Bank of Kenya (CBK) and the Capital Markets Authority (CMA) as the key regulators.

The CBK will oversee stablecoin issuers and custodial wallets, while the CMA will regulate exchanges, brokers, and tokenization platforms.

Kenya’s crypto regulations have steadily improved, showcasing the fierce and tight race between nations, each vying for Africa’s crypto hub title. Concurrently, Kenya is advancing its 2025 Virtual Asset Service Providers (VASP) Bill.

This legislation introduces a structured framework for the crypto industry, replacing the nation’s previous cautious stance.

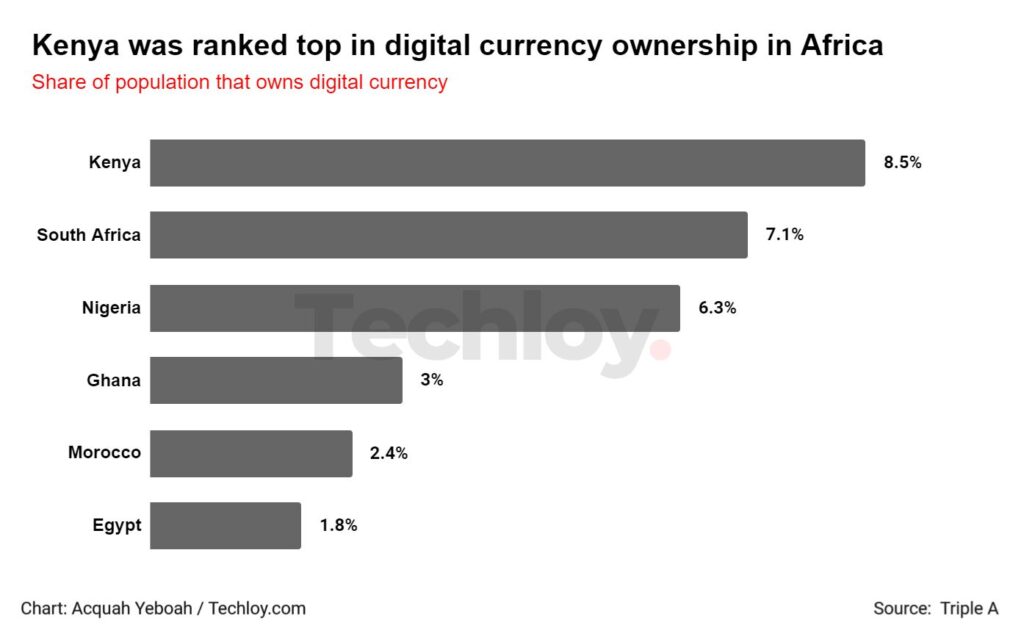

Kenya’s rank as one of the top digital asset adopter in Africa.[Photo: Techloy]

The CBK is in charge of stablecoin issuers and custodial wallets, while the CMA has its sights set on exchanges, brokers and tokenization platforms.

Among its various guidelines, its virtual asset offering approval process stands out. Companies launching token sales or listing assets on trading platforms must now go through regulatory bodies.

This typically mirrors traditional IPO safeguards aiming to reduce fraud, a common dilemma given Kenya’s recent CBEX fiasco.

As a result, the regulation mandate fit-and-proper checks for directos and senior staff to asses their intergity and financial capability. Furthermore, AML/CFT protocols are mandated, including real-time transaction monitoring and reporting suspicious activity.

Fintech Innovation Policies: Balancing Innovation and Control

Reducing the digital asset tax will lead to better fintech innovation policies. Creating crypto laws isn’t just about how the economy can benefit; the initial tax scare off many investors. On the contrary, it’s a blend forering customer protection while encouraging adoption.

Kenya’s government now aims to balance tax revenue generation with more adaptive policies.

Despite this progress, challenges do occur. The VASP approval process often favours more established players, leaving small-time players with limited access. Unfortunately, challenges are a part of development, so most are considered progressive.

A Regional Blueprint for Digital Tax Policy in Emerging Markets

Kenya’s 2025 digital asset tax reduction represents a significant shift in its approach to digital assets.

Developing a balanced digital tax policy for emerging markets is a feat not even South Africa has managed to pull off, showcasing much-needed work.

CHECK OUT: Pulse of Progress: Navigate Nigeria’s Crypto Dawn with Tactile Clarity and Bold Vision

Despite this, the progressing landscape paints a picture of the country’s rapid shift to digital assets. Initially, the thought of KRA crypto transaction reporting scared most small-time and large-time players.

However, a more pro-crypto space can be developed with better fintech innovation policies that seek to provide innovators and investors the safety they require.

Kenya is now shifting from a regulatory Wild West to a more inclusive ecosystem.

While challenges may persist, adjustments are inevitable to accommodate blockchain’s ever-evolving industry.

It’s not just about rules, it’s not about taxes, it’s about providing a regulatory framework that seeks to embrace a nation’s blockchain potential.