In Brief

-

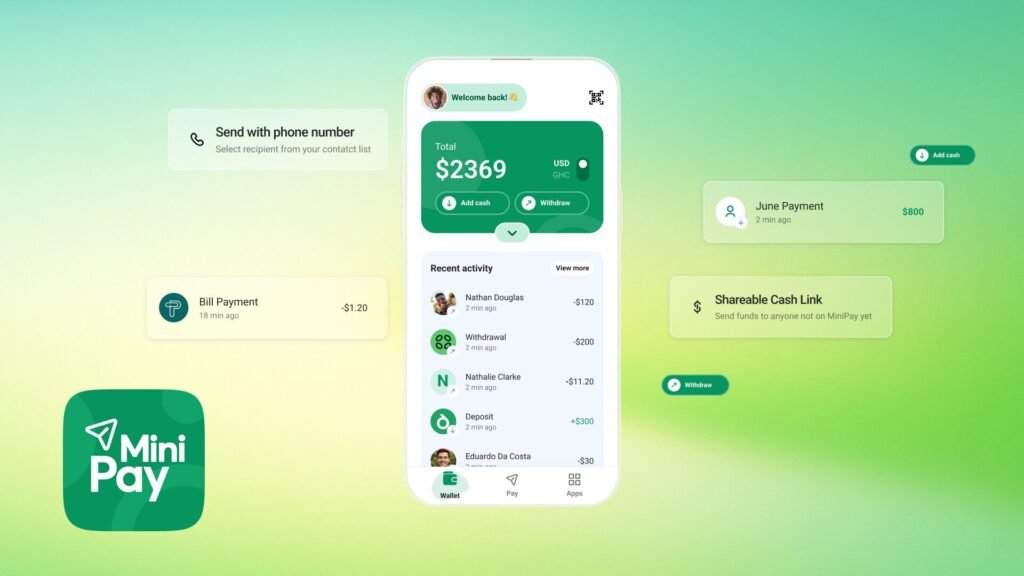

The MiniPay Ecosystem reached over 8M wallets and 224M+ transactions, demonstrating robust African stablecoin adoption.

-

Innovative features like external transfers and Cash 3.0 top‑ups simplify real‑world crypto use for users.

-

MiniPay Mini Apps and Mento rewards fuel community growth and incentivize on‑chain engagement.

The Second quarter of 2025 has wrapped up nicely, with Africa’s Web3 ecosystem gradually growing in reach, practicability and adoption.

The MiniPay ecosystem has contributed its fair share of support alongside Celo Blockchain.

Opera’s self-custodial stablecoin wallet has since grown and recently gave us a sneak peek at how its growth from a wallet to an ecosystem is reshaping Africa’s progress.

Numbers never lie, quantifying MiniPay’s growth.

In the first two quarters of 2025, Minipay has still managed to maintain a positive incline in stablecoin adoption in Africa.

Its adoption scale and activities speak for themselves:

- 8 million+ total wallet activations globally, a testament to growing user trust.

- 224 million+ transactions processed since launch, demonstrating consistent utility.

- 600,000+ transactions occurring daily, highlighting its integration into everyday financial life.

- Live in 50+ countries, with ongoing expansion solidifying its global footprint.

Stablecoins are steadily embedding themselves in Africa’s core economy. Freelancers, Online workers and a growing number of African youth rely on the MiniPay ecosystem to bypass the hurdles of normal fiat transactions.

From Scaling to Major Launches: Expanding Access and Flexibility

While still navigating Africa’s growing stablecoin adoption, MiniPay has released several pivotal products designed to enhance user experience while removing barriers.

For instance, the Minipay for iOS rocked headlines back in May.

Over 30 ecosystem partners supported this rollout, ensuring that the crypto payments app is accessible to Andrid users across 50+ countries.

Android is the most predominant mobile OS in Africa, which has unlocked a new financial avenue for diaspora communities across the continent.

This expansion was central to Opera’s strategy to capture a large share of Africa’s $54 billion stablecoin market.

Another key feature was an update to its services that enabled users to send stablecoins directly from their MiniPay wallet to external wallets and exchanges.

Launched in June, this feature simplified cashing out, trading and consolidating funds outside the MiniPay ecosystem, ensuring accessibility in regions lacking robust local ramp solutions.

CHECK OUT: Celo’s Expanding Influence in Africa through Web3 Initiatives.

Additionally, the platform introduced smarter Top-ups with Cash 3.0, offering intelligent auto-selection of the best-performing ramp. This mainly includes third-party providers like Yellow Card, Transak and Partna.

MiniPay Ecosystem processes 600,000+ daily transactions, leveraging stablecoins to bypass fiat limitations in Africa’s mobile-first economy. [Photo:MiniPay]

From onboarding workshops to demystify stablecoins and wallet usage to University campus demonstrations, MiniPay has taken matters into its own hands.

In addition, the platform has collaborated with various local merchants to integrate stablecoin payments, introducing an entire new generation to the superiority of stablecoins.

Explosive Ecosystem Growth: The Mini App Boom

However, the most defining trend of Q2 2025 was the breakout traction of MiniPay Mini Apps.

The initiative, which started as an idea during the Celo Camp surprisingly quickly became a hit onboarding third-party apps like:

- BitGifty – a bootstrapped stablecoin-powered local utility payment app built during Celo Camp Batch 8.

Partnerships with Celo and third-party ramps (Yellow Card, Transak) expand MiniPay’s utility for diaspora remittances and local commerce. [Photo: MiniPay]

- Bando – A local voucher and bill payment app. Grew from hundreds to tens of thousands of users in days.

- Topcasters by Polkamarkets – A USDT-powered prediction game where users forecast real-world events. 2.2M+ predictions played, 138K+ users

- Mdundo, one of Africa’s top music streaming platforms, now offers music subscriptions for as low as $0.50, paid in stablecoins.

- Gamifly, a trivia and challenge app that rewards users in stablecoins, is scaling rapidly through MiniPay’s built-in user base.

Mento Rewards Return: Incentivizing Real Usage

Adding another layer of value, June 2025 saw the return of Mento rewards campaigns($MENTO) within MiniPay.

This third iteration allowed users to earn crypto rewards in $MENTO governance tokens simply by holding or transacting in cUSD within their wallets.

This new initiative rewarded genuine stablecoin usage in real-world scenarios while also introducing millions of MiniPay users to on-chain governance.

CHECK OUT:Community-Driven Testnets: Building the Next Generation of African Chains

It showcased how the MiniPay ecosystem has grown to be a premier distribution channel or token utility, bridging user action with ownership stakes.

Building for the Long Run in H2 2025

After laying a strong foundation in H1 2025, MiniPay intends to boost its momentum on sustained innovation and broader reach.

The platform revealed several plans like:

- Deposit from any chain: Enhancing interoperability to make funding the wallet even more versatile.

- Major announcements at EthCC: Hinting at significant integrations or partnerships.

- Expansion of Mini App categories: This will bring even more diverse services (commerce, travel, DeFi) directly into the wallet.

- Targeted builder growth campaigns: Actively supporting developers to create the next wave of successful Mini Apps.

- Continued product refinement and market expansion: Further improving the core wallet experience and reaching new users globally.

For MiniPay, Q2 2025 was an undeniable success, with strategic product launches, Ecosystem breakout and the return of user incentives.

The platform thrives from its targeted community engagement, creating a blueprint for many.

By becoming an indispensable financial layer, empowering users and enabling builders, Minipay’s initiatives in Africa are a prime example of what to do right in Africa’s blockchain ecosystem.