TL;DR,

- Eversend fintech, a capital-efficient African payments startup, processed over $230M with just $1.2M in funding by focusing on strong unit economics, achieving a 62% gross margin and a 19:1 LTV/CAC ratio.

- The platform evolved from consumer remittances to essential B2B infrastructure, using stablecoins to settle cross-border payments in minutes for African businesses at a fraction of traditional costs.

- By building proprietary systems and navigating complex regulations across seven countries, Eversend demonstrates sustainable scale in African fintech without relying on massive venture funding.

When Stone Atwine needed to send money to his grandmother in rural Uganda, he discovered what millions across Africa already knew: cross‑border money transfers cost way too much. In some corridors, fees can reach 30%+ of the principal, and recipients often travel hours to collect cash at agents for networks like Western Union. That personal frustration led to the 2017 founding of Eversend fintech, a Kampala- and Paris-based startup that has since processed over $230 million in transactions across seven African countries—on total funding of just $1.2 million.

Here’s the twist: Eversend fintech didn’t rely on spending millions on marketing, yet they achieved 1 million customers.

“We operate with a maniacal focus on unit economics. If the metrics indicate a poor return on investment, we don’t hesitate to cease expenditure.”

The result was a 62% gross profit margin in 2021 and a customer lifetime value-to-acquisition cost ratio of approximately 19:1 (LTV $170, CAC $8.80).

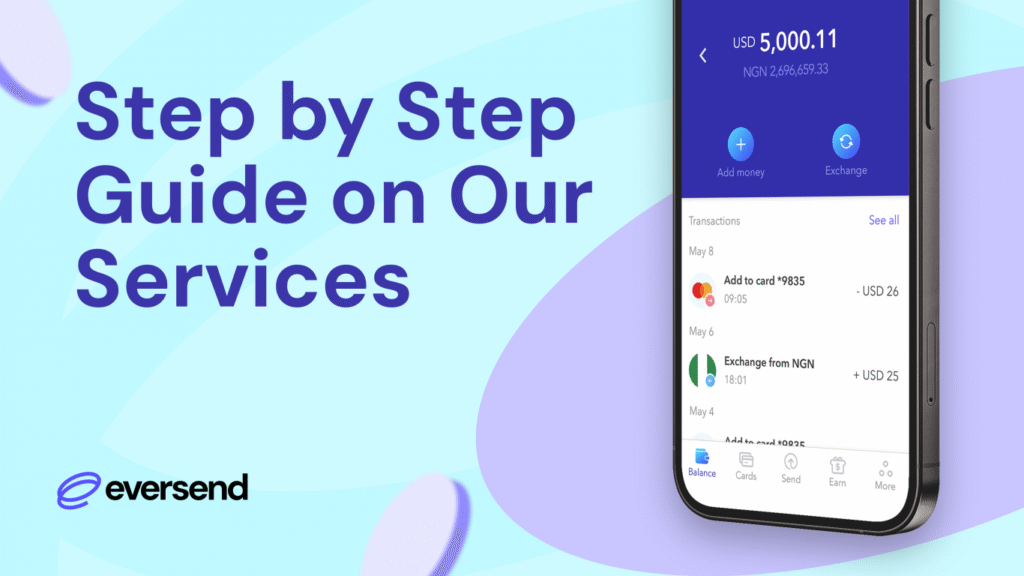

How Eversend Works: The Multi-Currency Infrastructure

Eversend fintech operates as an all-in-one platform integrating services that typically require multiple providers:

Multi-currency digital wallets hold seven currencies simultaneously (USD, EUR, GBP, NGN, KES, UGX, RWF), enabling users to switch between them at real-time exchange rates without repeated conversion fees. This makes access to international transactions cheap and within a few clicks.

Virtual cards for African businesses and consumers solve the inability to pay for global SaaS subscriptions (Netflix, AWS, Zoom) or make international purchases. Eversend issues virtual US dollar cards for a $1 creation fee and $1 monthly maintenance, plus roughly a 3.5% FX margin on non-USD spending. According to one user (Nelson Osoro), who discovered the platform in 2022, these cards provided “guaranteed security for your funds” with “no worry of chargebacks from your client.”

Cross-border money transfers integrate directly with mobile money platforms. Think of MTN Mobile Money, M-Pesa, and Airtel Money having access to your business transactions at a much cheaper transaction fee of 2.5-4%. It’s a big gap, especially with traditional operators charging 15-20%, eliminating the dangerous bus rides Atwine’s grandmother once took to collect Western Union payments.

Finally, access to digital assets (Bitcoin, BNB, and USDT) remains its most sought-after feature. This feature launched in late 2021, starting with stablecoins in Uganda, eventually expanding through a 2022 partnership with Binance.

From Remittances to B2B Crypto-Fiat Settlement

Eversend’s most consequential evolution came in 2022–2023 when the company launched B2B crypto-fiat payments infrastructure.

“We stopped focusing solely on migrants sending money back to grandma and started focusing on people doing higher volumes, businesses, and traders. That is where the real volume is.”

Atwine stated in an interview.

The Crypto-Fiat API allows businesses to settle cross-border money transfers using stablecoins (USDC/USDT), while end-users receive local fiat currency in minutes. A norm in the crypto space, while traditional SWIFT transfers take days.

This generally means a European company can send stablecoins, and Eversend settles Nigerian naira or Kenyan shillings to the recipient’s mobile money wallet nearly instantly.

Complementary Collections and Payouts APIs enable African merchants to accept payments in local currencies and settle in USD or stablecoins (hedging against currency devaluation), while the Payouts API handles bulk disbursements to mobile money wallets across the continent.

Rather than battling it out with veteran fintechs and banks, Eversend fintech opted to become the middleware between global crypto liquidity and Africa’s mobile-money-dominated payment rails. Today its fintech banking solutions have transformed it into what most operators call a “clearinghouse for cross-border trade using crypto rails.”

Capital Efficiency as a Competitive Moat

Building any B2B crypto-fiat payment system requires heavy backing. Chipper Cash raised over $300 million, and most local fintech banking solutions raise between $20M and $50M+. Eversend only got $1.2 million in total funding (as of 2023, with total disclosed funding around $1.5M–$2M).

In the end the platform managed to achieve 500,000 active users by 2023, and when asked what his secret was, Atwine had a few enlightening strategies.

Revenue-first philosophy: Rather than subsidizing users with “free money” promotions common among competitors, Eversend focused on foreign exchange services with substantial margin potential from day one.

Lean operations: The company operates with just 25 team members as of 2023, maintaining a major Kampala office supplemented by co-working spaces in Lagos, London, and Paris rather than expensive headquarters.

Crowdfunding validation: The May 2020 Seed campaign raised £706,000 within two days, exceeding its target and creating a community of stakeholder-investors. As Atwine explained:

“It brings our supporters and users closer to us by making them stakeholders in the business. When we win, they win.“

Proprietary infrastructure: During 2021, Eversend reduced dependence on external core banking rails, building proprietary systems that lowered per-transaction costs.

Transaction volume growth tells us how this approach paid off. In 2019, the fintech achieved $800,000, steadily moving to $5.2 million (40,000 users) in 2020 and $230 million (62% gross margin and 500,000 downloads) in 2021. The cumulative growth exceeded 28,000% over three years. Volumes for 2024 remain undisclosed but are described as “multifold growth” driven by the B2B segment.

What About Regulation? What’s the story behind navigating Africa’s fragmented regulatory maze?

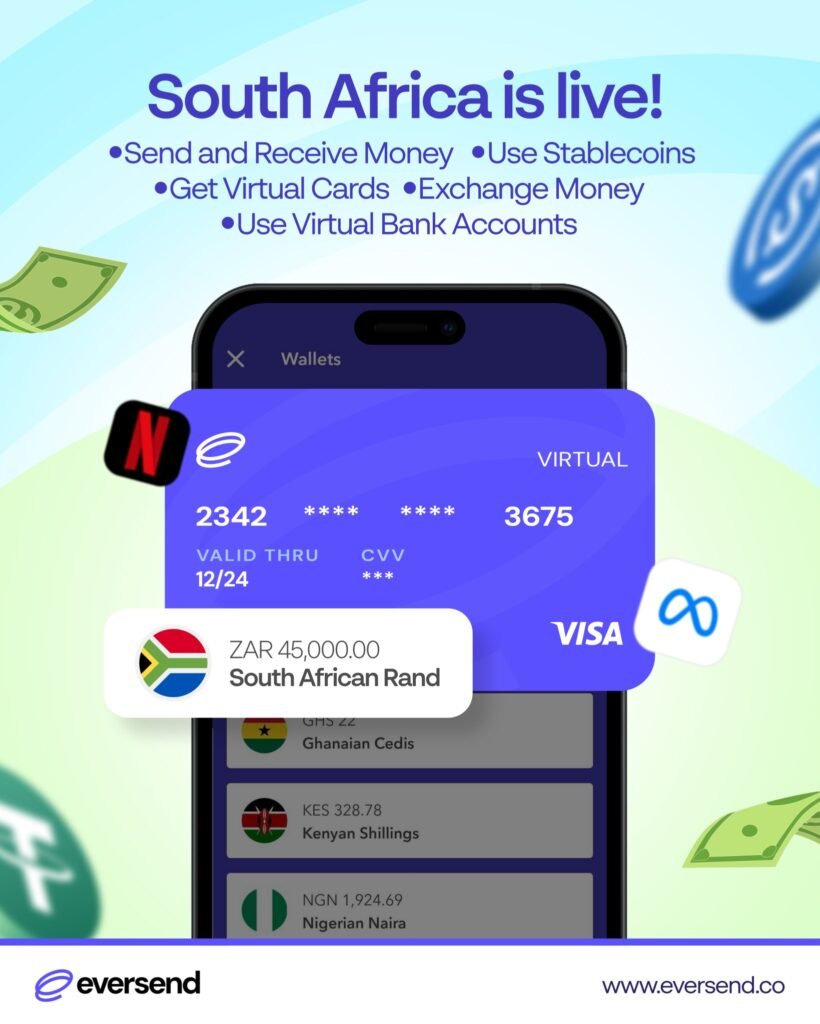

Operating fintech banking solutions across seven African countries (Uganda, Kenya, Rwanda, Nigeria, Ghana, Cameroon, and Zambia) plus UK/European corridors requires navigating fragmented regulatory frameworks. Eversend fintech deliberately chose compliance over speed.

In Uganda, the company secured a money lending license from the Uganda Microfinance Regulatory Authority (UMRA) by 2020. By late 2021, it had obtained a money service business registration in Canada and initiated license applications in five additional countries. The company is registered as a Money Service Business (MSB) with FinCEN in the US, essential for processing USD.

However, it came as no surprise that Nigeria was its largest opportunity and greatest regulatory complexity. The Central Bank of Nigeria (CBN) lifted its crypto ban in December 2023, while the SEC introduced new rules for Virtual Asset Service Providers (VASPs) in 2024/2025. Eversend operates via partnerships with licensed banks and is positioning for VASP compliance to legally process B2B crypto-fiat payment flows.

This means extremely high legal costs across multiple jurisdictions, ongoing compliance obligations for KYC/AML, and the constant risk of regulatory changes that could restrict business models. The company ultimately chose to focus on “regulation and compliance in the latter half” of 2021.

The Good, the Bad, and the Regulatory Nightmare for SMEs and Traders

Eversend’s B2B infrastructure solves three long-standing problems for small and medium-sized businesses that do business across African borders:

Speed of payment: It can take 5 to 10 business days for a bank transfer between African countries. Eversend’s stablecoin settlement cuts this time down to minutes.

Cost predictability: The average cost of cross-border money transfers in Sub-Saharan Africa is 8%, which is the highest in the world, according to World Bank data. Some corridors have rates as high as 31%. Eversend’s 2.5–4% fee structure offers big savings on volume.

Currency hedging: The Collections API lets merchants accept local currency but settle in USD or stablecoins. This protects them from the devaluation that happens to many African currencies. A Nigerian exporter selling to Kenya can invoice in Kenyan shillings (accessible to the buyer) but receive settlement in USDC, then convert to naira or hold in dollars—all within one platform.

There are some risks involved as well. For instance, managing multi-currency liquidity and spreads across volatile currencies is complex, especially at scale. Furthermore, the company’s rail dependencies, like mobile money and banks, can experience policy shifts, which could switch up their approach entirely.

Sustainable Scale in African Fintech

Eversend fintech demonstrates that African fintech banking solutions can achieve meaningful scale without Silicon Valley-style blitz-scaling. The company’s $1.2 million to 1 million users trajectory offers a counternarrative to the “raise big, spend big” approach that has left many African fintech startups pre-revenue despite massive funding.

For this fintech, the story is more of a need transforming into a million dollar-dollar company that focuses on efficiencies over anything else.