Stablecoin investment in Africa has gone from a trend to a necessity to combat hyperinflation markets. Currency devaluation ranks among the top enemies for any daily business operations.

For instance, Zimbabwe’s 85.7% inflation rate resulted in ZiG, a gold-backed currency, to plummet over 50%.

-

Stablecoin investment offers African individuals and businesses a reliable hedge against hyperinflation, currency devaluation, and capital erosion.

-

Using stablecoins like USDT or USDC provides low-cost, global financial access for savings, remittances, payments, and investments.

-

Success in stablecoin investment requires education, secure wallets, regulatory awareness, and smart integration into business operations.

South Sudan didn’t fare any better, projecting a three-year cumulative inflation of 5345 by the end of the year. Nigeria and Malawi grapple with a similar scenario, albeit less dire.

With the relentless erosion of purchasing power, a digital tool offers a lifeline to most upcoming African youths: stablecoin.

Understanding the Stablecoin Shield

Unlike cryptocurrencies, whose value is attached directly to their demand, stablecoins do what it was named for: stability.

To achieve this, these digital assets peg their value to reserve assets, most commonly the US dollar(USDT or USDC). However, recent advancements have led to various stablecoins pegging to commodities like gold or BTC(USDB).

This attribute makes them uniquely suited as a stable store of value and a reliable medium of exchange, especially in Africa.

The benefits of stablecoins vs local currency volatility are stark and immediate for entrepreneurs.

For starters, it preserves capital shielding from overnight devaluations. When fiat value fluctuates daily, converting earnings into stablecoin acts as a crucial hedge.

photo:Emurgo

When the unit of account is stable, setting prices for goods or services becomes more feasible, promoting long-term contracts and financial planning gains meaning.

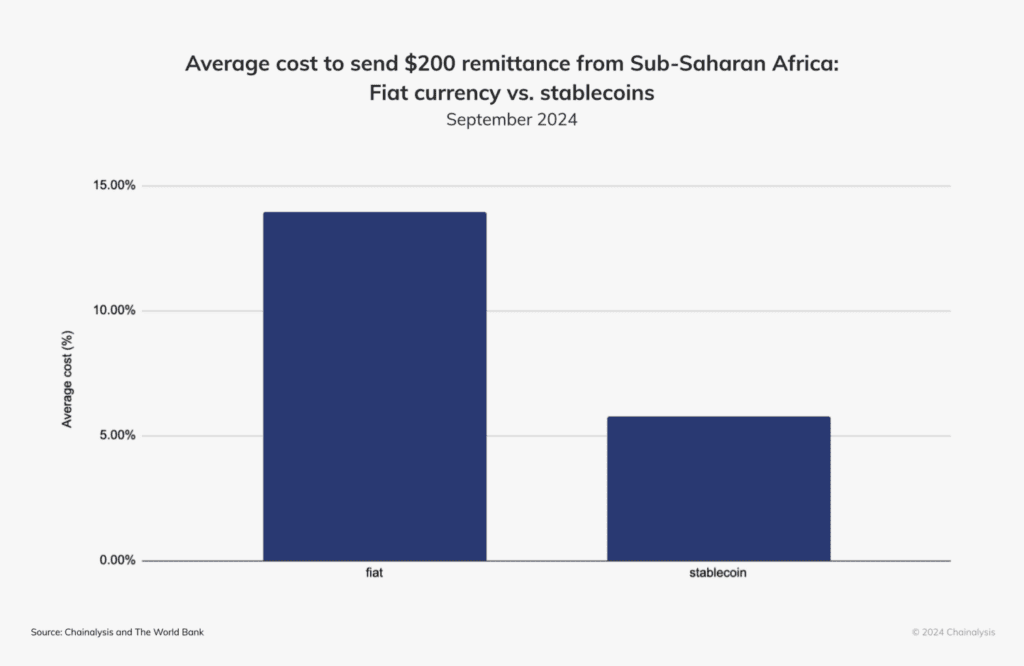

A major plus for stablecoins is its international access while leveraging blockchain’s near-instantaneous, low-cost transfers.

When compared to traditional outlets, stablecoin remittances slacks cost by 60% while opening doors to a global customer base comfortable with digital payments.

In addition, it provides enhanced liquidity and savings, with many providers offering yield-bearing opportunities.

Stablecoin Adoption in Africa: From Niche to Necessity

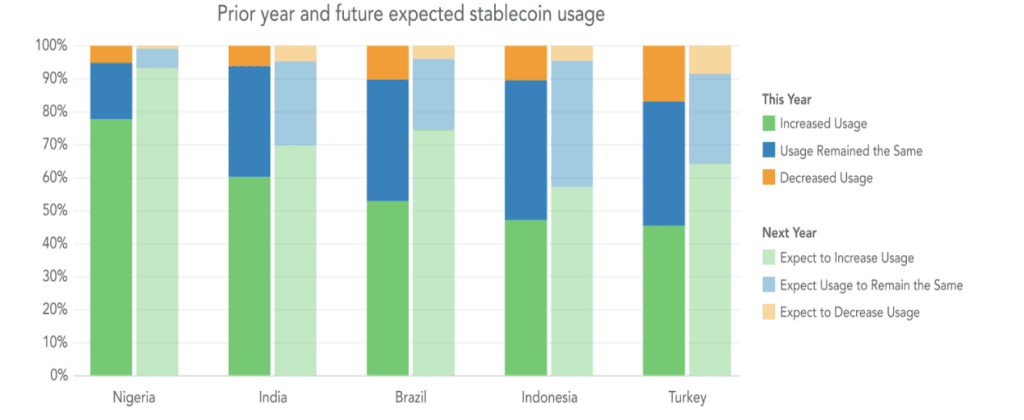

The data speaks for itself; stablecoin adoption in Africa is through the roof, accounting for 43% of the total crypto transaction volume.

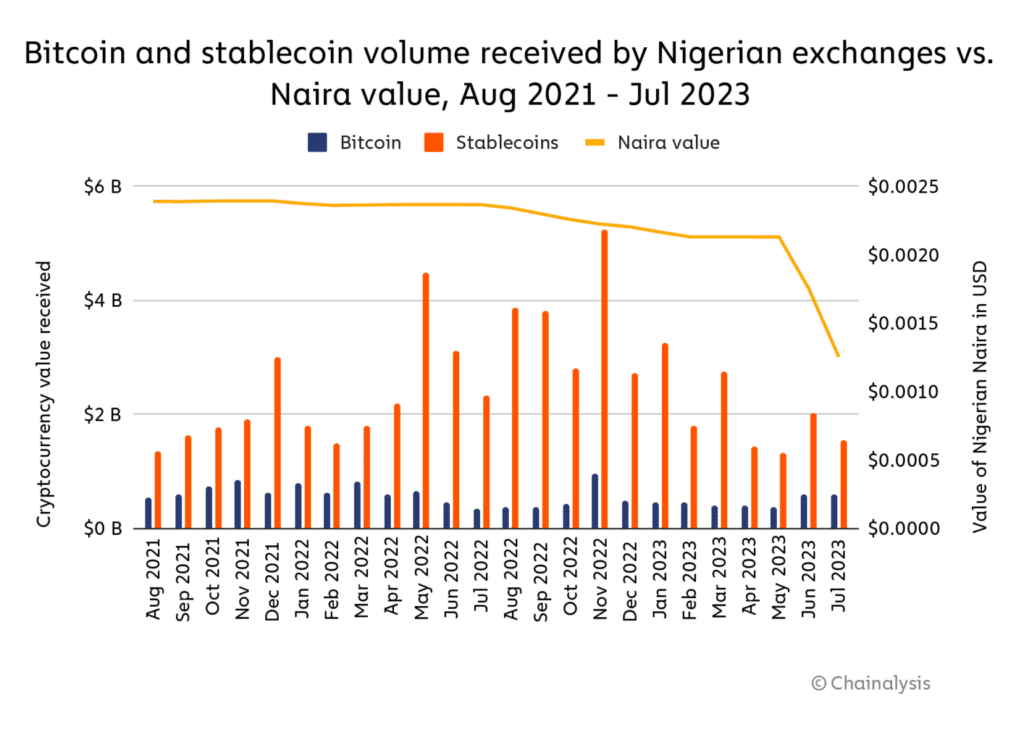

Nigeria, Africa’s largest crypto economy, recorded over $21.8 billion in stablecoin transactions in 2024, recording $3 billion in Q1 alone.

Mainly, transactions under $1 million have dominated this figure, but South Africa has showcased growing institutional interest. Even in Ethiopia, now facing inflation challenges, stablecoin usage spiked as devaluation loomed.

Photo:Emurgo-Africa

This adoption isn’t abstract. Entrepreneurs pay Chinese suppliers in USDT to avoid cash-based bottlenecks and FX scarcity. Freelancers opt for USDT/USDC for payments, and families no longer rely on bank transfers to send over finances.

The success of platforms like Yellow Card, Conduit, Busha and Flutterwave are testaments to this growth.

Practical Hyperinflation Strategies with Stablecoins

Knowing why stablecoins help is step one. Implementing them effectively is the survival tactic. Here’s a practical guide:

Education is Foundational:

Before diving in, heavily research different stablecoins(USDT, USDC, and DAI are major players). Gain insight into their backing mechanism (fiat-collateralized is most common and stable) and how blockchain transactions work.

Secure Your Digital Vault: Choosing Stablecoin Wallets:

Your stablecoin wallet is effectively your bank.

Security is paramount, so it’s best to go for reputable, non-custodial wallets. where you control the private keys) like MetaMask, Trust Wallet, or Ledger (hardware wallet).

Don’t botch on security; this is your money; hence, enable all available security(strong passwords, two-factor authentication, biometrics).

Understand the difference between “hot” wallets (connected to the internet, convenient for frequent transactions) and “cold” storage (offline, highly secure for savings).

Acquiring Stablecoins: How do you get them?

We highly recommend using local exchanges for better services like Yellow Card, Busha, Quidax, Luno, or Binance Africa (where available). These often provide local currency converts, making it easier to buy stablecoins.

Peer-to-peer platforms like Paxful allow direct buying/selling with other individuals but tread carefully, use escrow services, and verify counterparty reputation.

For business owners, integrating stablecoin payment gateways is a sure way to diversify and secure your payment services.

Integration into Business Operations:

This is where resilience is built.

When dealing with international suppliers, go for stablecoins; they directly bypass banks and FX hassles and open doors internationally.

photo:Chainalysis

Holding a significant portion of your operating capital and savings in stablecoins projects against local currency collapses and can explore yield-generating options. However, caution is highly advised.

Using stablecoins as a reference point for pricing, especially for imported goods or services with international cost bases.

Risk Management is Non-Negotiable:

Keep in mind that various factors have to be accounted for, such as the regulatory landscape.

Each region has its own set; while South Africa, Nigeria and Kenya are proactive, others might differ, so seek local legal advice before jumping in.

As mentioned earlier, using reputable exchanges and custodial services will save you a lot of hustle. Using such services often gives you added pointers on how to use stablecoins during hyperinflation effectively.

Treat your wallet credentials like gold. Never share private keys. Use hardware wallets for significant holdings. Beware of phishing scams. Secure your devices.

Ensure you can convert stablecoins back to local currency when needed via reliable exchanges or P2P channels. Test liquidity before committing large sums.

Building Resilience in the Storm

Stablecoin adoption in Africa has steadily become one of the rising hyperinflation strategies, proving to be a pragmatic survival tool.

Some of the best stablecoins for unstable economies include USDT and USDC, aiding millions in reliable transactions domestically and internationally.

At the same time, local currencies tend to fail. Stablecoins remain an alternative, especially given the recent surge in numbers.

Although facts remain, stablecoins aren’t a magic bullet but a part of a diversified financial strategy providing a powerful hedge.

Stablecoin investment requires careful education, robust security practices, diligent risk management, and regulatory awareness.

Africa’s fintech ecosystem is rapidly evolving, and nations have gotten a whiff of this trend, with many gearing for better regulations.

Initiatives like cNGN spark interest within other nations, showcasing that even African nations can take a swing at providing stability.

In a continent where resilience is second nature, stablecoin investment is proving to be a powerful alternative for growth, global access, risk mitigation and profit.