The crypto wallet adoption rate has increasingly improved over the years, given the continent’s Web3 frenzy(DeFi, Stablecoins, and Blockchain Development).

In Brief

- Crypto wallet adoption reached 1.6 billion wallets globally by 2025, driven by mobile-first designs.

- Smart contract wallets like Safe and Coinbase Smart Wallet enable gasless transactions and social recovery, lowering barriers for non-technical African users.

- Embedded wallets and interoperability trends (e.g., EIP-7702) position Africa to dominate Web3, bypassing legacy banking systems via secure, user-friendly solutions.

As highlighted in the Dune Analytics Crypto Wallets 2025 report, wallets have gon form simply holding digital assets into a dynamic gateway to decentralized finance, nonfungible tokens(NFTs), gaming ecosystems, and cross-chain compatibility.

This trend highlights over 1.6 billion wallets created globally, an 80% increase post-2022, showcasing unprecedented growth, particularly in emerging markets like Africa.

This article summarizes key crypto wallet trends, showcasing the rise of mobile-first crypto wallets, smart contract wallet growth, and the strategic shift driving mainstream adoption both in new and legacy industries.

The Global Surge in Crypto Wallet Adoption

Crypto wallet adoption is no longer confined to upcoming startups but is now necessary to safely facilitate the digital assets trend in Africa.

Local Kings like Nigeria, Kenya, South Africa and international players like India and Indonesia are spearheading the demand.

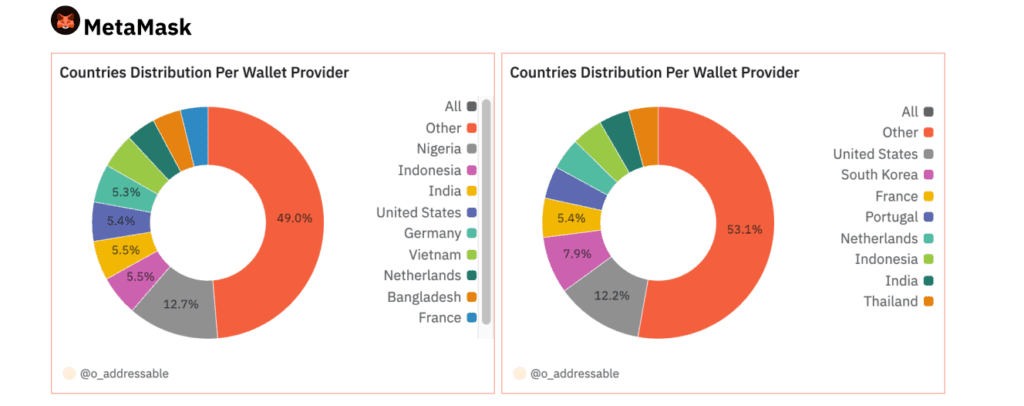

For instance, Nigeria alone accounts for 12.7% of all global MetaMask use, underscoring Africa’s steady but upcoming pace.

More traders in the regions often follow the non-custodial wallets for emerging markets narrative.

[Photo:Dune Analytics]

The latter has been a vital factor differentiating top wallet providers from the rest of the competition.

CHECK OUT: DeFi, DEXs, and Disclosure: The US Crypto Bill’s Bold Agenda

MetaMask remains a linchpin in this expansion, showcasing massive adoption stats like 63% and 59% in India and Indonesia, with traders relying on its secure crypto wallet features.

Despite its reign, upcoming rivals like Gem Wallet and Trust Wallets are gaining traction fast with tailored services catering to regional needs.

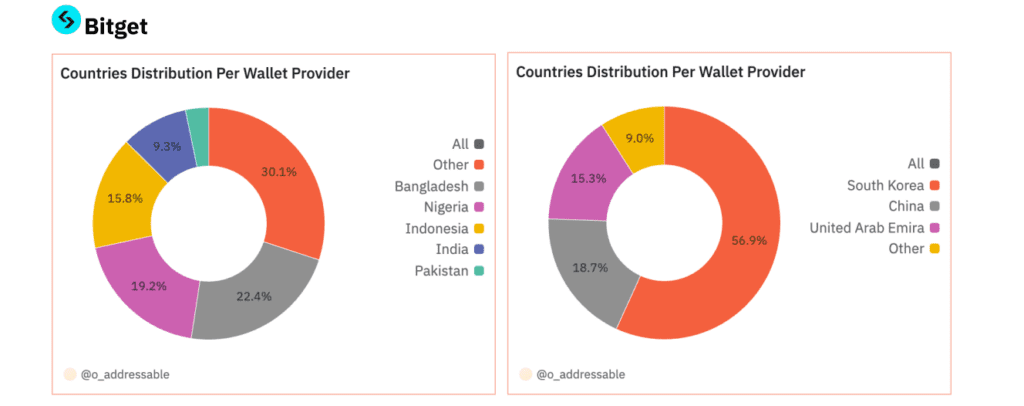

[Photo:Dune Analytics]

Emerging Crypto Wallet Trends: From Invisible UX to Programmable Finance]

The document highlights many key features, and we are here to provide an accurate summary.

In the 2025 landscape, there are three defining crypto wallet trends;

Smart Contract Wallet Growth

As previously emphasized, wallets have stepped into a new frontier with smart contract wallet growth at its core.

Essentially leveraging on Account Abstraction policy and ERC-4337 protocols, these new-gen wallets have outpaced Externally Owned Accounts in monthly deployments, with known players like Safe and Coinbase Smart Wallet dominating the space.

These secure crypto wallets’ primary edge is eliminating the need for seed phrases, enabling gasless transactions, and supporting social recovery.

These are essentially the case, especially with more non-technical users joining the industry.

Safe, the market leader, has over 43 M+ accounts processing $65+ billion in DEX transactions on Base and Arbitrum. In addition, this wallet is partnered with crypto titans like World App and is interested in protocols like PolyMarket.

[Photo:Dune Analytics]

Added mentions include Biconomy and ZeroDev, which are best known as infrastructure players.

Mobile-First Crypto Wallets Redefine Accessibility

Mobile-first crypto wallets are a rage in Africa and globally, bridging the gap between everyday usage and cryptocurrency.

Phantom’s dominance in Solana’s ecosystems highlights significant demand, featuring its 97% swap volume rate and cross-chain compatibility.

Similarly, OKX’s Asia-centric growth(40% of all swaps and 47% of volume) relies on seamless mobile integration.

Nigeria accounted for 17% and 19% of users in Phantom and Bitget in this category, showcasing significant growth.

In addition, these wallets often prioritize passkey login, gas sponsorship, and social login options, giving users a smoother experience, especially for newbies.

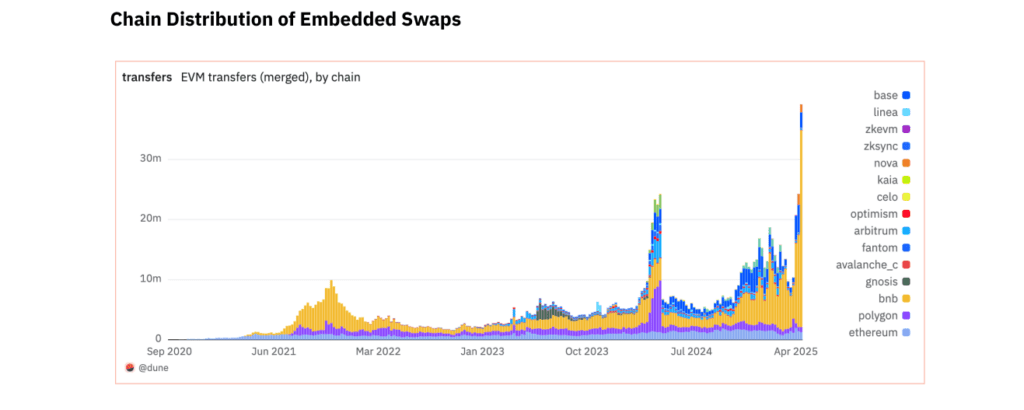

Embedded and Invisible Wallets

Web3 is the frontier of innovation and apps like Farcaster and friend. tech takes a unique tangent into walletless onboarding, where users unknowingly create wallets during signups.

This feature is still in its nascent stage, but its popularity is increasing.

It provided users easy access to wallets without the technical jargon that most non-tech users struggle with, especially with the end of seed phrases.

Passkey or social login is an upcoming trend in developing individualized wallets.

Security and Compliance: Balancing Innovation with Risk Mitigation

As crypto wallet adoption grows, so does the need for secure crypto wallets.

Programmable wallets introduce new vulnerabilities despite providing innovative alternatives.

This necessitates a robust auditing framework.

Fortunately, institutional-grade solutions like Safe, Ronin, and others are diving into various features like multi-party computation (MPC) and multi-signature.

This is also seen in open-source projects like Gem Wall,, which emphasizing transparency by leveraging security features such as Know Your Transaction.

This approach will pay off well, especially in Africa, where non-custodial wallets for emerging markets are often the primary financial tools.

CHECK OUT: Ripple in the Desert, How DFSA License Fuels UAE Crypto Boom

Some of the best crypto wallets for investors offer security, ease of use, and access to multiple assets across various networks.

Wallets like Phantom integrated OKX’s DEX API, giving access to over 100 DEXs and 18 bridges, offering access across Ethereum, Polygon, Base, and Solana.

Game-focused Ronin is often the go-to option for most NFT sectors, supporting Base, Arbitrum, Polygon, BNB Chain, and Ethereum via Open Ronin.

The Road Ahead: Wallets as the OS of Web3

The future of crypto wallet adoption hinges on interoperability, security, and contextual designs.

Innovations like EIP-7702 enable EOAs(wallets with access to Ethereum) to function as smart contracts, bridging legacy systems with AA(Account Abstraction) advancements.

Phantom and Coinbase have focused on the super-app title, integrating swaps, governance, and gaming under one interface.

For emerging markets, mobile-first crypto wallets are a major selling point, bypassing the hurdles of traditional banking systems.

With Nigeria leading the frontier, Africa has a chance to dominate the crypto market with access to various wallets, each offering diverse advantages.