-

The Mantra Token price crashed over 90% due to forced liquidations, low liquidity, and whale sell-offs, exposing risks in centralized exchange markets.

-

African investors face significant risks from such crashes, necessitating portfolio diversification and improved risk management strategies.

-

Despite the crash, Mantra’s tokenized real estate model offers growth potential if supported by clear regulations and transparency.

Traders and institutional investors from Lagos to Nairobi are all asking a key question: What happened to Mantra Token? The abrupt freefall of the Mantra Token price underscores several vulnerabilities we all dread when it comes to real-world asset (RWA) tokens, especially when centralized exchanges are involved behind closed doors.

Veteran traders can all attest how sudden market moves can erase billions in minutes. We’ve seen it before; we’ve paid the price. Thus, understanding the nuances can be the difference between novices and seasoned strategies.

The Scoop Behind Mantra Token price’s 90% Crash: Why Mantra Token Price Nosedived

What’s Happening With the Mantra Token Price?

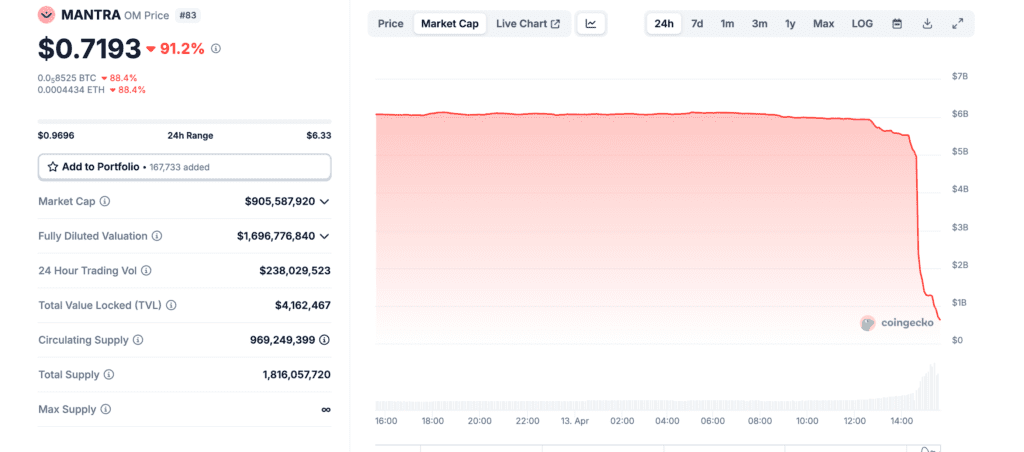

In just under 24 hours on April 13th, the Mantra Token price nosedived from about $6.30 to below $0.50, erasing over 90% of its $6 billion market cap—making the LUNA collapse seem like a steady decline. As per early adopters, the token experienced a brief recovery above $1, but sentiments remain fragile, with the token only at $0.70 at the time of writing.

Timeline:

- April 7–12: On-chain observers noted unusual deposits onto exchanges.

- April 13, 02:00 UTC: Price tumbled from $6.30 to $0.40 within hours.

- April 13, 05:00 UTC: Minor bounce above $1, followed by renewed selling.

Anatomy of the OM Token Crash

The question on everyone’s mind is: What set off the OM Token crash? What caused the market to experience another LUNA-like scenario?

CHECK OUT: Why the IRS crypto rule reversal thrills African Web3 builders.

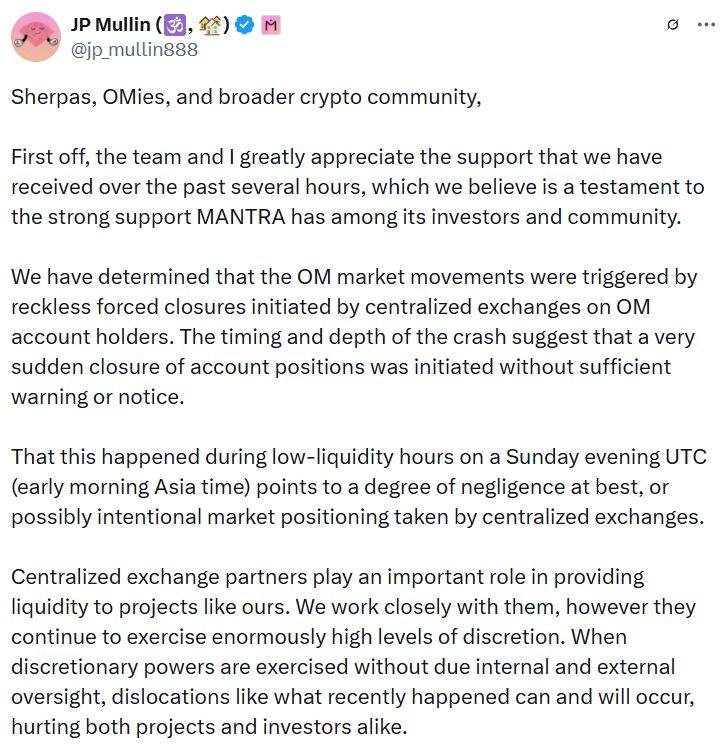

According to experts, a sudden cascade of forced liquidations by centralized exchanges triggered a sequence of margin calls and automated sell orders. According to a viral X post by co-founder John Mullin, he stated, “Reckless forced closures initiated by centralized exchanges,” hinting that the timing of low-liquidity hours magnified the impact severely.

Mantra token market cap and metrics.[Photo: CoinGecko]

Why Did Mantra Token Crash? Exploring the Causes

Several factors converged:

- Forced Liquidations: Centralized exchanges closed under-collateralized positions without notice.

- Low-Liquidity Window: Sunday evening UTC saw thinner order books, amplifying price swings.

- Whale Movements: Large on-chain deposits into exchanges hinted at strategic sell-offs.

- Algorithmic Margin Calls: Automated selling pressures accelerated the decline.

- Speculative Theories: Some alleged the Mantra team used tokens as collateral for loans, though Mullin denied this.

Impact on African Crypto Investors and Traders

African traders face amplified risks when tokens like Mantra plunge. Here’s what to watch:

- Capital Flight: Sudden crashes drive users toward stablecoins, weakening local DeFi TVL.

- Portfolio Diversification: Local DeFi users should consider multi-chain allocations instead of single-asset bets.

- Risk Assessment: Local asset managers must factor in exchange-driven volatility when evaluating RWA tokens.

A prime factor in the market is understanding that exchange policies can override on-chain health metrics, causing highly volatile behavior for various tokens.

Regulatory Landscape: Compliance and Policy Insights

Other theories suggest that the sudden crash has links to Mantra’s February approval under Dubai’s Virtual Assets Regulatory Authority. The Mantra UAE regulatory license empowered the project to operate exchanges, broker-dealer services, and investment consulting in the UAE. This essentially provided a large use case for its OM Token, showcasing how positive regulations can significantly boost token prices.

[Photo:X]

- Unified Licensing Standards across African jurisdictions.

- Mandatory Liquidation Protocols requiring advance notice for margin calls.

- On-chain Transparency Mandates for token vesting and team allocations.

Mantra’s Middle East Expansion and Regional Partnerships

In January 2025, Mantra inked a $1 billion Mantra-DAMAC tokenization deal to tokenize real estate and data centers for DAMAC Group. This milestone showcased how the future of digital assets has shifted into fractional ownership and cross-border capital flows.

This shift is seen in Nigeria, Kenya, and Ghana, with each finding new ways to invest in tokenized real estate, providing ample use cases for digital assets or native coins.

Community and Team Response: Mantra Team Response to Crash

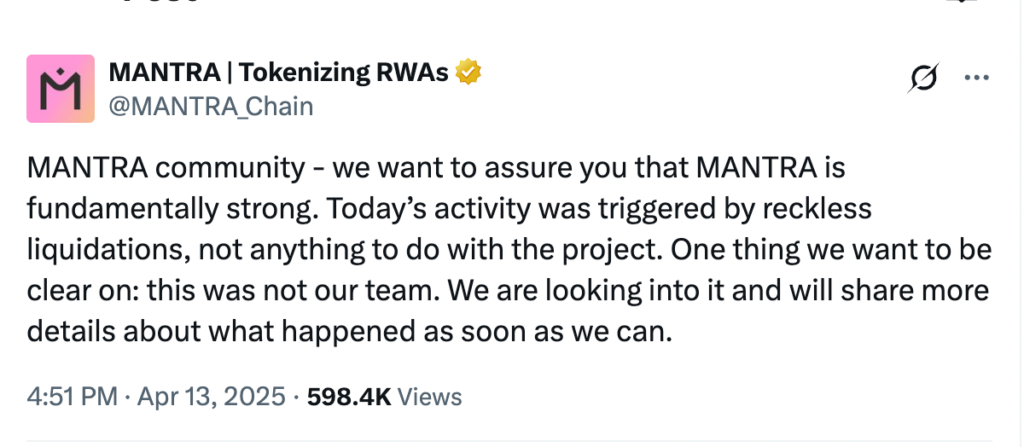

Following the OM Token crash, JP Mullin tried reassuring stakeholders: “We are here and not going anywhere,” providing verifiable on-chain addresses for team-held tokens.

[Photo: X]

Investing in Tokenized Real Estate: Opportunities and Risks

Despite the rapid decline of the Mantra Token price, its applicability holds benefits. Organizations intending to invest in tokenized real estate offer advantages—fractional ownership, lower entry costs, and enhanced liquidity—but it’s not without pitfalls.

CHECK OUT: Unlock Radiant Horizons: Experience the Vibrant Pulse of Tokenized Investments.

Compare Yields:

- Traditional REITs: Yields of 6–8%.

- Tokenized Property Models: Pilot programs show 5–10% yields, but with higher volatility.

Due Diligence Checklist:

- Verify regulatory compliance and licenses.

- Review smart contract audit reports.

- Analyze tokenomics: supply caps, vesting schedules, and collateral requirements.

Emerging evidence suggests that blending tokenized and traditional real estate allocations can smooth returns—though e-commerce may differ from B2B real-estate funding models.

Reflecting on the Broader African Impact

The Mantra Token price crash isn’t just a cautionary tale; it’s a catalyst for Africa’s Web3 ecosystem to mature. It showcased the rising need for clear policies, robust risk tools, and community vigilance.

The Web3 ecosystems have solidified their presence in the world, and now a culling is underway to see which projects stay afloat and which fall under pressure. Understanding the OM Token crash equips you to build more resilient protocols and portfolios.

For those eager to know more, explore Web3Africa.news’s tailored learning paths, join upcoming policy round-tables, and leverage regional networks to turn volatility into opportunity.