Table of Contents

TL;DR,

- South Africa’s FSCA warned against MMM Krypto, an unlicensed crypto scheme promising 24-36% monthly returns through aggressive social media campaigns.

- The scheme follows the blueprint of MMM Global, which defrauded millions across Nigeria, Zimbabwe, and Russia, causing billions in losses.

- Using USDT transfers and a “mutual aid” facade, the platform requires participants to pay others before withdrawing, a classic Ponzi structure.

Scammers are increasingly sophisticated, and digital assets have become their new ‘golden’ opportunity. South Africa’s Financial Sector Conduct Authority (FSCA) issued an official warning against MMM Krypto, a cryptocurrency-based scheme courting locals with “24–36% per month” returns.

The FSCA warning confirmed that MMM Krypto is not licensed under any financial sector law to provide financial products or services in the region and referred the entity to the National Consumer Commission for investigation.

While the name MMM might seem like an obvious link, MMM Krypto doesn’t have any direct relation to MMM Global. For the most part, MMM Krypto appears to copy the same high‑yield, referral‑driven strategy as MMM Global, without a direct corporate connection.

The FSCA Warning: What South African Regulators Found

The FSCA became aware that MMM Krypto was rendering financial services to members of the South African public through aggressive social media campaigns. According to the Authority’s official statement, MMM Krypto uses videos on YouTube, TikTok, and Facebook, combined with referrals, to encourage public participation.

The regulator’s primary concern centers on the “unrealistic monthly returns” offered to participants. In its press release, the FSCA stated:

“Without commenting on the business of MMM Krypto, the FSCA points out that offering financial products or services in South Africa requires authorization by the FSCA.“

Legitimate, traditional investment returns often range between 10-15% annually. The crypto boom has essentially skewed these figures offering veterans traders upto 150% returns. In reality, such returns depend on many factors and are far from guaranteed, but the belief that they are common is enough to fuel countless crypto Ponzi schemes.

CHECK OUT: United Front: SEC, CBN, and EFCC Form Alliance to Crush Crypto Scams

The warning came after a YouTube video called “MMM is back with a Big Bang,” which was reportedly filmed in Durban at an MMM Krypto rebranding event on December 7, 2023. The promotional materials touted the opportunity to earn up to 36% in referral bonuses, guider bonuses, and rank bonuses. This is typical scammer language that immediately raises red flags about its reliance on recruitment rather than genuine investment activity.

The Story of the MMM Scheme

MMM Krypto isn’t MMM Global, but there are some lingering ties to how both schemes lured in their victims. There are, however, some peculiar links to the MMM title. For instance:

MMM Global Nigeria (2015–2016): Approximately three million Nigerians lost N18 billion (about $60 million as of March 2017). The scheme facilitated $150 million in transfers per day at its peak before freezing accounts in December 2016. Researchers found that 41% of participants didn’t receive any returns at all. The participant who made the most money, on the other hand, made $765,000 in profit, which came entirely from the losses of later participants.

MMM Global Zimbabwe (2015-2016) affected 66,000 Zimbabweans when it froze accounts in September 2016 due to a decline in participant numbers. Upon unfreezing, members encountered a devastating situation: withdrawing would result in an 80% loss of their available funds. The scheme caused economic instability and widespread financial hardship.

The original MMM scheme, launched in Russia in 1994 by mathematician Sergei Mavrodi, defrauded between 5 and 10 million Russians, causing losses estimated between $50 million and $1.5 billion. Mavrodi was convicted of fraud in 2007, served his sentence, and relaunched the scheme as “MMM Global” in 2011 specifically targeting developing countries in Asia and Africa. He died in 2018, but the scheme continues under various rebranded iterations—MMM Krypto being the latest.

How MMM Krypto Operates: The Peer-to-Peer Illusion

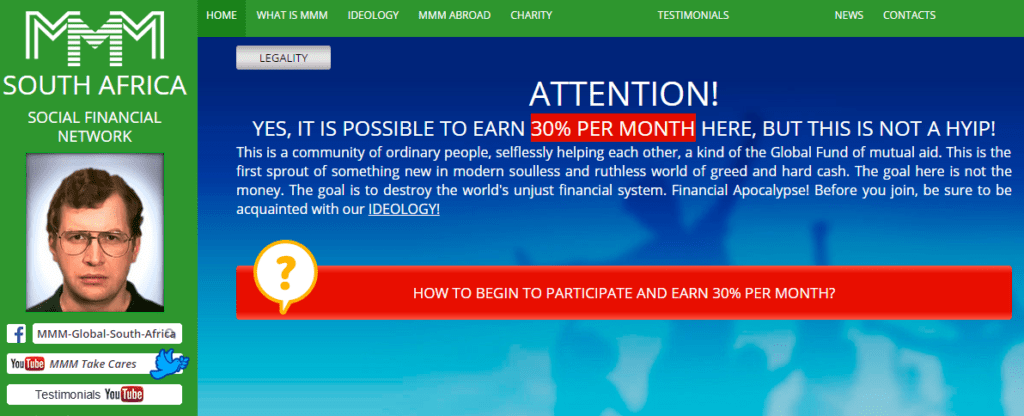

MMM Krypto describes itself as a “worldwide mutual aid fund,” a “financial social network,” and a “world people’s bank” that has “declared war against the banks and the FED.”

It’s basically fed off the desperation of low-income earners, hinting at a “fighting the system” narrative.

Its operational model involved:

- Create an account in the MMM Krypto “personal office” and click “provide help.”

- Your account is credited with “Mavro”—the system’s internal currency that grows daily from the moment of deposit.

- You can only request help after transferring funds to assist another participant—only then is your Mavro account “confirmed.”

- Orders to “provide help” arrive in your account, and failure to complete the order within 36 hours results in being blocked from the system.

- Transactions are conducted via Tether (USDT), one of the largest stablecoins by market capitalization.

CHECK OUT: Inside ISA 2024: How Nigeria Is Legalizing Crypto and Cracking Down on Ponzi Scheme Laws

This particular scheme was a crypto Ponzi scheme, with MMM Krypto claiming how participants could transfer USDT directly to each other “without intermediaries,” with MMM only regulating the process.

The main flaw was plausible deniability, an aspect of a peer-to-peer structure that made prosecution all the more difficult. However, the structure was still the same; early participants are paid exclusively from later participants’ deposits, not from any productive economic activity.

In bad taste, the organization’s official website displayed

“There are no guarantees or promises. And in general, you can lose all your money. Always remember this and participate only with spare money. Or do not participate at all!“

This disclaimer offers no legal protection to participants and serves primarily to shield operators from liability.

What This Means for South African Investors

South Africa is implementing a licensing regime for virtual asset service providers (VASPs), making it the first country in Africa to have a comprehensive regulatory framework that legally recognizes and oversees the digital asset sector. The FSCA ordered all VASPs to apply for a license by the end of November 2023 or face legal action. By December 2023, 128 companies had filed applications.

To no one’s surprise, MMM Krypto was among the many unregulated crypto firms. This means that if the platform collapsed or froze accounts (as MMM schemes have done repeatedly), you have virtually no legal avenue to recover your funds. The platform would face no capital requirements, audits, or consumer protection obligations.

Gerhard van Deventer, FSCA’s head of enforcement, noted that the new VASP regulations will help stamp out crypto crime in South Africa, with MMM Krypto being a prime example—”a scam originating in Russia that’s luring unsuspecting investors with promises of up to 36% monthly returns.”

Red flags typical of crypto Ponzi schemes

If you encounter a pitch that resembles MMM Krypto, watch for:

- “Guaranteed” or “no‑risk” returns of 24–36% per month or similar extraordinary claims.

- Requirements to “provide help” (pay in first) before you can withdraw.

- Strict payment windows (like 36 hours) that force people to make quick decisions and do less research.

- Referral, rank, and “guider” bonuses that reward hiring people instead of doing real business.

- The reasons for how profits are made are often unclear or subject to change.

- USDT peer‑to‑peer transfers that make tracing and recovery difficult.

- People often feel like they have to pay for training, upfront fees, or extra fees to “unlock” withdrawals.

Check the FSCA’s online database at fsca.co.za or call their toll-free number, 0800 110 443, to see if a crypto platform is real in South Africa. The FSCA must give permission for all legitimate financial service providers to do business.

Industry experts like Cédric Jeannot, CEO of the digital bank Be Mobile Africa, and Christo De Wit, country manager for South Africa at Luno exchange, have praised the VASP licensing system as a way to prove that crypto businesses are real and a necessary step to separate regulated platforms from scams like MMM Krypto in South Africa.