-

The announcement of the first-ever Tether financial audit by a Big Four accounting firm signals a major step toward transparency.

-

The audit process, expected to complete by end-2025, may lead to enhanced regulatory clarity and increased institutional investment in Africa’s crypto ecosystem.

-

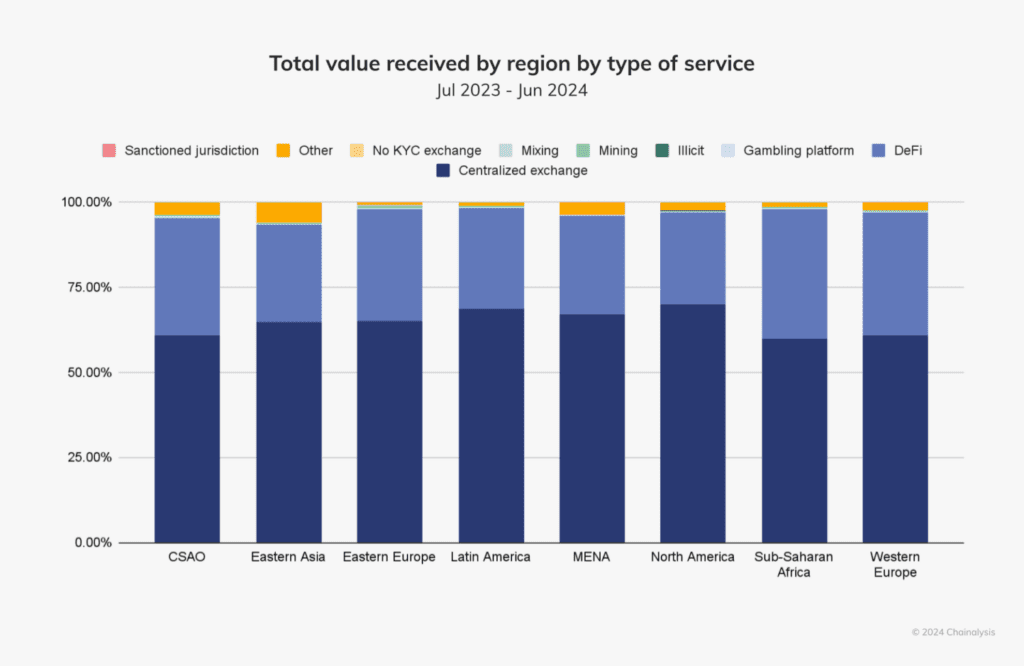

As per Chainalysis reports, stablecoins accounted for almost half of the total crypto transaction volume in Africa 2024.

The crypto industry is in a frenzy with the latest news on Tether, the world’s most popular stablecoin USDT issuer. According to the latest topic on the block, Tether is seeking a Big Four accounting firm for its first full Tether financial audit.

This new development has significant implications for the market and, more so, Africa’s crypto market where USDT has seen tremendous growth. As an African crypto trader, understanding what this means for the stability and legitimacy of the assets you use is crucial. Now that Tether seeks a Big Four audit, it has ripple effects that could affect USDT stability concerns in Africa, impact Africa stablecoin regulation, and enhance USDT transparency.

The Big Picture

Recent Africa crypto regulation updates have taken a turn toward adoption and incorporation. Stablecoins have had a history of success among many African businesses and individuals when navigating currency volatility, high inflation rates, and unreliable banking infrastructure. As per Chainalysis reports, stablecoins accounted for almost half of the total crypto transaction volume in Africa. Without further ado, let’s dive into how Tether’s actions could improve transparency and security for African users. What it means for you as an investor, trader, or someone new to the industry.

Tether Financial Audit Pursuit Amid Africa’s USDT Growth

In a surprising turn of events, Tether has confirmed its engagements with Big Four accounting firms for its first full Tether financial audit. As per the words of CEO Paolo Ardoino, “Obtaining a Big Four audit has become imperative as we continue to grow and serve markets like Africa where trust is paramount.”

This procedure will take several months, but the organization is hoping to complete it by the end of 2025. According to Ardoino, the company has already started preliminary discussions with multiple Big Four firms—PricewaterhouseCoopers (PwC), Ernst & Young (EY), Deloitte, and KPMG—though he was reluctant to specify which ones are currently under consideration.

USDT transparency is an in-demand topic, especially in Africa with its high usage rate. A Big Four audit sets a pace for security and answers many lingering questions about its reserves. Historically, despite USDT stability concerns in Africa being close to none, the organization has faced criticism before due to lack of transparency.

Back in 2021, the company had a run-in with the U.S. Commodities and Futures Trading Commission (CFTC) for misrepresenting its reserves. Tether’s compliance efforts addressed those “questions” head-on, potentially stabilizing the market and reducing liquidity risks that would heavily affect African markets.

ALSO, READ: How Fiscal Policy Impacts Cryptocurrency Markets: A Comprehensive Guide

Tether seeks a Big Four audit as part of its strategy to address global regulatory pressures and market demands for transparency. This essentially acts as a cushion, setting an important precedent for other stablecoin providers. As Africa crypto regulation updates continue, this sets up an interesting reference point for ensuring transparency. It also highlights how the industry is willing to embrace stricter oversight to ensure security and consumer safety.

Key Elements Affecting the African Crypto Market

Current State of Stablecoins in Africa

USDT’s dominance in African crypto transactions has only grown stronger in recent years. Even amid the first quarter of 2025, USDT now accounts for a good portion of the crypto volume in Africa, with Nigeria, South Africa, and Kenya being the largest markets. This dominance isn’t really much of a surprise given the high inflation rates and tax laws in most African countries. USDT’s ability to provide a stable store of value amid local currency volatility is a major draw for most African traders and those looking to earn an extra buck or two.

Regulatory Landscape

Recent Africa crypto regulation updates have created a patchwork of approaches across the continent. Regions like South Africa have dominated the crypto regulation sector with their progressive laws that recognize stablecoins as legitimate financial instruments.

Others like Nigeria have taken a cautious approach focusing more on licenses. Kenya has taken a more exploratory aspect by implementing regulatory sandboxes, allowing limited operations while pondering which rules will best aid the market.

Market Stability Factors

Addressing USDT stability concerns in Africa through enhanced transparency is crucial for maintaining market confidence. The continent has already experienced several instances where rumors about Tether’s reserves caused short-term panic in local crypto markets.

By undergoing a rigorous audit, Tether aims to prevent such liquidity crises and protect user funds, which is particularly important in regions where crypto often serves as a primary financial infrastructure rather than just an investment vehicle.

How to Utilize This Information

Tether’s compliance efforts have rippling effects on any investor’s portfolio. In addition, it’s important to keep in mind that the audit procedure has just been announced and the findings could take several months. Diversifying one’s stablecoin holdings is a safe approach as the Tether financial audit is processed.

Increased USDT transparency will create more opportunities in African crypto markets as it will essentially greenlight institutional investors to take action. This would lead to major capital being allocated to projects built on stable foundations. Thus, developing risk management strategies that account for potential regulatory changes is a sane approach for investors.

USDT transparency results in improved cross-border transactions, which spell good profits for any business leveraging this new technology. However, staying informed about Africa stablecoin regulation is a prime factor when considering a business’s market and how Tether’s compliance efforts might affect payment processing.

Why This Matters for Africa’s Future

Tether’s compliance efforts could pave the way for broader blockchain adoption across Africa by establishing higher standards of transparency and accountability. The crypto ecosystem in Africa stands at a critical juncture where transparency and regulation will determine its trajectory. As Tether seeks a Big Four audit, it represents a positive step toward maturation of the market. This could eventually lead to more Africa crypto regulation updates with a main focus on transparency rather than control.

You as our valuable reader should consider getting more involved in how regulatory developments internationally could affect the African market.

If you prefer informative, factual, and entertaining news updates, ensure to sign up on our newsletter or our social media platforms at Web3Africa.news. Join our newsletter to be part of our vibrant and growing Web3Africa community.