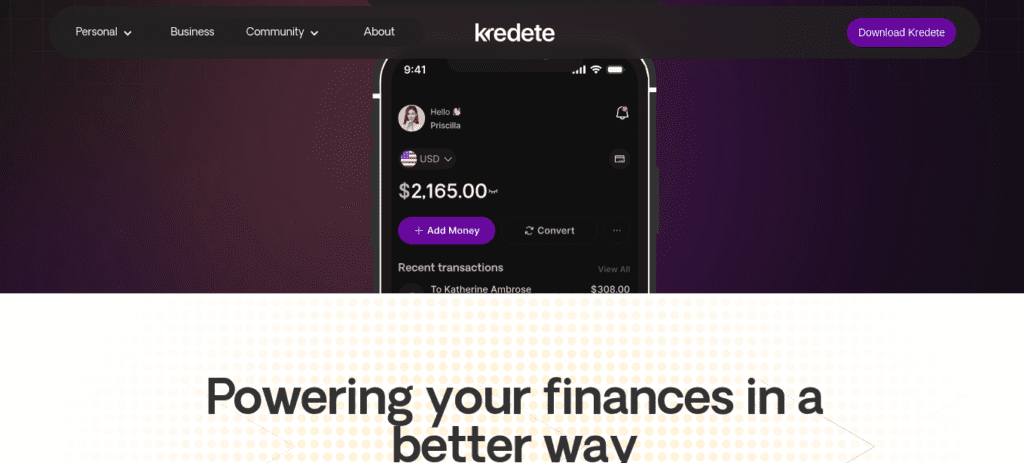

Following up groundbreaking research showcasing Africa’s fast-paced stablecoin transaction volume, Kredete, a fintech platform, has unveiled the continent’s first stablecoin credit.

In Brief

-

Stablecoin credit card by Kredete enables Africans to spend USDC globally with near-instant Stellar settlements.

-

Real-time FX conversions and minimal gas fees make it a genuinely low-cost remittance and spending solution.

-

Integrated FDIC-insured accounts and U.S. credit-building offer financial empowerment for immigrants and freelancers.

With stablecoins accounting for 43% of the region’s total crypto transaction volume, this new tool is set to boost the adoption rate further.

The blockchain credit card for remittances is specifically designed to give locals access to low-cost global spending.

Powered by Visa, Stellar and Rain, the platform bridges the gap between digital assets and day-in-day consumption, providing Web3 an added layer of tangibility.

Kredete Launches Stablecoin Credit Card for Borderless Payments

For decades, millions across Africa have grappled with the realities of fragmented financial systems and high inflation rates.

High fees for international transactions, limited access to globally accepted payment tools and unreliable local infrastructure have barred many local startups from thriving within the global economy.

The solution: Kredete card, a stablecoin credit card, directly addresses these pain points by leveraging blockchain technology to offer premium cross-border finance solutions.

CHECK OUT:Mastercard x MoonPay: Stablecoin Cards for Africa’s Unbanked

The card is directly linked to a user’s digital wallet, allowing users to spend USDC anywhere a Visa is accepted. These local initiatives allow anyone access to online e-commerce sites and offline at any point-of-sale terminals globally.

Photo:Kredete.io

Crucially, transactions leverage the speed and efficiency of the Stellar network for near-instant settlements.

At the point of purchase, real-time foreign exchange(FX) conversions occur, eliminating the need for users to pre-convert currency, which at times leads to unpredictable delays and excess fees in common traditional systems.

Adeola Adedewe, Founder & CEO of Kredete, emphasized:

“Access to money shouldn’t stop at your country’s borders. We’ve built a system that lets Africans store value securely in digital dollars and use those funds however and wherever they choose—instantly. This is about empowerment and dismantling artificial financial barriers.”

This philosophy underpins the entire Kredete Fintech approach, allowing users to store value in digital dollars and deploy them instantly, whether paying school fees in Accra or booking courses in Dakar.

How the Card Empowers Users: A Low-Fee International Spending Card

The USDC Visa Card functions similarly to any standard Visa credit card but is backed by the speed, efficiency and transparency of Stellar Network.

The card’s FX conversion narrows the distance between digital assets and fiat currencies at competitive, transparent exchange rates.

Aside from speed, Stellar Network also offers minimum gas fees as compared to traditional international wire transfers or card forex fees.

These features make it a genuinely low-fee international spending card made by Africa for Africa.

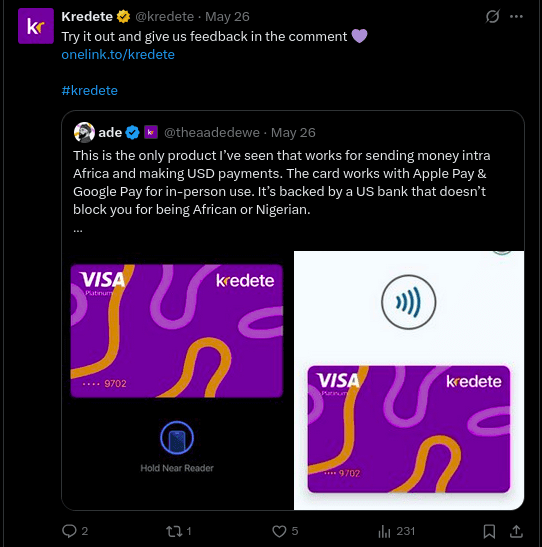

Kredete calling upon more users to try out the new features.[Photo:X]

A popular trend among many Gen Z is seeking alternative incomes to compact ever-growing inflation rates.

Kredete already facilitates remittances in over 25 African countries, uniquely allowing these transactions to contribute to users’ U.S. credit scores.

The stablecoin credit card is integrated seamlessly into Kredete’s app, which provides FDIC-insured U.S. bank accounts using international IDs, a critical factor for immigrants establishing financial roots.

The Visa Card linked to the crypto wallet is the logical next step, creating a unified, full-stack financial experience designed to democratize finances but also circumvent the limitations of legacy banking infrastructure.

Building on a Foundation of Growth and Trust

The innovation taps into Africa’s growing stablecoin use and extends Kredete’s vast reach. Founded in 2023, the company already has a user base beyond 500,000, processing over $100 million in transactions.

Its success was mainly fostered by its $2.25 million seed funding round, led by Blockchain Founders and other well-known entities such as Techstars, Tezos Foundation and others.

CHECK OUT:Africa’s Fintech Trifecta: Circle, Flutterwave & Yellow Card Join Forces

Its approach enables local users from the U.S. to build credit scores, send money home and access financial tools typically reserved for traditional banks.

The card’s rollout across 41+ African countries showcases its viability and scaling capabilities.

Ebuka Arinze, Kredete‘s Chief Product Officer, highlighted the practical utility driving their vision:

“We believe stablecoins aren’t just a technology—they’re a fundamental utility. By embedding them directly into real-world financial tools like this Visa card, we’re giving everyday users across Africa and beyond a reliable, efficient, and low-cost way to store and move money with unprecedented confidence.”

A New Chapter in African Financial Access

The card will effectively function as a blockchain credit card for remittances and daily spending, signifying a tangible shift towards a more inclusive financial stem for Africa.

The stability of USDC, accompanied by its transparency, user-centric approach, cost-effectiveness and global reach, is honey to most youths in Africa.

It empowers Africans to transact globally without fear of sudden price change, delayed transactions or even fraud, offering viable alternatives.

In particular, for freelancers and those sending finances back home, it offers direct access to funding and gives a bonus of building credit history for those outside.

As this stablecoin credit card becomes available to users across dozens of African nations, it paves the way for a future where geography no longer dictates financial access or opportunity.