Table of Contents

TL;DR,

- The quidax report shows 85% of Nigerian crypto investors earn under ₦250k ($171) monthly, using crypto as a utility for survival, not for high-risk speculation.

- Nigerian users overwhelmingly prefer Centralized Exchanges (88%) for their security and ease of use, valuing trust and stability over the ideological benefits of P2P or DEX platforms.

- Stablecoins are the backbone of Nigeria’s crypto economy, used by the majority to hedge against Naira inflation, receive remittances, and make small, frequent payments.

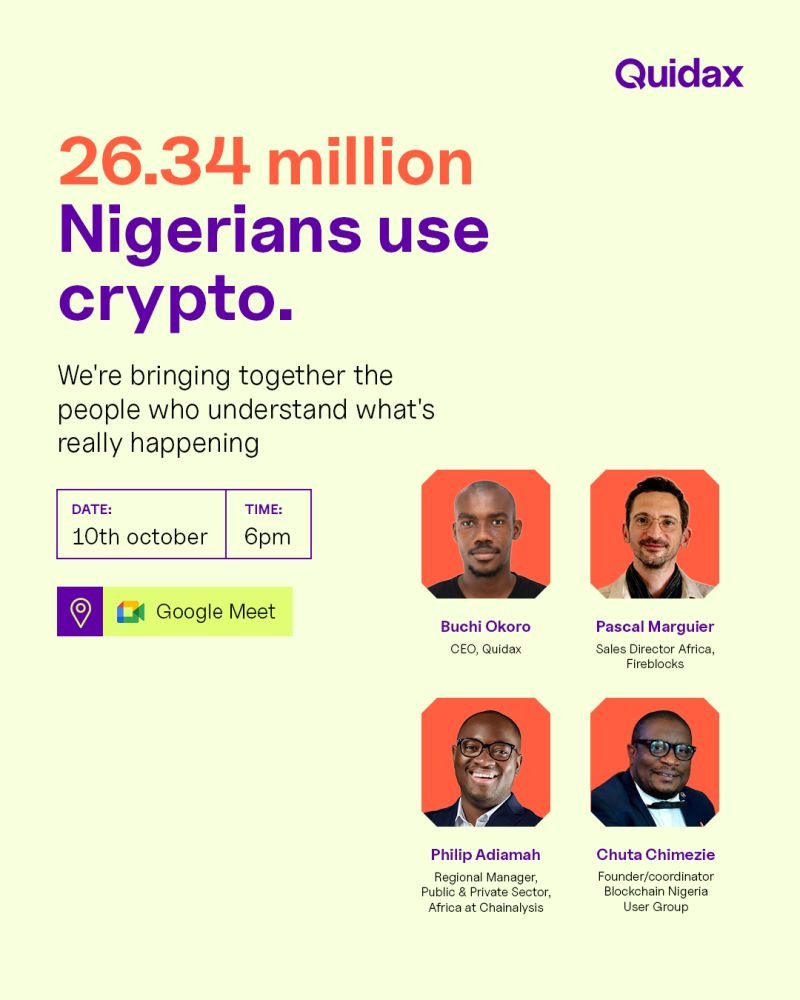

A new Quidax report, “The State of Crypto Adoption in Nigeria 2025,” in collaboration with the IFS Insight, reveals that the majority of Nigerian crypto investors are not who we actually think.

Nigeria, being Africa’s largest crypto ecosystem, is surprisingly mainly comprised of everyday citizens earning modest incomes of up to $200 monthly. As per the data, Africa’s top ecosystems are dominated by low-income crypto investors who prefer centralized exchanges, stablecoins to hedge against inflation, and small but frequent transactions that serve real-world needs.

The Quidax Report shows Low-Income Crypto Investors Dominate Nigeria

Crypto is mainly attributed to having a diverse demographic ranging from high net earners to institutions; however, in Africa a different story is portrayed. According to the Quidax report, approximately 85% of retail crypto investors in Nigeria earn below $171 (₦250,000). Typically, this is an average daily or weekly salary for first-world countries.

The figures place the main drivers of crypto adoption in Nigeria as low-income earners with a few middle-income earners. “This investor class, however, is not a high-net-worth segment,” the study explicitly states. In Africa, crypto and digital assets are viewed as utility assets rather than elite financial instruments. The data suggest that Nigeria’s 26.3 million crypto users opt for digital assets as practical tools for economic survival and mobility.

Chainalysis did provide some insights with data citing how Sub-Saharan Africa only represented 2.3% of global transaction volume (July 2022–June 2023), versus the U.S. at nearly 24%. It challenges the myth of oversized crypto earnings and the long misconception of overnight millions, a propaganda often portrayed to lure unsuspecting users.

The irony of the Quidax report is how students dominate Nigeria’s crypto population by 43%. Freelancers, self-employed individuals, and small business owners account for much of the remaining share (25.67%). The fact still remains that for many, it’s a financial system of choice for the systematically excluded rather than a million-dollar machine.

FOLLOW UP: Quidax Report: How OTC and Stablecoins Are Changing African Payments

Students and young entrepreneurs are reshaping cryptocurrency adoption in Nigeria.

Digital assets and blockchain are fairly new, with Gen Zs being most of their users. The question of how students invest in cryptocurrency offers insight previously unaccounted for.

Eight out of ten respondents report using crypto for purposes beyond short-term trading but as a means to escape the Naira inflation (204% decline in value between May 2023 and February 2024). For this particular group, it’s more about small values, frequent activity, stablecoin use for stability, and a strong pull toward CEX interfaces that feel familiar and reliable.

The Quidax report segments user behaviors into Investors (67.2%), Pragmatists (18.4%), and Traders (14.4%). This means that more than four out of five users are using crypto for savings, payments, and financial problem‑solving. Most Nigerian users skew local and international centralized apps and rely on local stablecoin pairs like CNGN/USDT for savings and payments. They also receive more than they send overall (56.1% “mostly receive”), reflecting remittances and freelance income streams.

imagesource:Quidax

The Centralized Exchange vs. P2P Debate: Security Trumps Ideology

The analysis also answers the “centralized exchange vs. P2P” debate, with 88% of Nigerian adopters preferring centralized exchanges. Their reasoning, stability, and ease of use are tools with localized payments platforms. Currently, centralized exchanges command 83.2% preference, while just 10.7% prefer P2P and 2.6% opt for DEXs.

For the most part, users prioritize security and trust (23.24% of respondents) and ease of use (19.26%) over the theoretical benefits of peer-to-peer transactions. Blockchain’s “bank-like” security with low transaction fees offers reassurance and a better alternative. CEX has a monopoly with deep liquidity, perceived safety, and a wide product set (e.g., Binance’s 79.36% historical usage), creating high switching costs, especially for first‑time adopters and students.

Interestingly, the study documents what they term as a “loyalty paradox,” with 70% of investors sticking with platforms that offer reliable tools and security. In Africa, if you offer quality, you’re likely to retain most of your community and users.

Stablecoins as Nigeria’s digital anchor

Asset utility patterns complete the picture of a utility-first market. Stablecoins have remained the backbone of everyday usage, with 45.52% of users receiving them, 38.28% sending them, and Stablecoin/NGN being the top trading pair (25.51%). They typically serve as a “digital anchor,” providing a means to transact throughout the globe, hedge against inflation, and offer more value.

When dissecting crypto earnings, users choose ETH since it’s cheaper to send and receive than Bitcoin (34.46%). The data also shows how 56.1% receive cryptocurrencies that are sent, placing Nigeria as Africa’s net receiver in the global crypto economy.

FOLLOW UP: Nigeria’s SEC and Quidax Host Powerful Blockchain Training Series

Furthermore, 40% of transactions fall within the 10−10−50 range, with 88.1% of users transacting at least monthly. Crypto earnings are a means to maintain purchasing power, with stablecoins being the go-to medium of conversion and withdrawal.

imagesource:Quidax

Nigeria’s Improved Regulations

Nigeria has had its fair share of bumps throughout its regulatory history, but in 2025 it’s steadily outpacing regulatory frontiers like South Africa. Regulators (SEC and CBN) now opt for complementary mandates and a “Sanction‑Free Invitation to Innovate,” reinforced by programs like the Acceleratory Regulatory Incubation Program.

The Investment & Securities Act 2025 provides the legal framework the industry had awaited. With 96.2% of users intending to use crypto more and a projected 29 million adopters by the end of 2026, momentum is strong. Users say the biggest unlocks are easier onboarding (22.14%), lower risk (21.67%), and clearer government support (18.42%).

The Quidax report provides a unique look into how Nigeria’s $57.11 billion trading volume is ironically dispersed throughout its entire population. Unlike global trends where institutional whales and high-net-worth individuals hoard most market trends, for Nigeria, it’s distributed, creating a wider sense of adoption.

Low-income crypto investors don’t attest to “overnight millions,” but they do showcase steady adoption and how digital assets are practical financial lifelines.