-

Kenya Crypto laws slice digital chaos, forging razor‑sharp compliance.

-

CBK and CMA guard transactions with strict vetting and AML shields.

-

Crushing fines and five‑year jail terms deter unlicensed operators.

The wait is finally over as Kenya crypto laws joins among the ranks of Africa’s top adopter of the industry. The introduction of the Virtual Asset Service providers Bill 2025 has answered many pending questions looming over the regions massive crypto industry. This officially shifts the nation’s earlier cautionary stance to structured framework.

Without further ado, lets unpack the compliance requirements and answer the pressing questions: “What are Kenya’s new crypto laws?”

Unpacking What’s Really Important in the New Kenya Crypto Laws

The VASP Bill Kenya, enacted in early 2025, marks a historic pivot in the nation’s policy toward digital assets.

Two key regulators are dominant in the new Kenya crypto laws: the Central Bank of Kenya(CBK) and the Capital Markets Authority. According to the new law, CBK will oversee stablecoin issuers and custodial wallets, while the CMA gets to tango with exchanges, brokers and tokenization platforms.

A standout feature of the bill is its virtual asset offering approval process. Companies launching token sales or listing assets on trading platforms must now seek regulatory green-lights, mirroring traditional IPO safeguards.

CHECK OUT: Pulse of Progress: Navigate Nigeria’s Crypto Dawn with Tactile Clarity and Bold Vision.

This mandate aims at reducing fraud, a plague than many veterans in the regions fell prey to. In addition Kenya’s crypto adoption rate significantly improved according to the FSD Africa report.

For Newbies in the Space: How to Start a Crypto Business in Kenya

For entrepreneurs wondering how to start a crypto business in Kenya, the path now hinges on strict licensing. Whether you’re launching an exchange, wallet service, or tokenization platform, buttering up the CBK or CMA is a non-negotiable.

For the try hards or natural persons (individuals) operating crypto services is now a fantasy, emphasizing institutional accountability, and avoiding well-known disappearing acts.

Key requirements under the Kenya crypto laws include:

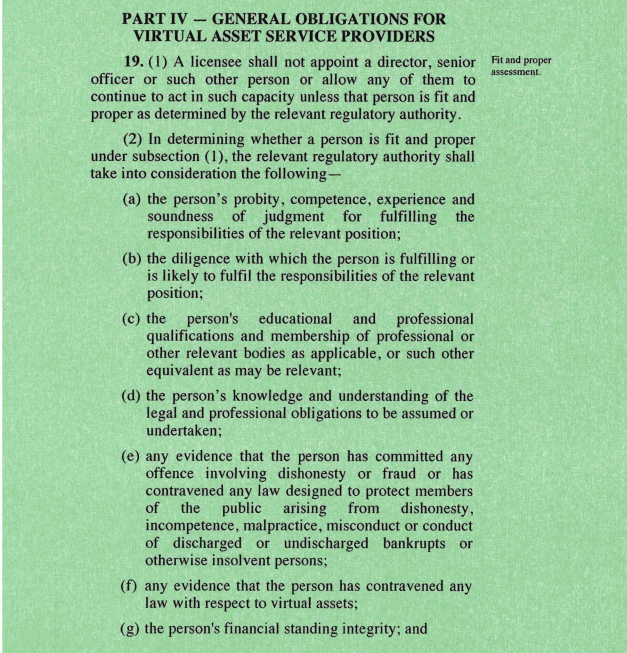

- Fit-and-proper checks for directors and senior staff, assessing integrity and financial stability.

- AML/CFT protocols, including real-time transaction monitoring and reporting suspicious activity.

- Minimum capital reserves (undisclosed publicly) and cybersecurity insurance.

The virtual asset offering approval process also demands detailed project disclosures. This key facts ensures investors receive transparent information about risks and asset valuations.

Penalties for Unlicensed Crypto Operations: A Stark Warning

The government isn’t mincing words about enforcement. Its about to go down.

Penalties for unlicensed crypto activities include fines up to KSH 25 million ($192,745) for firms and five-year jail terms for individuals. In 2024 alone, regulators blacklisted 12 entities for flouting licensing rules—a figure expected to rise as the CMA intensifies audits.

In addition, under the crypto regulations penalties, misleading marketing or deviations from approved token sales plans won’t just result on a smile and a small bride here and there. Up to KES 20 million($154,440) in fines will be incurred for falsifying information on license applications.

Consumer Protections and Market Confidence

In an attempt to rebuild trust after years of playing jump rope with regulations, the Bill requires client asset segregation. In simpler terms, registered companies cannot mix user funds with operational capital. Reinforcing this mandate is paramount annual audits an seven-year record-keeping preventing any fabrications or “shenanigans”.

Stablecoin issuers have it worse with additional scrutiny, including reserve audits and governance checks. This addresses concerns from Kenya’s $45 million stablecoin market, which fuels cross-border trade and remittances.

Transition Period: What Existing Businesses Must Do

Legacy crypto firms have until mid-2026 to align with the Kenya crypto laws. Otherwise they might find themselves with large bills and fines right on their doorsteps.

Early adopters praise the clarity but warn of compliance costs. This raised several questions and concerns of the practicability of the Bill .

The new VASP Bill clearly defines the obligations of the asset providers and their eligibility for a license.[Photo: Web3Africa]

Balancing Innovation and Control

So, what are Kenya’s new crypto laws achieving?What difference are they making and can it help you to better learn how to start a crypto business in Kenya? At its core, formalizing the sector aims at two aspects: foreign investments and stopping illicit flows.

This presents new challenges especially to smaller startups who argue that the virtual asset offering approval process favors established players while rural users grapple with limited access to licensed platforms

For those exploring the how, collaboration with legal experts is crucial. Meanwhile, traders must stay vigilant—penalties for unlicensed crypto activities are now among Africa’s strictest.

The Good, The Bad and The Progressive

Kenya’s 2025 crypto reforms reflect a maturing market eager to balance innovation with accountability. The VASP Bill Kenya and its crypto regulations penalties framework set a regional precedent, though their long-term success hinges on adaptive enforcement.

As the nations continues to adjust its polices with its ever-growing blockchain industry playing by the rules in Kenya is no longer an option but a survivability concern

So if you want to gain trailblazing news with new angles sign up below to our newsletter and be part of the community.