Table of Contents

TL;DR,

- Opera MiniPay reached one million users in under five months across Nigeria, Kenya, and Ghana, enabling phone‑number stablecoin transfers with fast, sub‑cent fees on Celo.

- Embedded in Opera Mini, this self‑custodial wallet mimics mobile money UX to move dollar stablecoins via phone contacts—ideal for small, frequent, everyday payments.

- Utility meets trade‑offs: easy, low‑cost transfers versus self‑custody recovery risks, potential stablecoin depegs, regulatory uncertainty, and reliance on partners for on/off‑ramps.

Opera MiniPay, a self-custodial stablecoin wallet integrated directly into the Opera Mini browser, just broke the milestone of one million users in five months.

Announced at the Africa Money and DeFi Summit in Nairobi, this particular blockchain-based payment tool is living proof that utility always trumps any other factor in Africa. Here’s a breakdown of how it works and why 1 million users decided it was far better than the rest.

What Opera MiniPay Is and How It Works

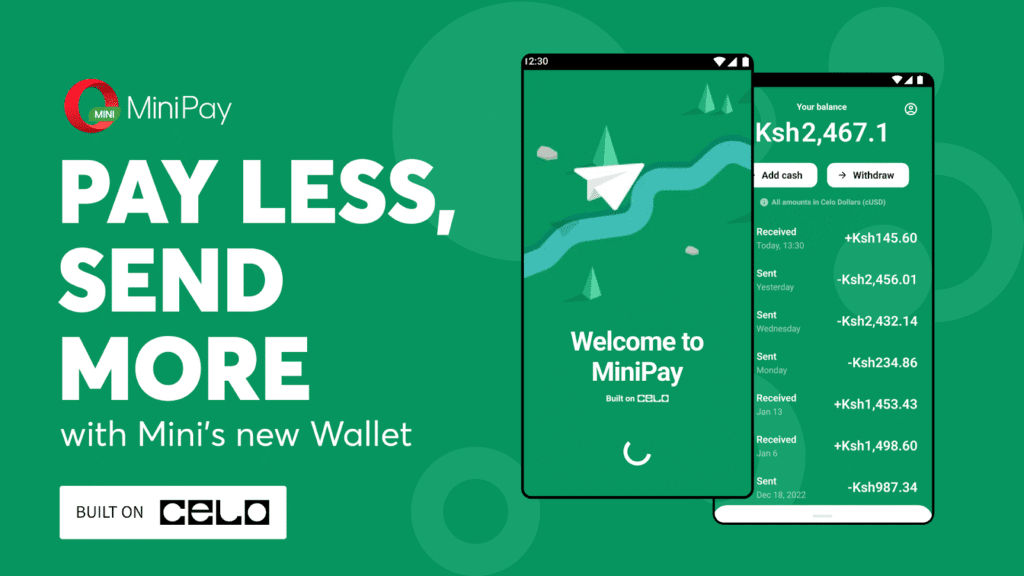

Opera Minipay first debuted on September 13, 2023, as a blockchain-based payment wallet built on the Celo blockchain and embedded into the Opera Mini browser. The platform focused mainly on mobile payments, working primarily on Android phones.

Often described as the Opera Mini mobile payment wallet, users can send and receive dollar‑denominated stablecoins using mobile numbers rather than long crypto addresses. This approach provides a feel similar to local mobile money apps while remaining non‑custodial.

The mobile payment wallet is

- Built by Opera in collaboration with the Celo Foundation and Mento Labs.

- Uses Mento’s cUSD (and later also USDT/USDC), with on‑ramps via FiatConnect‑compatible partners.

- Non‑custodial keys with a familiar Web2 recovery flow (Google Account/Drive backup).

According to Charles Hamel, Product Director at MiniPay:

“The MiniPay wallet has been designed to be intuitive for users of all experience levels… simply by using mobile phone numbers.”

MiniPay is a lightweight, self-custodial stablecoin wallet developed by Opera and built on the Celo blockchain, which initially used cUSD (Celo Dollar).[Photo: Minipay]

Why adoption reached 1 million so quickly.

In under five months and within only three initial markets, Nigeria (the launch market), Kenya, and Ghana, Opera Minipay broke previous records, attaining 1 million active users. From the model and features, this payment system focused on an M-Pesa or MTN Momo feel.

In Africa, mobile money is a predominant financial rail, with many leaning on its ease of use. Opera’s stance as an “unregulated software product” has contributed to its growth in certain cases. The platform relies on third-party partners for fiat on-ramps and off-ramps rather than directly handling traditional banking transactions.

At the Africa Money and DeFi Summit milestone celebration, Jason Rodrigues, Head of Founder Programs at the Celo Foundation, stated;

“The Celo community is thrilled to support the growth of our shared mission, to create the conditions of prosperity for all, through Opera MiniPay. This partnership allows real-world users access to various inclusive financial tools in a seamless, fast, and reliable way.”

Furthermore, instead of focusing on corporate transactions, MiniPay targets locals. Data shows that 87% of transactions on the platform were under $5, and 60% of USDT transactions were specifically under $5. This transaction pattern suggests the wallet serves primarily peer-to-peer transfers and small purchases rather than large-value remittances or savings.

Mento Labs is the development team behind the Mento platform, which provides the decentralized stablecoins and on-chain foreign exchange (FX) infrastructure that power core functionalities within the MiniPay wallet.[Photo: Mentos-labs]

Built on the Celo blockchain: how transfers work

Under the hood, phone numbers are mapped to wallet addresses using Celo’s SocialConnect. Users pay network fees in the same asset they hold (e.g., cUSD), and the app abstracts gas so that people don’t need to manage multiple tokens. At launch, the product was designed for near‑instant settlement and sub‑cent fees—key for low‑value, high‑frequency transfers typical in daily life.

- Protocol: Celo (mobile‑first architecture, low fees; later migrated to an L2 with one‑block finality)

- Stable asset: The Mento Protocol maintains cUSD’s peg to the US dollar through over-collateralization with diversified crypto assets and algorithmic supply-demand management via smart contracts.

Opera MiniPay is viewed more as a stablecoin wallet if nothing else. The product favors simple actions—send, receive, add cash, withdraw—over advanced crypto features. Most early users relied on small, frequent transactions (for bills, P2P transfers, and top‑ups), which aligns with the wallet’s fee and speed profile.

cUSD (Celo Dollar) is a decentralized stablecoin built on the Celo blockchain, designed to maintain a stable value pegged 1:1 with the US Dollar.[Photo: Celo]

Opera’s pre‑existing distribution—especially in bandwidth‑constrained markets—meant many users could try the wallet without downloading a new app.

Risks and trade‑offs to watch

While Opera Minipay achieved unprecedented success, it’s important to consider both positive and negative aspects.

Self-custodial vulnerability: If a user loses access to their linked Google account and hasn’t backed up keys separately, they could lose access to funds permanently. MiniPay’s own FAQs emphasize that neither Opera nor partners can restore funds without the user’s keys.

Risk of depegging stablecoins: Any algorithmic or over-collateralized stablecoin could lose its peg to the US dollar during times of market stress, but there are no known examples of cUSD depegging events in the available sources. Research from Mento’s documentation on stability mechanisms and risk outlines how the protocol is designed to handle extreme scenarios, though no system is risk-free.

Uncertainty about regulations: MiniPay’s claim to be “unregulated software” that doesn’t directly handle fiat money could draw the attention of regulators as the platform grows. The absence of comprehensive country-specific regulatory frameworks or central bank collaborations in public communications indicates a dynamic regulatory environment. Publications such as the GSMA Mobile Money Policy and Regulatory Handbook show how quickly policy around mobile money and digital wallets can evolve.

Infrastructure dependencies: The platform depends on several layers, such as the stability of the Celo blockchain, the reliability of FiatConnect partners, the availability of Google Drive, and the distribution of Opera Mini. Each of these layers could fail.

Partner counterparty risk: On- and off-ramp partners do their own Know Your Customer (KYC) checks. Their reliability and compliance with the law have a direct impact on user experience and security.

Limited independent verification: Available information consists exclusively of statements from direct stakeholders (Opera, Celo Foundation, and Mento Labs). No independent academic researchers, fintech analysts, or regulatory experts provided third-party assessment of the platform’s claims.

A new stablecoin wallet for African mobile users

If you’re wondering how to use cUSD stablecoin in Africa, here’s the practical flow:

- Open Opera Mini on Android and find the integrated wallet.

- Create your non‑custodial wallet and enable Google Account backup.

- Add cash via a local on‑ramp partner (expect standard KYC at the partner level).

- Send/receive using your phone contacts; fees are sub‑cent and settled quickly.

- Cash out via local partners when needed.

Opera MiniPay is a useful way for the target group—smartphone users who don’t have access to a bank, especially those under 25 (over 60% of Africa’s population)—to:

- Hold dollar-denominated savings without foreign bank accounts

- Send money across borders without having to pay the usual remittance fees, which can be as high as 10% in Africa.

- Get access to DeFi apps on the Celo blockchain. Developers can build “Mini Apps” directly on MiniPay using Celo’s MiniPay developer tooling.

The platform is best for people who make many small transactions (less than $5) and trust the technical infrastructure. They also have to be okay with the risks of stablecoin volatility and self-custody. The fact that 1 million people used it in five months indicates that there is a real need for easy-to-use, low-cost digital payment tools in Nigeria, Kenya, and Ghana.

Opera MiniPay’s ability to work with existing mobile money systems and the familiar browser infrastructure made it easier for people to use than standalone crypto wallets.

But there are still questions about the platform’s long-term future: Is it possible for a model based on transactions of less than $5 to stay financially stable? How will changing rules in target markets affect how we do business? What are the retention rates after the first time someone uses their wallet?