-

IRS crypto rule reversal blasts open vibrant DeFi corridors, igniting African innovation.

-

Innovators, investors and Web3 startups gearing for streamlined reporting fuels faster cross‑border blockchain collaborations.

-

Developers can taste freedom, building privacy‑centric protocols without looming U.S. reporting burdens.

President Trump continues to defy logic and stand up to what he claims. Well-known as the “Crypto President,” he has taken it up a notch with his recent repeal of the IRS crypto rule—a Biden-era mandate requiring decentralized finance (DeFi) platforms to report user transactions. This controversial move has ignited heated debates far beyond American borders.

Let’s be honest for a minute: if you think U.S. policy shifts cannot have ramifications on your crypto venture in Lagos, Nairobi, or Johannesburg, you might need to revisit some of our previous articles.

This reversal could shape innovative pathways, compliance strategies, and cross-border collaboration that any sane entrepreneur is hungry for. Let’s dissect how African traders, builders, and policymakers can turn this development into a strategic advantage.

How the IRS Crypto Rule Reversal Impacts Africa’s Web3 Ecosystem

What’s Going On: The IRS Crypto Rule Reversal Explained

As of April 2025, President Trump proved he is a man of his word by signing a congressional resolution overturning the IRS crypto rule, a Biden-era directive. For newcomers, the rule classified DeFi platforms as “brokers.”

This mandate forced them to collect taxpayer data (names, transaction histories) and report gross proceeds to the IRS, sparking privacy concerns DeFi broker reporting among developers and users.

The repeal marks the first pro-crypto legislation to pass through Congress, reflecting the Trump administration crypto stance favoring deregulation and technological innovation.

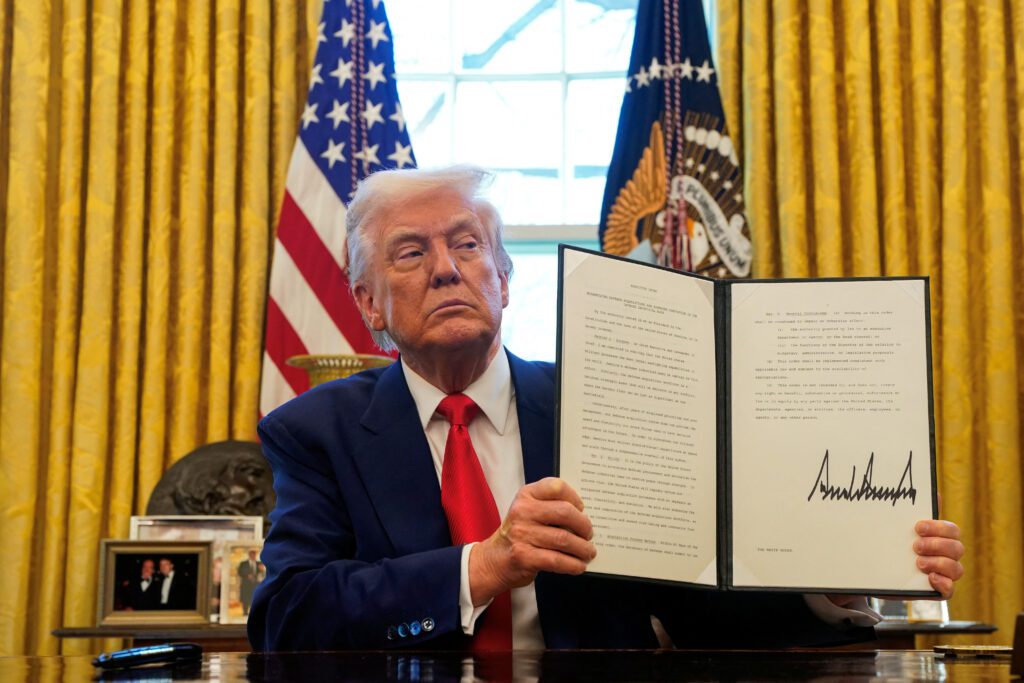

U.S. President Donald Trump holds a signed executive order on ‘Modernizing Defense Acquisitions And Spurring Innovation In The Defense Industrial Base’, in the Oval Office at the White House in Washington, D.C., U.S., April 9, 2025. [Photo: REUTERS]

From many industry groups, this move is a win for privacy and innovation that could influence African projects to collaborate more with global platforms. For instance, Nairobi-based DeFi startups integrating with Ethereum protocols may face fewer compliance hurdles when accessing U.S. liquidity pools.

CHECK OUT: Kenya Crypto Laws: Hyperfocused Pathway Through Regulatory Overwhelm.

Decoding Crypto Tax Compliance for African DeFi Users

Crypto Tax Compliance: What African Traders Need to Know

The new law provides leeway for streamlined collaborations between global DeFi platforms and African projects (e.g., Kenya’s AZA Finance, formerly Bitpesa, or Flutterwave), due to lowered operational costs tied to cross-border settlements.

While the IRS crypto rule reversal eases U.S. oversight, African regulators are moving in the opposite direction. Nigeria’s SEC, for example, recently tightened reporting requirements for virtual asset providers, and Kenya’s 2025 VASP Bill proposes stringent transaction monitoring.

This essentially requires traders to account for dual compliance: adhering to emerging crypto tax mandates at home while leveraging lighter access to liquidity pools from the U.S.

IRS Rule Reversal Impact on DeFi: Opportunities for African Web3 Startups

The IRS rule reversal impact on DeFi unlocks opportunities for African innovators. Grassroots projects—like solar microgrid tokenization, AgriTech yield protocols, and the rise of tokenized asset platforms—can now prototype faster without fearing U.S.-style reporting burdens.

Mike Carey’s notes in recent bill.[Photo: X]

How Does This Affect You? Tailored Insights for African Stakeholders

For Traders & Investors

Yield seekers should gear up, as many DeFi platforms will now opt for lighter U.S. scrutiny. Traders should monitor volume trends and TVL (Total Value Locked) metrics on DeFi platforms to identify emerging pools.

However, do this with local tax regimes in mind. It’s beneficial to always log gains, consult advisors, and recognize that Africa is developing its own tax laws. Just because U.S. demands ease doesn’t mean African nations will. Diversifying DeFi protocols can mitigate jurisdictional risks.

For Developers

Developers now have greater freedom to tinker with advanced features like privacy-centric protocols, cross-chain bridges, or DeFi lending modules without looming questions of broker-reporting compliance.

The IRS rule reversal impact on DeFi enables projects to leverage grants like Polygon’s Builder Fund to fast-track development.

For Policymakers

Policy is now the norm for African nations. The Trump administration’s crypto resolution underscores the need to foster innovation while safeguarding consumer privacy and revenue collection.

Kenya’s 2025 VASP Bill could adopt similar flexibility, but drafting hybrid frameworks requires dedication and progress.

For Creatives & NFT Artists

The creative community is not left behind. African artists can tap into global DeFi platforms to monetize works across borders.

On-chain royalties in smart contracts ensure steady revenue streams and reduced reliance on marketplaces. A prime example is Uganda’s Murcom NFT marketplace, illustrating how local creatives can leverage tokenized art to reach global audiences.

Africa’s DeFi Horizon Post-IRS Rule Reversal

The IRS crypto rule repeal signals a global shift toward policies that champion innovation over red tape. For Africa, this may be a call to develop frameworks focused on encouraging adoption while benefiting from taxation.

The IRS rule reversal impact on DeFi doesn’t discard its entire framework but seeks balance above all else. As the year enters its second quarter, much remains to be seen for Africa’s legal approach to decentralized finance.