Table of Contents

TL;DR,

- Flatcoins are experimental digital assets designed to track the cost of living, currently holding a niche market capitalization under $200 million despite growing interest from leaders like Brian Armstrong.

- Unlike traditional stablecoins pegged to depreciating fiat currencies, these protocols use CPI oracles and algorithmic adjustments to preserve purchasing power, offering a theoretical shield against global inflation.

- While promising, the ecosystem faces significant hurdles including oracle manipulation risks, complex regulatory uncertainty under frameworks like MiCA, and low liquidity compared to established assets like USDC.

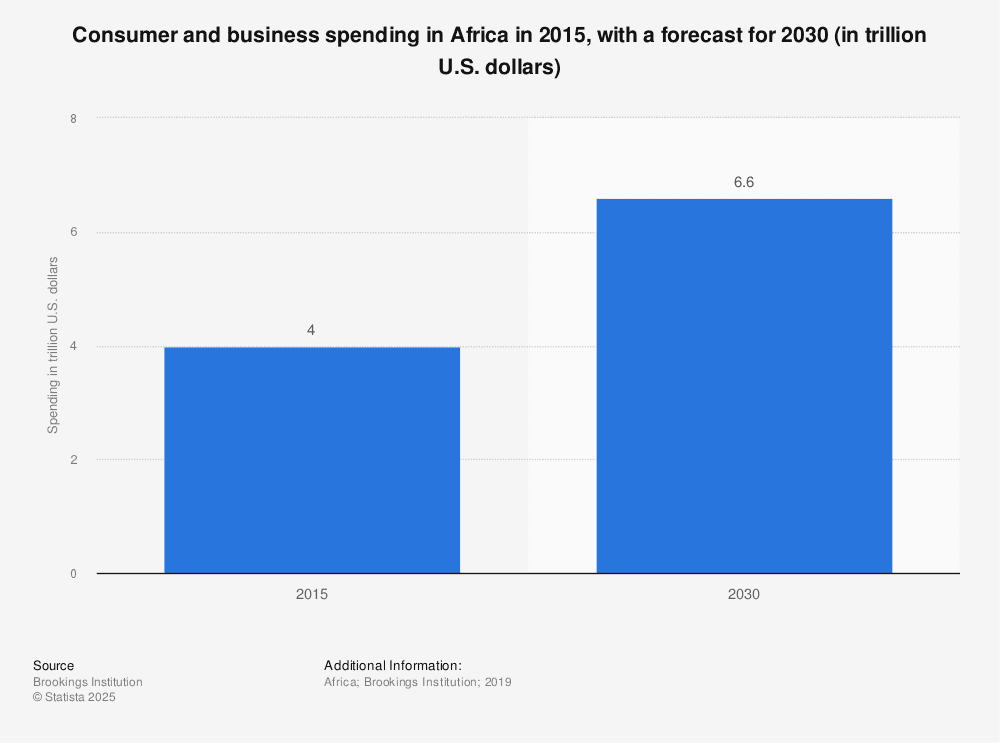

While stablecoins like USDC and Tether have become the backbone of Africa’s crypto ecosystems, they share a vital weakness: they lose real purchasing power as inflation erodes the dollar itself.

To answer this problem is a new invention, flatcoins, a new class of digital assets designed to track the cost of living rather than a fiat currency. This design focuses on preserving what its pegged asset can actually buy over time. Its notion is still experimental and a long way from reaching stablecoin’s $290 billion market, but they do raise compelling questions. Even crypto gurus like Ethereum’s Vitalik Buterin and Coinbase CEO Brian Armstrong have called it “the next iteration of stablecoins.”

What Are Flatcoins?

Flatcoins are inflation‑indexed assets that use oracles, collateral, and/or algorithmic adjustments to target stable purchasing power rather than a fixed $1 price. In layman’s language, they are pegged to cost-of-living indices, such as the U.S. Consumer Price Index (CPI), rather than to a fixed fiat value. According to CoinMarketCap’s definition, flatcoins aim to maintain constant purchasing power.

On June 7, 2021, former Coinbase CTO Balaji Srinivasan publicly tweeted the term “flatcoin” for the first time, stating, “Two kinds of stablecoins.”

Fiatcoins are pegged to an external fiat currency… Flatcoins are newer… A flatcoin optimizes instead for price flatness vs. an on-chain basket of goods.”

Like many new innovations in blockchain, it resonated especially in Africa, where economies see inflation spikes like Nigeria at 34.8% in December 2024, Egypt at 33.7% in July 2024, Kenya at 9.6% in 2023, and South Africa at 7.8% in July 2022.

In a December 2022 interview, Vitalik Buterin identified “inflation-resistant stablecoins” as one of three major innovations to crack in crypto, asking whether one could build a stablecoin that survives even U.S. dollar hyperinflation. In 2023, Brian Armstrong echoed this excitement, calling inflation-proof cryptocurrency “a better form of money in the crypto space” and saying that Coinbase was interested in investing.

How Do Flatcoins Track Cost-of-Living Indices?

How do flatcoins keep track of the cost of living index data, since algorithmic stablecoins depend solely on supply and demand (a design that failed when Terra collapsed in 2022)? It means putting together three things:

Real-world inflation data oracles: Chainlink or proprietary feeds bring CPI or other inflation indices on-chain for real-world inflation data oracles.

Collateral treasuries: Flatcoins are backed by reserves, which can be either fiat stablecoins (like USDC) or crypto assets (like ETH) that are kept in protocol treasuries.

Changes to supply or price: Protocols either change the amount of tokens in user wallets or the price of redemption to keep up with the index.

Three Primary Mechanisms

1. Basket of Assets with CPI Oracles

This is the most common approach. Protocols like the Frax Price Index (FPI) and Volt Protocol (VOLT) peg their tokens to the official U.S. CPI-U index using a basket of assets methodology. FPI, launched in February 2022, uses a specialized Chainlink oracle that posts monthly Bureau of Labor Statistics CPI data on-chain.

FPI’s redemption price changes whenever new CPI-U numbers come out. It goes up (or down) every month at the reported 12-month inflation rate. FPI was worth about $1.32 in late 2024, which was the same as the total amount of inflation in the U.S. since its peg date in December 2021.

The treasury of FPI has assets that pay interest. FPIS governance token holders get extra yield above inflation (seigniorage), and if there aren’t enough reserves, new FPIS tokens can be issued to make up the difference.

Basket of assets is not infallible:A basket

Pros: Transparent link to official inflation data and employs a relatively simple mental model.

Cons: Reliance on a single oracle creates a point of failure. Official CPI may not reflect lived inflation for all users, and liquidity in the underlying basket of assets must be sufficient for smooth redemptions.

2. Rebasing Supply with Proprietary Indices

Nuon (NUON), which deployed on Arbitrum in early 2023, takes a different approach to inflation-proof cryptocurrency. Users deposit USDC 1:1 to mint NUON, and the protocol uses a concept known as Truflation. It’s a proprietary, real-time CPI index aggregating millions of price points daily, rather than official BLS data. NUON’s supply rebalances continuously in holders’ wallets at Truflation’s daily inflation rate, so balances grow automatically.

Nuon calls itself “the world’s first decentralized and overcollateralized flatcoin.” Its treasury uses USDC in DeFi yield strategies to pay for the rebase. This lets people who own NUON earn “Truflation APY” as their balance grows.

Rebasing makes it easier to adjust for inflation automatically, but it also makes things more complicated:

Pros: No need to manually claim or redeem, and the mechanics on the chain are clear.

Cons: It relies too much on Truflation as a centralized data provider, which makes it possible for oracle manipulation to happen. There is very little liquidity right now, and DeFi yield strategies come with smart contract and market risks.

CHECK OUT: Western Union’s USDPT to Launch on Solana, Accelerating Stablecoin Remittances Worldwide

3. Tranched Collateral (Crypto-Native Approaches)

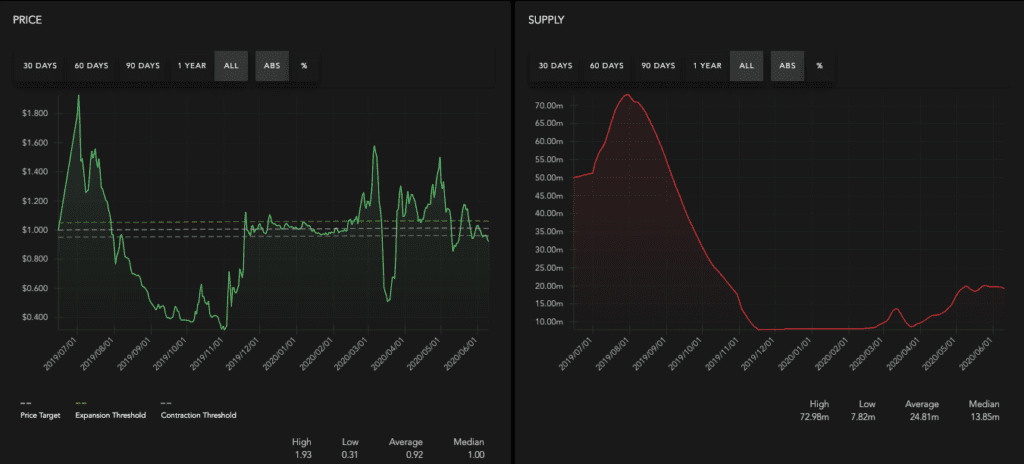

SPOT, built atop Ampleforth (AMPL), doesn’t use a direct CPI oracle. Instead, AMPL itself targets “2019 CPI-adjusted USD” through daily supply rebases. SPOT uses Buttonwood’s tranching protocol to split AMPL into senior (stable, lower-volatility) and junior tranches. SPOT holders own rotating claims on senior AMPL tranches, gaining exposure to AMPL’s long-run CPI target while dampening short-term volatility.

The price and supply of AMPL are incentivized to move in lockstep, but sometimes the market doesn’t agree (Source: Ampleforth)

SPOT is described as “low-volatility commodity money” that “bends rather than breaks,” with price volatility bounded between the 2019 CPI-adjusted USD floor and AMPL’s higher volatility ceiling. It has traded in a wide range (ATH $3–4, lows near $1), reflecting this design philosophy.

The Practical Story of Flatcoins

Flatcoins remain experimental. Total market capitalization across all projects is under $200 million, a rounding error compared to USDT or USDC. Some of the metrics include:

Frax Price Index (FPI): $96.8M fully diluted valuation and an 84.7M FPI in circulation at $1.14–$1.32.

Nuon (NUON): small, thinly traded, recently completed a security audit in August 2025, and is preparing v2 with yield-bearing innovations.

SPOT: $0.5M market cap and is highly illiquid.

Volt Protocol (VOLT): $76k market cap and is effectively dormant.

Flatcoins vs Stablecoins vs CBDCs: Understanding the Trade-offs

The difference between flatcoin and CBDC is fundamental:

Feature | Flatcoins | Fiat Stablecoins | CBDCs |

|---|---|---|---|

Peg Target | Cost of living / CPI | 1:1 to USD or other fiat | 1:1 to national currency |

Inflation Protection | Yes (in theory) | No; loses real value as CPI rises | No |

Backing | Crypto or stablecoin treasuries + yield | Fiat reserves, T-bills | Central bank liability |

Governance | DAO / protocol rules | Centralized issuer or DAO | Central bank + legislature |

Regulatory Status | Largely unregulated | Increasingly regulated (MAS, MiCA) | Fully regulated public money |

Censorship Resistance | High (if decentralized) | Low | Very low |

A stablecoin is a cryptocurrency that is issued by a private company and is often governed by a DAO. It is inflation-proof and aims to keep purchasing power stable.

The difference between a stablecoin and a CBDC is that a CBDC is a central-bank digital version of fiat that maintains nominal parity with the national currency but offers no inflation shield. CBDCs focus on legal enforceability, KYC/AML compliance, and monetary policy integration, goals that are the polar opposite of flatcoins’ permissionless, non-sovereign design.

Risks and Uncertainties for Users

There is a reason why these digital assets have remained experimental, and it’s mainly due to

Oracle Risk: Flatcoins depend on off-chain data (CPI-U, Truflation) delivered by oracles like Chainlink. If Oracle experiences failures, delays, or changes, the peg may break or become vulnerable to exploits.

Algorithmic Complexity: The Terra/Luna collapse in May 2022, when an algorithmic stablecoin lost its peg in a terrible way, has made algorithmic designs “a curse word” for many investors. Most stablecoins use collateral, but any reliance on making money or seigniorage adds risk.

Yield Strategy Risk: Projects like FPI and Nuon depend on DeFi yield to fund inflation adjustments. If yields go below inflation, reserves lose value, or governance tokens have to be split up.

Regulatory Uncertainty: Frameworks like the EU’s MiCA and Singapore’s MAS stablecoin regime (finalized August 2023) put a lot of emphasis on full reserves and redemption at par, which makes complex or algorithmic models less appealing. The Financial Stability Board’s review in 2025 found “significant gaps” in the rules for global stablecoins, leaving flatcoin issuers in a legal gray area.

CHECK OUT: We Built the Tooling We Wished Existed: The Infrastructure Powering Africa’s Stablecoin Boom

Liquidity: When markets are thin, there is a lot of slippage, and they are easy to manipulate. In 2023, Forbes columnist Steven Ehrlich said that flatcoins are worse than just holding USDC and traditional inflation hedges like Treasury Inflation-Protected Securities (TIPS) because they are too complicated and have risks on the blockchain.

An ambition that remained a mere ideal

Flatcoins are a bold attempt to solve a problem that stablecoins don’t: keeping real purchasing power in a world where prices are going up. Projects like FPI, Nuon, and SPOT want to be real inflation hedges by linking to CPI or cost-of-living indices instead of fiat. They are like TIPS bonds on-chain, but they can be used all over the world and combined in DeFi.

Flatcoins are still a niche experiment after four years, though. Adoption has been low because of the complexity, Oracle dependencies, thin liquidity, and the fear of Terra’s collapse. There are more rules and regulations around stablecoins, and the algorithmic features of flatcoins may come under more scrutiny.

In the end, flatcoins are still an ideal because they show the promise of a cryptocurrency that won’t lose value over time.