The June crypto unlocks are fast approaching, with over $3.3 billion worth of digital assets scheduled to enter circulation as the vesting period concludes.

In Brief

- June’s $3.3B crypto unlocks, including $193M in Metars Genesis and $160M in Sui, will test market resilience amid potential sell pressure.

- Linear unlocks ($1.9B) mitigate short-term volatility compared to cliff unlocks ($1.4B), but long-term impacts depend on project fundamentals.

- Tools like Token Unlocks App and blockchain explorers are essential for tracking June’s token inflows and anticipating price movements.

According to Tokenomist’s latest token vesting schedule, this figure showcases a 32% decrease from May’s substantial $4.9 billion unlock.

Despite this downtrend, the figure remains one of the major crypto vesting events of the year, fundamentally altering the circulating supply and potentially impacting market sentiment.

Understanding these events is a must-know skill for investors and traders within the industry.

Various crypto projects strategically allocate tokens for several purposes, ranging from rewarding team members, compensating early investors, funding foundations, and even building community reserves.

Below is a breakdown of what to look out for as June rolls in with new opportunities to make millions.

$3.3B in June Crypto Unlocks Signal Major Market Shifts

In a nutshell, when tokens are “unlocked,” they transition from restricted access to free circulation, impacting overall market dynamics.

Typically, projects or organizations implement token vesting schedules to prevent early dumping by team members, investors, or contributors.

CHECK OUT: Crypto Wallet Adoption Accelerates: Key Trends and Innovations Shaping 2025 and Beyond

The $3.3 billion scheduled for release in June comprises two primary distribution mechanisms:

- Cliff Unlocks ($1.4 Billion): This approach releases large portions, or sometimes the entirety, of bested tokens all at once on a pre-announced date. Like most token releases, this sudden influx creates immediate selling pressure if the recipient chooses to liquidate, a more likely scenario.

- Linear Unlocks ($1.9 Billion): This method opts for the gradual release of the tokens over time, i.e., daily or monthly, after an initial cliff or starting point. Its nature makes it less disruptive to the market, smoothing out the supply increase.

Each project has a different token vesting schedule dictating its timing, quantity, and recipients of the releases, tracking each distribution for later analysts. Tokenomics documentation and whitepaper often detail the schedules.

June crypto unlocks are particularly notable due to high-profile projects distributed throughout the month.

Spotlight on Key Projects Releasing Tokens

For investors, trader these projects are sure to catch your eye:

- Metars Genesis (MRS): This NFT project dominates the unlocks with a massive $193 million cliff unlock scheduled for June 21st. These funds are earmarked for a significant AI partnership showcasing the intertwined nature of AI and digital assets. MRS has maintained its current strategy of releasing 10 million tokens monthly since March, with nearly $1 billion already in circulation.

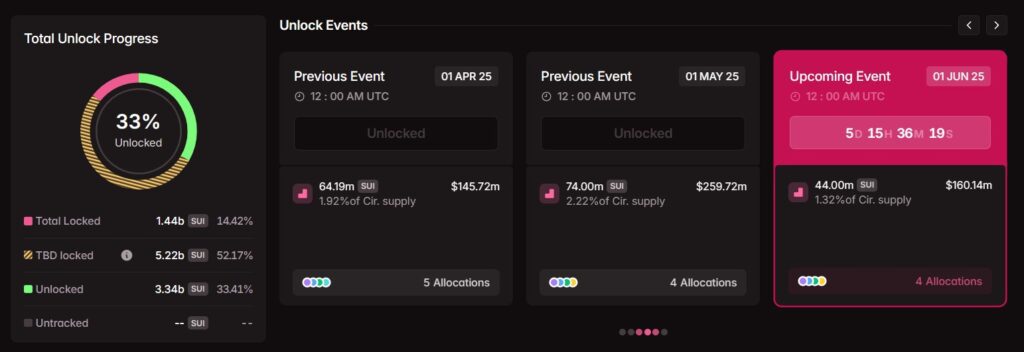

- Sui (SUI): Sui, an upcoming underdog within the crypto market, is set to unlock 44 million tokens worth $160 million on June 1st. The release is strategically targeting the Mysten Labs treasury, early contributors, the community reserve, and, notably, Series B invested, who will receive the largest share of over $70 million. Sui’s vesting history reveals that 3.3 billion tokens(33% of total supply) worth $12 billion have already been unlocked, with another 5.22 billion worth $20 billion awaiting future release dates per Tokenomist data.

Tokenomist data showing Sui’s vesting schedule. [Photo:Tokenomist]

- Fasttoken (FTN): A major crypto vesting event allocating $88 million(20 million FTN) to its founders

- LayerZero (ZRO): Set to compensate core contributors and partners with 25 million ZRO worth $71 million

- Aptos (APT): Released $61 million in tokens (11.31 million APT) to core contributors, the foundation, community initiatives, and investors.

- ZKsync (ZK): Distributed over 760 million tokens (worth approx. $49 million) to its investors and team members.

- Arbitrum (ARB): Also had tokens scheduled for release during the month.

These major crypto vesting events showcase why June is a focal point for analysts monitoring token supply inflation.

Navigating Vesting Events: Tracking and Implications

Knowing how to track the crypto vesting period is a key skill, especially for those seeking to stay ahead of these supply shifts.

Tools like Tokenomics Trackers like Token Unlocks App, Polygonscan, and Tokentrack offer comprehensive dashboards, calendars, and detailed breakdowns per project.

These dedicated platforms offer real-time data on scheduled unlocks amongst and some recipient categories.

CHECK OUT:Coinbase S&P 500 Inclusion: A Catalyst for Crypto Institutional Adoption

Project-specific resources like whitepapers, tokenomics pages, blockchain explorers, and community announcements often provide authoritative sources for vesting details.

Aggregator sites and Calendars frequently include token unlock dates and integrate data from specialized tokens.

Finally, Social Media remains a cornerstone of information; however, caution is advised to avoid rug pulls and scams.

By carefully monitoring projects and the above categories, investors can anticipate potential volatility around specific unlock dates.

More often, these unlocks correlate with short-term price dips due to increases in pressure, and long—term impact varies depending on various factors like project fundamentals, market conditions, and recipient behavior.

Looking Ahead: The Broader Vesting Landscape

As we near the token unlock schedule in 2025, for veterans, this is just a continuous cycle within the ecosystem.

For many, analyzing top altcoins after token unlocks requires considering factors like project development and utility, price action relative to the market, and even locked supply remaining.

For instance, Sui’s remaining $20 billion in locked tokens will likely follow a phased release, mitigating potential shocks to the market.

The June crypto unlocks showcases the growing maturity and resilience of the crypto space.

They are a fundamental aspect of tokenomics that every savvy market participant must factor into their analysis.

Crypto isn’t a rick-quick scheme funneled by hype. Rather, it requires detailed analysis, staying informed, and avoiding FOMO as much as possible.

As always, due diligence remains key to capitalizing on opportunities while managing risks.