Table of Contents

TL;DR,

- The stablecoin stability myth is real: despite $300B circulating and 74.6% institutional volume, USDC fell to $0.8789 during SVB and Moody’s logged 1,914 depegs in 2023.

- Central bankers warn that digital assets lack true security; unlike insured bank deposits, stablecoin holders act as unsecured creditors vulnerable to issuer insolvency, fraud, and panic-induced bank runs.

- With USDT and USDC controlling 89% of supply, concentration amplifies balance‑sheet risk.

“Stablecoins are the “biggest misnomers” and “oxymorons. Stablecoins are not stable. They are only as good as the balance sheet of the person offering that stablecoin.”

A warning from the Reserve Bank of New Zealand Governor Adrian Orr regarding the hype over digital assets, particularly stablecoin. However, how true were his words about the stablecoin stability myth?

Today, over $300 billion in stablecoins are now circulating, and these tokens account for 74.6% of institutional crypto trading volume. Here is the claim, and whether or not he was right.

What Stablecoins Promise (and Who Controls Them)

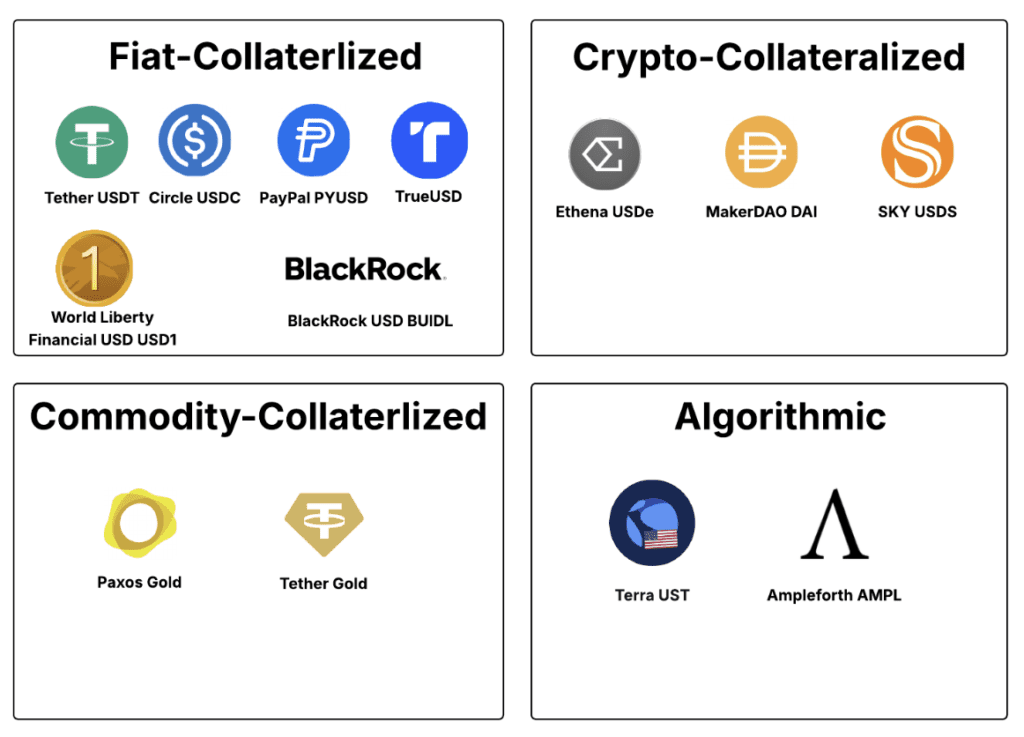

Stablecoins are a type of cryptocurrency that are meant to keep their value stable. Usually, they are pegged 1:1 to the U.S. dollar. Despite their broad use, they fall into main categories:

- Fiat-collateralized stablecoins (like USDT and USDC) claim to hold one dollar in reserves (cash, bank deposits, or short-term U.S. Treasuries) for every token issued. These account for approximately 95% of the $300+ billion stablecoin market as of late 2025.

- Crypto-collateralized stablecoins, such as DAI, need users to deposit volatile cryptocurrencies worth 150–175% of the stablecoin value. If the collateral value drops too low, smart contracts will automatically sell the positions. These crypto-collateralized stablecoins are often marketed as over‑collateralized and safer, but they are central to the stablecoin stability myth when collateral correlations spike.

- Algorithmic stablecoins attempt to maintain their peg through programmatic supply adjustments. This generally focuses on minting or burning companion tokens in response to price movements and with little or no traditional backing.

However, the market has greatly favored the fast-paced adopters, with Tether (USDT) commanding 63% market share ($184 billion), while Circle’s USDC holds 26% ($75 billion). Together, just two private companies control roughly 89% of the entire stablecoin ecosystem.

Types of stablecoin.[Source: Certik]

Adrian Orr’s Core Critique: “Only as Good as the Balance Sheet”

Adrian Orr’s look focuses on a fundamental question: What backs the promise of stability?

Here’s the pinnacle of the stablecoin stability myth: backed value. Stablecoins were an attempt to democratize mobile money with the power of blockchain.

Unlike bank deposits protected by government insurance (such as FDIC coverage in the U.S.), stablecoin holders are unsecured creditors of private companies. If the issuer’s balance sheet deteriorates through poor reserve management, fraud, or exposure to failing counterparties, the “stable” peg quickly loses its meaning. This is true for both crypto-collateralized stablecoins and fiat-collateralized stablecoins, and it directly shapes the answer to “are stablecoins safe investments?”

This has been a shared view across the industry. For example, the Bank for International Settlements said in its 2025 Annual Economic Report that stablecoins “perform poorly” as a mainstay of a monetary system. The Bank for International Settlements specifically cited stablecoins as failing in terms of singleness, elasticity, and integrity.

The European Central Bank identified the primary vulnerability as a “loss of confidence in redemption at par,” which can trigger runs reminiscent of 19th-century bank panics.

Reserve Bank of New Zealand Governor Adrian Orr

Academic researchers Gary Gorton and Jeffery Zhang framed it starkly: stablecoins fail the “no-questions-asked” test. True money is accepted at face value without users constantly checking the issuer’s financial health.

Stablecoins require ongoing due diligence that most retail holders never perform. This gap between perception and reality is at the core of the stablecoin stability myth and fuels confusion about are stablecoins safe investments for ordinary users.

The Other Side of the Stablecoin Stability Myth: When “Stable” Coins Broke

Orr’s warnings did come true at some point.

The Silicon Valley Bank Crisis (March 2023)

Circle’s USDC, one of the most regulated and transparent fiat-collateralized stablecoins, experienced a sudden crisis when Silicon Valley Bank collapsed. Circle had $3.3 billion (roughly 8% of USDC’s reserves) trapped at the failed bank.

USDC plummeted to approximately $0.8789 (a 12% loss) before recovering only after the U.S. government guaranteed all SVB deposits. According to S&P Global analysis, this represented one of the steepest depegs among major stablecoins.

USDC’s total supply shrank 9.1% as spooked holders redeemed en masse. DAI, a crypto-collateralized stablecoin, also fell below $0.90 due to its significant USDC backing. It was a domino effect, one that cost billions.

The Terra/UST Catastrophe (May 2022)

The algorithmic stablecoin TerraUSD (UST) was one of the biggest failures in the industry. UST had a market cap of $50 billion, but its algorithmic design, which used a mint/burn mechanism with its partner token LUNA, was very vulnerable to a loss of confidence.

The terra ust collapse.

CHECK OUT: Western Union’s USDPT to Launch on Solana, Accelerating Stablecoin Remittances Worldwide

From May 7 to 13, 2022, UST dropped from $1 to less than $0.10. LUNA’s value went up to almost nothing as the protocol tried to protect the peg by minting tokens. About $40–45 billion in value disappeared, and retail investors lost the most. Liu, Makarov, and Schoar’s research showed that experienced investors sold early, while less-informed holders who bought “the dip” lost a lot of money.

U.S. Treasury Secretary Janet Yellen cited the UST collapse when calling for comprehensive stablecoin regulation. This would ultimately lead to the 2025 GENIUS Act.

The Frequency of Instability

Moody’s Analytics kept track of depeg events, which are changes of 3% or more from the peg:

- 707 depeg events happened in 2022 across all stablecoins.

- In 2023, there were 1,914 depeg events, 609 of which were for major fiat-pegged coins.

- 2025: 9 events with more than 1% deviation, most of which were short-lived but showed that things were still fragile.

During the May 2022 crypto market stress, Tether (USDT) traded as low as $0.945, even though it has never dropped below $0.90 in major studies.

Three Risk Categories Behind the Stablecoin Stability Myth

Orr’s “balance sheet” warning encompasses several distinct risks:

1. Counterparty and Credit Risk

Fiat-collateralized stablecoins depend entirely on the issuer’s reserve quality and management. The SVB crisis demonstrated that even regulated issuers can have concentrated exposure to fragile counterparties.

Tether has faced persistent questions about reserve transparency, despite moving toward short-term U.S. Treasuries and becoming one of the world’s largest holders.

Regulation also causes some “issues.” In February 2023, New York regulators ordered Paxos to stop minting Binance USD (BUSD)—a fully backed stablecoin—due to compliance concerns.

BUSD began an orderly wind-down without a major depeg, but the incident proved one stablecoin stability myth: regulation rules all. For investors asking are stablecoins safe investments, this shows that legal and regulatory risk can matter as much as market risk.

2. Structural Vulnerabilities in Collateralization

Crypto-collateralized stablecoins are very volatile. MakerDAO’s DAI traded for well over $1 during the “Black Thursday” crash in March 2020. This decrease was because Ethereum’s price dropped, liquidation auctions didn’t clear as the network was too busy, and some users lost all of their collateral.

How do algorithmic stablecoins maintain price stability? In theory, through programmatic supply adjustments. However, practically, it’s been one failure after the next. Aside from Terra/UST, Iron Finance’s TITAN collapsed from $65 to near zero in June 2021, and Ethena’s USDe depegged to $0.65 in October 2025 amid leveraged liquidations.

A classic illustration that “synthetic” designs remain fragile and that the question “how do algorithmic stablecoins maintain price stability” often has a disappointing real‑world answer.

CHECK OUT: Wall Street Meets Crypto Street: Citi-Coinbase Deal Signals $4 Trillion Stablecoin Future

3. Systemic and Run Risk

The 2024 Annual Report from the Financial Stability Oversight Council said that stablecoins “continue to pose a risk to financial stability because they are very vulnerable to runs without proper risk-management standards.”

A working paper from the Federal Reserve Bank of Boston found that stablecoins act like money-market funds when they run. However, they have a discrete “break-the-buck” threshold around $0.99, below which redemptions accelerate dramatically.

Because major issuers hold hundreds of billions in U.S. Treasuries, a large-scale run could force fire sales that destabilize core financial markets. A concern repeatedly raised by the International Monetary Fund and European Central Bank.

Here’s the verdict on the stablecoin stability myth.

Are Stablecoins Safe Investments?

The answer depends critically on use case and risk tolerance:

For short-term transactions (moving funds between exchanges, facilitating cross-border payments), large, regulated fiat-collateralized stablecoins like USDC under the new U.S. GENIUS Act framework carry relatively low—but not zero—risk. They spend over 99% of the time within 1–2% of their peg under normal conditions.

As a store of value or investment, stablecoins have become a hailmary for most African investors. This is where the question “are stablecoins safe investments” becomes most urgent: historical depegs and collapses show that both crypto-collateralized stablecoins and algorithmic stablecoins can wipe out savings in extreme scenarios.

For yield-seeking through DeFi protocols or algorithmic models, the stablecoin stability myth becomes acutely dangerous. Terra, Iron Finance, and Ethena demonstrate that the promised yields frequently carry the risk of total loss, a fact that marketing materials often fail to highlight.

If you decide to keep stablecoins:

- Know what you have: Is it backed by fiat? Who is the issuer? Where can you check reserves?

- Spread your investments across different issuers: The 89% concentration in USDT/USDC makes the system more risky.

- Keep an eye on the peg: Use tools like CoinGecko or DeFiLlama to keep an eye out for changes.

- Have exit plans: Know how to redeem your points and be ready for possible delays when you’re stressed.

- Match duration to use case: Use stablecoins for transactions, not long-term savings.

Stability Requires More Than a Name

Adrian Orr’s characterization of the stablecoin stability myth cuts to the heart of a nearly $300 billion market built on a promise that historical evidence repeatedly contradicts. From USDC’s 12% plunge during the SVB crisis to Terra/UST’s total collapse, the record shows that “stable” is a design goal, not a guarantee.

Both crypto-collateralized stablecoins and fiat-collateralized stablecoins have, at different moments, failed to live up to their branding, forcing investors to confront are stablecoins safe investments in a far more skeptical way.

As regulators worldwide implement frameworks like the U.S. GENIUS Act and the EU’s MiCA, the industry may achieve greater stability through mandatory reserves, audits, and redemption rights. But Orr’s fundamental point remains: these are liabilities of private companies, not equivalents to central bank money.