Table of Contents

TL;DR,

- The Nigeria crypto ban is officially lifted following a period where P2P inflows hit $59 billion, though new regulations strictly control how licensed firms interact with banks.

- Nigeria’s crypto rules have evolved from blanket banking exclusions to a dual‑regulator framework where CBN and SEC license VASPs, tax capital gains, and force naira‑only, bank‑mediated channels for crypto trades.

- Individual traders and startups now gain formal access to crypto bank accounts, but must navigate strict KYC/AML, transfer limits, high collateral requirements, and ongoing crackdowns on P2P platforms like Binance.

The Nigeria crypto ban is officially lifted after nearly three years of banking restrictions that severed the formal link between cryptocurrency and Nigeria’s financial system.

The tug‑of‑war between the Central Bank of Nigeria (CBN), growing local startups, and local demand for digital assets finally ended. The December 2023 verdict reopens banking channels for licensed crypto firms via the CBN VASP guidelines.

Here is a breakdown of Nigeria’s regulatory journey and 2025 updates to how far that single decision opened doors for startups, retail, and institutional investors.

From warning shots to the CBN cryptocurrency ban

While Nigeria’s crypto boom was steadily rising, its regulation took a step back into caution. In January 2017, the CBN issued Circular FPR/DIR/GEN/CIR/06/010, instructing banks to avoid trading virtual currencies on their own accounts and to apply strict anti-money laundering controls to customers operating as crypto exchanges.

The CBN warned that “consumers may therefore lose their money without any legal redress” on unregulated platforms.

The warning was ineffective, as more local startups cropped up looking for banks as an off-ramp solution for Nigeria’s booming ecosystem.

This bold defiance was soon met with a definitive turn. On February 5, 2021, the CBN issued the circular widely known as the CBN cryptocurrency ban (Ref: BSD/DIR/PUB/LAB/014/001).

December 2023 CBN warning.[Photo: CBN]

The CBN justified the directive by citing money laundering, terrorism financing, and cybercrime concerns, stating that crypto use was “a direct contravention of existing law.”

The CBN clarified that the Nigeria crypto ban only targeted banks, not individual traders.

RELATED TOPIC: Morocco Ditches Crypto Ban: Bill 42.25 Opens Door to $11 Billion Market

How the “ban” backfired: P2P boom and opaque crypto trading volume

The Nigeria crypto ban did have an effect, but one regulators didn’t anticipate. Soon after a massive shift to peer-to-peer trading, decentralized exchanges and local startups providing access soon began.

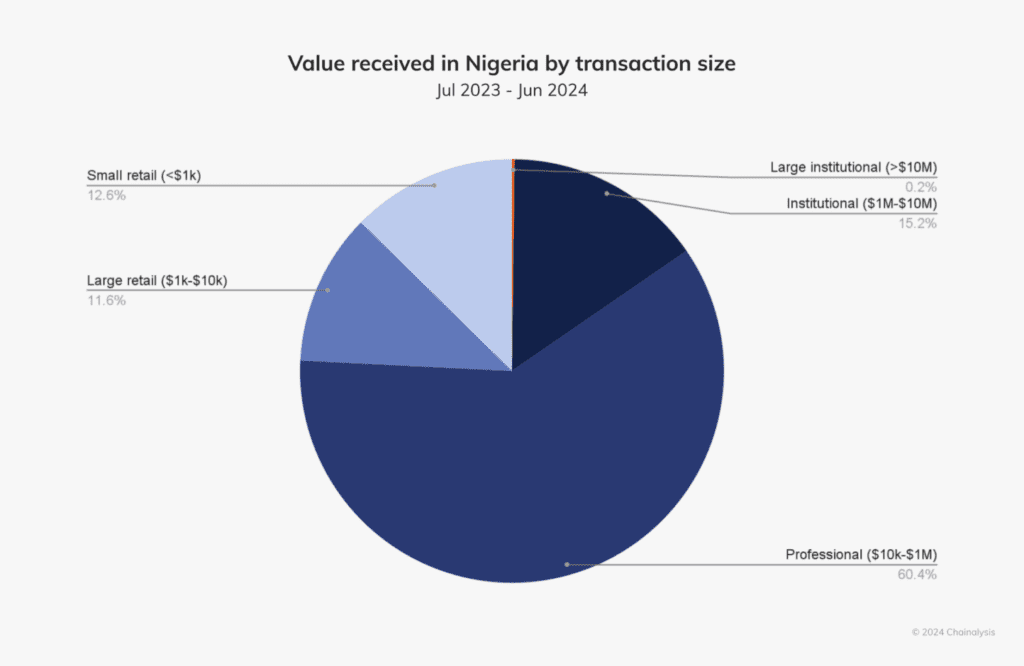

P2P platforms like Paxful recorded a boom, with Nigerian P2P trades hitting around $1.5 billion in Q1 2021 alone and an annual volume of over $760 million. Chainalysis further proved the shift with Nigeria ranking #1 globally in P2P trading volume during 2021–2022. Subsequently recording crypto inflows of about $56.7 billion (July 2022–June 2023) and $59 billion (July 2023–June 2024).

Nigeria stats.[Source: Chainalysis]

The Nigeria crypto ban was meant to curb the high usage of digital as an attempt to manage its future risk. Ultimately the Naira depreciated sharply during this period—from approximately ₦470 per USD in early 2021 to over ₦1,200 by December 2023 (parallel market rates)—making dollar-pegged stablecoins and Bitcoin attractive hedges for everyday Nigerians.

The Regulatory Pivot From 2022 to the Ban Lift

When exclusion failed, the Nigerian regulator quickly changed gears, with the Securities and Exchange Commission (SEC) issuing a digital asset rule in May 2022, creating categories and licensing paths for Virtual Asset Service Providers (VASPs).

Eventually the pressure was at an all-time high as CBN issued new CBN VASP guidelines on December 22, 2023 (Circular Ref: FPR/DIR/PUB/CIR/002/003). These guidelines officially superseded the 2017 and 2021 circulars.

Later on, the 2023 Finance Act introduced a 10% capital gains tax on digital asset disposals, signaling government intent to tax the sector, not ignore it.

December 22, 2023 – What changes occurred?

The framework is permissive but tightly controlled. Here’s what crypto businesses and users need to know:

What Banks Can Do:

- Open designated crypto bank account facilities for SEC-licensed VASPs

- Provide designated settlement accounts and payment services

- Act as channels for foreign exchange flows related to crypto trade (subject to FX regulations)

What Banks Still Cannot Do:

- Hold, trade, or transact in virtual currencies for their own portfolios

- Facilitate the foreign exchange positions of individual users on VASP platforms

Requirements for Designated Settlement Accounts (DSAs):

- Purpose: Warehouse all Naira positions of individuals transacting with VASPs

- Non-interest bearing: Accounts do not accrue interest.

- Transfer limits: Users can transfer from their Naira positions in the DSA to personal bank accounts only twice per quarter.

- Settlement cycle: T+3 (three days)

- Collateral: VASPs must keep at least 150% of the highest net debit position from the last 10 days as collateral.

- Currency restriction: Only Naira can be used for transactions on VASP platforms.

- No cash withdrawals; can’t be used as collateral for a loan or to clear checks from other people.

- If you don’t obey the rules, you could face fines of at least ₦2,000,000, have your operating licenses suspended, and be banned from opening any more designated accounts.

What This Means for Crypto Users and Businesses in Nigeria

Crypto bank accounts are now accessible to individual traders at a licensed VASP to buy and sell crypto with Naira, ending the years of informal P2P-only access. However, some restrictions were employed.

Transfers from your settlement account to your personal bank are limited to twice per quarter. The crypto tax laws also went into full effect with all crypto profits. Crypto profits are subject to a 10% capital gains tax.

CHECK OUT: Nigeria Crypto Tax 2026 Guide: Calculate and Report Your Gains

With the Nigeria crypto ban now gone, local startups have to obtain an SEC VASP license to operate or even offer a crypto bank account. Gaining the VASP license required all businesses to maintain 150% collateral, adhere to strict AML/CFT controls, and operate only in Naira on-platform.

The lift also heavily favored the banking system opening a new revenue line. Although there was a catch to the “open corridor.” There was a dual-regulator model, meaning banks had to meet the expectations of the CBN and the SEC.

Additionally, they were restricted from offering crypto trading and would possibly face operational risk if their VASP clients would be deemed as “non-compliant.”

The 2024 Complication: P2P Crackdown and the Binance Crisis

Despite the Nigeria crypto ban now being lifted and a formal liberalization in place, the damage was already done.

A severe foreign exchange crisis led the CBN and Office of the National Security Adviser to clamp down specifically on P2P platforms, alleging they were being used for illicit flows and had become a de facto benchmark for the Naira’s unofficial exchange rate.

In February 2024, CBN Governor Olayemi Cardoso claimed;

“In the case of Binance, in the last year alone, $26 billion has passed through Binance Nigeria from sources and users whom we cannot adequately identify.”

The government blocked Binance’s website, detained executives, and instructed the SEC to have crypto platforms delist the Naira from P2P markets. Binance complied, disabling its Naira P2P market entirely.

Obinna Iwuno, president of the Stakeholders in Blockchain Association of Nigeria (SiBAN), warned that banning P2P would not solve the FX crisis, stating;

“P2P is not the problem… If you ban P2P, people will just move to WhatsApp and Telegram, where there is zero oversight.”

This tension shows the ongoing problem: the CBN wants to control currency flows and fight illegal finance, but strict enforcement could push activity even more into unregulated, unclear channels.

A controlled reopening, not a free‑for‑all

The Nigeria crypto ban is lifted, but its ecosystem is still in chains. The CBN VASP guidelines dictate harsh penalties for not meeting harsher requirements.

By replacing blanket banking restrictions with the CBN VASP guidelines, regulators are betting that tightly supervised, Naira‑only channels can capture activity that had spilled into opaque P2P networks—without surrendering control of the currency.

Will this affect Nigeria’s ecosystem? Nope. From previous examples we’ve seen how digital assets have a way of looping regulators. However, this presents an opportunity for Nigeria’s government to finally embrace the thriving crypto industry.