In recent months, Ethereum restaking has witnessed a dramatic drop in its total value locked(TVL), staggering by roughly 37% in just 6 months from its $18.6 billion valuation to just $12 billion by May.

In Brief

- Ethereum restaking TVL fell 37% amid fading airdrop incentives, prompting yield hunters to shift to Solana’s faster, cheaper DeFi ecosystem.

- Solana’s 65,000 TPS and $0.025 fees attracted $10B in DeFi TVL, outpacing Ethereum’s declining yields in Africa’s Web3 markets.

- Ether.fi’s dual-reward model and real staking yields highlight Ethereum’s potential to retain investors despite broader restaking sector declines.

Ethereum, the once reigning king of DeFi, has recently succumbed to competition from alternative ecosystems with faster, broader and more efficient services.

In this particular case, Solana DeFi TVL has surged tremendously, surpassing Ethereum by having the highest revenue in 2025.

Without further ado, let’s dive into the factors behind Ethereum’s liquid staking struggles and highlight the rise of the new King of DeFi, Solana.

Why Has Ethereum Restaking TVL Declined?

Ethereum TVL decline has become a focal point for analysts tracking the progress of the DeFi industry. What was once the leader of decentralized finance, particularly with its liquid staking protocols and restaking options.

Unfortunately, recent trends have showcased a substantial shift in user preference with Solana dominating the franchise.

According to data, the substantial decrease in these protocols’ TVL from $18 billion to $12 billion paints a broader picture of the advancements of ecosystems, with many offering cheaper alternatives with better services.

These new protocols are particularly preferred within Africa, given the vast difference in fiat currency value.

CHECK OUT: Solana dApp Revenue Dominance Signals New DeFi Era

Factors Contributing to Ethereum TVL Decline

At its core, several factors have contributed to the decline of Ethereum TVL, especially its reluctant restaking initiatives.

As per the data, the causes are a blend of fading airdrop incentives, risk management adjustments and competition from emerging chains like Solana, Avalanche and many more.

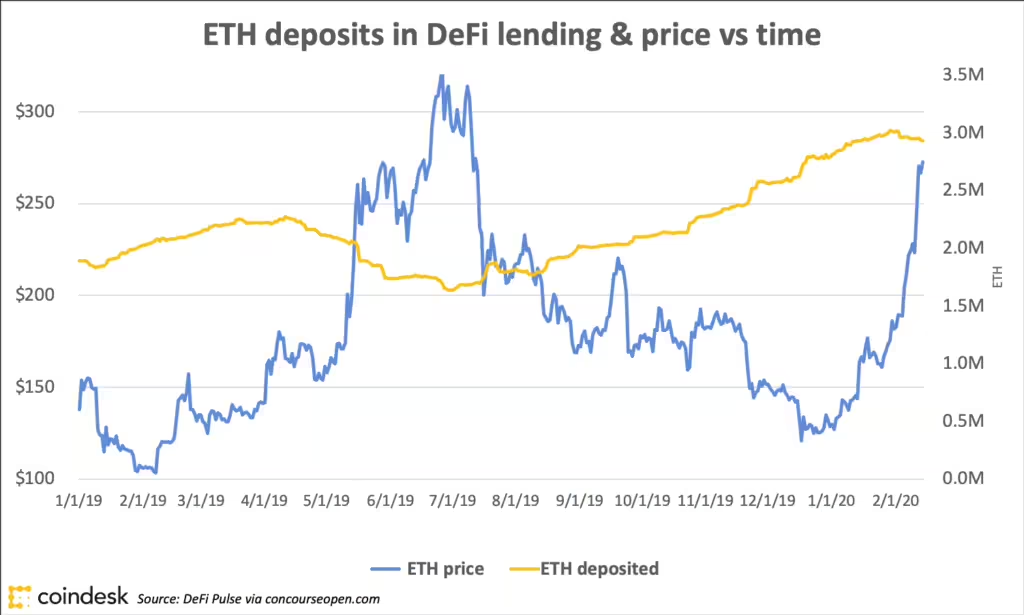

[Photo: CoinDesk]

The middleware protocol enabled ETH holders to restake assets for shared security across the decentralized applications.

Sid Powell, CEO of Maple Finance, stated in an interview;

“Early EigenLayer incentives and the model’s novelty drove the initial TVL boom. That speculative inflow naturally tapers once rewards stabilize or dry up”

Quite honestly, he was right on the money as EigenLayer’s TVL fell from 5.4 million ETH in June 2024 to 4.4 million ETH as deposit caps tightened to manage systemic risks.

In addition, the drop also reflected how initial capital influxes can wane once the initial excitement fades.

In hindsite it reflected the hype trend surrounding meme coins back in 2024, where an initial coin never heard of before skyrockets in the first two weeks before tanking to nearly zero.

Of course, this liquid staking protocol has some use cases, giving a bit more backbone than meme coins.

Willian McKinnon of Beluga notes that inflated TVL figures were driven by “airdrop farms”, many of which have dried out with yield hunters quickly changing targets to other short-duration, higher risk opportunities.

Other protocols that suffered similar fates include:

- Kelp: TVL dropped 10% from 615,000 ETH to 557,000 ETH.

- Renzo: TVL plummeted 61% from 1.04 million ETH to 387,000 ETH.

The Rise of Solana DeFi TVL as a Competitive Force

While Ethereum’s liquid staking protocols decline, Solana DeFi TVL exploded, showcasing a $10 billion growth driven mainly by decentralized exchange activities, Phantom Wallet hype even in Africa, Pump. fun’s meteoric rise and lending platform efficiency and low payment costs.

Furthermore, Solana’s high throughput of 65,000+ TPS and low gas fees of $0.025 is honey to any yeild seeker. DEXs such as Raydium and Jupiter have also showcased impressive trading volumes surpassing Ethereum;s activity.

The ecosystem is also well known amid the memecoin sectors with its ecosystems being te spotlight of the meme coin hype in 2024 hosting tokens like TRUMP.

Notably, Solanal’s DeFi staking yields have outpaced Ethereum’s by 5-7%, drawing capital seeking higher returns as more investors prioritize chain agility over brand loyalty.

The ball-game has now shifted as more ecosystems improve their performance and Solana provided the perfect ecosystem for African developers seeking to enter the game.

This difference, first appeared subtle but became a game changer in the long run.

CHECK OUT:Stateless Ethereum Node Cuts Storage Needs, Boosts Network Security.

The Role of Risk-managed Liquid Restaking Strategies

As the yield opportunities in Ethereum restaking decline, investors are staking a turn for risk-managed liquid restaking strategies to maximise the returns.

Ether.fi has defied the trend with its TVL skyrocketing from 44,000 ETH in January 2024 to 2.75 million ETH today.

This unprecedented growth is attributed to Its focus on ETH staking yields offering users real and tangible returns in markets while still offering cautious approach.

Furthermore, the ETHFI, a governance token, incentivises long-term participation, providing possible pans of a full banking suite.

In addition its Dual reward approach offered by its staking yield and points systems have retained users during its market downturns.

Powell commented;

“Ether.Fi’s rebound is notable, and most likely this is tied to their current focus on a strong community and real yield as they are one of the few protocols offering both points exposure and actual ETH staking yield, which makes them sticky in a risk-off market.”

The Future of Ethereum Restaking and DeFi Shifts

The Ethereum restaking sector’s contraction and Solana’s ascent highlight DeFi’s evolved cyclical nature.

While Ethereum rebuilds around sustainable models and its recently announced stateless node agenda, Solana’s blend of speed, novelty, and lower costs positions it as a formidable contender.

For yield hunters, diversification is key.

Allocate to risk-managed liquid restaking strategies on Ethereum while capitalizing on Solana’s high-octane opportunities—but always anchor decisions in long-term viability, not fleeting trends.