Table of Contents

TL;DR

- Strike Africa launched in 7 countries using Bitcoin Lightning Network for instant remittances, targeting Nigeria’s 26 million crypto users amid the naira’s 50% February 2024 crash.

- The platform promises “zero-fee” transfers but applies variable FX spreads and faces serious regulatory risks after Nigeria blocked major crypto exchanges just weeks before launch.

- Users can send cross-border payments and trade BTC/USDT without learning crypto, but volatility, de-pegging risks, and potential banking restrictions require careful consideration.

When the Nigerian naira plummeted nearly 50% against the U.S. dollar in February 2024, millions of people watched their savings evaporate overnight. This very crisis is why most Nigerians opt for digital assets as a better alternative, and Strike Africa, a bitcoin-enabled payment platform, solves this exact need.

The best part is they promise they won’t force users to “learn crypto.” However, how true are these claims? Is it just headline bravado, or do their services actually live up to the marketing pitch? Here’s an unfiltered dissection of who Strike Africa is. How their services work and how to use them while avoiding the Bitcoin “risk” factor.

Understanding Strike Africa’s Value Proposition

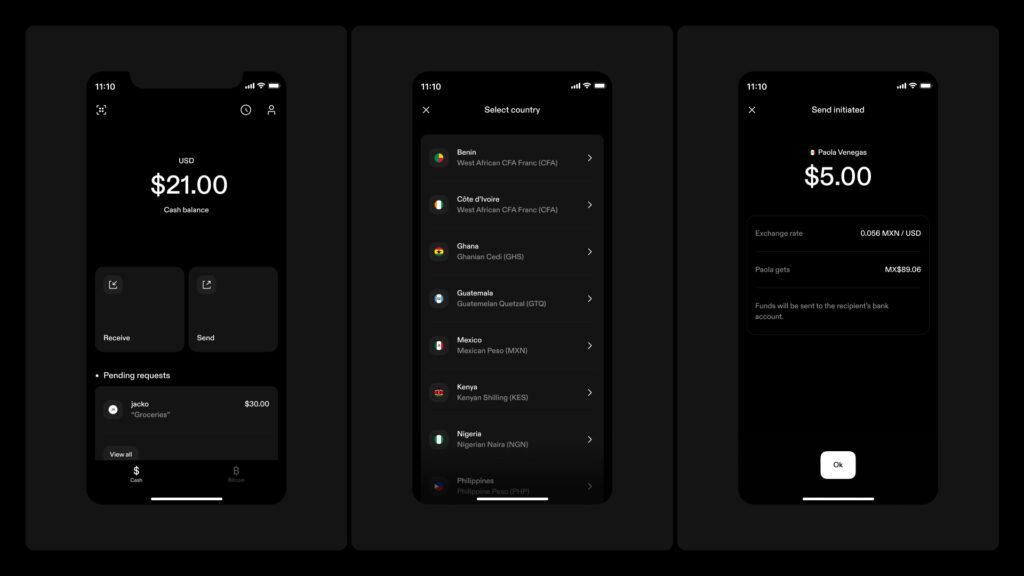

Strike Africa launched officially in February 2024 across Gabon, Ivory Coast, Malawi, Nigeria, South Africa, Uganda, and Zambia. Developed by Chicago-based company Zap and led by CEO Jack Mallers, the mobile app allows users to buy and sell Bitcoin (BTC) and Tether’s dollar-pegged stablecoin (USDT), send cross-border payments, and access local currency on-ramps and off-ramps.

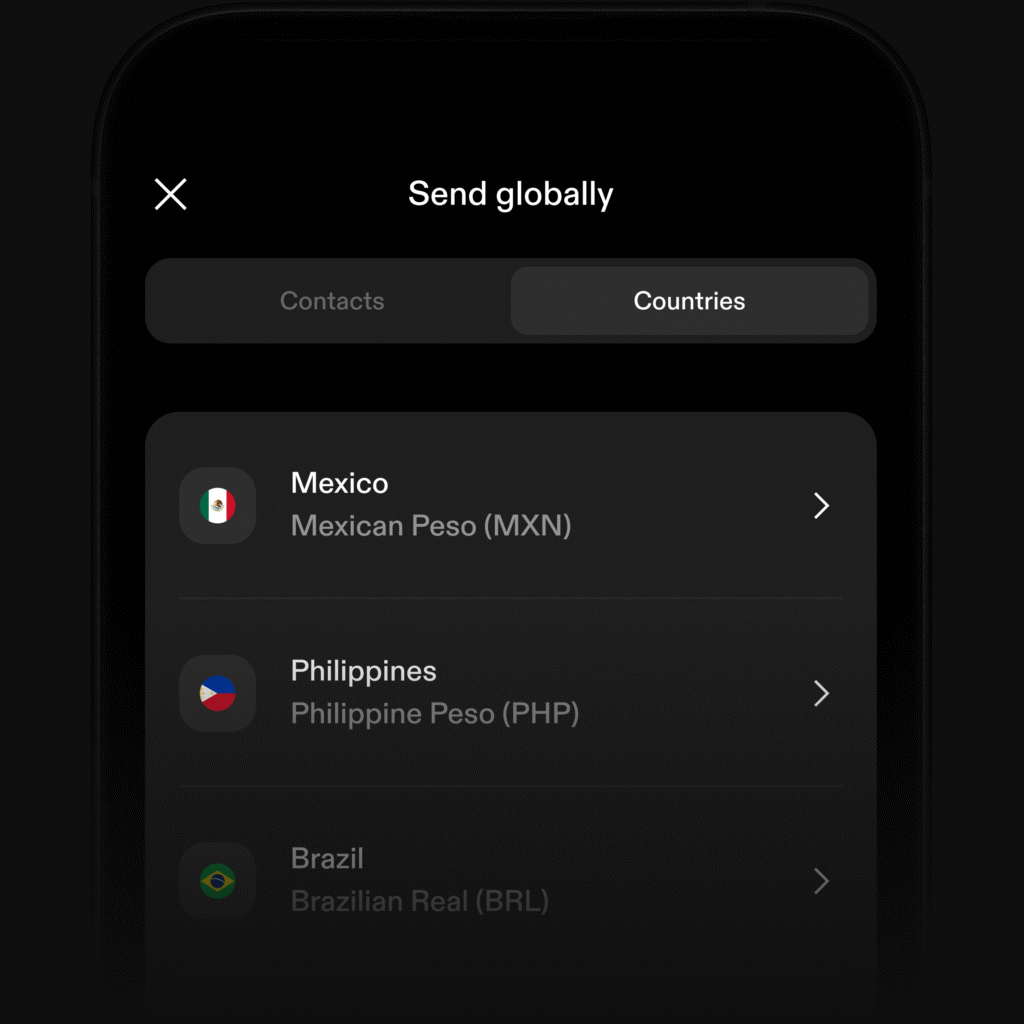

All these services are powered by the Bitcoin Lightning Network, a vital factor that places this particular application a notch higher. Strike’s game plan for Africa started in 2022 when the platform introduced “Send Globally,” letting U.S. users pay instantly to Nigeria, Ghana, and Kenya with local-currency payout. These very rails expanded to the Philippines in 2023, proving how Strike functions similarly to Venmo or Cash App but with Bitcoin rails underneath.

During a March 2023 demonstration at the Africa Bitcoin Conference, Mallers showed a remittance from the U.S. to a Nigerian bank account completing in approximately one minute—a stark contrast to traditional services that can take days.

A few months later (November 2023), Strike officially announced its launch for Gabon, Ivory Coast, Malawi, Nigeria, South Africa, Uganda, and Zambia. Now Strike Africa is the new look, but what do you get?

Under the hood: the Bitcoin Lightning Network

Some of the app’s core features include:

- Bitcoin and USDT trading: Users can convert local currency to BTC or USDT and back again.

- Lightning Network transfers: Instant, low-cost Bitcoin payments between Strike users globally

- Local currency integration: Direct connections to bank accounts and, where available, mobile money services

- Cross-border remittances: The “Send Globally” feature converts currencies on both ends while using Bitcoin as the settlement layer.

Strike routes value over Lightning; on the receiving end, funds convert into the recipient’s local currency (or USDT/BTC) via local partners and bank/mobile-money rails. Users don’t need to hold Bitcoin to use it.

During the app’s demo launch, Stroke Africa proved that it provides

- Speed/cost: Lightning enables near‑instant, low‑cost value transfer; on‑chain withdrawals (BTC/USDT) incur normal network fees.

- FX and pricing: Strike markets “zero‑fee” transfers but applies a variable spread on conversions. The exact spread is shown in the app at the moment of trade.

- Assets and networks: BTC and USDT are available; USDT primarily uses TRC‑20 (Tron) to keep network fees low.

- On/off‑ramps: Local bank transfers are primary; mobile money exists where supported. Availability is partner- and country-dependent.

Why this matters (and for whom)

The question is, your mind might be asking, why is this important? We’ll need to provide some context. In the world of digital assets, utility is basically the echoing factor in Africa. Bitcoin and USDT are used as hyperinflation hedges.

Practically speaking, Nigeria alone has over 26 million crypto users; the country ranks second globally in Chainalysis’s 2023 Crypto Adoption Index, which measures grassroots usage by ordinary people.

About 33.4% of Nigerian adults have engaged with digital assets, often as a hyperinflation hedge against the naira’s persistent devaluation. From July 2022 to June 2023, Nigeria recorded $56.7 billion in crypto transaction volumes—a 9% year-over-year increase despite regulatory headwinds. It’s warranted, especially with the 50% drop in February 2024. As Alex Gladstein noted that month, “Food prices have doubled in Nigeria… Fiat currency is broken.”

The story is quite similar in other regions: 40.3% in Ghana, 28.7% in Malawi, 11.1% in Zambia, and 6.0% in South Africa (World Bank; IMF forecasts remain elevated).

So for many, an average cost of 7.9% to send $200 is steep when an alternative only requires less than 1%, while still offering a hyperinflation edge and yield-bearing alternatives. Strike Africa comes in offering Bitcoin payments, and if the volatility scares you, USDT is a viable option.

What this means for senders and receivers

For senders (U.S./Europe):

- Check corridor support and expected payout method in‑app before sending.

- Compare the quoted FX rate and spread to alternatives.

- Start with small test transfers; confirm your recipient can cash out to a bank or mobile money quickly.

For users in Africa:

- Use Strike for global P2P and cross‑border inflows; convert promptly if you can’t stomach BTC swings.

- Short‑term USDT holding can stabilize day‑to‑day spending, but understand stablecoin risks and how to off‑ramp locally.

- If you’re wondering how to buy Bitcoin with naira using Strike: when NGN on‑ramps are available, you can link a bank account in‑app, review the spread, and purchase BTC/USDT—then convert back to NGN as needed.

Trade-offs and risks you should weigh.

Unfortunately, it’s not all rosy, especially when regulation comes into play. Strike Africa launched a week after the Nigerian government blocked access to major crypto exchanges, including Binance, Coinbase, and Kraken, and six days after Binance suspended all naira peer-to-peer trading.

Strike did partner with Bitnob, a Nigerian crypto firm, to establish local banking relationships, but this might fall in Nigeria’s “ban book.” If authorities decide to restrict Strike’s access to banking partners or telecom networks, the service could become unusable—potentially trapping users’ funds in a state of limbo between crypto and local currency.

Other launch countries present varied regulatory environments. South Africa is developing clearer crypto licensing frameworks through its Financial Sector Conduct Authority. Gabon and Ivory Coast, as CFA franc zone members, operate under regional banking authorities that have historically warned against crypto within formal banking systems. Zambia maintains a cautious, exploratory stance.

While Bitcoin payments do provide plenty of benefits, they’re still highly volatile. Mallers suggested volatility concerns were “in the past” during a 2023 bull phase, but any veteran can tell you Bitcoin plays by its own metrics. A remittance held in BTC can swing intraday. USDT reduces price swings but introduces counterparty and de‑pegging risk.

Getting started—safely

- Confirm your country corridor and payout options in the app. Availability varies and can change.

- Verify your identity (KYC) and link a bank account or mobile money if supported.

- Test a small transfer. Please review the quoted FX rate, the spread, and the recipient’s actual cash‑out experience.

- Choose where to hold value: local currency for simplicity; USDT for short‑term stability; BTC only if you accept volatility.

- Security basics: enable 2FA, beware phishing, and avoid off‑platform P2P deals. Keep only working capital in your app.

- Recheck conditions periodically. Regulations, partners, and fees can shift quickly.

Competitive context and the bigger picture

Traditional remittances to Africa are costly and often settle through European banks. Mallers cited IMF data indicating that historically, “just less than 90% of payments within Africa” cleared abroad, even for naira-to-rand transactions.

Strike’s mimics the model of industry success stories like M‑Pesa (50M+ users) and MTN MoMo (60M+ users) but bets on the competitive edge of using open networks (Lightning/BTC) and a fiat‑first UX. Whether that translates to sustained scale will come down to partner reliability, compliance, and corridor liquidity.

Used thoughtfully, Strike Africa could make cross‑border transfers faster and cheaper and give households a way to hold value in digital dollars or BTC between paychecks. But the upside sits alongside real regulatory, partner, and asset risks. Compare all‑in costs, start small, and keep your off‑ramp options open.